Green Ammonia Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Green Ammonia Price Trend, Index and Forecast

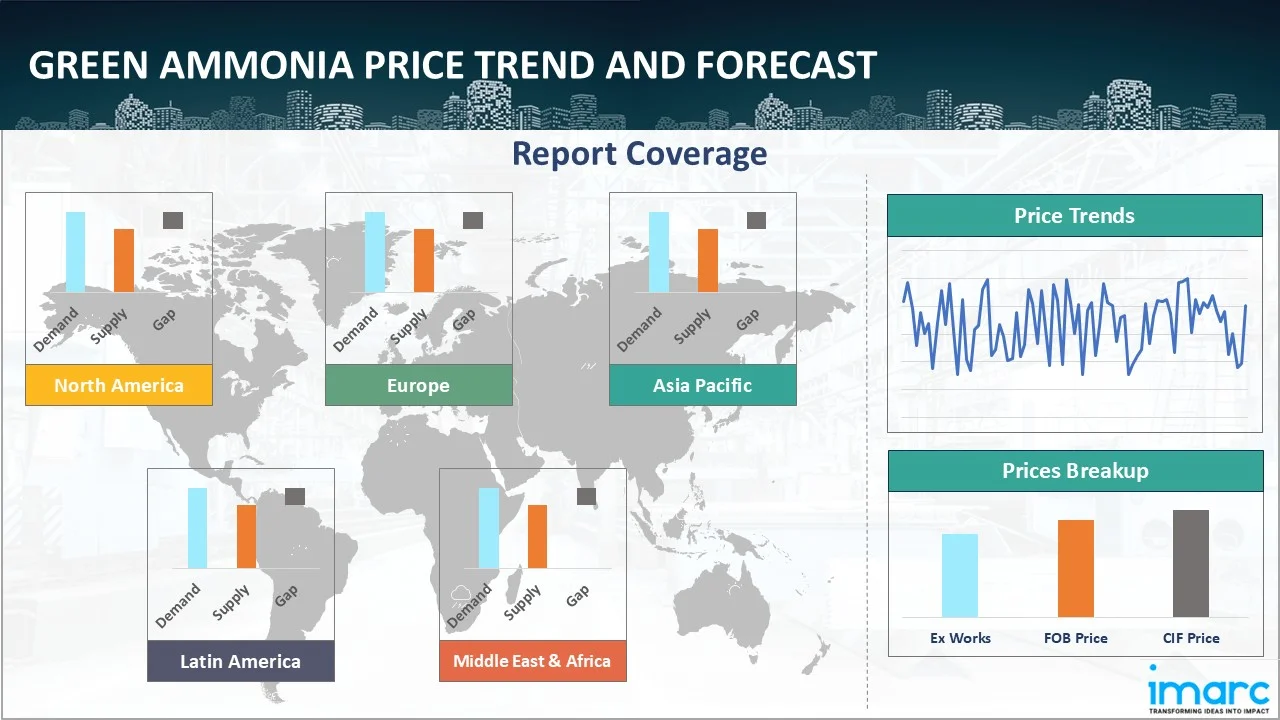

Track the latest insights on green ammonia price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Green Ammonia Prices Outlook Q3 2025

- USA: USD 839.69/MT

- Canada: USD 911.06/MT

- Australia: USD 826.02/MT

- India: USD 736.66/MT

- NW Europe: USD 902.45/MT

Green Ammonia Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the third quarter of 2025, the green ammonia prices in the USA reached 839.69 USD/MT in September. The upward pressure emerged from expanding demand in decarbonization sectors, particularly green hydrogen projects and fertilizer producers adopting lower-carbon feedstocks. On the supply side, electricity costs for renewable power generation increased in certain states, pushing production margins tighter. Grid congestion and limited renewable capacity during peak months caused operational constraints, elevating marginal costs.

During the third quarter of 2025, the green ammonia prices in Canada reached 911.06 USD/MT in September. Canada’s elevated pricing reflected high logistical burdens from remote renewable generation sites to export or industrial demand zones. Seasonal constraints increased backup power or storage costs, pressuring margins. Domestic demand from export-oriented hydrogen/ammonia hubs to Europe and Asia exerted upward pressure on delivered pricing.

During the third quarter of 2025, the green ammonia prices in Australia reached 826.02 USD/MT in September. Australia saw a slight downward movement relative to the prior quarter, reflecting easing of electricity pricing in certain renewable zones during the winter months. Export competition to Asia and neighboring demand regions applied downward pressure, forcing producers to moderate premiums. Transmission and grid balancing costs, especially in remote renewable zones, remained significant, but spot power prices softened somewhat.

