Germany Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

Germany Private Equity Market Overview:

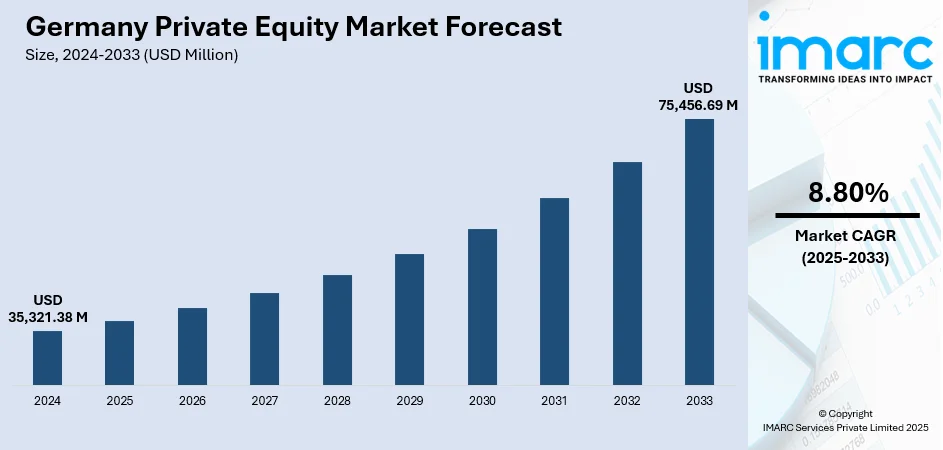

The Germany private equity market size reached USD 35,321.38 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 75,456.69 Million by 2033, exhibiting a growth rate (CAGR) of 8.80% during 2025-2033. Strong economic fundamentals, a robust industrial base, and increasing interest from institutional investors are driving the market. Government support for innovation and digital transformation in SMEs further boosts investment. Cross-border deal activity and sectoral diversification also shape Germany private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 35,321.38 Million |

| Market Forecast in 2033 | USD 75,456.69 Million |

| Market Growth Rate 2025-2033 | 8.80% |

Germany Private Equity Market Trends:

ESG Integration in Investment Strategy

The Germany private equity market is witnessing a strong pivot toward environmental, social, and governance (ESG) integration. Private equity firms are embedding ESG metrics into due diligence, deal structuring, and post-investment strategies. With increasing regulatory focus from the EU and rising investor expectations, ESG compliance is becoming a vital differentiator. German firms are particularly focused on decarbonization, diversity in boardrooms, and sustainability reporting. These trends are encouraging firms to reassess portfolio risks and realign long-term value creation strategies. As stakeholders demand more transparency, ESG-focused funds are seeing growing allocations. This trend reflects broader shifts in capital deployment and risk management that support responsible investment practices, contributing significantly to Germany private equity market growth. For instance, in April 2025, EQT X acquired a strategic stake in Germany-based WTS Group, a leading tax and financial advisory firm, aiming to accelerate WTS’s domestic and international growth. The partnership focuses on expanding digital and AI capabilities, particularly through WTS’s ‘plAIground’ platform. With 1,500 employees and a client base including 95% of DAX40 firms, WTS is poised to become a European tax advisory leader.

To get more information on this market, Request Sample

Increased Mid-Market Deal Activity

Mid-market transactions are becoming increasingly dominant in the Germany private equity market, especially in sectors such as healthcare, technology, and industrial automation. Many private equity firms are targeting family-owned and Mittelstand companies looking for succession planning or growth capital. These businesses offer strong fundamentals but often lack digital agility or international reach—gaps that private equity partners aim to bridge. The post-pandemic recovery has further accelerated deal volume in this segment, with investors attracted to lower entry valuations and high growth potential. Strategic operational involvement, scalability, and sector consolidation strategies are common drivers of value creation. These developments reflect the deepening of Germany private equity market growth. For instance, in February 2025, Munich Private Equity launched Germany’s first BaFin-approved European Long-Term Investment Fund (ELTIF), granting retail investors access to private equity with a minimum investment of €5,000. The fund-of-funds targets lower mid-market companies across the EU, offering broad diversification through institutional private equity funds. With two investments already made, the ELTIF marks a major step in democratizing private equity for retail investors in Germany and the EU.

Germany Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on fund type.

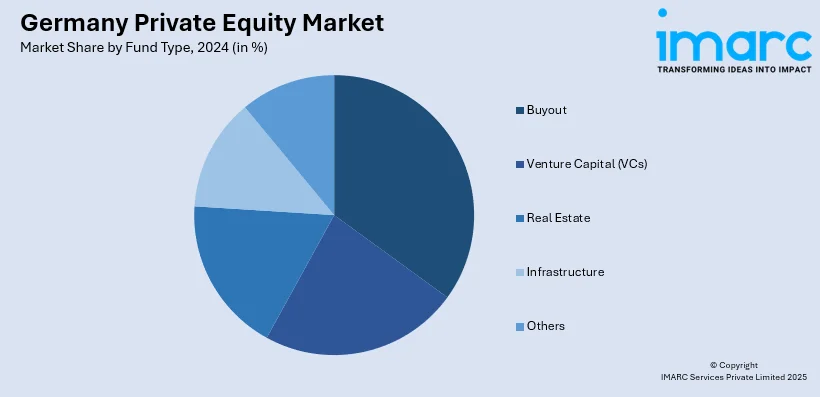

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Private Equity Market News:

- In June 2025, Deutsche Private Equity (DPE) acquired a majority stake in CPM Partners, a Geneva-based consulting and technology firm specializing in Corporate Performance Management (CPM). The partnership aims to accelerate growth and expand CPM’s capabilities in complex transformation projects. DPE sees strong potential in building an end-to-end platform serving CFOs. This move aligns with DPE’s strategy to back high-growth mid-sized companies in the DACH region.

- In January 2025, Germany’s VBL (Versorgungsanstalt des Bundes und der Länder) announced plans to increase its allocations to private equity and private debt. The new investments will be financed using a combination of new premiums and reallocations from public equities, gold, and cash. This move signals VBL’s growing focus on alternative assets to enhance returns and diversify risk, aligning with broader pension fund trends toward more sophisticated portfolio strategies amid evolving market conditions.

Germany Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany private equity market on the basis of fund type?

- What is the breakup of the Germany private equity market on the basis of region?

- What are the various stages in the value chain of the Germany private equity market?

- What are the key driving factors and challenges in the Germany private equity market?

- What is the structure of the Germany private equity market and who are the key players?

- What is the degree of competition in the Germany private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany private equity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)