Gold Potassium Cyanide (GPC) Production Cost Analysis Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue

Gold Potassium Cyanide Production Plant Project Report (DPR) Summary:

IMARC Group’s report, titled “Gold Potassium Cyanide (GPC) Production Cost Analysis Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue,” provides a complete roadmap for setting up a gold potassium cyanide production plant. The global gold potassium cyanide market size was valued at USD 1,112.84 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,410.67 Million by 2034, exhibiting a CAGR of 2.67% from 2026-2034. The gold potassium cyanides market is expanding steadily due to the widespread adoption of gold potassium cyanide (GPC) for medical devices, and growing demand for high-reliability electronics, gold-plated connectors, and precision components.

The report covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc. The gold potassium cyanide production plant setup cost is provided in detail covering project economics, capital investments (CapEx), project funding, operating expenses (OpEx), income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI and net present value (NPV), profit and loss account, financial analysis, etc.

-production-cost-analysis-report.webp)

To gain detailed insights into the report, Request Sample

What is Gold Potassium Cyanide?

Gold Potassium Cyanide (GPC) is the most important compound used to electroplate gold on electronics components, jewelry and products used to manufacture semiconductors. It is manufactured by combining metallic gold with potassium cyanide under controlled conditions, purifying and crystallising the resulting compound. The result is an on-target, pure material that is white to yellow in colour and highly water soluble. This allows for stable electroplating baths to be created from GPC. In addition to being the most cost-effective electroplating material, GPC has several beneficial properties that include: high purity, exceptional stability, consistent gold build-up rate and well-developed adhesion ability. Due to its characteristics of being very conductive and resistant to oxidation, GPC is a critical material in the creation of microelectronics. In addition to its electrical capabilities, GPC also has relatively high amounts of gold within its composition, thus making it one of the highest value plated materials in the world. Due to its pervasive use in the manufacturing of modern equipment such as smartphones, connectors, printed circuit boards (PCBs), medical devices, parts for aerospace, and luxury jewelry, GPC continues to play a central role in high-tech manufacturing processes.

Key Characteristics of Gold Potassium Cyanide:

- High solubility in aqueous plating solutions

- Provides uniform, bright, and adherent gold deposits

- Excellent chemical stability in controlled environments

- High purity, enabling precision electroplating applications

- Strong conductivity enhancement in plating baths

- Sensitive to heat, moisture, and light exposure

- Requires stringent handling and safety measures due to cyanide content

Gold Potassium Cyanide Market Outlook & Investment Overview

The rising demand for luxury jewelry is creating increased opportunities for high-quality gold-plating materials used in fine jewelry manufacturing. For instance, as per a recent report, the UAE’s luxury jewelry market is forecast to reach USD 2.24 billion by 2030, supported by strong tourism inflows and the enduring cultural significance of jewelry in weddings and traditional celebrations. Also, the sector is expected to grow at an annual rate of 10.36%, driven by affluent shoppers, rising disposable incomes, and increasing demand for premium, design-focused pieces across the Emirates. This growing consumption of gold in premium jewelry is expected to drive higher demand for gold potassium cyanide (GPC), supporting the market’s expansion globally. Besides, stringent quality standards in aerospace and medical devices continue to reinforce demand for high-purity GPC. Also, technological advancements in plating processes such as low-voltage deposition, cyanide-free alternatives, and regenerative recovery systems are reshaping the industry. Furthermore, environmental regulations in the EU, US, and South Korea are influencing manufacturing practices through tighter cyanide handling and effluent controls, driving investment into safer, automated plants.

The gold potassium cyanide (GPC) market is growing due to rising demand for gold electroplating across electronics, jewelry, and semiconductor industries. As consumer electronics become more advanced and miniaturized, manufacturers increasingly rely on high-purity GPC for precision plating and conductivity. The jewelry sector’s shift toward high-quality finishes and durable coatings further boosts consumption. Moreover, the expanding semiconductor industry and growing demand for high-purity gold plating chemicals are contributing to the market growth. According to the India Brand Equity Foundation (IBEF), India’s semiconductor market reached USD 26.3 billion in 2022 and is poised for rapid expansion. The sector is projected to grow at a CAGR of 26.3%, potentially hitting USD 271.9 billion by 2032, reflecting strong demand across electronics, automotive, and emerging technology segments. With India’s semiconductor market projected to grow sharply, industries such as electronics manufacturing, PCB fabrication, and microchip packaging are increasing the consumption of gold potassium cyanide (GPC) for precision coating applications.

