Germany Pallet Market Size, Share, Trends and Forecast by Type, Application, Structural Design, and Region, 2025-2033

Germany Pallet Market Overview:

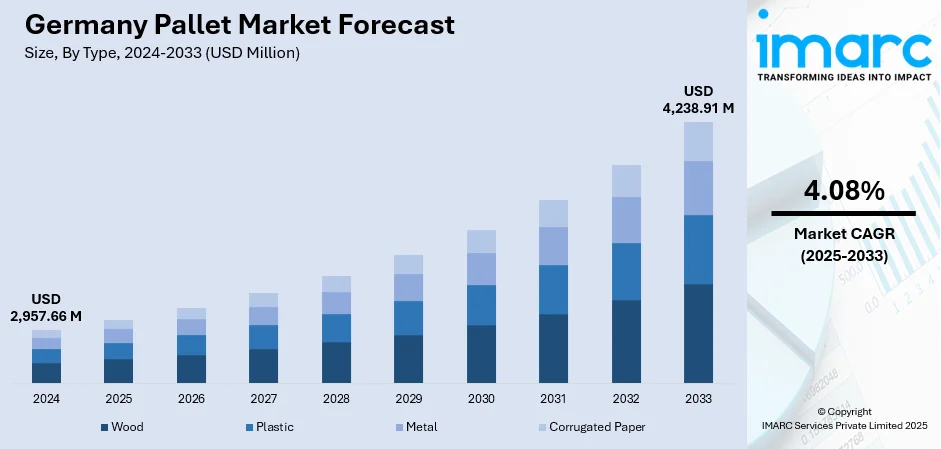

The Germany pallet market size reached USD 2,957.66 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,238.91 Million by 2033, exhibiting a growth rate (CAGR) of 4.08% during 2025-2033. The market is driven by intense pressure on businesses to optimize logistics costs and enhance operational efficiency, converting pallet ownership from capital expenditure into a predictable operational expense. Moreover, changing regulations such as the VerpackG, plus demands for supply chain transparency, security, and data-driven optimization, incentivize durable materials and smart pallet technologies with IoT and RFID, further augmenting the Germany pallet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,957.66 Million |

| Market Forecast in 2033 | USD 4,238.91 Million |

| Market Growth Rate 2025-2033 | 4.08% |

Germany Pallet Market Trends:

Accelerated Adoption of Pallet Pooling and Rental Models

The market is experiencing a significant shift towards pallet pooling and rental systems, moving away from traditional outright ownership, driven by several converging factors. Additionally, businesses face intense pressure to optimize logistics costs and improve operational efficiency. Pooling eliminates the capital expenditure and administrative burdens (procurement, storage, repair, reverse logistics) associated with owned pallets, converting them into a predictable operational expense. In addition, supply chain volatility and the need for greater flexibility make the guaranteed availability and standardized quality of pooled pallets highly attractive, ensuring smoother operations. Apart from this, stringent environmental regulations, such as the German Supply Chain Due Diligence Act – LkSG and corporate ESG (Environmental, Social, Governance) goals strongly favor the circular economy principles inherent in pooling. The market is experiencing significant transitions as the country pushes forward its circular economy policy. Germany has bolstered its regulatory framework with the Kreislaufwirtschaftsgesetz (KrWG), which mandates that materials such as pallets be recycled or reused to reduce raw material dependence. According to this broader shift, Germany is also pushing programs to stimulate material reuse in the transport and logistics industries, especially in terms of offering incentives for the recycling and recovery of wooden pallets. Major players including LPR (La Palette Rouge), CHEP, and IPP Logipal are expanding their German networks and service offerings, while even traditional pallet manufacturers are increasingly participating in or establishing their own pooling ventures. This trend is particularly pronounced in fast-moving consumer goods (FMCG), retail, and automotive sectors, fundamentally changing how pallets are sourced and managed.

