Goat Milk Market Size, Share, Trends and Forecast by Sector, Product Type, Distribution Channel, and Region, 2025-2033

Goat Milk Market Size and Share:

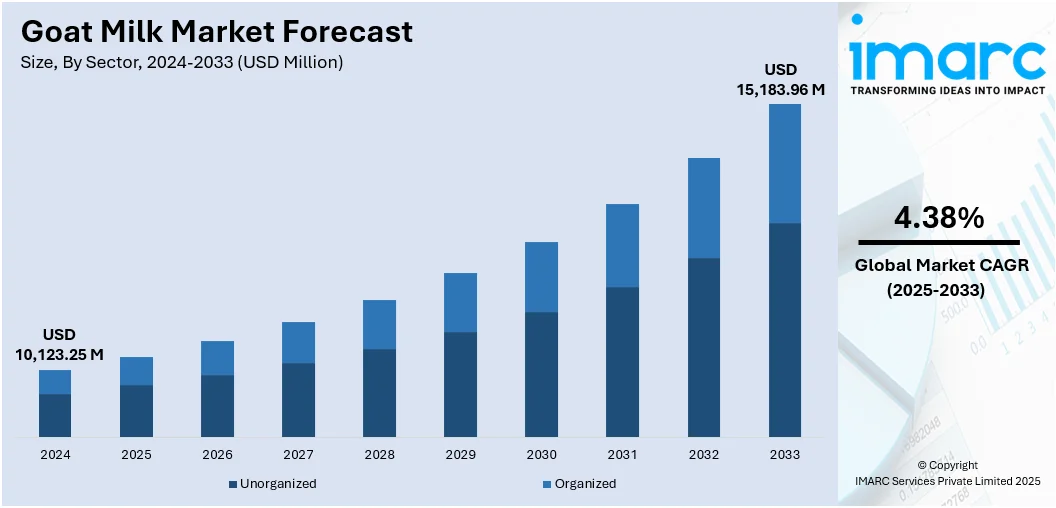

The global goat milk market size was valued at USD 10,123.25 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 15,183.96 Million by 2033, exhibiting a CAGR of 4.38% during 2025-2033. North America currently dominates the market, holding a significant market share of over 38.0% in 2024. This leadership is attributed to rising consumer interest in alternative dairy, expanding product availability, and strong retail infrastructure. The region remains a key contributor to the overall growth of the global goat milk market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10,123.25 Million |

|

Market Forecast in 2033

|

USD 15,183.96 Million |

| Market Growth Rate 2025-2033 | 4.38% |

The market is witnessing notable growth due to the increasing demand for premium dairy alternatives with high nutritional density. The rising popularity of goat milk in functional food formulations, such as fortified yogurts, cheeses, and protein supplements, is contributing to its global appeal. Additionally, innovations in cold chain logistics and packaging technologies are improving product shelf life and distribution efficiency, particularly in emerging markets. The expansion of specialty dairy segments and heightened interest in ethnic and traditional dairy products are also influencing consumer preferences. Moreover, global trade liberalization and supportive policies for small-scale dairy farmers in developing economies are fostering increased production and export of goat milk products. For instance, as of 2025, Artisanal goat farming is growing in Paraguay, led by Agroganadera Don Diego, a family-run agricultural business in Areguá. The farm produces cheeses, yogurts, and soaps from high-yield Alpine and Saanen goats. Through direct sales at fairs and online, Don Diego has built a strong brand around quality and consumer trust.

To get more information on this market, Request Sample

In the United States, the goat milk market growth is being driven by a shift toward clean-label and ethically sourced dairy products, as consumers seek transparency in origin and production practices. The growing popularity of artisanal and farmstead goat milk products—particularly in urban farmers’ markets and health food retailers—is expanding the domestic market. For instance, the 2025 American Dairy Goat Association (ADGA) National Show was held in July 2025 for the first time in Nebraska. With 541 exhibitors and 3,314 goats representing various breeds, the event highlighted the growth of dairy goat breeding in the U.S. Beyond competition, it fostered community and youth engagement, showcasing the ADGA’s key role in pedigree preservation, milk testing, and animal evaluation. The event reflects the rising interest in dairy goats and their value to both agriculture and personal wellbeing. Advances in goat breeding techniques and herd health management are also enhancing milk yield and quality. Furthermore, the incorporation of goat milk in niche wellness categories, including probiotic-rich fermented drinks and hypoallergenic skincare, is diversifying its applications. Strategic marketing campaigns emphasizing traceability, local sourcing, and animal welfare are further reinforcing consumer confidence and boosting market penetration.