Medical devices such as pacemakers, diagnostic connectors, and implants rely on gold-plated components due to their biocompatibility and corrosion resistance. For instance, as per the AdvaMed, the United States is currently the world’s largest medical device market accounting for over 40% of global medtech sales. The growing dominance of the medical device sector across the United States is escalating the demand for high-precision electronic components and specialized metal coatings. Additionally, gold potassium cyanide (GPC), a key material used in electroplating medical instruments, connectors, and diagnostic equipment, benefits from this surge. As medical device manufacturing expands and shifts toward higher-quality, corrosion-resistant components, the need for gold-plating chemicals rises, thereby accelerating the growth of the GPC market.

Gold Potassium Cyanide Plant: Key Highlights

- End-use Industries: Electronics, semiconductors, jewelry, aerospace, medical devices, automotive electronics

- Applications: Used for gold electroplating, connector coating, semiconductor packaging, jewelry finishing, precision component plating

How to Setup a Gold Potassium Cyanide Production Plant?

The Following Aspects Have Been Covered in the Gold Potassium Cyanide Production Plant Report:

Detailed Process Flow:

- Product Overview

- Unit Operations Involved

- Mass Balance and Raw Material Requirements

- Quality Assurance Criteria

- Technical Tests

The report also provides detailed information related to the gold potassium cyanide production process flow and various unit operations involved in a production plant.

Gold Potassium Cyanide Production Process:

- Gold Dissolution: Metallic gold is dissolved in an aqueous cyanide solution under controlled conditions to form a stable gold cyanide complex. This step requires precise temperature and pH control to ensure complete dissolution.

- Filtration: The solution is passed through industrial filters to remove insoluble residues and achieve high-purity feed for downstream processing.

- Reaction with Potassium Source: Potassium hydroxide or potassium carbonate is added to convert the dissolved gold cyanide complex into gold potassium cyanide crystals. The reaction is carefully monitored to maintain purity and yield.

- Crystallization: The reaction mixture is cooled gradually to promote uniform crystal formation with controlled morphology and high chemical stability.

- Drying: Crystals are dried in vacuum or tray dryers to eliminate moisture, preventing product degradation and ensuring safe handling.

- Milling & Sieving: Dried crystals are milled and sieved to achieve consistent particle size distribution suitable for electroplating applications.

- Quality Testing: Samples undergo chemical analysis to verify gold content, cyanide concentration, impurity levels, and crystal structure compliance.

- Packaging: The finished product is sealed in airtight, moisture-resistant containers to maintain stability and prevent contamination during storage and transport.

Key Considerations for Gold Potassium Cyanide Plant Setup Requirements and Costs

Land, Location and Site Development

Selecting the optimal location for a gold potassium cyanide production plant is critical for operational efficiency and cost-effectiveness. The report provides comprehensive analysis covering land location selection criteria, site significance, environmental impact assessment, and associated expenditure. Usually, a medium scale gold potassium cyanide plant has a capacity of 5-20 Tons Per Annum (TPA)*.

Plant Layout

The gold potassium cyanide plant setup requires careful planning of the facility layout to optimize workflow, material handling, and safety protocols. Factors influencing the layout include production capacity, machinery placement, raw material storage, finished product warehousing, and regulatory compliance requirements.

Key Layout Zones:

- Raw Material Storage: A secure, restricted-access area designed for safe storage of metallic gold and cyanide compounds under strict monitoring.

- Reaction Area: Houses reactors and dissolution units where gold is converted into gold cyanide complexes under controlled chemical conditions.

- Crystallization Room: Maintains temperature-controlled environments that enable consistent and high-purity crystal formation.

- Drying Section: Equipped with vacuum or tray dryers to remove moisture from crystals while preventing thermal decomposition.

- Quality Control Laboratory: Performs analytical testing to ensure chemical purity, structural integrity, and regulatory compliance of each production batch.

- Waste Treatment Unit: Dedicated facility where cyanide-containing effluents are neutralized and treated to meet environmental discharge standards.

- Finished Goods Warehouse: Secure, climate-controlled storage for packaged GPC to maintain product stability and safety.

- Utility Section: Provides essential utilities including power distribution, purified water supply, air handling, and ventilation systems.

- Administrative Block: Contains office space for management, documentation, regulatory compliance, and operational coordination.

- Safety & Emergency Zone: Equipped with PPE stations, cyanide antidote kits, emergency showers, and monitoring devices for rapid incident response.

Gold Potassium Cyanide Machinery List and Requirements

Establishing a gold potassium cyanide production plant requires specialized machinery and equipment to ensure efficient production.

