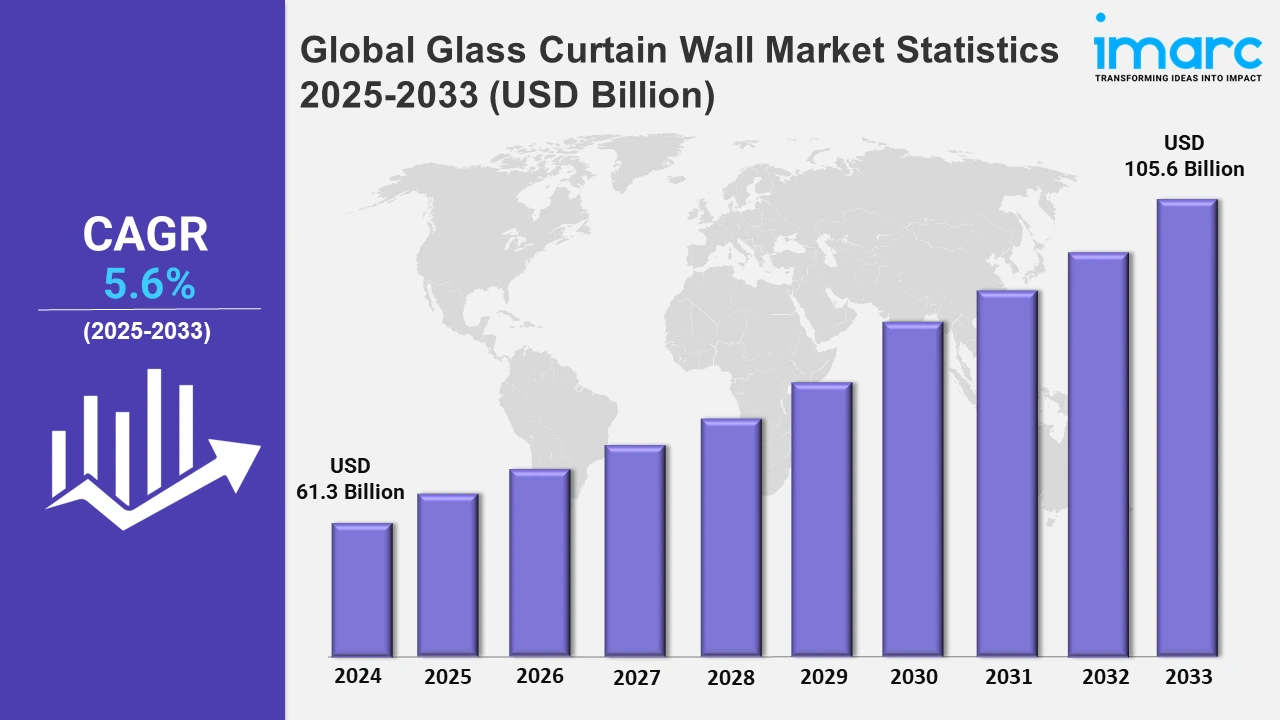

Global Glass Curtain Wall Market Expected to Reach USD 105.6 Billion by 2033 - IMARC Group

Global Glass Curtain Wall Market Statistics, Outlook and Regional Analysis 2025-2033

The global glass curtain wall market size was valued at USD 61.3 Billion in 2024, and it is expected to reach USD 105.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.6% from 2025 to 2033.

To get more information on this market, Request Sample

The primary driver for this market involves the fast expansion of the construction sector, stimulated by urbanization and the global requirement for energy-efficient designs of buildings. Governments and corporations are increasingly oriented toward green policies; thus, these glass walls have become an integral part of modern architectural applications, encouraging daylighting while also reducing energy consumption. On 22nd May 2024, the European Government announced relaunching the double glazing Scheme through support from the Malta Freeport Corporation and the Regulator for Energy and Water Services (REWS). The scheme this time has been targeted exclusively at Birżebbuġa residents and aims to mitigate the noise impact from Freeport operations. From this scheme, 90% of the material and installation costs, up to a maximum of €2,000, will be covered for existing homes when they upgrade the windows from the existing windows to either a double or triple glazing system. The costs will include value-added tax. In addition to this, developments in the technology of materials, such as double- and triple-glazed systems, are yielding improvements in thermal insulation as well as acoustic performance, which is attractive to users. Along with this, the aesthetic attraction and structural stiffness of glass curtain walls make them a desirable option for architects and developers, further favoring the market. Moreover, the rising urban landscape with high-rise and commercial building activity, especially in emerging economies, also increases the demand. Additionally, stringent environmental rules and LEED certification raise the prospects for glass curtain walls since these entities significantly contribute to green building standards.