To get more information on this market, Request Sample

Material Innovation and Integration of Smart Technologies

The accelerating innovation in pallet materials and the integration of smart technologies is also propelling the Germany pallet market growth. While wood remains dominant due to cost and reparability, there's growing demand for high-performance alternatives such as durable plastic and composite pallets. These cater to specific needs: plastic excels in hygienic environments (pharma, food), export scenarios requiring ISPM 15 compliance without treatment, and applications demanding extreme durability or lighter weight. Composite pallets offer a middle ground. Crucially, innovation extends beyond material. The rise of the "pallet as a service" model leverages technology, embedding sensors (IoT), RFID tags, and QR codes. This enables real-time tracking, condition monitoring (temperature, shocks), automated check-in/check-out, and enhanced inventory visibility throughout the supply chain. Germany's RFID industry, which includes the growing adoption of pallet tracking, has seen stunning growth, with RFID-enabled smart card exports growing by 26% between 2017 and 2023 to USD 6.2 Billion. Moreover, Germany achieved the fifth position among international RFID exporters, with a considerable share in the U.S. market, where RFID imports grew by 45% in 2023, driven largely by Mexican suppliers. With the growth of RFID technology usage across supply chain management, organizations, including Avery Dennison are also expanding business operations in Mexico, thus shaping pallet tracking and logistics futures. Driven by demands for greater transparency, security, automation, and data-driven optimization, this smart pallet trend is gaining traction. Furthermore, changing regulations such as the Packaging Act (VerpackG) and potential Extended Producer Responsibility (EPR) schemes incentivize durable, traceable, and recyclable solutions, further pushing material innovation and smart features to improve lifecycle management and compliance reporting.

Germany Pallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and structural design.

Type Insights:

- Wood

- Plastic

- Metal

- Corrugated Paper

The report has provided a detailed breakup and analysis of the market based on the type. This includes wood, plastic, metal, and corrugated paper.

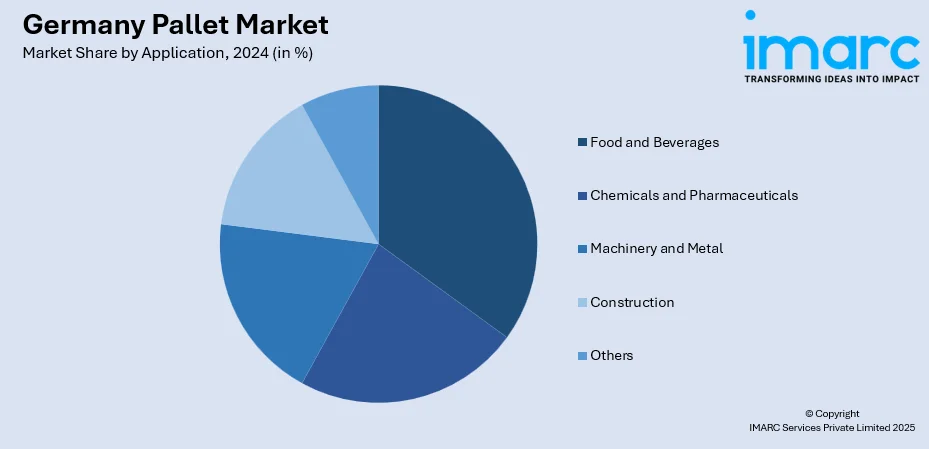

Application Insights:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes food and beverages, chemicals and pharmaceuticals, machinery and metal, construction, and others.

Structural Design Insights:

- Block

- Stringer

- Others

The report has provided a detailed breakup and analysis of the market based on the structural design. This includes block, stringer, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Pallet Market News:

- September 2024: Nidec OKK Corporation announced the launch of its highly space-saving stereoscopic pallet stocker, which will be used for automating material handling in industries such as electric vehicle production, semiconductor equipment, and electronics manufacturing. The system, coupled with the VB-X350 five-axis stereoscopic machining center, features a vertically stacked pallet rack supporting 16 to 28 pallets, each sized at 280x280mm and able to carry up to 100kg of workpieces. This innovative development will be unveiled in Stuttgart, Germany, at AMB 2024, showcasing its capabilities to enhance productivity by operating autonomously and providing significant labor-saving benefits.

Germany Pallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany pallet market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany pallet market on the basis of type?

- What is the breakup of the Germany pallet market on the basis of application?

- What is the breakup of the Germany pallet market on the basis of structural design?

- What is the breakup of the Germany pallet market on the basis of region?

- What are the various stages in the value chain of the Germany pallet market?

- What are the key driving factors and challenges in the Germany pallet market?

- What is the structure of the Germany pallet market and who are the key players?

- What is the degree of competition in the Germany pallet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany pallet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany pallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)