Germany Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Germany Steel Tubes Market Overview:

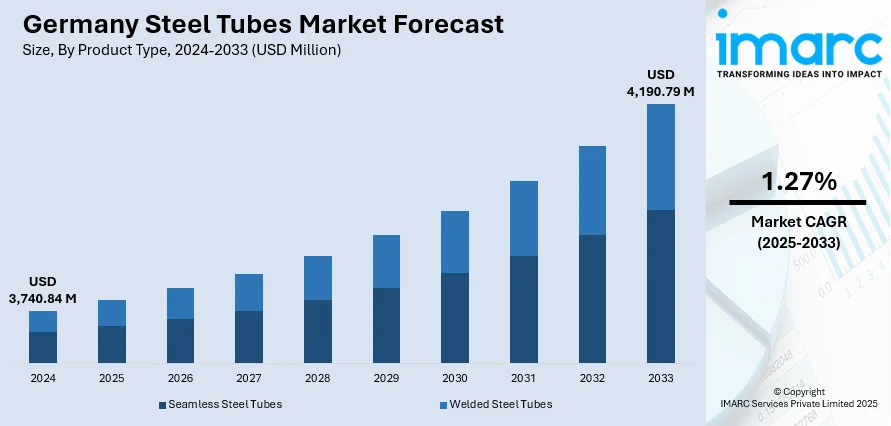

The Germany steel tubes market size reached USD 3,740.84 Million in 2024. The market is projected to reach USD 4,190.79 Million by 2033, exhibiting a growth rate (CAGR) of 1.27% during 2025-2033. The market is witnessing robust growth, driven by thriving automotive, mechanical engineering, and construction industries. Technological improvements in production processes and material efficiencies are improving product quality and diversity. Sustainability and conformity with regulations are still central issues, with producers concentrating on lowering carbon footprints and maximizing the use of resources. Growth is being fueled by persistent infrastructure initiatives and strong export orientation. Competition escalates as innovation and demand converge, leading to strategic positioning in the Germany steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,740.84 Million |

| Market Forecast in 2033 | USD 4,190.79 Million |

| Market Growth Rate 2025-2033 | 1.27% |

Germany Steel Tubes Market Trends:

Domestic Production Rebound Steady

In January 2025, Germany’s steel output showed encouraging signs of recovery with industrial production indices moving upward compared to the previous year. This rebound reflects renewed activity across key manufacturing sectors, especially in mechanical engineering and infrastructure development, where demand for steel tubes is gradually increasing. Domestic producers of welded and seamless tubes are experiencing growing interest due to investments in transport, energy, and industrial maintenance projects. Despite ongoing caution in the construction sector amid broader economic uncertainty, demand from specialized machinery and power generation applications supports a more balanced market. The trend toward higher-quality, locally sourced tubing aligns with government policies emphasizing supply chain resilience and reduced dependency on imports. Additionally, fabricators are focusing on value-added products tailored to evolving industrial needs rather than bulk commodity tubes. Taken together, these factors signal a steady recovery in tube manufacturing activity. These developments offer a positive outlook for Germany steel tubes market growth as the industry adapts to changing demand patterns and regulatory frameworks.

To get more information on this market, Request Sample

Resilience Drives Steel Tube Evolution

In June 2025, Germany’s steel production had declined notably, marking the sixth consecutive month of year-on-year decreases, as ongoing demand weakness hit core sectors like automotive, machinery, and construction. This prolonged reduction reflected broader economic caution, with lower domestic orders leading tube manufacturers to adjust production strategies. Rather than focusing on volume, firms increasingly targeted niche markets and specialized tubing applications to maintain profitability amid challenging conditions. Rising energy costs further pressured production facilities, sparking calls for policy support to ensure competitiveness. Meanwhile, buyers in energy and transport infrastructure sectors have shifted priorities toward sourcing tubes with verified quality and traceability, reinforcing the importance of compliance and domestic supply security. This shift aligns with broader supply chain resilience efforts and changing procurement behavior. Taken together, these adaptations suggest a market in transition, moving toward stabilization despite near-term headwinds. These dynamics highlight the evolving nature of Germany steel tubes market trends as manufacturers and buyers navigate economic uncertainty and regulatory shifts.