Goat Milk Market Trends:

Rising Demand Due to Health-Conscious Consumer Behavior

The growing global burden of lifestyle diseases such as obesity, diabetes, and cardiovascular disorders is significantly influencing consumer dietary preferences, shifting demand toward functional and nutrient-dense foods like goat milk. Consumers are increasingly seeking natural alternatives with higher digestibility and better nutritional profiles. Goat milk, being rich in calcium, potassium, and medium-chain fatty acids, is perceived as a healthier option over traditional cow milk. This trend is particularly evident among individuals managing hypertension, cholesterol, and diabetes. According to the International Diabetes Federation (IDF), around 589 million individuals aged 20–79 years suffer from diabetes globally—a number projected to reach 853 million by 2050—indicating strong long-term growth prospects for goat milk consumption. The goat milk market outlook remains optimistic, driven by rising health awareness, shifting dietary habits, and increasing demand for functional dairy products.

Geriatric Population Fueling Demand for Bone-Strengthening Products

With the global population aging rapidly, goat milk is emerging as a preferred dietary component for older adults due to its bone-strengthening benefits and easier digestibility. Its high calcium and vitamin D content makes it effective in combating osteoporosis and other bone-related conditions common in the elderly. Moreover, its bioavailability of nutrients and anti-inflammatory properties enhance its appeal among aging consumers. The World Health Organization (WHO) estimates that the number of people aged 60 and above will reach 2.1 billion by 2050, with those aged 80 and above hitting 426 million—creating a large potential consumer base for goat milk products specifically targeted at age-related health needs.

Product Diversification and Rising Lactose Intolerance Rates

The market is witnessing notable diversification in goat milk-based products, from low-sugar, fat-free flavored milk to infant formulas and skincare applications. The increasing prevalence of lactose intolerance is a critical factor driving this trend, as goat milk contains less lactose than cow milk, making it a favorable alternative. Moreover, value-added products such as goat milk-based infant formulas are gaining traction due to their high digestibility and potential to support neurodevelopment in children. In parallel, demand is rising in the personal care sector, with goat milk being used in natural soaps, creams, and lotions. Approximately 65% of the global population suffers from lactose intolerance, further fueling the shift toward goat milk alternatives. Current goat milk market trends reflect this growing demand for both nutritional and cosmetic applications, highlighting consumer interest in multifunctional, health-forward products.

Goat Milk Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global goat milk market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on sector, product type, and distribution channel.

Analysis by Sector:

- Unorganized

- Organized

Organized stands as the largest component in 2024. The organized segment dominates the goat milk market due to its ability to ensure consistent quality, standardized packaging, and adherence to regulatory guidelines, which are increasingly important to modern consumers. Organized players typically invest in advanced processing technologies, supply chain infrastructure, and R&D, enabling them to offer a wide variety of value-added products such as flavored milk, yogurt, cheese, and infant formula. These companies also benefit from stronger brand recognition and broader retail presence across supermarkets, e-commerce platforms, and specialty stores. Additionally, rising consumer awareness regarding food safety and traceability has led to a preference for organized brands over unregulated local vendors.

Analysis by Product Type:

- Liquid Milk

- Cheese

- Milk Powder

- Others

Liquid milk segment leads the market in 2024. The liquid milk segment dominates the goat milk market primarily due to its widespread consumption and ease of integration into daily diets. Consumers prefer liquid goat milk for its natural nutritional benefits, including high calcium content, easier digestibility, and lower lactose levels compared to cow milk, making it suitable for lactose-intolerant individuals. Its availability in both fresh and UHT (ultra-high temperature) forms further boosts convenience and shelf life. Additionally, the increasing demand for natural and minimally processed dairy products has elevated the appeal of liquid goat milk. Its usage across households, cafes, and health-focused establishments reinforces its strong position in the market.

