Graphene Market Size, Share, Trends and Forecast by Type, Application, End-Use Industry, and Region, 2025-2033

Graphene Market Size and Share:

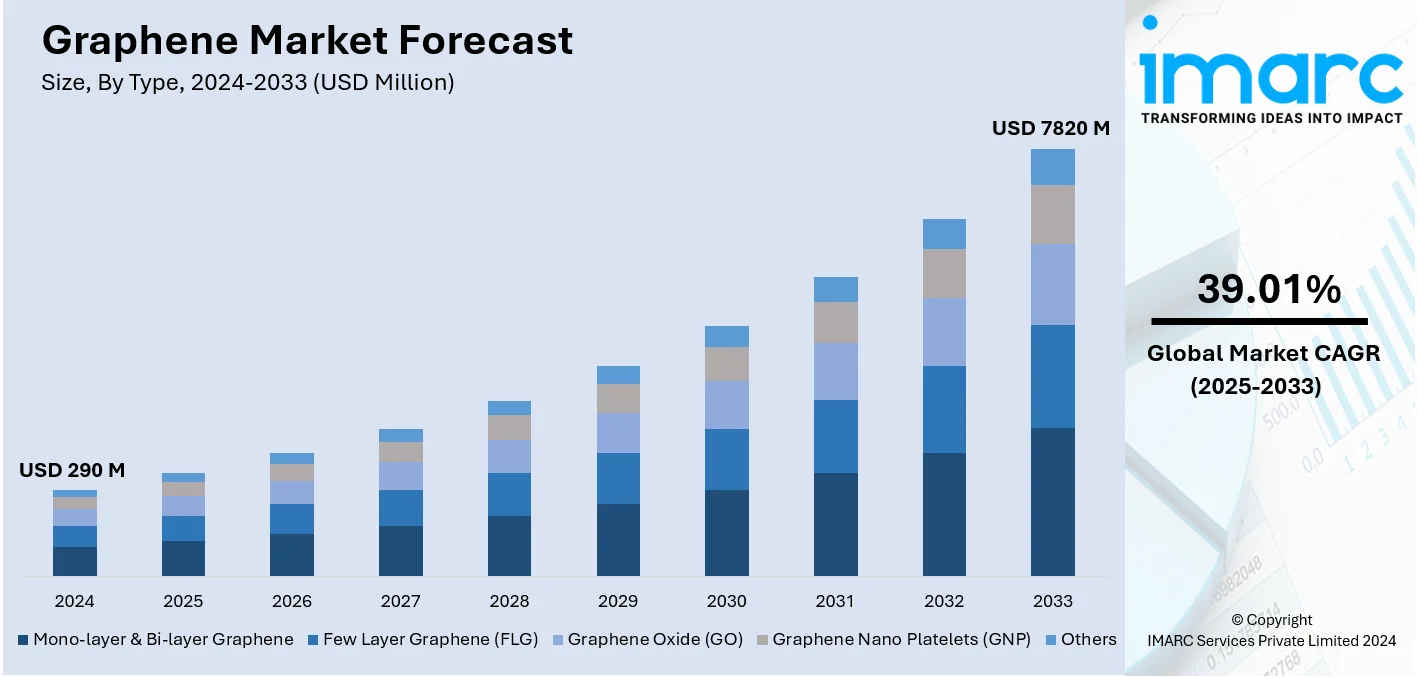

The global graphene market size was valued at USD 290 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 7,820 Million by 2033, exhibiting a CAGR of 39.01% during 2025-2033. Asia-Pacific currently dominates the market. Improvements in various biomedical applications, advancements in the production of semiconductors for enhanced performance, and increasing demand for lighter and more durable construction materials are some of the key factors that are impelling the graphene market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 290 Million |

| Market Forecast in 2033 | USD 7,820 Million |

| Market Growth Rate 2025-2033 | 39.01% |

The global graphene market is driven by its increasing adoption across diverse industries, including electronics, energy, automotive, and healthcare. Graphene's exceptional properties, such as high electrical conductivity, lightweight structure, mechanical strength, and thermal stability, make it a preferred choice for advanced applications such as batteries, sensors, and flexible electronics. The growing demand for sustainable and energy-efficient solutions further accelerates graphene's usage in renewable energy technologies and next-generation semiconductors. On 19th December 2024, Westlake Innovations, a subsidiary of Westlake Corporation, invested in Burlington-based Universal Matter, Inc., a firm that focuses on sustainable graphene production. FJH technology patented by Universal Matter guarantees the upcycling of carbon waste into high-quality graphene for industrial purposes through the cost-effective Flash Joule Heating technology. This investment aligns with Westlake's commitment to sustainability and innovation in advanced materials. Additionally, rising investments in research and development, coupled with government initiatives supporting nanotechnology, are fostering market growth. Moreover, the expanding scope of graphene-based materials in composites and coatings also propels the market's advancement worldwide.

