Green and Bio-Solvents Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Green and Bio-Solvents Market Size and Share:

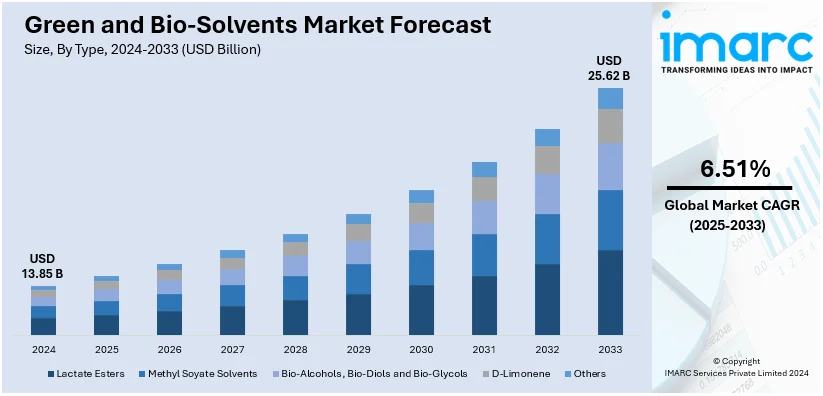

The global green and bio-solvents market size was valued at USD 13.85 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.62 Billion by 2033, exhibiting a CAGR of 6.51% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.7% in 2024. The increasing focus of key players on sustainable development and the rising usage of environment-friendly solvents are primarily driving the growth of the green and bio-based solvents market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.85 Billion |

|

Market Forecast in 2033

|

USD 25.62 Billion |

| Market Growth Rate (2025-2033) | 6.51% |

The global market is majorly driven by the rising environmental awareness and stringent regulations aimed at reducing volatile organic compound (VOC) emissions. Increasing demand from industries such as paints and coatings, adhesives, and pharmaceuticals, which seek sustainable and eco-friendly alternatives, is further fueling growth. Along with this, consumer preference for greener products and advancements in bio-based feedstock technologies are enhancing product efficiency and supporting widespread adoption. On 14th February 2024, Covestro started an aniline pilot plant at its facility in Leverkusen, which uses plant biomass to replace petroleum. Bio-based aniline will feed into innovations in the manufacturing of MDI, the material backbone of energy-efficient building insulation. The innovation is aligned with Covestro's Circular Economy and sustainable innovation commitment. Moreover, growing investment in research and development for cost-effective and high-performance bio-solvents is creating new opportunities. The shift towards a circular economy and policies promoting sustainable industrial practices also play a crucial role in market expansion.

The United States stands out as a key regional market, primarily driven by the growing focus on sustainable manufacturing processes and the shift towards renewable resources. The increasing adoption of bio-solvents in industries such as agriculture, personal care, and cleaning products highlights the demand for non-toxic and biodegradable alternatives. Rising health awareness among consumers and efforts to reduce dependency on petrochemical-based solvents have further accelerated this trend. Favorable government policies, subsidies, and tax benefits for green initiatives are encouraging manufacturers to innovate in bio-based solutions. Additionally, the country’s robust infrastructure for biotechnology and advanced research capabilities supports the development of cost-efficient, high-performance green solvents, fostering widespread acceptance across various sectors

Green and Bio-Solvents Market Trends:

Rising Environmental Concerns

The increasing adoption of agricultural sources to extract green solvents, including distilled glycerin, lactic acid, maize, bio-succinic acid, etc., is positively impacting the green and bio-solvents market outlook. Additionally, the growing demand for eco-friendly consumer products, including perfume, owing to the European Commission (EC) and Eco-product Certification Scheme (ECS), is driving the usage of green and bio-based solvents in their production. Apart from this, as the adoption of hazardous substances and solvents has negative impacts on the environment, producers are focusing on using green and bio-based solvents, as they generate lesser volatile organic compounds (VOCs) emissions than conventional petroleum-based solvents. In July 2024, the Ecodesign for Sustainable Products Regulation (ESPR) was introduced as new framework legislation to advance the EU's goal of creating a greener and cleaner chemical industry in the long run. The regulatory shift further increases demand for green and bio-based solvents, strengthening the shift towards more sustainable industrial practices.