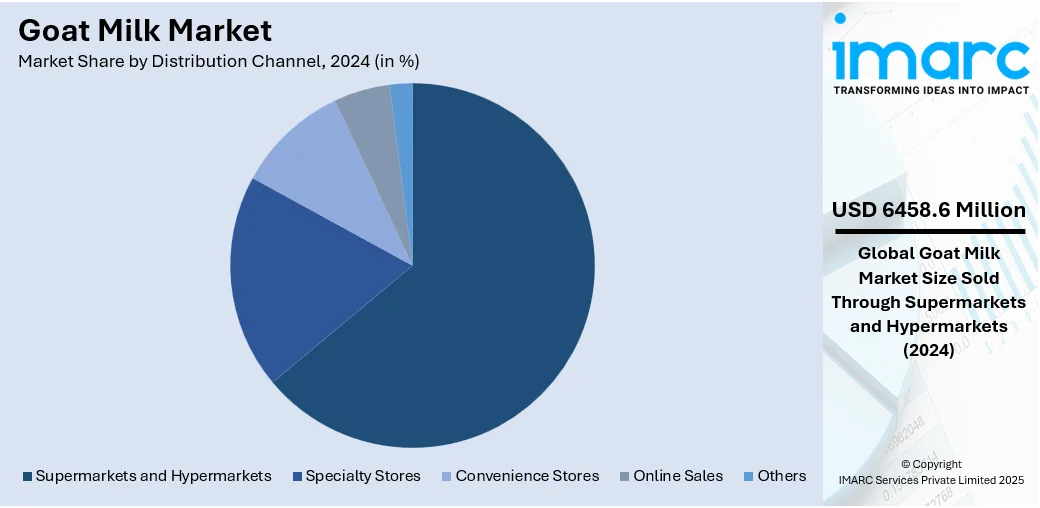

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Sales

- Others

Supermarkets and hypermarkets lead the market with around 63.8% of market share in 2024. The supermarket and hypermarket segment dominates the goat milk market due to its extensive product visibility, wide distribution network, and ability to offer a diverse range of brands and product variants under one roof. These retail formats provide consumers with the convenience of one-stop shopping, access to fresh and packaged goat milk products, and promotional offers that drive purchase decisions. Their well-organized shelf displays and emphasis on product hygiene and quality assurance also appeal to health-conscious buyers. Additionally, supermarkets and hypermarkets often serve urban and semi-urban areas where demand for premium, organic, and value-added goat milk products is consistently growing, further cementing their market dominance. For instance, in 2025, the price of organic goat milk has surged by 40% compared to conventional milk, earning it the nickname “white gold” in the dairy sector. This price premium is driven by rising consumer demand for natural, sustainable, and ethically produced dairy products.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- India

- Japan

- Indonesia

- Australia

- Others

- Europe

- Russia

- Germany

- France

- Italy

- United Kingdom

- Netherlands

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- South Africa

- Others

In 2024, North America accounted for the largest market share of over 38.0%. North America dominates the goat milk market due to its well-developed dairy industry, high consumer awareness regarding nutritional benefits, and rising demand for alternative dairy options. For instance, as per industry reports, goat milk offers exceptional nutritional and therapeutic benefits, including easier digestion, low allergenicity, and immune-boosting properties. It contains 87% water, 4.5% carbs, 4% fat, and 3.5% protein. Besides this, the growing prevalence of lactose intolerance has led many consumers to opt for goat milk, which is easier to digest. Additionally, increasing health consciousness and a shift towards natural, organic, and minimally processed products have driven interest in goat milk-based items. The region also benefits from strong retail infrastructure, allowing widespread availability of goat milk across supermarkets, health stores, and online platforms. Furthermore, investments in innovation and value-added products continue to fuel the market's expansion in North America.

Key Regional Takeaways:

United States Goat Milk Market Analysis

In 2024, the United States held a market share of around 88.80% in North America. The United States goat milk market is primarily driven by evolving consumer preferences, health consciousness, and diversification of dairy alternatives. Due to increasing cases of lactose intolerance, more individuals are seeking lactose-friendly and nutrient-dense options. According to industry reports, 30-50 Million individuals in the United States suffer from lactose intolerance. 80% of Native Americans and African-Americans, and more than 90% of Asian-Americans in the United States are lactose intolerant. Goat milk’s natural digestibility and high levels of essential vitamins and minerals cater to health-conscious consumers and those with mild lactose sensitivities. As a result, artisan and small-batch goat dairies are capitalizing on this trend by offering premium, locally sourced, and sustainably produced products that appeal to conscious buyers seeking transparency and farm-to-table experiences. The rise of specialty food and wellness trends has also boosted demand for goat milk–based products, such as yogurts, kefir, ice cream, and infant formula. Consumers are increasingly drawn to goat milk’s perceived benefits, such as its protein quality, fatty acid profile, and immune-supporting properties. Other than this, expansion into mainstream retail channels, alongside established niche outlets, is also increasing market accessibility nationwide. Furthermore, supportive policies and funding for small farmers, combined with improved production technology, are enhancing yield and lowering costs, thereby supporting overall market growth.

