Guacamole Market Size, Share, Trends and Forecast by Form, End Use, Packaging, Distribution Channel, and Region, 2025-2033

Guacamole Market Size & Share:

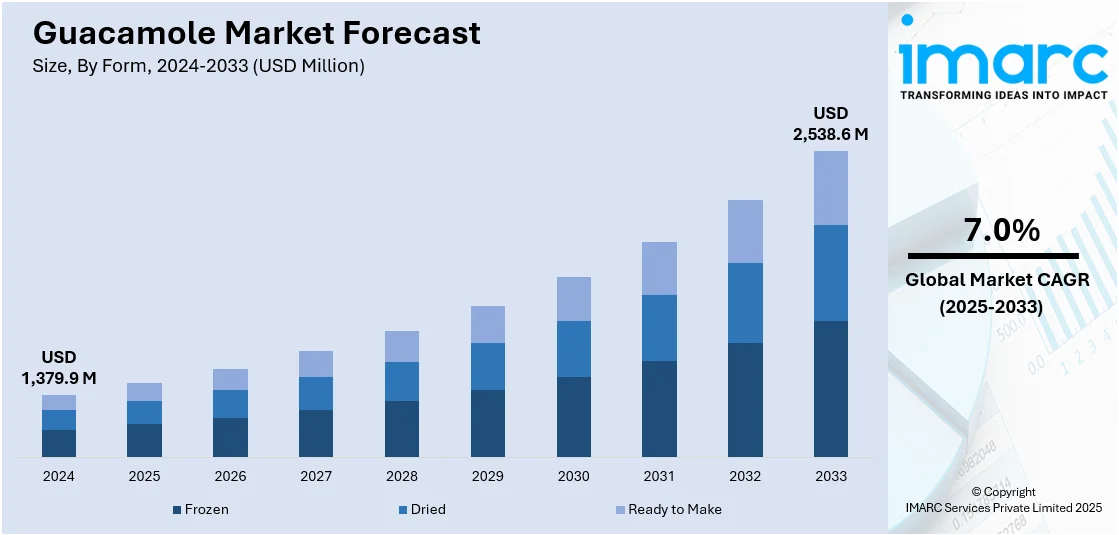

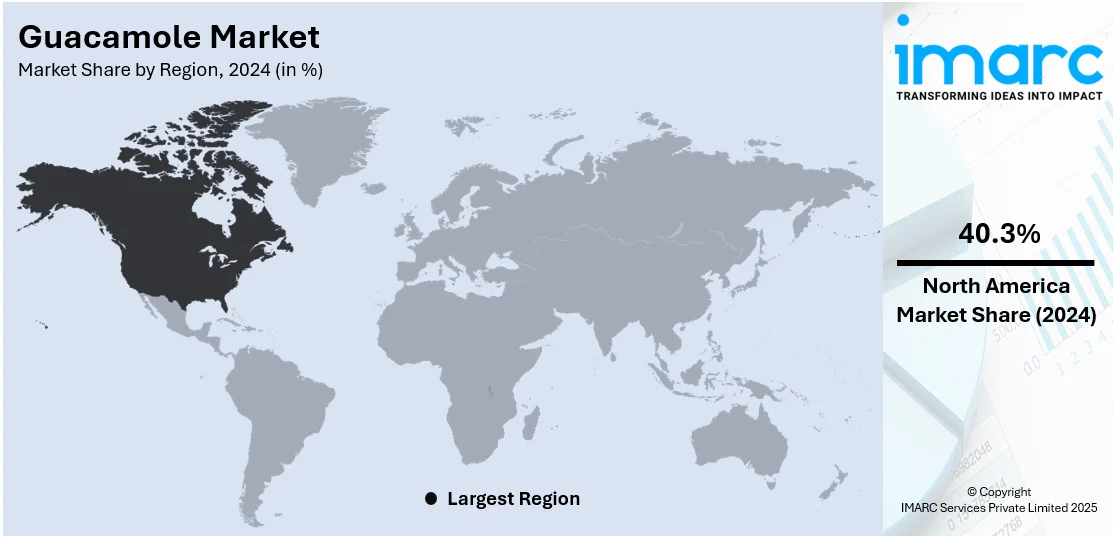

The global guacamole market size was valued at USD 1,379.9 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,538.6 Million by 2033, exhibiting a CAGR of 7.0% from 2025-2033. North America currently dominates the market, holding a market share of 40.3% in 2024. At present, consumers are becoming health conscious, which is driving the demand for guacamole. Apart from this, increasing preferences for convenience is another factor that is actively contributing to the growth of the market. Moreover, the heightened interest in Mexican cuisine and flavors is expanding the guacamole market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,379.9 Million |

|

Market Forecast in 2033

|

USD 2,538.6 Million |

| Market Growth Rate 2025-2033 | 7.0% |

The market for guacamole is experiencing growth, with consumers demanding healthier and tastier food choices. With the increasing awareness about the health gains of avocados, the demand for guacamole is rising. Moreover, there is an emphasis on providing ready-to-consume products to match the high demand for convenience, which is helping make guacamole more popular across a broader base. In addition, the clean label trend, which uses fewer preservatives and additives, is positively influencing the market as people are becoming more conscious of what they are putting in their food. Apart from this, the heightened demand for Mexican food is also propelling the guacamole market growth, as guacamole is becoming a standard menu item in restaurants, fast-casual places, and household kitchens. Customers are further getting creative and adding ingredients and spices to create diverse versions of guacamole, such as adding fruits.