Stringent Government Regulations

The market demand is propelled by the rising emphasis of government bodies on using bio-based products. For example, according to a report released by the Organization for Economic Co-operation and Development (OECD), the German Environment Agency (UBA), Nature Conservation and Nuclear Safety (BMU), the Swiss Federal Office for the Environment (FOEN), the Swiss State Secretariat for Economic Affairs (SECO), and the German Federal Ministry for the Environment are all actively encouraging the adoption of bio-based goods in a wide array of sectors. Stringent government regulations aimed at reducing VOCs and initiatives such as achieving net-zero carbon emissions by 2050 are expected to create significant opportunities for the market. This, in turn, will provide lucrative growth opportunities for green and bio-solvent market revenue in the foreseeable future.

Diverse Applications of Product

The development of bio-based or green adhesives and sealants that are produced by using ingredients, including vegetable oil, proteins, starch, etc., is augmenting the market growth. Furthermore, according to Anagha Engineers, the adhesives and sealant sector is helping other conventional businesses in their initial transition to sustainability. In line with this, the percentage of green and bio-based solvents employed in the pharmaceutical industry ranges from 80% to 90%. Besides this, recent research has focused on the use of bio-based chemicals manufactured from agricultural wastes as green solvents to introduce novel pharmaceutical ingredients as a renewable alternative to fossil chemicals. Such innovations related to the utilization of green solvents in the pharmaceutical industry are projected to bolster the green and bio-solvents market value over the forecasted period.

Green and Bio-Solvents Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global green and bio-solvents market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Lactate Esters

- Methyl Soyate Solvents

- Bio-Alcohols, Bio-Diols and Bio-Glycols

- D-Limonene

- Others

Bio-alcohols, bio-diols and bio-glycols lead the market in 2024. The market expansion in the segmentation is being accelerated by the broad use of bio-based diols for foam applications, polyurethane coatings, elastomers, and adhesives and sealants, among others. Furthermore, as they emit 61% fewer greenhouse gases than petroleum-based products, these greener alternatives are becoming increasingly popular. Besides this, the PNNL developed the catalytic process of converting the plant-based raw material for bio-based glycol. This has resulted in their applications across the entire world, as they happen to be green and bio-based solvents.

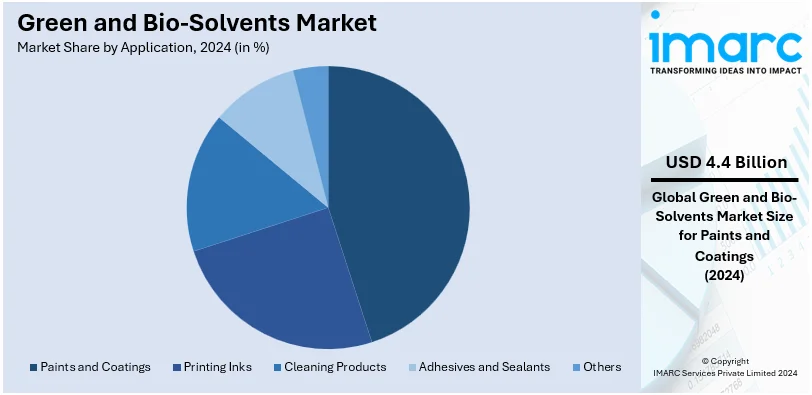

Analysis by Application:

- Paints and Coatings

- Printing Inks

- Cleaning Products

- Adhesives and Sealants

- Others

Paints and coatings lead the market with around 31.4% of market share in 2024. Elevating usage of lactate ester solvents in the paints and coatings industry is further growing the market under this segmentation. Besides this, a rising trend towards ethyl lactate over other solvents used in the coatings, such as toluene, acetone, NMP, and xylene, among others is the significant factor helping the market grow under the mentioned segment. Besides this, the growing housing construction and the inflating income-levels of individuals in countries, such as Mexico, India, China, and Brazil, among others, are escalating the demand for paints and coatings, which, in turn, will augment the green and bio-based solvents market over the forecasted period.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.7%, driven by a strong commitment to sustainability as well as strict environmental regulations. The region's advanced industrial base, particularly in the United States and Canada, fosters significant demand for bio-solvents across industries including paints and coatings, pharmaceuticals, and personal care. Consumer awareness of eco-friendly products and the presence of key market players further amplify regional growth. North America's robust infrastructure for research and development, coupled with government incentives for green technologies, supports innovation and scalability in bio-based solvent production. Additionally, the adoption of circular economy practices and a focus on reducing carbon footprints solidify the region’s leadership in this growing market.