During the third quarter of 2025, the green ammonia prices in India reached 736.66 USD/MT in September. India’s pricing trend saw strong upward momentum, backed by renewed government support, incentive frameworks, and aggressive targets in green hydrogen/ammonia transitions. The auction mechanisms and demand signals from fertilizer and power sectors pushed producers to bid higher. In addition, renewable generation costs, water desalination, and transmission charges elevated input costs. Logistics from coastal production to inland demand centers incurred markups.

During the third quarter of 2025, the green ammonia prices in NW Europe reached 902.45 USD/MT in September. Prices were influenced by decarbonization mandates, import dependency for renewable feedstocks, and high costs of renewable electricity plus grid levies. Compliance with EU regulatory frameworks also added cost overheads. Import and transportation into inland industrial zones incurred premiums.

Green Ammonia Prices Outlook Q2 2025

- USA: USD 782/MT

- Canada: USD 858/MT

- Australia: USD 832/MT

- India: USD 707/MT

- Germany: USD 827/MT

During the second quarter of 2025, the green ammonia prices in the USA reached 782 USD/MT in June. As per the green ammonia price chart, the quarter saw moderate upward pressure as some regions experienced higher generation costs due to seasonal capacity dips and grid congestion. Those cost increases translated into broader pressure on green ammonia pricing. Besides, demand continued to strengthen, particularly from sectors requiring low-carbon inputs, such as hydrogen‑based industries, decarbonizing fertilizer producers, and pilot marine fuel applications.

During the second quarter of 2025, the green ammonia prices in Canada reached 858 USD/MT in June. Transportation costs played a major role in Canada’s pricing dynamics. The country’s green ammonia projects had proximity advantages for exports to Europe, but internal logistics and limited export infrastructure still added cost premiums. Shipping routes from western Canada to Asian markets entailed higher freight, which elevated delivered pricing compared with other origin points. Besides, the lack of mature domestic capacity and long supply chains resulted in Canadian green ammonia trading at a significant premium to conventional ammonia benchmarks.

During the second quarter of 2025, green ammonia prices in Australia reached 832 USD/MT in June. The cost base for producing green ammonia in Australia remained elevated. Domestic demand in Australia was still at an early stage, with offtake largely awaiting firm contracts from export markets or pilot-scale users. Global demand fundamentals for green ammonia, driven by decarbonization in fertilizers, shipping bunkering, and hydrogen hubs, remained nascent. Hence, support for price improvement in that quarter was limited and prospective buyers exerted pressure for discounts until supply scaled more convincingly.

During the second quarter of 2025, the green ammonia prices in India reached 707 USD/MT in June. Green ammonia prices in India were significantly influenced by the relaunch of the country’s high-profile reverse auction initiative. The announcement introduced renewed optimism into the market, as it signaled the government's concrete commitment to accelerating the green hydrogen and ammonia transition. Moreover, the presence of substantial government incentives through the Production Linked Incentive (PLI) framework further supported the feasibility of green ammonia production, potentially lowering future production costs and exerting downward pressure on market prices.

During the second quarter of 2025, the green ammonia prices in Germany reached 827 USD/MT in June. Green ammonia prices in Germany were shaped by a mix of policy-driven momentum, infrastructure challenges, and evolving market sentiment within the broader European energy transition framework. The country continued to pursue its aggressive decarbonization goals, with green hydrogen and its derivatives like green ammonia positioned as strategic components in reducing industrial carbon emissions. Moreover, despite strong governmental incentives, industrial buyers were cautious due to the high cost differential between green ammonia and conventional grey ammonia. This cautious demand growth created an uncertain pricing environment.

Green Ammonia Prices Outlook Q1 2025

- USA: USD 815/MT

- Canada: USD 880/MT

- Australia: USD 808/MT

- India: USD 715/MT

- NW Europe: USD 865/MT

During the first quarter of 2025, the green ammonia prices in the USA reached 815 USD/MT in March. As per the green ammonia price chart, increased demand, particularly from the agricultural sector for fertilizers, exerted pressure on prices. Besides, higher energy costs in regions with increased energy consumption, drove up production costs and subsequently impacted green ammonia prices.

During the first quarter of 2025, green ammonia prices in Canada reached 880 USD/MT in March. Transportation costs significantly impacted the delivered price of green ammonia. Besides, advancements in production technologies, such as electrolysis methods and renewable energy sources, affected production costs and prices.