The United States stands out as a key regional market, primarily driven by robust advancements in nanotechnology and material science, supported by strong government and private sector investments. On 18th July 2024, the U.S. Department of Energy's Advanced Materials and Manufacturing Technologies Office (AMMTO) has announced USD 33 Million for smart manufacturing technologies, representing an important step toward the clean energy transition. It is geared to enhance efficiency, sustainability, and innovation in areas such as circular supply chains, clean transportation, and high-performance materials, and enhance American competitiveness in manufacturing. The country's focus on innovation fuels the demand for graphene in high-performance applications such as aerospace, defense, and renewable energy. The rapid development of electric vehicles (EVs) and the need for efficient energy storage solutions have bolstered graphene's use in batteries and supercapacitors. Concurrently, the U.S. healthcare sector's exploration of graphene-based biomedical applications, including drug delivery and biosensors, contributes to market growth. Furthermore, growing partnerships between academic institutions and industries further catalyze graphene innovation in the region.

Graphene Market Trends:

Growing advancements in the production of semiconductors

Advancements in the production of semiconductors are offering a positive graphene market outlook. Graphene exhibits enhanced electrical conductivity and heat dissipation properties that help in increasing the performance of semiconductors. Apart from this, manufacturers in the graphene market are focusing on producing electronic devices faster and more energy efficient. They are also exploring various methods to incorporate graphene into transistors and other semiconductor components. The semiconductor industry sales totaled USD 46.2 Billion worldwide during February 2024, as reported by the Semiconductor Industry Association (SIA).

Rising improvements in biomedical applications

The integration of graphene into biosensing technologies is expanding the graphene market scope. According to the IMARC Group, the global biosensors market reached USD 30.9 Billion in 2024. Graphene-based materials are used for wound dressings and healing applications as they exhibit antimicrobial properties and can help fasten the wound healing process by maintaining a sterile environment. In line with this, advancements in biomedical applications are strengthening the graphene market demand in the medical sector. Furthermore, researchers and healthcare professionals are focusing on employing graphene-based biosensors to identify pathogens and health-related indicators. For instance, researchers at IIT Guwahati made crucial discoveries regarding the use of modified graphene oxide for biomedical applications. They introduced cost-effective experiments for modifying graphene oxide on 8 November 2023.

Increasing demand for lighter and durable construction materials

Due to the growing construction sector, graphene application is increasing. It is applied in the components of building such as concrete, composites, and coatings, to fortify infrastructure projects and extend their lifetime. This will help enhance the durability and efficiency of building materials. Additionally, construction projects are becoming increasingly sophisticated, making them require creative solutions. According to the Invest India, the construction sector in India is anticipated to achieve USD 1.4 Trillion by 2025.

Graphene Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global graphene market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end-use industry.

Analysis by Type:

- Mono-layer & Bi-layer Graphene

- Few Layer Graphene (FLG)

- Graphene Oxide (GO)

- Graphene Nano Platelets (GNP)

- Others

Graphene nano platelets (GNP) stand as the largest component in 2024. Graphene nano platelets (GNPs) are one of the nanomaterials. They comprise stranded graphene sheets. These materials show a very high level of electrical conductivity, high thermal conductivity, and flexibility along with good mechanical strength. GNPS are used in industry as filler materials to produce products to enhance electrical conductivity and some mechanical qualities. They are added to composite materials, such as polymer composites and coatings, to enhance mechanical strength, thermal conductivity, and electromagnetic shielding properties. Besides this, many industry players are launching products based on GNPs to cater to a broader consumer base. On 5 May 2023, Gerdau Graphene announced two new cutting-edge additives as being commercially available for the paint and coatings industry, including NanoDUR and NanoLAV. These additives are being developed based on GNPs in order to provide more premium performance improvements for water-based paints and coatings.