The United States guacamole market is expressing rapid growth caused by the escalating consumer demand for healthy and convenient food. With the rise in the number of people adopting plant-based diets, the demand for guacamole is growing, as it is regarded as a healthy and dairy-free substitute. Individuals are gaining consciousness about the health advantages of avocados, which contain healthy fats, fiber, and necessary vitamins, leading to the growing popularity of guacamole. American consumers are also demanding convenience, and manufacturers are complying with pre-packaged, ready-to-eat guacamole. This transition towards convenience is making busy families and individuals include guacamole in their everyday meals without the hassle of preparing it from scratch. Moreover, brands are launching guacamole-flavored products for catering to this demand. For instance, Doritos announced the launch of guacamole-flavored Doritos in 2025 in the US.

Guacamole Market Trends:

Rising Health and Wellness Trends

Consumers are focusing on healthier-eating, which has been a significant driver in the increased demand for guacamole. Since individuals are becoming more health-conscious, they have become more attracted to nutrient-dense foods such as avocados. According to USDA, El Economista predicts that Mexican avocado exports will hit a record $4 billion in 2025. To satisfy rising demand abroad, particularly from the United States, the USDA projects that Mexican avocado exports will reach 1.34 million metric tons in 2025, a 5% year-over-year rise. Being comprised of mainly avocados, guacamole provides consumers with the health benefits they seek, such as heart-healthy fats, fiber, and antioxidants. People are actively seeking clean, plant-based products, and guacamole is fitting seamlessly into this trend. This growing awareness of the health benefits is encouraging both consumers and restaurants to incorporate guacamole into various meal options. Additionally, the rising popularity of low-carb, gluten-free, and keto diets is catalyzing the demand, as guacamole fits these dietary needs. The product’s association with better nutrition is making it a go-to snack for health-conscious individuals, leading to its consistent growth in the market.