During the first quarter of 2025, the green ammonia prices in Australia reached 808 USD/MT in March. The green ammonia sector experienced growth, driven by factors such as the transition to renewable energy sources, decarbonization efforts in agriculture and industry, and the expansion of the green economy.

During the first quarter of 2025, the green ammonia prices in India reached 715 USD/MT in March. Green ammonia prices in India experienced moderate stability with subtle upward pressure influenced by robust global project developments and strengthening demand dynamics. India's growing investments and expanding production capacity driven by renewable-powered technologies further influenced pricing trends.

During the first quarter of 2025, the green ammonia prices in NW Europe reached 865 USD/MT in March. Instability in natural gas costs impacted production expenses and final prices. Additionally, seasonal demand from agricultural activities and global supply constraints, including import restrictions, further influenced availability.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing green ammonia prices.

Europe Green Ammonia Price Trend

Q3 2025:

In Q3 2025, the green ammonia price index in Europe reflected sustained strength. High-level legislation and carbon reduction mandates reinforced demand from chemical, fertilizer, and industrial sectors. Import reliance for renewable electricity and hydrogen intermediates, combined with grid usage charges and certification compliance, imposed cost adders on producers. Inland logistics, especially movement from ports or renewable hubs to end-users added freight premiums. The limited scale of local production capacity relative to demand meant pressure on delivered pricing.

Q2 2025:

In the second quarter of 2025, green ammonia prices in Europe were shaped by a combination of regulatory momentum, project-level progress, and subdued industrial demand. The European Union's ongoing push for decarbonization, continued to drive policy support for green hydrogen and its derivatives, including ammonia. This regulatory backing sustained investor interest and spurred movement on several planned green ammonia projects. However, despite the policy enthusiasm, actual production volumes remained limited, keeping supply tight and prices relatively firm. Industrial users, especially in the chemical and fertilizer sectors, were cautious in transitioning to green ammonia due to high production costs and limited infrastructure for transport and storage.

Q1 2025:

As per the green ammonia price index, imports from major suppliers, despite upstream gas limitations, contributed to the fluctuating prices in regions like Germany and the Netherlands. Besides, demand was impacted by factors like delayed fertilizer applications due to weather conditions. Moreover, the supply-demand equation caused volatility in the market.

This analysis can be extended to include detailed green ammonia price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Green Ammonia Price Trend

Q3 2025:

The green ammonia price index in North America in Q3 2025 rose notably, as the USA and Canada markets both recorded price increases. Underlying drivers included stronger industrial and hydrogen-fuel demand, especially in decarbonizing applications. Rising renewable electricity costs in peak demand zones and grid constraints elevated production marginal costs. Logistics from production zones to demand centers, particularly in inland regions, incurred additional premiums. Transmission and storage bottlenecks occasionally restricted supply flows, enabling producers to maintain higher margins. Policy incentives supported adoption, reducing resistance to passing cost increases to buyers.

Q2 2025:

As evident by the green ammonia price index, competition from conventional ammonia and blue ammonia producers, who benefited from temporarily lower natural gas prices, created price pressure on green ammonia suppliers. End-users, particularly in the industrial and agricultural sectors, weighed sustainability goals against cost considerations, often slowing their shift toward green alternatives. Besides, demand from sectors such as power generation, maritime fuel, and fertilizer production continued to evolve. Although interest in green ammonia as a zero-carbon fuel remained high, actual offtake volumes remained moderate, as infrastructure and regulatory readiness lagged behind technological ambition.

Q1 2025:

Green ammonia prices in North America experienced fluctuations due to a combination of factors, including stable supply, cautious demand, and the potential impact of a new USA tariff on imports. While production and imports remained adequate, weather-related transportation disruptions and a wait-and-see approach from buyers contributed to varied purchasing activity and pressure on prices.

Specific green ammonia prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Green Ammonia Price Trend

Q3 2025:

As per green ammonia price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

Q2 2025:

The report explores the green ammonia trends and green ammonia chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

Q1 2025:

The report explores the green ammonia trends and green ammonia price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on green ammonia prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Green Ammonia Price Trend

Q3 2025:

In Q3 2025, Asia Pacific green ammonia markets experienced mixed price movements. In India, strong policy backing, auctions, and export demand compelled producers to raise bids. Renewable electricity cost pressures, grid balancing, and storage/additional power backup expenses influenced input costs. Transmission from generation sites to coastal and inland demand hubs incurred freight and logistics markups. Competition among export players to markets such as Southeast Asia, Japan and Korea further shaped pricing. The regional pricing environment reflected the evolving balance between scale, infrastructure readiness, and regulatory support.