Analysis by Application:

- Batteries

- Supercapacitors

- Transparent Electrodes

- Integrated Circuits

- Others

Batteries lead the market in 2024. Lithium-ion batteries employ graphene as an anode material. Its high electrical conductivity and large surface area enhance the capacity and charge-discharge efficiency of batteries. Graphene oxide and reduced graphene oxide are adopted as components of battery separators. These materials assist in enhancing the thermal and mechanical stability of the separator while maintaining good ionic conductivity. This also improves the safety and overall performance of the battery. Besides this, the rising utilization of batteries in vehicles is catalyzing the demand for graphene.

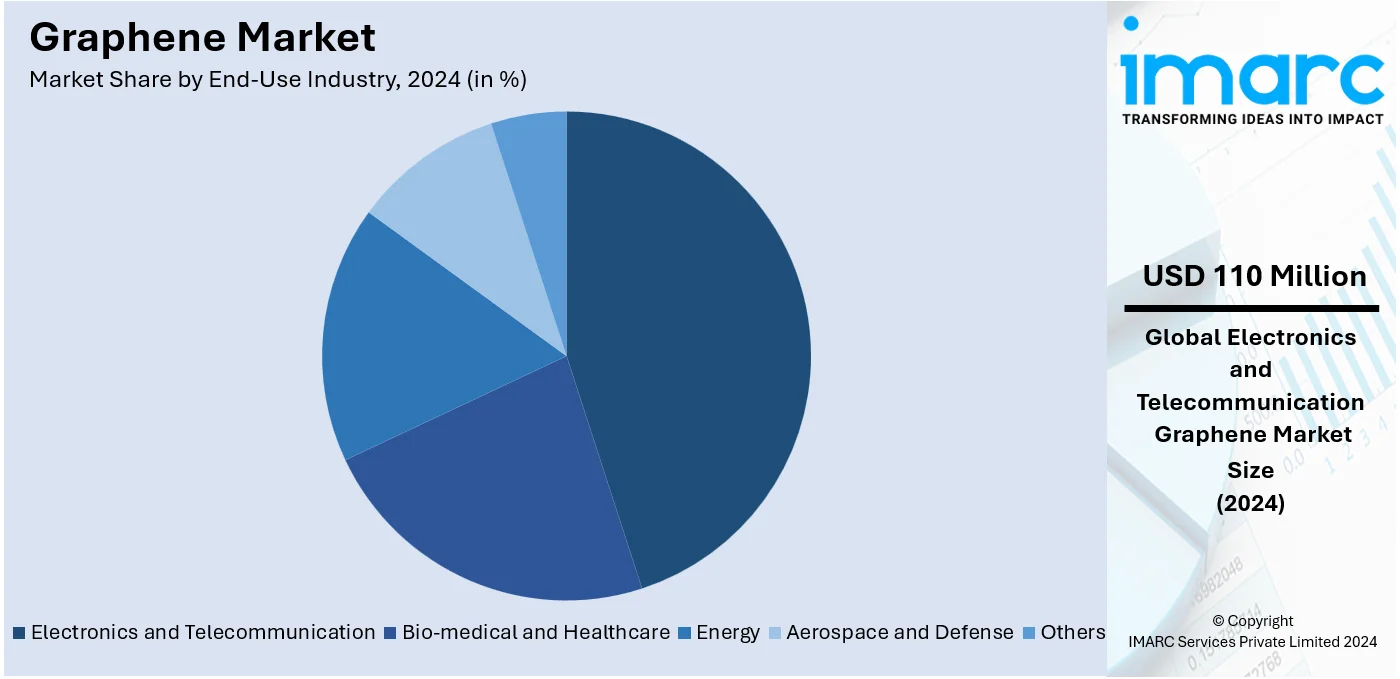

Analysis by End-Use Industry:

- Electronics and Telecommunication

- Bio-medical and Healthcare

- Energy

- Aerospace and Defense

- Others

Electronics and telecommunication lead the market in 2024. The electronics and telecommunication sector uses graphene for making flexible and bendable electronic components, including wearable electronics, displays, and flexible sensors. Graphene-based sensors are sensitive to a variety of signals, such as temperature, pressure, and gas molecules. In addition, graphene antennas enhance the performance of wireless communication devices. They can also function over a wide array of frequencies and offer improved radiation efficiency. Furthermore, there is a rise in the adoption of wearable electronics owing to changing lifestyles of individuals. The global wearable electronics market is projected to grow to US$ 624.7 Billion by 2032, as claimed by the IMARC Group.