Asia Pacific Goat Milk Market Analysis

The Asia Pacific goat milk market is expanding due to growing health awareness and rising consumer preference for functional dairy alternatives with better digestibility and nutrient profiles. Increasing middle-class incomes and urban lifestyles are driving demand for premium goat milk products, such as yogurt and cheese, positioning them as aspirational and nutritious choices. Numerous countries in the region are also witnessing government-supported rural development and dairy modernization programs, which are enhancing goat farming efficiency and output. For instance, the Government of India allocated Rs. 324 Crores for the National Livestock Mission (NLM) for the year 2024-25. The initiative primarily focuses on creating employment opportunities and increasing per-animal productivity to boost the production of goat milk, meat, eggs, and wool. Besides this, cultural acceptance of goat dairy in key markets such as China, India, and Southeast Asia is creating a favorable backdrop for product innovation and wider adoption, propelling market growth.

Europe Goat Milk Market Analysis

The growth of the Europe goat milk market is largely propelled by demographic shifts, including a growing geriatric population that is increasingly seeking easier-to-digest, nutrient-rich alternatives to traditional dairy. According to reports, in January 2024, individuals aged 65 years and older accounted for 21.6% of the population of the European Union (EU). The naturally high levels of calcium, medium-chain fatty acids, and bioavailable nutrients of goat milk make it an attractive option for supporting bone health and digestive wellness among older adults. Additionally, rising interest in alternative infant formulas made from goat milk is boosting demand, particularly among parents seeking gentler options for babies with sensitivities to cow’s milk. Growth in organic food consumption is also supporting industry expansion, with numerous goat milk producers operating within organic and biodynamic farming frameworks to meet consumer expectations. According to reports, the overall number of organic producers in Europe reached 495,000 in 2023, representing a 1.4% increase in comparison to the previous year. Retail sales of organic products totaled 54.7 Billion Euros in 2023 in Europe. Other than this, tourism and rural development initiatives in the Mediterranean and Alpine regions are also supporting local goat dairies, turning farm-based goat milk production into a key aspect of agritourism and local food economies.

Latin America Goat Milk Market Analysis

The Latin America goat milk market is significantly influenced by the increasing demand for locally sourced and sustainable dairy products, as consumers become more aware of the environmental impact of traditional livestock farming. For instance, according to the World Bank report, the agricultural sector accounts for about 8.4% of Brazil's GDP. As a result, goat farming, which generally requires fewer resources and adapts well to diverse terrains, is gaining popularity as a viable livelihood in rural and semi-arid regions. Growth in health-focused food and beverage startups across the region is also driving innovation in goat milk products, resulting in a wider variety of offerings in domestic markets.

Middle East and Africa Goat Milk Market Analysis

The Middle East and Africa goat milk market is experiencing robust growth due to the growing popularity of goat milk as a staple in traditional and ethnic cuisines, where it is used in beverages, cheeses, and desserts, appreciated for its authentic flavor and cultural significance. Increasing urbanization and the expansion of supermarket chains are improving product availability and variety in cities. Rising disposable incomes in urban centers are also leading to greater experimentation with alternative dairy products, including flavored goat milk drinks and specialty cheeses. For instance, the household monthly average disposable income in Saudi Arabia reached SAR 11,839 in 2023, according to the Saudi Arabia General Authority for Statistics. Other than this, goat milk is also finding new applications in halal dairy lines and clean-label skincare products, broadening its appeal among health-oriented consumers.

Competitive Landscape:

The competitive landscape of the goat milk market is characterized by the presence of numerous regional and international players actively focusing on product innovation, quality enhancement, and expansion into emerging markets. Companies are increasingly investing in research and development to introduce value-added products such as flavored milk, probiotic-rich variants, and goat milk-based infant formulas to meet evolving consumer preferences. Strategic collaborations with local dairy farms, expansion of distribution networks, and marketing of organic and clean-label offerings are also shaping competition. With growing demand for functional and health-focused dairy alternatives, the market is witnessing intensified competition. The goat milk market forecast projects continued consolidation, technological integration, and brand diversification as companies aim to capture a larger consumer base in both developed and developing economies. For instance, at the 2025 Global Pet Expo, Primal Pet Foods unveiled its new Dehydrated Goat Milk, offering a convenient, shelf-stable alternative to its popular frozen raw goat milk. Designed to support hydration and digestion in pets, the product is rich in probiotics, vitamins, and minerals. Launching in May 2025, it comes in single-serve packets and larger pouches, making it easier for pet owners to add moisture and nutrition to their dog or cat’s diet, without the need for freezer storage.

