Germany Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

Germany Paper Packaging Market Overview:

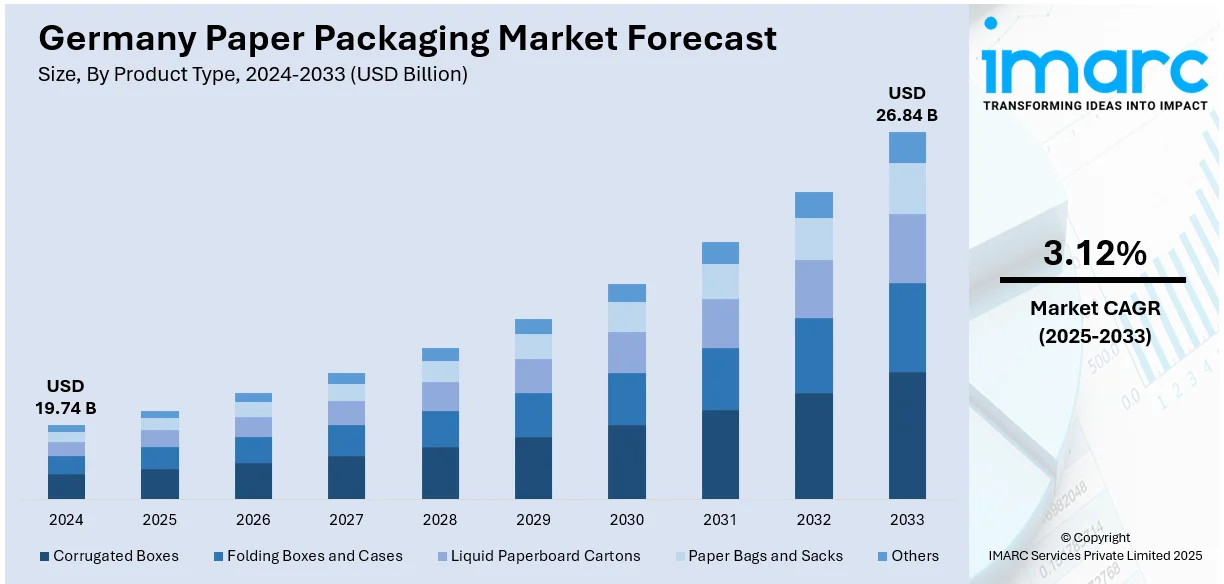

The Germany paper packaging market size reached USD 19.74 Billion in 2024. The market is projected to reach USD 26.84 Billion by 2033, exhibiting a growth rate (CAGR) of 3.12% during 2025-2033. The market is influenced by a strong drive towards sustainability, aided by stringent environmental legislation and established recycling culture that demands a transition away from plastics to sustainable paper-based solutions. Also, ongoing material and design innovation in the form of specialized coatings, increased durability, and luxury branding opportunities increases the versatility and attractiveness of paper packaging across many different industries, thus further increasing Germany paper packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.74 Billion |

| Market Forecast in 2033 | USD 26.84 Billion |

| Market Growth Rate 2025-2033 | 3.12% |

Germany Paper Packaging Market Trends:

Sustainability and Circular Economy Push

Germany boasts one of the most advanced environmental policies in Europe, and sustainability is one of the primary drivers of the paper packaging industry. The nation's robust recycling culture and stringent directives on packaging waste compel companies to shift away from plastic toward environmentally friendly paper-based formats. Paper packaging is aligned with circular economy principles, being renewable, biodegradable, and easily recyclable. Increased consumer sensitivity to ecological concerns further fuels this transition, with customers positively predisposing towards brands utilizing sustainable packaging. Major manufacturers and large retail chains are even switching to paper-based alternatives to satisfy corporate social responsibility objectives and respond to changing regulatory landscapes. This has generated a favorable ecosystem for innovation in paper packaging that minimizes environmental footprint without compromising product integrity or shelf appeal, thereby making sustainability a primary driver for Germany paper packaging market growth.

To get more information on this market, Request Sample

E-commerce Growth and Changing Consumer Habits

The expansion of e-commerce in Germany has significantly increased the demand for durable, lightweight, and cost-effective paper packaging. Online retail requires protective, eco-friendly options for storage, transport, and delivery, making paper-based materials highly desirable. Consumers now expect brands to adopt eco-friendly practices, positioning paper packaging as a way to meet logistics needs while enhancing brand image. The growth of direct-to-consumer models and subscription services has further fueled demand for customized paper formats that support brand storytelling and premium unboxing experiences. In 2023, Germany’s dual-system packaging collection from households recovered over 5.5 million tonnes of packaging waste, with around 5.2 million tonnes recycled, meeting or exceeding statutory recycling targets for paper, paperboard, and cardboard. This reflects how paper packaging aligns with evolving consumer preferences for convenience and reduced environmental impact, driving companies to innovate and expand their offerings.