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

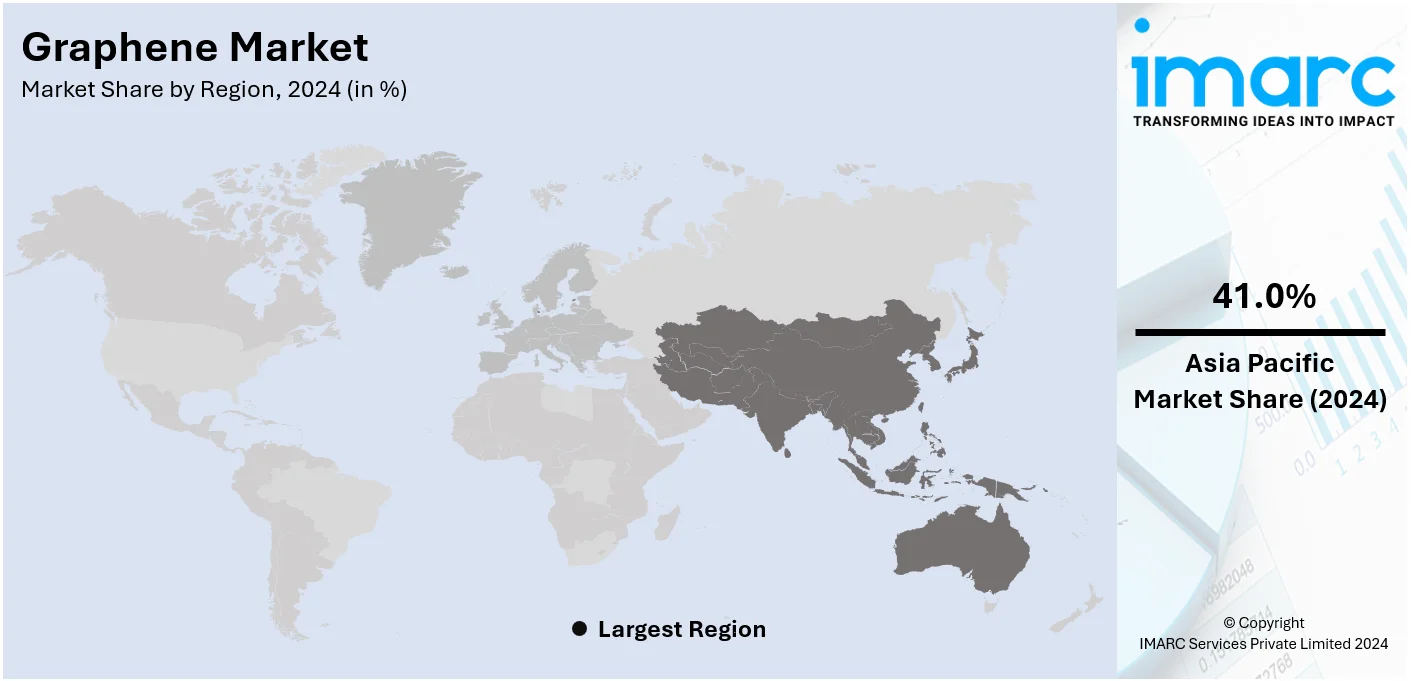

In 2024, Asia-Pacific accounted for the largest market share due to the growing emphasis on developing efficient semiconductor materials. Along with this, rising demand for energy storage solutions that are more efficient and longer lasting is fueling growth in the market. In addition to this, growing healthcare expenses coupled with the development of drug delivery, tissue engineering, and diagnostic devices support the market growth. The region also benefits from significant government investments in nanotechnology research and development. Moreover, the increasing adoption of graphene-based materials in automotive and aerospace industries further drives the market's expansion in Asia-Pacific.