Gold Potassium Cyanide Raw Material Requirements

The production of gold potassium cyanide requires specific raw materials in precise quantities to ensure optimal output quality. Primary raw materials include gold metal, potassium cyanide, hydrogen peroxide. Raw materials account for 85-95% of total operating expenses (OpEx), making raw materials price fluctuations the most significant cost factor in gold potassium cyanide production.

Key Raw Materials:

| Raw Material Name | Specifications | Average Price in US$ |

| Gold Metal |

XX |

XX |

| XX | XX | XX |

| XX | XX | XX |

| XX | XX | XX |

| XX | XX | XX |

| XX | XX | XX |

To access raw materials list, Request Sample

Utility Requirements and Costs

The gold potassium cyanide plant setup demands significant utility infrastructure, including electricity for machinery operation, water for cooling and processing, fuel for heating and reduction processes, and compressed air systems. The report provides detailed utility consumption patterns and cost estimates. Utility expenses account for a share of 2-4% of the total OpEx.

Human Resource Requirements and Costs

Skilled manpower is essential for efficient plant operations. The report covers human resource requirements across production, maintenance, quality control, administration, and management functions, along with associated salary and wage structures.

Packaging & Transportation Requirement

Gold potassium cyanide is typically packaged in sealed, airtight, corrosion-resistant HDPE or metal containers, usually in units of 1 kg, 5 kg, or 10 kg, depending on user requirements. Containers must include tamper-proof seals, clear hazard labeling, and moisture-control inserts. Transportation requires compliance with hazardous chemical transport regulations, using insulated, well-secured cargo with spill-containment systems. Temperature and humidity control are essential to preserve product stability and prevent decomposition during transit.

Quality Assurance Systems: A comprehensive quality control system should be established throughout production. Analytical instruments must be used to monitor product concentration, purity, and stability. Documentation for traceability and regulatory compliance must be maintained.

Gold Potassium Cyanide Plant Cost Analysis & Project Economics

The report provides comprehensive analysis of project economics for establishing a gold potassium cyanide production plant. This detailed assessment enables stakeholders to make informed investment decisions by evaluating financial viability and long-term profitability.

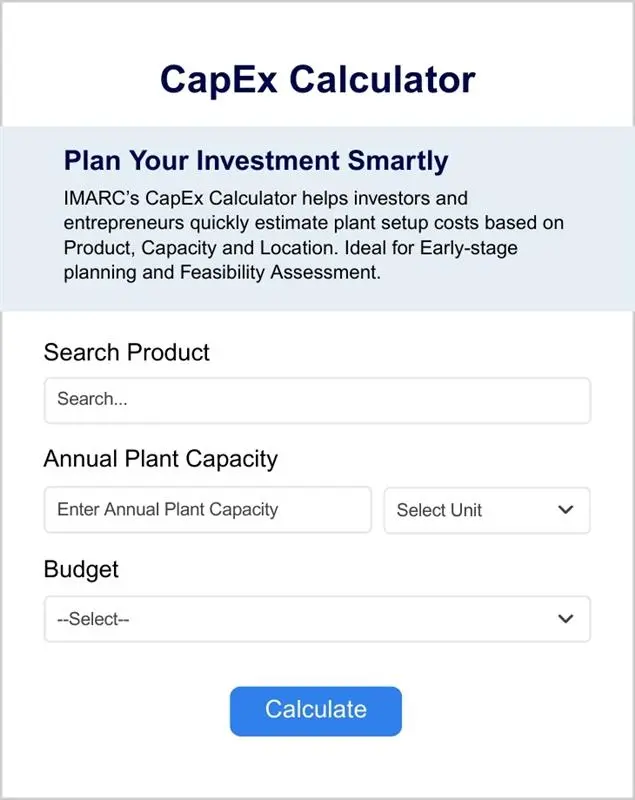

Gold Potassium Cyanide Plant Capital Investment (CapEx)

Capital Investment (CapEx): Machinery costs account for the largest portion of the total capital expenditure. The cost of land and site development, including charges for land registration, boundary development, and other related expenses, forms a substantial part of the overall investment. This allocation ensures a solid foundation for safe and efficient plant operations.

Capital Expenditure Breakdown:

| Particulars | Cost (in US$) |

|---|---|

| Land and Site Development Costs | XX |

| Civil Works Costs | XX |

| Machinery Costs | XX |

| Other Capital Costs | XX |

To access CapEx Details, Request Sample

The gold potassium cyanide plant capital investment encompasses all upfront expenditures required to establish the production facility. This includes land acquisition and site development, civil construction works for buildings and infrastructure, procurement and installation of machinery and equipment, utilities and auxiliary systems, initial working capital requirements, pre-operative expenses, and contingency provisions. The report provides detailed breakdowns of each capital cost component to facilitate accurate budget planning and financing arrangements.

