Germany Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Germany Luxury Fashion Market Overview:

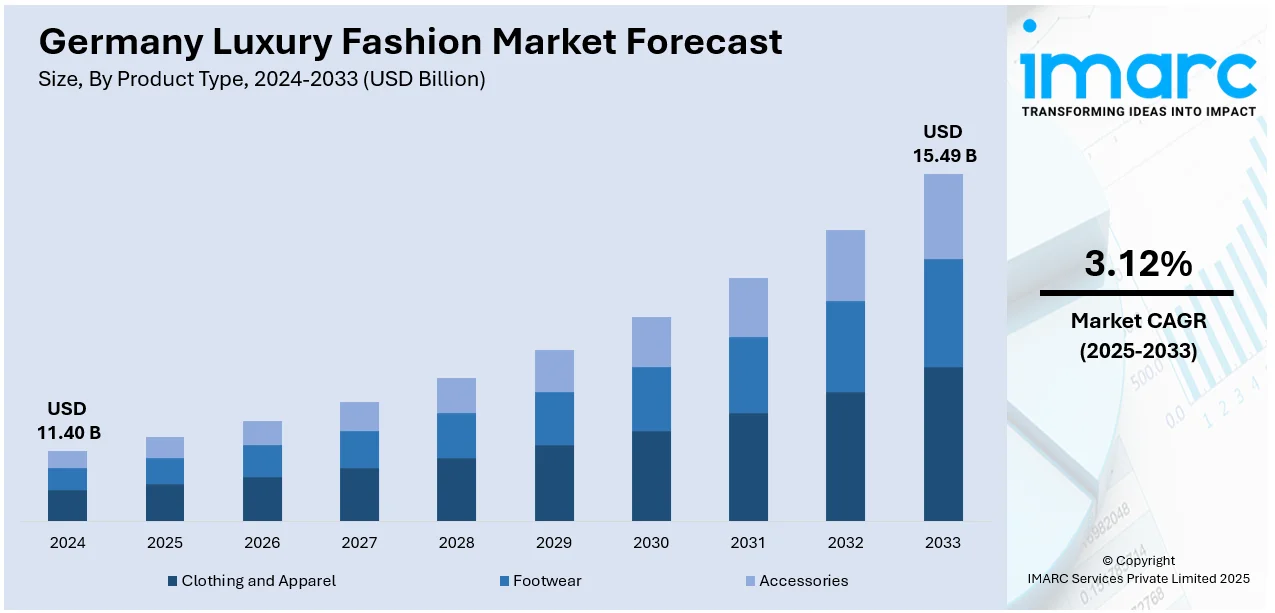

The Germany luxury fashion market size reached USD 11.40 Billion in 2024. The market is projected to reach USD 15.49 Billion by 2033, exhibiting a growth rate (CAGR) of 3.12% during 2025-2033. The market is fueled by growing disposable incomes and a robust domestic desire for high-quality craftsmanship. In addition, the growing demand for sustainable and responsibly sourced luxury products is encouraging brands to embrace open supply chains and environmentally friendly practices. Furthermore, the online transformation of luxury retailing, fueled by sophisticated e-commerce sites and tailor-made online experiences, is significantly augmenting the Germany luxury fashion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.40 Billion |

| Market Forecast in 2033 | USD 15.49 Billion |

| Market Growth Rate 2025-2033 | 3.12% |

Germany Luxury Fashion Market Trends:

Sustainability, Ethical Production, and Circular Fashion

Sustainability has emerged as a central concern in the German luxury fashion market, driven by strong environmental awareness, regulatory frameworks, and consumer demand for transparency. Luxury fashion brands must adjust to changing EU regulations. As per industry reports, under the EU Green Claims Directive (GCD), companies must back up any environmental promises with solid evidence or risk penalties, sales bans, or other legal action. By March 2026, brands will no longer be allowed to make vague green claims, use unverified carbon offset statements, or display sustainability labels that haven’t been approved. Furthermore, German shoppers, particularly Millennials and Gen Z, are holding brands accountable for their environmental and social impact, prompting a wave of ethical initiatives across the value chain. Luxury fashion houses are responding by integrating certified organic materials, low-impact dyeing processes, and carbon-neutral production models. Also, luxury brands are increasingly embracing cradle-to-cradle design philosophies and adopting blockchain technology for product traceability to meet the expectations of eco-conscious consumers. Additionally, strategic partnerships with sustainability certifiers and local artisan communities are enhancing brand credibility and market appeal. Ethical sourcing, fair labor practices, and inclusive employment initiatives are becoming essential components of corporate strategy. As a result, sustainability is transitioning from a niche value proposition to a defining standard in the market.