Key Regional Takeaways:

United States Graphene Market Analysis

The advancements in technology, rising demand for lightweight and durable materials, and increasing investment in research and development (R&D) activities is propelling the market growth. One key driver is the increasing use of graphene in energy storage systems, including lithium-ion batteries and supercapacitors. With the growing demand for electric vehicles (EVs) and renewable energy, graphene’s ability to improve battery efficiency and lifespan is attracting significant attention. In 2023, sales of new electric light-duty vehicles in the United States reached about 1.4 Million, as reported by the International Council on Clean Transportation. In addition, the U.S. Department of Energy’s focus on enhancing energy storage technologies is contributing to increased research funding in this domain. The electronics sector is another major growth area. Graphene’s high electrical conductivity and transparency make it ideal for applications in flexible displays, sensors, and high-speed transistors. Additionally, rising environmental concerns are encouraging the use of graphene in water filtration systems, where it aids in removing contaminants efficiently. Federal policies promoting sustainable technologies are further impelling the adoption of graphene in environmental applications.

Asia Pacific Graphene Market Analysis

The Asia Pacific region’s graphene market is driven by robust industrial growth, increasing investments in advanced materials, and government initiatives supporting innovation. India's industrial production increased to 3.8% in December 2023, as per the Ministry of Statistics and Programme Implementation (MoSPI). This region, home to leading economies including China, Japan, South Korea, and India, is becoming a global hub for graphene research, development, and commercialization. Moreover, rapid advancements in the electronics industry are a major driver in the Asia Pacific market. Countries, such as South Korea and Japan, known for their cutting-edge semiconductor and display technologies, are increasingly incorporating graphene into flexible displays, transistors, and high-speed circuits. Furthermore, the rising focus on energy storage is supporting the market growth. Additionally, with rising adoption of electric vehicles (EVs) and renewable energy solutions, graphene is being used to improve the performance and longevity of lithium-ion batteries and supercapacitors. China, a global leader in EV production, is driving demand for graphene-based energy storage solutions, supported by significant government incentives for clean energy technologies. China and India are using graphene to improve the performance of materials, reduce the weight of vehicles and aircraft, and enhance energy efficiency. Apart from this, the significant government support through funding, partnerships, and other positive policies on advanced material research is driving graphene development in the region.

Europe Graphene Market Analysis

Increased investment in research and development, the demand for advanced materials, and the region's focus on sustainability and innovation is driving the growth of the market. Europe has emerged as a leader in graphene technology through partnerships between industry, academia, and government. The commitment to green energy solutions and decarbonization is one key driver. This would complement Europe's general thrust of devising renewables as an energy base while encouraging electric vehicles. Graphene can improve the energy storage efficiency of batteries and supercapacitors. The European Environment Agency estimates that 24.1% of the EU's total energy consumption in 2023 came from renewable sources. Moreover, the European Green Deal and initiatives such as Horizon Europe are providing substantial funding for graphene research, particularly in energy applications. The electronics and semiconductors industries are other contributors to growth in the market. Graphene's properties also include high electrical conductivity and mechanical flexibility, giving it an application in developing cutting-edge components: sensors, transistors, and flexible displays. European firms are already using graphene-based technology to improve their device performance based on a relatively well-established electronic ecosystem. Automotive and aerospace segments constitute considerable market share for graphene in Europe, integrating it into lightweight composites for fuel efficiency and emission management according to EU regulations. The exceptional strength and durability of graphene make it particularly useful for electric vehicles and high-performance aerospace components.

Latin America Graphene Market Analysis

The region’s expanding automotive and aerospace sectors are adopting graphene to enhance material strength, reduce weight, and improve energy efficiency. According to the CEIC, Brazil motor vehicle production was reported at 2,324,838.000 units in December 2023. In line with this, Brazil, with its robust industrial base, is a leading contributor, supported by government-backed research programs. Energy storage solutions are another key driver, as Latin America’s renewable energy initiatives and the rising adoption of electric vehicles spur demand for graphene-enhanced batteries and supercapacitors. Countries such as Chile, a major lithium producer, are exploring synergies between local resources and graphene technologies. Besides this, graphene’s use in water purification aligns with regional efforts to improve water quality. Its ability to efficiently remove contaminants makes it a valuable material in addressing water scarcity and pollution challenges. Furthermore, collaborations between academia and industry are further accelerating graphene innovation across Latin America.

Middle East and Africa Graphene Market Analysis

The Middle East and Africa graphene market is driven by growing investments in advanced materials, increasing demand for sustainable technologies, and regional economic diversification initiatives. The rising number of renewable energy projects in the Middle East, particularly solar power, is enhancing interest in graphene-based energy storage and photovoltaic applications. By the end of 2023, the production capacity of renewable energy projects under construction in Saudi Arabia will exceed 8 GW, as per the Saudi and Middle East.