Key Regional Takeaways:

United States Green and Bio-Solvents Market Analysis

In 2024, the US accounted for around 78.90% of the total North America green and bio-solvents market. The U.S. green and bio-based solvents market is very significantly growing due to increased initiatives towards sustainability and regulation. Many factors, such as programs promoted by the United States Green Building Council (USGBC), LEED, low VOC paints, and reduction of VOCs, can trigger industries to upgrade themselves towards eco-friendly products. For that reason, bio-solvents are finding greater acceptance and utilization in the paints and coatings sector. Besides paints, cleaning products, printing inks, adhesives, and sealants exhibit increasing demand for green and bio-solvents. Increasing consumer demand for biodegradable and non-toxic solvents in the cleaning industry is driving manufacturers to embrace environmentally friendly solutions. Concurrently, the printing industry has an affinity towards bio-based solvents as the environment turns increasingly stringent in its regulations along with low VOC emission and high print quality. According to the American Coatings Association, the volume of the coatings industry is expected to increase by 2.3% while the value is expected to increase by 5.3% in the U.S. by 2025. This shows an increased trend toward sustainable products and a demand for green and bio-solvents.

Europe Green and Bio-Solvents Market Analysis

Europe's market for green and bio-solvents is growing significantly under the strict environmental rules along with increasing sustainability needs coupled with adoption in significant sectors. The main driver is the European Commission's Renovation Wave initiative, which wants to enhance the energy performance of buildings across the European Union by doubling renovation rates by 2030. This ambitious plan targets renovating 35 million buildings and creating up to 160,000 green jobs in the construction sector. These large-scale renovation activities are expected to significantly enhance the demand for eco-friendly products, including bio-based adhesives, sealants, and paints. Paints and coatings remain a dominant segment, supported by EU initiatives such as REACH and the EU Ecolabel, which aim to minimize volatile organic compound (VOC) emissions. As businesses embrace sustainable approaches to meet EU resource efficiency targets, green and bio-solvents are well-positioned to support low-VOC formulations, enable recyclable packaging, and contribute to regional goals on carbon emissions reduction and a more circular economy.

Asia Pacific Green and Bio-Solvents Market Analysis

The Asia Pacific green and bio-solvents market is growing at a great pace, due to robust industrial and infrastructure growth across the region, especially in India and China. India has set an ambitious economic target to become a USD 5 Trillion economy by 2025, which is intensifying the need for sustainable solutions in key industries. Signification infrastructure projects include the 15 announced in March 2024 for USD 12.1 Billion airports projects and 15 national highways projects in Bihar inaugurated in June 2022, worth INR. 13,585 crore, or USD 1.7 billion, for paints, coatings, and adhesives-the core end-uses of green and bio-solvents. According to IBEF, India's packaging industry is growing at an impressive 22-25% annually, positioning it as the fifth largest industry in the Indian economy. Growth has been powered by advancements in technology and infrastructure that have positioned India as a global hub for packaging solutions. The industry's fast growth is promoting the adoption of eco-friendly bio-solvents in manufacturing processes, as it fits with the general direction toward sustainability. These similar trends are also reflected in China, where the focus of the industrial sector revolves around green manufacturing to fulfil tough requirements of environmental regulations. Over time, the Asia Pacific region will see an increasing demand from the regional industries for green and bio-solvents towards being part of meeting regulatory as well as consumer expectations.

Latin America Green and Bio-Solvents Market Analysis

The growth of the Latin American automotive industry is a significant driver for the green and bio-solvents market in the region. As reported by the industry, the sector grew 8.2% year-over-year in unit sales in 2023, marking its third consecutive year of growth. This robust performance reflects a strong recovery and increased demand for automobiles across key markets such as Brazil, Mexico, Colombia, Chile, and Argentina. The increasing demand for sustainable manufacturing processes involving paints, coatings, and cleaning products in the automotive sector is a requisite for efficient business operations. Bio-based solvents have been the new norm for applications in the automotive industry; this is mainly driven by the demand from consumers for responsible products as well as stiffer environmental regulations. Auto manufacturers are pushing towards greener solvents for the coatings on vehicles. This is primarily due to green solvents ensuring a decrease in VOC usage and the attainment of sustainability goals, and help improve the environmental footprint while ensuring good finishes for automobiles. Growing consumer awareness and pressure from the regulatory side are increasing the use of bio-based solvents in the automotive paints, coatings, and other related applications. This growth in the automobile industry along with a promise of green manufacturing drives the demand for green and bio-solvents in Latin America, which shifts the region towards more environmentally friendly production.