Trade Policies Support Sector Recovery

In March 2025, the European Commission introduced its Steel and Metals Action Plan aimed at curbing excess imports and protecting domestic producers amid growing global steel supply concerns. Germany actively supported these measures, recognizing their potential to shield local steel tube manufacturers from pricing pressures and unfair competition. The plan includes import restrictions and safeguards, promoting fair trade and strengthening the domestic market. Concurrently, German policymakers allocated significant funding toward the green steel transition, encouraging producers to adopt low-carbon technologies and sustainable practices. This dual approach helps position the steel tubes industry for long-term resilience by combining trade protection with environmental innovation. Buyers in energy, infrastructure, and transport sectors increasingly prioritize certified, locally sourced tubes that meet strict environmental and quality standards. Such trends highlight a strategic market realignment driven by policy and buyer preferences. Together, these developments underpin positive prospects for the steel tubes sector moving forward.

Germany Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

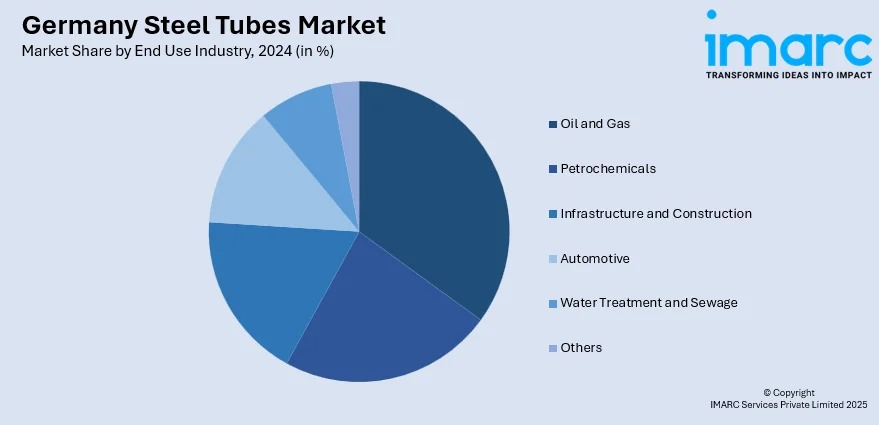

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include the Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Steel Tubes Market News:

- April 2024: ThyssenKrupp Steel showcased its tailored hot‑rolled steel solutions for the tube industry in Düsseldorf. The Germany‑based steel leader highlighted manganese‑boron grades for lightweight automotive precision tubes and robust steels for long‑lasting pipelines used in water, oil, gas and hydrogen transport. Emphasis was placed on bluemint® Steel its low‑carbon flat steel produced in Duisburg alongside the broader Materials Services and Steel units. Overall, Germany’s industrial strength was clear through ThyssenKrupp’s commitment to innovation and sustainable material offerings.

- May 2025: The German Poppe + Potthoff Group has launched a joint‑venture plant in Badli, Haryana, partnering with Lalbaba Engineering Limited under the name Indodeutsche Precision Tubes. This new facility will produce input materials for manufacturing precision steel tubes, leveraging India’s potential for future-oriented industrial projects. The venture expands Poppe + Potthoff’s strategic global footprint and enables access to innovative materials previously unavailable, reflecting Germany’s commitment to sustainable and advanced engineering in the precision steel segment.

Germany Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany steel tubes market on the basis of product type?

- What is the breakup of the Germany steel tubes market on the basis of material type?

- What is the breakup of the Germany steel tubes market on the basis of end use industry?

- What is the breakup of the Germany steel tubes market on the basis of region?

- What are the various stages in the value chain of the Germany steel tubes market?

- What are the key driving factors and challenges in the Germany steel tubes market?

- What is the structure of the Germany steel tubes market and who are the key players?

- What is the degree of competition in the Germany steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)