Graphene’s high conductivity and efficiency enhance the performance of solar panels and batteries, aligning with the region’s clean energy goals. In Africa, the need for effective water purification technologies is a key driver. Graphene’s capability to filter impurities and improve water quality addresses critical challenges in water-scarce areas, supporting governmental and non-governmental sustainability initiatives. Additionally, increased collaborations between local industries and global research institutions are accelerating graphene innovation and commercialization in the region.

Competitive Landscape:

Key market players are investing hugely to expand the application range of graphene, which include new manufacturing techniques, improving graphene product quality, and discovering new applications for graphene in different fields. They also diversify their product portfolios in order to reach a wider spectrum of graphene-based materials and products. Along with this, large companies have taken to upscaling their manufacturing process through designing large-scale manufacturing plants and further refining manufacturing methodologies. The organizations also forge strategic collaborations with others such as the university, research institute, or even other organizations operating in this sector for new products that might incorporate graphene-based innovation. Haydale Graphene Industries announced its collaboration with Cadent Ltd to manufacture graphene ink-based low-power radiator heaters on 24 July 2023.

The report provides a comprehensive analysis of the competitive landscape in the graphene market with detailed profiles of all major companies, including:

- ACS Material, LLC,

- Global Graphene Group, Inc.

- CVD Equipment Corporation

- Grafoid Inc.

- G6 Materials Corp. (Graphene 3D Lab Inc.)

- Graphene NanoChem PLC

- Graphenea Inc.

- Haydale Graphene Industries Plc

- Vorbeck Materials Corp.

- XG Sciences Inc.

Latest News and Developments:

- October 2024: Komaki Electric Vehicle introduced the new model of Cat 3.0 NXT before the festive season. There are two battery types available for the new CAT 3.0 NXT model: graphene and LIPO4. Last-mile delivery drivers are the target of an environmentally friendly e-fleet.

- June 2024: Tecnalia and Avanzare collaborated on the European Sunshine project to develop novel Safe and Sustainable by Design (SSbD) techniques for graphene production.

- January 2024: Black Swan Graphene Inc. announced the initiation of a Distribution and Sales Agreement with Thomas Swan & Co. Ltd., strengthening their strategic collaboration. Under this agreement, Thomas Swan will act as a value-added, non-exclusive distributor and reseller of Black Swan's graphene-enhanced masterbatch products in the polymer additive market.

- January 2024: NanoXplore Inc., a global leader in graphene technology, revealed an expansion of its production capacity at the St-Clotilde, QC facility to fulfill increased demand for graphene-enhanced SMC parts required for an ongoing customer program. As part of its five-year strategic plan, this capacity growth is linked to the SMC lightweighting project and starts right away.

Graphene Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mono-layer & Bi-layer Graphene, Few Layer Graphene (FLG), Graphene Oxide (GO), Graphene Nano Platelets (GNP), Others |

| Applications Covered | Batteries, Supercapacitors, Transparent Electrodes, Integrated Circuits, Others |

| End-Use Industries Covered | Electronics and Telecommunication, Bio-medical and Healthcare, Energy, Aerospace and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACS Material, LLC, Global Graphene Group, Inc., CVD Equipment Corporation, Grafoid Inc., G6 Materials Corp. (Graphene 3D Lab Inc.), Graphene Nanochem plc, Graphenea Inc., Haydale Graphene Industries plc, Vorbeck Materials Corp., XG Sciences Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the graphene market from 2019-2033.

- The graphene market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the graphene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global graphene market was valued at USD 290 Million in 2024.

IMARC estimates the global graphene market to exhibit a CAGR of 39.01% during 2025-2033.

The graphene market is driven by its adoption across industries like electronics, energy, and healthcare, thanks to its high conductivity, lightweight structure, and mechanical strength. The growing demand for sustainable solutions in energy storage, renewable technologies, and semiconductors further accelerates market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the global graphene market include ACS Material, LLC, Global Graphene Group, Inc., CVD Equipment Corporation, Grafoid Inc., G6 Materials Corp. (Graphene 3D Lab Inc.), Graphene Nanochem plc, Graphenea Inc., Haydale Graphene Industries plc, Vorbeck Materials Corp., and XG Sciences Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)