Operating Costs (OpEx)

Operating Expenditure (OpEx): In the first year of operations, the operating cost for the gold potassium cyanide production plant is projected to be significant, covering raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance. By the fifth year, the total operational cost is expected to increase substantially due to factors such as inflation, market fluctuations, and potential rises in the cost of key materials. Additional factors, including supply chain disruptions, rising consumer demand, and shifts in the global economy, are expected to contribute to this increase.

Operational Expenditure Breakdown:

| Particulars | In % |

|---|---|

| Raw Material Cost | 85-95% |

| Utility Cost | 2-4% |

| Transportation Cost | XX |

| Packaging Cost | XX |

| Salaries and Wages | XX |

| Depreciation | XX |

| Other Expenses | XX |

To access OpEx Details, Request Sample

Expenditure Projections

The report presents detailed projections of operating expenses over the project lifecycle, distinguishing between fixed and variable costs to provide clarity on cost behavior patterns.

Revenue Projections

Revenue forecasts are based on production capacity, market pricing trends, and sales volume assumptions, enabling stakeholders to assess income potential. Usually, the gross profit and net profit for a typical gold potassium cyanide plant comes at around 10-20% and 5-12%, respectively.

Taxation and Depreciation

The gold potassium cyanide project cost analysis includes comprehensive treatment of tax obligations, depreciation schedules, and their impact on financial performance.

Profit Projections

Profitability Analysis:

| Particulars | Unit | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Average |

|---|---|---|---|---|---|---|---|

| Total Income | US$ | XX | XX | XX | XX | XX | |

| Total Expenditure | US$ | XX | XX | XX | XX | XX | XX |

| Gross Profit | US$ | XX | XX | XX | XX | XX | XX |

| Gross Margin | % | XX | XX | XX | XX | XX | 10-20% |

| Net Profit | US$ | XX | XX | XX | XX | XX | XX |

| Net Margin | % | XX | XX | XX | XX | XX | 5-12% |

To access Financial Analysis, Request Sample

Financial Analysis

The comprehensive financial analysis covers liquidity assessment, profitability ratios, payback period calculation, net present value (NPV) determination, internal rate of return (IRR) analysis, uncertainty and sensitivity analysis, and economic feasibility evaluation. This multi-dimensional approach ensures stakeholders understand the gold potassium cyanide plant investment analysis from all critical perspectives.

Leading Gold Potassium Cyanide Manufacturers:

Leading manufacturers in the global gold potassium cyanide industry include several multinational chemical companies with extensive production capacities and diverse application portfolios. Key players include:

- Cyanco

- Aurochemicals

- Coogee Chemicals

- Tenova

- Orica

- JINNENG GROUP

- PPM Pure Metals GmbH

- Shandong Gold Group

- Kemetyl

- Hunan Gold Group

all of which serve end-use sectors such as electronics, semiconductors, jewelry, aerospace, medical devices, and automotive electronics.

Latest Industry Developments:

- February 2024: Orica signed a binding agreement to acquire Cyanco, a leading U.S. sodium cyanide producer serving the gold mining industry, for US$640 million on a cash-free, debt-free basis. The deal will significantly expand Orica’s mining chemicals portfolio and strengthen its North American presence. Funded through existing facilities and an A$400 million institutional placement, the acquisition is expected to boost capacity, enhance synergies, and close by the end of FY2024.

Report Coverage:

| Report Features | Details |

|---|---|

| Product Name | Gold Potassium Cyanide (GPC) |

| Report Coverage | Detailed Process Flow: Unit Operations Involved, Quality Assurance Criteria, Technical Tests, Mass Balance, and Raw Material Requirements Land, Location and Site Development: Selection Criteria and Significance, Location Analysis, Project Planning and Phasing of Development, Environmental Impact, Land Requirement and Costs Plant Layout: Importance and Essentials, Layout, Factors Influencing Layout Plant Machinery: Machinery Requirements, Machinery Costs, Machinery Suppliers (Provided on Request) Raw Materials: Raw Material Requirements, Raw Material Details and Procurement, Raw Material Costs, Raw Material Suppliers (Provided on Request) Packaging: Packaging Requirements, Packaging Material Details and Procurement, Packaging Costs, Packaging Material Suppliers (Provided on Request) Other Requirements and Costs: Transportation Requirements and Costs, Utility Requirements and Costs, Energy Requirements and Costs, Water Requirements and Costs, Human Resource Requirements and Costs Project Economics: Capital Costs, Techno-Economic Parameters, Income Projections, Expenditure Projections, Product Pricing and Margins, Taxation, Depreciation Financial Analysis: Liquidity Analysis, Profitability Analysis, Payback Period, Net Present Value, Internal Rate of Return, Profit and Loss Account, Uncertainty Analysis, Sensitivity Analysis, Economic Analysis Other Analysis Covered in The Report: Market Trends and Analysis, Market Segmentation, Market Breakup by Region, Price Trends, Competitive Landscape, Regulatory Landscape, Strategic Recommendations, Case Study of a Successful Venture |