The report provides a comprehensive analysis of the competitive landscape in the goat milk market with detailed profiles of all major companies, including:

- Ausnutria Dairy Corporation Ltd.

- AVH Dairy Trade B.V.

- Goat Partners International

- Granarolo S.p.A.

- Meyenberg

- Redwood Hill Farm & Creamery

- St Helen's Farm

- Stickney Hill Dairy Inc

- Woolwich Dairy Inc.

- Xi'an Baiyue Goat Dairy Group Co.Ltd. (Baiyue)

Latest News and Developments:

- May 2025: Ramat Hagolan Dairy, under the ownership of ZNLR, introduced a brand new range of products, featuring Goat Feta, Tzfatit, Brinza, and numerous other offerings. The 16% Goat Feta is a Greek-style, salty cheese produced from goat milk. It has a delicate, smooth texture and has the rich, strong flavor that is characteristic of traditional goat cheeses.

- April 2025: Canada-based goat milk manufacturing company Kabrita announced the launch of its High-Calcium Adult Goat Milk Powder. Initially launched in Australia in collaboration with Aumake, Kabrita’s exclusive distribution partner in the country, the milk powder is produced using goat’s milk from Kabrita’s farm in the Netherlands.

- February 2025: Kabrita launched its new Goat Milk-Based Infant Formula for infants aged 0 to 12 months. After securing certification from Health Canada, the Infant Formula can now be purchased by families throughout Canada at Walmart and Amazon.ca. The product will be available for purchase in other major stores in the following months.

- January 2025: Under the Sustainable Canadian Agricultural Partnership (Sustainable CAP), the Governments of Canada and Ontario announced an investment of nearly USD 7.18 Million in 70 projects throughout the province to improve and upgrade dairy processing capabilities and food safety. The investment is anticipated to strengthen the availability of safe, premium Ontario milk on store shelves. The initiative includes funding for goat, cow, water buffalo, and sheep milk processors.

Goat Milk Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Unorganized, Organized |

| Product Types Covered | Liquid Milk, Cheese, Milk Powder, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialized Retailers, Convenience Stores, Online Sales, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Netherlands, Russia, China, Japan, India, Australia, Indonesia, Brazil, Mexico, Turkey, South Africa |

| Companies Covered | Ausnutria Dairy Corporation Ltd., AVH Dairy Trade B.V., Goat Partners International, Granarolo S.p.A., Meyenberg, Redwood Hill Farm & Creamery, St Helen's Farm, Stickney Hill Dairy Inc, Woolwich Dairy Inc. and Xi'an Baiyue Goat Dairy Group Co.Ltd. (Baiyue) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the goat milk market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global goat milk market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the goat milk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The goat milk market was valued at USD 10,123.25 Million in 2024.

The goat milk market is projected to exhibit a CAGR of 4.38% during 2025-2033, reaching a value of USD 15,183.96 Million by 2033.

The goat milk market is driven by growing consumer awareness of the nutritional benefits of goat milk, including easier digestibility and lower allergenicity compared to cow milk. Rising demand for functional and organic dairy products, an increasing lactose-intolerant population, and expanding applications in infant formula and skincare products further fuel market growth. Additionally, improvements in dairy farming practices, growing availability of goat milk-based products in retail and e-commerce, and a rising preference for sustainable and ethical food sources are positively influencing the market.

North America currently dominates the market, holding a significant market share of 38.0% in 2024. This is attributed to rising health-consciousness among consumers, increasing demand for alternative dairy products, and the presence of leading goat dairy producers. A well-established retail infrastructure and growing awareness of goat milk’s health benefits further contribute to the region’s market leadership.

Some of the major players in the goat milk market include Ausnutria Dairy Corporation Ltd., AVH Dairy Trade B.V., Goat Partners International, Granarolo S.p.A., Meyenberg, Redwood Hill Farm & Creamery, St Helen's Farm, Stickney Hill Dairy Inc, Woolwich Dairy Inc., Xi'an Baiyue Goat Dairy Group Co. Ltd. (Baiyue), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)