Middle East and Africa Green and Bio-Solvents Market Analysis

Green and bio-solvents in the Middle East and Africa find robust growth in the region on booming construction and infrastructure sectors. Industry reports state that UAE has a big project pipeline with a valuation of USD 590 Billion. Residential projects amount to USD 125 Billion (21%), and mixed-use projects make up USD 232 billion (39%). Another evidence of growth in construction is the handover of 1,600 residential units in Abu Dhabi during Q1 2024, with another 6,000 units in the pipeline for the rest of the year. Growing demand for sustainable and energy-efficient buildings also translates to a greater uptake of green and bio-based solvents in construction-related applications such as paints, coatings, and adhesives. This trend is highly apparent in the UAE, where the government is leading initiatives and promoting green building standards through low-VOC and eco-friendly materials. With continuous investments in residential and mixed-use developments, the region is focusing much on sustainability that is driving the demand for green solvents. This, in turn, places the Middle East and Africa market for further growth as industries push to both meet regulatory demands and consumer demand for the environment-friendly products.

Competitive Landscape:

Innovation, strategic partnerships, and sustainability-focused actions by key players are the major elements that are shaping the competitive dynamics of the market. Research and development investments by the companies are very high with the objective of improving both the performance and cost competitiveness of bio-based solvents. Many of the major companies are entering partnerships and acquiring smaller companies to expand market access and increase their product diversity. Some of the players are increasing production capacity by adopting new developments in bio-based feedstock and fermentation technologies. In addition, efforts are focused on stringent regulatory compliance and growing demand from consumers for environmentally friendly alternatives. Some of the major players are also focusing on developing application-specific bio-solvents to gain better positions in various end-use industries.

The report provides a comprehensive analysis of the competitive landscape in the green and bio-solvents market with detailed profiles of all major companies, including:

- Archer Daniels Midland Company

- Cargill, Incorporated

- Circa Group

- Dow Inc.

- Florachem Corporation

- Solvay

- Vertec Biosolvents Inc.

Latest News and Developments:

- March 2024: Eastman has expanded its portfolio of solutions for a more sustainable world by introducing Eastman Omnia™, a bio-based solvent. This solvent is applicable to cleaning products, personal care, and industrial applications. Part of the efforts of reaching the carbon neutrality goal set at 2050.

- January 2024: Circa Group announced it had ramped up production of its bio-based solvent levoglucosenone, derived from waste biomass. The solvent has been marketed under the name Cyrene and is positioned as a safer replacement for toxic solvents such as NMP (N-Methyl-2-pyrrolidone) and DCM (Dichloromethane). Increased production of Cyrene keeps pace with the increasing appetite for more sustainable alternatives in the pharmaceutical and electronics industries.

- May 2023: Dow teamed up with New Energy Blue to develop a bio-based ethylene from renewable materials. The partnership aimed to decrease the carbon footprint of plastic production used across footwear, transportation, and packaging.

Green and Bio-Solvents Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lactate Esters, Methyl Soyate Solvents, Bio-Alcohols, Bio-Diols and Bio-Glycols, D-Limonene, Others |

| Applications Covered | Paints and Coatings, Printing Inks, Cleaning Products, Adhesives and Sealants, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Archer Daniels Midland Company, Cargill, Incorporated, Circa Group, Dow Inc., Florachem Corporation, Solvay, Vertec Biosolvents Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the green and bio-solvents market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global green and bio-solvents market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the green and bio-solvents industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Green and bio-solvents are environmentally friendly chemical compounds derived from renewable resources such as plant biomass and agricultural waste. They are designed to replace traditional petroleum-based solvents, offering lower volatile organic compound (VOC) emissions and greater sustainability.

The green and bio-solvents market was valued at USD 13.85 Billion in 2024.

IMARC estimates the global green and bio-solvents market to exhibit a CAGR of 6.51% during 2025-2033.

The market is driven by rising environmental awareness, stringent regulations to reduce VOC emissions, growing demand for sustainable industrial practices, and advancements in bio-based feedstock technologies. Key industries including paints, coatings, adhesives, and pharmaceuticals also contribute to market growth.

Bio-alcohols, bio-diols, and bio-glycols represented the largest segment by type, driven by their wide adoption in adhesives, sealants, and polyurethane coatings due to their significant reduction in greenhouse gas emissions.

Paints and coatings lead the market by application due to their growing use of lactate ester solvents and the demand for eco-friendly formulations in construction and housing projects.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the market due to strict environmental regulations and advanced research capabilities.

Some of the major players in the global green and bio-solvents market include Archer Daniels Midland Company, Cargill, Incorporated, Circa Group, Dow Inc., Florachem Corporation, Solvay and Vertec Biosolvents Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)