Q2 2025:

In the second quarter of 2025, green ammonia prices in the Asia Pacific region were shaped by a complex interplay of regulatory developments, evolving project economics, and fluctuating renewable energy dynamics. Several countries in the region, including Australia, Japan, and India, accelerated policy support for green hydrogen and ammonia, aiming to meet decarbonization goals across sectors such as power generation, maritime fuel, and fertilizer production. This policy-driven push reinforced long-term demand potential but had mixed effects on near-term pricing. On the supply side, project announcements and early-stage commissioning of pilot-scale green ammonia plants contributed to growing optimism around future capacity expansion. However, inconsistent infrastructure development and uncertainty around certification standards in several countries dampened broader price competitiveness.

Q1 2025:

In the first quarter of 2025, green ammonia prices in India experienced a period of moderate stability, with subtle upward pressure primarily driven by a mix of global project developments and growing demand trends. Besides, renewable-powered technologies, symbolized a larger trend of transitioning ammonia production from conventional methods to green processes that utilize renewable energy, like solar and wind, to reduce carbon emissions, causing price fluctuations.

This green ammonia price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Green Ammonia Price Trend

Q3 2025:

Latin America's green ammonia market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in green ammonia prices.

Q2 2025:

Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the green ammonia price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing green ammonia pricing trends in this region.

Q1 2025:

Latin America's green ammonia market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in green ammonia prices. Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the green ammonia price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing green ammonia pricing trends in this region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin America countries. |

Green Ammonia Price Trend, Market Analysis, and News

IMARC's latest publication, “Green Ammonia Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the green ammonia market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of green ammonia at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed green ammonia prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting green ammonia pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Green Ammonia Industry Analysis

The global green ammonia market size reached USD 445.7 Million in 2024. By 2033, IMARC Group expects the market to reach USD 34,261.8 Million, at a projected CAGR of 62% during 2025-2033. The market is primarily driven by strengthened government incentives and subsidies, falling renewable electricity costs, advancements in electrolyze technologies, expanding infrastructure for ammonia distribution, and alignment of climate policies with energy transition goals.

Latest developments in the Green Ammonia industry:

- June 2025: A tender for the offtake of green ammonia was launched by the Solar Energy Corporation of India Limited (SECI), a 'Navratna' Central Public Sector Undertaking under the Ministry of New and Renewable Energy (MNRE). This served as an important step in decarbonizing India's vital fertilizer sector and is in line with the country's ambitious climate goals.

- July 2024: SJVN Green Energy (SGEL), is building a large green ammonia facility. AM Green Ammonia Holdings will receive its 4.5 gigawatts of renewable energy from this facility. The goal is to produce 5 Million Tons of green ammonia annually, meeting 20% of India's green hydrogen target under its National Green Hydrogen Mission. It will also help meet 10% of Europe's green hydrogen import needs by 2030.

- March 2024: GHC SAOC, a division of Acme Cleantech, teamed up with Yara, a world leader in crop nutrition and ammonia commerce, to guarantee a steady supply of low-CO2 ammonia. This collaboration emphasizes a commitment to decarbonized ammonia trade and sustainable energy solutions.

Product Description

Green ammonia is produced using renewable energy sources, primarily wind, solar, or hydropower, to power the process of nitrogen fixation. This stands in contrast to conventional ammonia production, which relies on natural gas in a process known as the Haber-Bosch method. The key distinction lies in the source of energy used to produce the hydrogen needed for ammonia synthesis. In green ammonia production, hydrogen is generated through electrolysis of water, powered by renewable energy, as opposed to conventional methods that use natural gas reforming. This makes green ammonia a low-carbon alternative to traditional ammonia, reducing its environmental impact significantly.

Green ammonia is considered a key solution for addressing the challenges of decarbonization, particularly in industries that are difficult to electrify, like agriculture, where ammonia is used as a critical component in fertilizers. Beyond agriculture, green ammonia has potential in energy storage and as a fuel for shipping, acting as a carrier for hydrogen or even being used directly as a zero-emission fuel in maritime transport.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Green Ammonia |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonium Perchlorate Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of green ammonia pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting green ammonia price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The green ammonia price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)