To get more information on this market, Request Sample

Digital Integration and the Rise of Omnichannel Retail

Digital integration is providing an impetus to the Germany luxury fashion market growth, as consumers seek seamless, high-touch experiences across both physical and digital touchpoints. As per an industry report, the Germany e-commerce market is expected to reach USD 6,107 Billion by 2033, exhibiting a growth rate (CAGR) of 19.8% during 2025-2033. This rapid growth highlights how digital channels are transforming shopping habits across sectors, including luxury fashion. The convenience of online platforms enables luxury brands in Germany to craft personalized, immersive, and seamless experiences that strengthen customer loyalty and expand their reach beyond traditional brick-and-mortar stores. Apart from this, German luxury shoppers increasingly expect online platforms to offer features such as virtual consultations, augmented reality try-ons, and tailored product recommendations powered by artificial intelligence. At the same time, luxury boutiques are incorporating digital elements, such as interactive mirrors, RFID-enabled fitting rooms, and app-based clienteling, to elevate in-store engagement. The COVID-19 pandemic accelerated the adoption of online shopping, and this behavioral shift has persisted among affluent consumers who value flexibility and convenience without compromising on exclusivity. This trend underscores the importance of investing in robust technological infrastructure while preserving the sensory and service-driven essence of luxury retail.

Germany Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

Distribution Channel Insights:

- Store-Based

- Non-Store Based

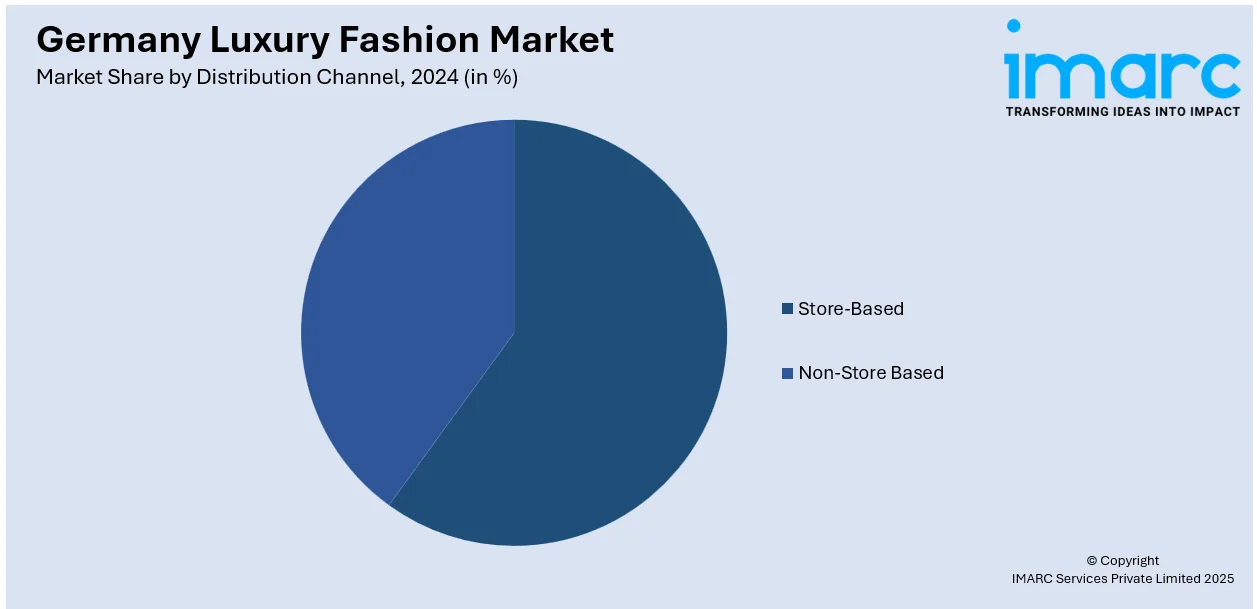

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Luxury Fashion Market News:

- On October 5, 2023, German luxury e-commerce specialist Fashionette AG unveiled a new platform dedicated to high-end fashion spanning women's apparel, shoes, leather goods, and accessories, following a rapid four-month development period. The platform, built in partnership with The Platform Group, features top-tier designer labels. Initially focused on women's fashion, it plans to roll out men's collections later in October and complete its luxury expansion with shoes, leather goods, and accessories.

Germany Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany luxury fashion market on the basis of product type?

- What is the breakup of the Germany luxury fashion market on the basis of distribution channel?

- What is the breakup of the Germany luxury fashion market on the basis of end user?

- What is the breakup of the Germany luxury fashion market on the basis of region?

- What are the various stages in the value chain of the Germany luxury fashion market?

- What are the key driving factors and challenges in the Germany luxury fashion market?

- What is the structure of the Germany luxury fashion market and who are the key players?

- What is the degree of competition in the Germany luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)