Key trends in the market for glass curtain walls involve smart technologies and the increasing popularity of smart glazing systems. Smart glass integrates electrochromic technology and offers buildings control over light and heat, thus being energy-efficient. On 23rd January 2024, TSI Corp. partnered with robotics firm Raise Robotics to install curtainwall brackets. Raise Robotics officials stated the robot used for the project can semi-autonomously attach fasteners via artificial intelligence. It features various attachments, including a hammer drill and pulse torque driver. For this particular project, the crew used a V1 robot that scanned anchor channels and installed top-of-slab curtainwall brackets to specification. Raise Robotics also tested out a new layout attachment. A fast-growing trend is also witnessed in the frameless glass curtain wall applications that offer seamless aesthetics and comply with current architectural needs and preferences. In addition, the use of photovoltaic panels in curtain walls is also increasingly becoming popular, where buildings are being equipped with the capability of harvesting solar energy. Another aspect gaining popularity in the market includes fire-resistant and blast-proof glass curtain walls, supported by stringent demands for safety standards in commercial and public buildings. Furthermore, technological innovators from leading manufacturers often collaborate and provide innovations beyond the scope of application for glass curtain walls.

Global Glass Curtain Wall Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid urbanization, industrialization, and extensive infrastructure development in countries such as China and India. Additionally, favorable government initiatives and increasing investments in high-rise and commercial buildings are further strengthening its position as the largest regional segment.

Asia-Pacific Glass Curtain Wall Market Trends:

The Asia-Pacific region dominates the glass curtain wall market due to fast-paced urbanization, industrialization, and the growing construction sector within countries such as China, India, and Japan. The dominance in China is due to widespread urban projects, high-rise developments, and strict green building mandates. The growth of demand for energy-efficient, sustainable construction and development of smart cities in India is fueling the market. According to a research report by IMARC Group, the India smart cities market size is projected to exhibit a growth rate (CAGR) of 17.01% during 2024-2032. Moreover, government initiatives on smart cities and infrastructure development across Southeast Asia are further strengthening this region. Growing disposable incomes and foreign investments in the construction sector augment demand for high-end architectural solutions, such as glass curtain walls. With further development in cost-effective manufacturing technologies and the availability of ample skilled labor, the Asia-Pacific region remains the epicenter for innovation and production worldwide in the market.

North America Glass Curtain Wall Market Trends:

The demand for energy-efficient and aesthetically pleasing buildings propels the North America market. The U.S. is a prominent country due to high commercial construction activities, complemented by environmental certifications such as LEED. Advances in technologies, specifically the integration of smart glazing systems, are enhancing the adoption of innovative curtain wall solutions.

Europe Glass Curtain Wall Market Trends:

Europe remains a significant market for glass curtain walls as it has strict energy efficiency regulations, and sustainable construction practices in the region increasing the demand. For example, countries such as Germany, the UK, and France are accelerating their green building certifications with BREEAM, which is positively influencing the market. Further, advanced architectural designs and retrofitting of old structures continue to grow the market steadily.

Latin America Glass Curtain Wall Market Trends:

Growing urbanization and infrastructure development are key growth promoters in the Latin American glass market, with a high demand being exhibited in Brazil and Mexico. Investments in commercial and residential buildings are increasing, and modern architectural aesthetics are gaining importance. Moreover, efforts by governments to support sustainable construction trends are increasing the demand for energy-efficient glass curtain wall systems.

Middle East and Africa Glass Curtain Wall Market Trends:

Key investments in the infrastructure of high-rise buildings and luxury developments in countries such as the UAE and Saudi Arabia contribute to the Middle East and Africa glass curtain wall market. Extreme climate conditions in the region are encouraging demand for high-performance energy-efficient glazing systems, and continuing urbanization and tourism projects fuel the growth of this market.

Top Companies Leading in the Glass Curtain Wall Industry

Some of the leading glass curtain wall market companies include AGC Inc., Apogee Enterprises Inc., AvicSanxin Co. Ltd, Central Glass Co. Ltd., China Glass Holdings Limited, Guardian Industries (Koch Industries Inc), Hansen Group Ltd., Kawneer, Nippon Sheet Glass Co. Ltd, Schott AG, Vitro, and Xinyi Glass Holdings Limited, among others.

Global Glass Curtain Wall Market Segmentation Coverage

- On the basis of the system type, the market has been categorized into unitized and stick, wherein unitized represents the leading segment. Unitized systems dominate the glass curtain wall market due to their efficiency in installation, reduced labor requirements, and superior performance in high-rise buildings. Pre-fabricated off-site, these systems ensure better quality control and faster project timelines. Their enhanced structural integrity, weather resistance, and suitability for large-scale projects make them the preferred choice for modern construction needs.

- Based on the end use, the market is classified into commercial, public, and residential, amongst which commercial dominates the market. The commercial sector dominates the market due to the rising construction of office spaces, retail centers, and hospitality projects. These walls help improve energy efficiency, aesthetic appeal, and natural lighting features as dictated by modern architectural styles. Increasing urbanization and growing demands for green and attractive designs assure this segment of dominance in the global market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 61.3 Billion |

| Market Forecast in 2033 | USD 105.6 Billion |

| Market Growth Rate 2025-2033 | 5.6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Unitized, Stick |

| End Uses Covered | Commercial, Public, Residential |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGC Inc., Apogee Enterprises Inc., AvicSanxin Co. Ltd, Central Glass Co. Ltd., China Glass Holdings Limited, Guardian Industries (Koch Industries Inc), Hansen Group Ltd., Kawneer, Nippon Sheet Glass Co. Ltd, Schott AG, Vitro, Xinyi Glass Holdings Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)