| Currency | US$ (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customized based on the requirement of the customer |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Report Customization

While we have aimed to create an all-encompassing gold potassium cyanide (GPC) production plant project report, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include:

- The report can be customized based on the location (country/region) of your plant.

- The plant’s capacity can be customized based on your requirements.

- Plant machinery and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why Buy IMARC Reports?

- The insights provided in our reports enable stakeholders to make informed business decisions by assessing the feasibility of a business venture.

- Our extensive network of consultants, raw material suppliers, machinery suppliers and subject matter experts spans over 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our cost modeling team can assist you in understanding the most complex materials. With domain experts across numerous categories, we can assist you in determining how sensitive each component of the cost model is and how it can affect the final cost and prices.

- We keep a constant track of land costs, construction costs, utility costs, and labor costs across 100+ countries and update them regularly.

- Our client base consists of over 3000 organizations, including prominent corporations, governments, and institutions, who rely on us as their trusted business partners. Our clientele varies from small and start-up businesses to Fortune 500 companies.

- Our strong in-house team of engineers, statisticians, modeling experts, chartered accountants, architects, etc. has played a crucial role in constructing, expanding, and optimizing sustainable production plants worldwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Frequently Asked Questions

Capital requirements generally include land acquisition, construction, equipment procurement, installation, pre-operative expenses, and initial working capital. The total amount varies with capacity, technology, and location.

To start a gold potassium cyanide (GPC) production business, one needs to conduct a market feasibility study, secure required licenses, arrange funding, select suitable land, procure equipment, recruit skilled labor, and establish a supply chain and distribution network.

Gold potassium cyanide (GPC) production requires gold (usually as gold ore or scrap) and potassium cyanide as the primary raw materials. Water is used to prepare and control solution concentration.

The gold potassium cyanide (GPC) factory typically requires reactors or mixing tanks, filtration units, drying equipment, storage tanks, and safety systems for handling toxic chemicals like cyanide, along with quality control and packaging machinery.

The main steps generally include:

-

Sourcing of gold material

-

Preparation of potassium cyanide solution

-

Controlled reaction of gold with potassium cyanide

-

Filtration and purification of the product

-

Drying and packaging

-

Quality control and testing

Usually, the timeline can range from 12 to 36 months to start a gold potassium cyanide (GPC) production plant depending on factors like plant scale, equipment procurement times, regulatory approvals, construction, and trial production phases.

Challenges may include high capital requirements, securing regulatory approvals, ensuring raw material supply, competition, skilled manpower availability, and managing operational risks.

Typical requirements include business registration, environmental clearances, factory licenses, fire safety certifications, and industry-specific permits. Local/state/national regulations may apply depending on the location.

The top gold potassium cyanide (GPC) manufactures are:

-

Bangalore Refinery Private Limited

-

Innova Corporate

-

LEGOR GROUP S.p.A.

-

Mahavir Expochem Ltd

-

Metalor Technologies SA (TANAKA HOLDINGS Co., Ltd.)

-

Prominex Precious Mineral Resources

-

Spectrum Chemical Manufacturing Corp

Profitability depends on several factors including market demand, production efficiency, pricing strategy, raw material cost management, and operational scale. Profit margins usually improve with capacity expansion and increased capacity utilization rates.

Cost components typically include:

-

Land and Infrastructure

-

Machinery and Equipment

-

Building and Civil Construction

-

Utilities and Installation

-

Working Capital

Break even in a gold potassium cyanide (GPC) production business typically range from 3 to 6 years, depending on initial capital investment, production scale, and operational costs. Market demand and pricing fluctuations for gold chemicals also significantly impact profitability.

Governments may offer incentives such as capital subsidies, tax exemptions, reduced utility tariffs, export benefits, or interest subsidies to promote manufacturing under various national or regional industrial policies.

Financing can be arranged through term loans, government-backed schemes, private equity, venture capital, equipment leasing, or strategic partnerships. Financial viability assessments help identify optimal funding routes.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization