Green Data Center Market Size, Share, Trends and Forecast by Component, Data Center Type, Industry Vertical, and Region, 2025-2033

Green Data Center Market Size and Share:

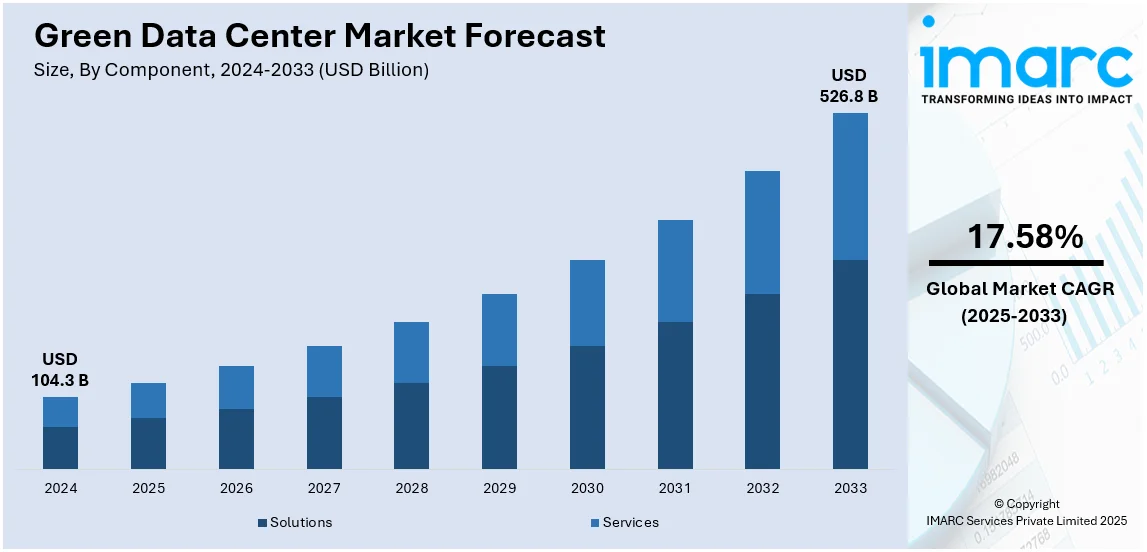

The global green data center market size was valued at USD 104.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 526.8 Billion by 2033, exhibiting a CAGR of 17.58% during 2025-2033. North America currently dominates the market, holding a significant market share of over 39.0% in 2024. The green data center market share is primarily driven by the rising focus on energy-efficient data center solutions to minimize operational costs, increasing data volumes and cloud computing, and implementation of stringent environmental regulations and sustainability goals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 104.3 Billion |

| Market Forecast in 2033 | USD 526.8 Billion |

| Market Growth Rate (2025-2033) | 17.58% |

The global green data center market growth is majorly driven by the increasing need for energy-efficient infrastructure and growing environmental concerns. As businesses and governments prioritize sustainability, there is a strong focus on reducing carbon footprints, which encourages the adoption of green data centers. Stringent regulatory frameworks, such as carbon emission reduction targets, further drive companies to adopt eco-friendly practices. According to the United Nations (UN), the total amount of carbon emissions was estimated to reach 41.6 Billion Tons in 2024, recording a significant increase from 2023. Other than this, technological advancements, such as the use of renewable energy sources, efficient cooling systems, and AI-based optimization, are creating a positive green data center market outlook overall.

The United States has emerged as a key regional market for green data centers, driven by the increasing emphasis on sustainability and energy efficiency in response to growing environmental concerns. With rising energy consumption and carbon emissions from traditional data centers, businesses are increasingly adopting green solutions to reduce their environmental impact. As per industry reports, in the United States, carbon emissions represented 13% of total global CO2 emissions in the year 2024. Government regulations, such as carbon reduction initiatives and sustainability standards, encourage companies to invest in energy-efficient technologies. Additionally, technological advancements, including renewable energy integration, advanced cooling systems, and AI-based management, are also driving the green data center market demand in the U.S.

Green Data Center Market Trends:

Rising environmental sustainability initiatives

The green data center market trends indicate that increasing environmental concerns and the rise of environmental sustainability initiatives are significantly influencing the industry. According to industry reports, from 1990 to 2021, total global emissions of greenhouse gases (GHG) increased by 51%. Many businesses have set ambitious targets to reduce their greenhouse gas emissions and minimize their environmental impact. Green data centers, designed to be highly energy-efficient and environmentally responsible, play a major role in helping companies achieve these objectives. These data centers reduce the consumption of energy consumption substantially, as well as carbon emissions, by optimizing various operations such as resource management, cooling systems, and power usage. Furthermore, compliance with environmental regulations is also supporting the green data center market growth. Governments and regulatory bodies around the world are enacting stricter environmental laws and standards. As a result, organizations are under increased pressure to adopt sustainable practices, including the deployment of green data centers, to remain compliant and avoid potential penalties. This regulatory emphasis reinforces the demand for energy-efficient and eco-friendly data center technologies, thus propelling market growth.

Escalating demand for cost savings

The rising need for cost savings is a powerful catalyst behind the increasing adoption of green data centers. These innovative facilities are designed with a keen focus on energy efficiency, resulting in substantial reductions in both energy consumption and operational expenses. As energy costs continue to rise globally, organizations are acutely aware of the need to control their budgets while maintaining reliable data center operations. Green data centers achieve cost savings through various means. They utilize advanced cooling technologies, such as free cooling and hot/cold aisle containment, to minimize the energy required for temperature regulation. Additionally, the integration of renewable energy sources, such as solar panels and wind turbines, further reduces electricity bills. As per the International Energy Association (IEA), in 2022, solar PV generation reached approximately 1,300 TWh, recording a significant growth of 26%, or about 270 TWh. Besides this, the optimization of server and IT equipment utilization in green data centers enhances resource efficiency, reducing the need for additional hardware and associated expenses. This approach aligns with the broader trend of achieving more with fewer resources, thus creating a favorable green data center market outlook.

Increasing data demands

The rising data demands are significantly propelling the adoption of green data centers. In today's interconnected world, businesses, IoT devices, and cloud services are generating an unprecedented volume of data. For instance, the global IoT market is forecasted to grow at a CAGR of 14.6% during 2025-2033, according to the IMARC Group. To accommodate this exponential growth, data centers must possess higher capacity and operational efficiency. Green data centers have emerged as the ideal solution to this pressing challenge, as they are purposefully designed to meet these growing data demands while simultaneously minimizing energy consumption and environmental impact. Green data centers achieve this balance through several key strategies. They employ advanced technologies for server virtualization, allowing for optimal resource allocation and reducing the need for additional hardware. Moreover, these data centers often implement energy-efficient cooling systems and lighting solutions, ensuring that power is used sparingly. Additionally, the integration of renewable energy sources further supports their capacity to handle data growth while maintaining sustainability. The ability of green data centers to efficiently manage inflating data volumes positions them as a vital component of modern infrastructure in the digital age.

Growing Popularity of Generative AI

Generative AI is significantly driving the growth of the global green data center market by optimizing energy utilization and enhancing sustainability. By analyzing historical energy usage data, generative AI can predict future usage patterns, allowing data centers to adjust operations proactively. This predictive capability helps in reducing energy waste, optimizing cooling systems, and balancing power loads, which aid in a more effective utilization of resources. Moreover, AI-driven models continuously learn and adapt, refining energy strategies in real time. Sustainability is becoming a core focus for organizations, which is driving the need for generative AI to enable green data centers to meet environmental goals, comply with energy regulations, and cut operational costs. This advanced technology's ability to enhance energy efficiency is a key factor driving the demand for green data centers across industries worldwide. In 2024, Aurum Equity Partners revealed a $400 million investment to construct an AI-powered, green data center in Hyderabad. The 100 MW data center will support both hyperscalers and enterprises while focusing on sustainability.

Green Data Center Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global green data center market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, data center type, and industry vertical.

Analysis by Component:

- Solutions

- Power Systems

- Servers

- Monitoring and Management Systems

- Networking Systems

- Cooling Systems

- Others

- Services

- System Integration Services

- Maintenance and Support Services

- Training and Consulting Services

Solutions stand as the largest component in 2024, holding around 65.0% of the market. This segment encompasses various systems that contribute to its dominance in the market. Power systems greatly focus on minimizing energy consumption through innovations in renewable energy integration, uninterruptible power supplies (UPS), and efficient power distribution. Servers are energy-efficient, often through virtualization and hardware optimizations, enabling data centers to process more data while consuming less power. Monitoring and management systems enable real-time tracking, enhancing resource utilization and energy efficiency. Networking systems feature energy-efficient switches and routers to lower overall power consumption. Cooling systems utilize techniques such as hot/cold aisle containment and liquid cooling to maintain optimal temperatures while reducing energy usage. Other solutions involve sustainable building materials and data center design, collectively driving sustainability and efficiency in the green data center market. Thus, the green data center market revenue is expected to increase, driven by advancements in energy-efficient solutions, renewable energy integration, and optimized system designs that promote sustainability and cost-effectiveness.

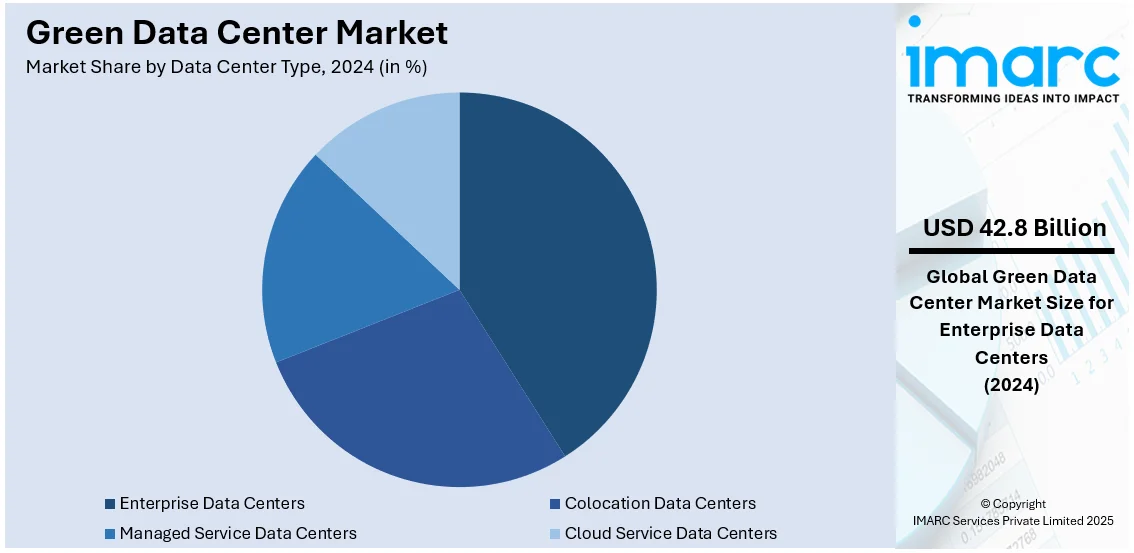

Analysis by Data Center Type:

- Colocation Data Centers

- Managed Service Data Centers

- Cloud Service Data Centers

- Enterprise Data Centers

Enterprise data centers lead the market with around 41.0% of market share in 2024. The large-scale operations of enterprise data centers and their high energy consumption are the primary reasons why they dominate the green data center market. Such data centers process enormous amounts of sensitive business data and require high-performance infrastructure, making energy efficiency and environmental sustainability very important. Adopting green technologies such as renewable energy sources, advanced cooling systems, and AI-driven optimization helps reduce the operational costs of enterprises and ensures they meet regulatory sustainability goals. In addition, increasing CSR focus and the pressure to reduce carbon footprints have further driven enterprises to move toward energy-efficient, eco-friendly data center solutions.

Analysis by Industry Vertical:

- Healthcare

- BFSI

- Government

- Telecom and IT

- Others

Telecom and IT represent the leading market segment in 2024. Telecom and IT sectors dominate the green data center market due to their massive data processing needs. These industries prioritize energy-efficient practices, renewable energy adoption, and resource optimization to support their extensive networks and digital services, making them a significant driving force behind green data center advancements. Furthermore, the telecom and IT sectors are witnessing heightened green data center adoption and serve as trendsetters by setting high sustainability standards. Their commitment to reducing carbon footprints and embracing innovative green technologies sets a compelling example for other industries, reinforcing their dominant role in shaping the green data center market landscape.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.0%. North America is in the lead because of its strong regulatory support, technological innovation, and a very high demand for services to be delivered digitally. Authorities regulate the environment here strictly, making businesses concentrate on more sustainable ways to reduce their carbon footprint. In addition, many mainstream tech companies and data center operators are in North America, with several of them striving to be more energy efficient and to make room for renewable energy. The introduction of AI for optimization and eco-friendly cooling systems further enhances the market growth. Additionally, the demands for cloud computing, big data, and IoT are propelling the need for energy-efficient data centers.

Key Regional Takeaways:

United States Green Data Center Market Analysis

In 2024, the United States accounts for over 85.60% of the green data center market share in North America. The rise in the adoption of environmentally friendly data centers in the United States is largely driven by the increasing demand for cloud services. As per a recent study, more than 51% of businesses are now utilizing cloud-based services. As the reliance on cloud computing continues to expand, many data centers are prioritizing energy efficiency and sustainable practices to meet the growing needs of businesses and consumers. With the rise in remote work, digital transformation, and the overall growth in cloud storage demand, these facilities are moving toward greener solutions. Innovations in cooling techniques, the use of renewable energy sources, and improved hardware efficiency are among the primary methods that are helping to reduce the environmental footprint of data centers. In response to regulations and consumer preferences for sustainability, these green data centers are being designed to consume less energy and generate fewer emissions, reflecting a broader shift toward eco-friendly infrastructure that aligns with corporate sustainability goals.

Asia Pacific Green Data Center Market Analysis

In the Asia-Pacific region, the growing adoption of green data centers is fueled by the expansion of small and medium-sized enterprises (SMEs) that are embracing digital tools and services. For instance, the India Brand Equity Foundation projects that at a compound annual growth rate (CAGR) of 2.5%, the country's MSMEs will increase from 6.3 Crore to around 7.5 Crore. As more businesses in this region adopt cloud computing and digital transformation strategies, the need for energy-efficient data storage solutions has become vital. Green data centers, known for their reduced environmental impact, are becoming a preferred choice for SMEs seeking to scale operations while adhering to sustainability goals. With an emphasis on energy efficiency, these data centers provide cost-effective solutions while simultaneously reducing carbon footprints. The increasing awareness about environmental issues and stricter regulations in several nations further encourage the shift toward sustainable practices, driving the growth of eco-conscious data centers across the region.

Europe Green Data Center Market Analysis

In Europe, the growing adoption of green data centers can be attributed to the expanding banking, financial services, and insurance (BFSI) sector, which increasingly demands sustainable solutions. Recent reports state that there were 784 foreign bank branches in the EU in 2021, out of which 619 were from other EU Member States while 165 belonged to third world countries. As the BFSI industry scales its digital infrastructure to support online services, data storage, and transaction processing, it faces heightened pressure to meet sustainability targets and comply with environmental regulations. The change to green data centers allows BFSI to maintain operational cost-effectiveness while ensuring its competitive position in the marketplace. Powered with renewable sources and new innovative cooling techniques, these centers provide support for the increased requirements by BFSI regarding digital banking, e-commerce, and online trading while also reducing their carbon footprint. Heightened consumer concern regarding eco-friendly practices also results in further intensification toward becoming aligned with European sustainability goals, further propelling the adoption of green data centers.

Latin America Green Data Center Market Analysis

Latin America is witnessing the growing trend of healthcare privatization, which is driving the growth of green data centers as health providers seek to digitize patient records, make services more streamlined, and become operationally efficient. As per the National Confederation of Health (CNSaúde) and the Brazilian Federation of Hospitals (FBH), 62% of Brazil's 7,191 hospitals are private. Privatized healthcare is now increasingly using digital technologies to manage large quantities of sensitive health data, which requires strong and secure data storage solutions. As these systems expand, there is a growing interest in minimizing the environmental impact of data storage and processing. Green data centers, given their energy efficiency and reduced emissions, offer an attractive solution for meeting the fast-growing demands of the health sector in ways that align with sustainability objectives. Private healthcare ownership further propels this shift toward a greener infrastructure in the region.

Middle East and Africa Green Data Center Market Analysis

The growing telecommunication and IT infrastructures that have been established in the region of the Middle East and Africa now have a rising demand for energy-efficient and sustainable data centers. For instance, overall spending on information and communications technology (ICT) across the Middle East, Türkiye, and Africa (META) will reach USD 238 Billion this year, an increase of 4.5% over 2023. As telecom and IT companies expand their services across the region, the need for scalable and reliable data storage solutions has become more pronounced. Green data centers have become highly accepted as businesses seek green solutions to minimize operational costs with high sustainability benefits. This is driving a growing need for cloud computing, data services, and telecom infrastructure while maintaining as low an environmental footprint as possible with large data storage facilities.

Competitive Landscape:

Key players in the green data center market are taking different proactive measures to drive growth and sustainability. Google, Microsoft, and Amazon, some of the major data center companies, have invested extensively in renewable sources of energy by using solar and wind energy sources for powering facilities, which decreases carbon footprints. They are also incorporating energy-efficient technologies such as AI-driven management of data systems, advanced cooling methods, and high-efficiency servers to optimize their use of power. Moreover, industry leaders are working hand-in-hand with governments to meet environmental regulations and sustainability goals. Energy conservation, reduction of waste, and environmental responsibility are becoming guiding lines to establish sustainable operations and promote the adoption of green data centers.

The report provides a comprehensive analysis of the competitive landscape in the green data center market with detailed profiles of all major companies, including:

- Cisco Technology Inc.

- Dell EMC Inc.

- Eaton Corporation

- Ericsson Inc.

- Fujitsu Limited (Furukawa Group)

- HCL Technologies Limited

- Hitachi Ltd

- HP Inc.

- Huawei Technologies Co. Ltd.

- IBM

- Microsoft Corporation

- Schneider Electric SE

- Siemens AG

- Vertiv Co.

Latest News and Developments:

- December 2024: A USD 15 Billion incentive is being discussed by Canada to entice pension funds to invest in green AI data centers. This project aims to promote green energy alternatives while addressing AI’s increasing energy requirements. The project supports Canada’s objective to become a leader in environmentally conscious technology infrastructure and boost its AI competitiveness internationally. It also intends to hasten the country’s shift to eco-friendly AI infrastructure.

- November 2024: Digital Transformation Capital Partners (DTCP), a leading investment management company based in Germany, has introduced GreenScale, an innovative data center system with a focus on environmentally conscious operations. Under the direction of CEO Dan Thomas, a former AtlasEdge employee, GreenScale intends to install 170MW in Donegal and Northern Ireland, with another 300MW in the Nordic region. GreenScale places a strong emphasis on employing clean energy sources for the operations of its green data centers, supporting local and renewable energy initiatives.

- October 2024: To improve its overall digital infrastructure capabilities, Maharashtra has authorized the construction of Green Integrated Data Centre Parks. Being the first state in India to implement green data center legislation, Maharashtra aims to attract international companies. Expected to cost approximately USD 20 Billion, the project will enhance the position of Maharashtra in the data center sector.

- August 2024: At the AGM, the Chairman of Reliance Industries, Mukesh Ambani, revealed that the company aims to construct data centers powered by green energy in Jamnagar, Gujarat, in order to fulfill its mission of ‘AI everywhere for everyone.’ These AI data centers intend to democratize artificial intelligence by offering Indian citizens reasonably priced AI and associated services.

- April 2024: With a 30 MW capacity, Viettel has opened the biggest operational green data center in Vietnam, the Viettel Hoa Lac Data Center. It has been constructed using cutting-edge sustainable technologies and is expected to use renewable energy sources to fulfill up to 30% of its energy requirements. Moreover, five layers of security are in place at this facility, which has 60,000 servers and is constructed to facilitate AI development. The launch of this facility represents a major milestone in terms of Viettel’s dedication to modernizing Vietnam’s digital infrastructure.

- June 2024: Hewlett Packard Enterprise (HPE) and Danfoss have entered into a strategic partnership to provide sustainable IT solutions through the use of Data Center Heat Recovery. This cutting-edge module promotes sustainable IT services by enabling businesses to control and recover excessive heat. It is intended to increase energy efficiency as businesses switch to more environmentally friendly IT infrastructure. The partnership also seeks to improve data center operations while assisting enterprises in lessening their impact on the environment.

Green Data Center Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Data Center Types Covered | Colocation Data Centers, Managed Service Data Centers, Cloud Service Data Centers, Enterprise Data Centers |

| Industry Verticals Covered | Healthcare, BFSI, Government, Telecom and IT, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cisco Technology Inc., Dell EMC Inc., Eaton Corporation, Ericsson Inc., Fujitsu Limited (Furukawa Group), HCL Technologies Limited, Hitachi Ltd, HP Inc., Huawei Technologies Co. Ltd., IBM, Microsoft Corporation, Schneider Electric SE, Siemens AG, Vertiv Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the green data center market from 2019-2033.

- The green data center market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the green data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The green data center market was valued at USD 104.3 Billion in 2024.

IMARC estimates the green data center market to exhibit a CAGR of 17.58% during 2025-2033.

The increasing energy consumption and the need for efficiency, government regulations and sustainability mandates, growing demand for cloud computing and digital services, technological advancements in energy-efficient infrastructure, and rising corporate focus on environmental responsibility and CSR are the primary factors driving the green data center market.

North America currently dominates the market due to strong regulatory support and a high concentration of leading tech companies.

Some of the major players in the green data center market include Cisco Technology Inc., Dell EMC Inc., Eaton Corporation, Ericsson Inc., Fujitsu Limited (Furukawa Group), HCL Technologies Limited, Hitachi Ltd, HP Inc., Huawei Technologies Co. Ltd., IBM, Microsoft Corporation, Schneider Electric SE, Siemens AG, Vertiv Co., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)