Innovation in Packaging Design and Materials

Technological progress and creative packaging design are central to trends shaping Germany's paper packaging market. Manufacturers are developing new grades of paperboard, coatings, and structural designs that enhance durability, barrier properties, and visual appeal. These innovations make paper packaging a viable alternative to plastic for a wide range of applications, including food, beverages, and personal care products. Additionally, brands increasingly view packaging as an important marketing tool, using innovative paper solutions for high-quality printing, customization, and premium aesthetics. Advances in biodegradable coatings, water-resistant paper, and multi-layer composites also expand the functional capabilities of paper packaging, enabling it to meet stricter performance requirements without compromising on environmental integrity. This innovation-driven approach allows companies to balance consumer expectations for eco-friendly materials with practical needs for product protection and shelf appeal, positioning paper packaging as a forward-looking solution.

Germany Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

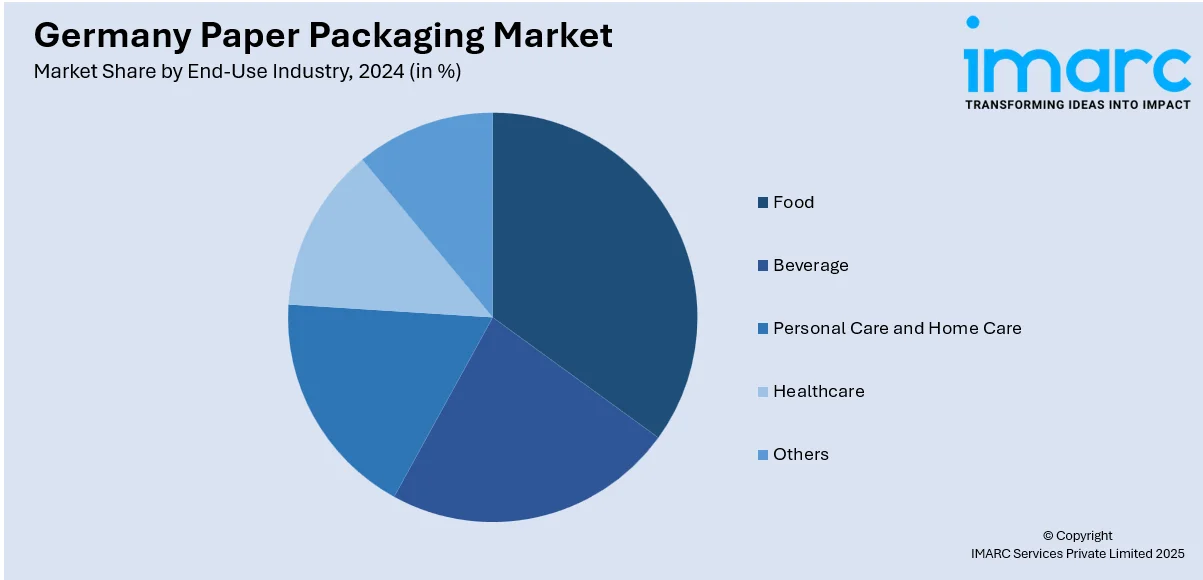

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Paper Packaging Market News:

- In June 2025, Evonik removed the plastic film layer from their MetAMINO (DL-methionine) product and replaced it with a sustainable 25-kg paper bag in order to adhere to the EU's Packaging & Packaging Waste Regulation. The new fully recyclable two-layer paper bag (PAP 22) reduces the packaging’s CO2 footprint by 20% and saves 32 tons of polyethylene annually at the Antwerp site. Product quality and its 36-month shelf life remain unchanged, with rollouts planned for Singapore and Mobile (US) production sites.

- In March 2024, Koehler Paper partnered with German chocolate maker nucao to introduce 100% paper-based packaging for chocolate bars. Designed for sustainability, the packaging is compatible with both vertical and horizontal machines, enabling production speeds of up to 600 bars per minute. This collaboration reflects a shared commitment to eco-friendly solutions, replacing conventional plastic materials with recyclable paper while maintaining efficiency and product quality in high-speed chocolate bar production.

Germany Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany paper packaging market on the basis of product type?

- What is the breakup of the Germany paper packaging market on the basis of grade?

- What is the breakup of the Germany paper packaging market on the basis of packaging level?

- What is the breakup of the Germany paper packaging market on the basis of end-use industry?

- What is the breakup of the Germany paper packaging market on the basis of region?

- What are the various stages in the value chain of the Germany paper packaging market?

- What are the key driving factors and challenges in the Germany paper packaging market?

- What is the structure of the Germany paper packaging market and who are the key players?

- What is the degree of competition in the Germany paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)