Heightened Demand for Convenience and Ready-to-Eat (RTE) Options

Increasing preferences for convenience is another factor that is offering a favorable guacamole market outlook. Busy lifestyles are prompting consumers to look for ready-to-eat (RTE), hassle-free food options, and pre-packaged guacamole is meeting these needs. Retailers are expanding their offerings of single-serve or multi-serve guacamole containers, making it more accessible for on-the-go consumption. This shift towards RTE products is not only catering to individuals but also appealing to families who seek quick meal solutions. Additionally, restaurants and food service providers are increasingly offering pre-made guacamole as a way to meet consumer demands for fast, fresh, and nutritious food options. The convenience factor is also playing a major role, and consumers always opt for guacamole instead of traditional, time-consuming options that are fueling the growth of the market. In 2025, Haldiram’s announced the launch of 5 new and unique avocado-based menus with an Indian twist. This menu is launched by collaborating with the World Avocado Organization (WAO).

Popularity of Mexican Cuisine and Flavors

Interest in Mexican cuisine and flavors has been the major driver for the guacamole market currently. As people look to expand the options they experience in their food, Mexican food takes up more scope in the United States and across the world. Guacamole, often considered a staple of Mexican cuisine, is now a favored dish in homes, restaurants, and fast-casual dining establishments. The growing trend of culinary experimentation is also encouraging individuals to try different variations of guacamole, incorporating fruits, spices, and even international ingredients to create unique flavor profiles. As consumers continue to seek authentic and flavorful dishes, guacamole is consistently being integrated into meals beyond traditional Mexican dishes, making it a versatile food product. This surge in the popularity of Mexican flavors is putting guacamole into mainstream food culture. The IMARC Group predicts that the Mexico fast food market size is expected to attain USD 19.5 Billion by 2033.

Guacamole Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global guacamole market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on form, end use, packaging, and distribution channel.

Analysis by Form:

- Frozen

- Dried

- Ready to Make

Ready to make stands as the largest component in 2024, holding 58.4% of the market. Ready-to-make guacamole is increasingly becoming a popular choice for consumers looking for convenience without sacrificing quality. By offering pre-packaged, fresh ingredients, these products are saving time and effort, making it easier for individuals to enjoy a nutritious snack or meal. Consumers are enjoying the ease of simply opening a package and serving guacamole, which is ideal for busy lifestyles. This is a solution as the amount of healthy and convenient food consumers demand is increasing, and ready-to-make guacamole solves the problem of buying ingredients, preparing, and chopping. The health advantage of ready-to-make guacamole is also drawing consumers in pursuit of plant-based, nutrient-dense foods. Full of healthy fats, fiber, and vitamins, guacamole presents heart-healthy benefits, contributing to well-being. With more consumers paying attention to clean eating, ready-to-make guacamole is a convenient, healthy substitute for regular snacking. With fewer preservatives and added flavoring, it is a popular pick among health-conscious consumers.

Analysis by End Use:

- Food Processing Industry

- Food Service Industry

- Households

Food service industry leads the market with 42.8% of market share in 2024. The food service industry is increasingly turning to guacamole as a versatile and popular ingredient across a range of menu items. Restaurants, cafes, and fast-casual spots are adding guacamole to appetizers, sandwiches, burgers, and salads, boosting flavor while offering customers a healthier choice. It is also becoming a common topping for tacos, nachos, and burritos, catering to the rising popularity of Mexican-inspired dishes. Beyond traditional uses, food service providers are getting creative with guacamole, introducing new options like guacamole dips and spreads to keep up with evolving consumer tastes. As the demand for fresh and customizable meals grows, many places are offering guacamole as a topping or side, giving customers the freedom to personalize their dishes. This flexibility and innovation are helping the food service industry meet the changing preferences of today’s diners.

Analysis by Packaging:

- Glass Bottles

- Plastic Containers

- Stand Up Pouches

Stand up pouches lead the market with 53.6% of market share in 2024. Stand-up pouches are gaining popularity due to their numerous benefits in packaging. They are providing businesses with a lightweight, cost-effective solution while offering increased convenience for consumers. As these pouches are flexible, they are easily adaptable for various product sizes, allowing for greater packaging versatility. The ability to stand up on shelves is enhancing product visibility, making it easier for consumers to spot and engage with the product in retail settings. Additionally, the use of stand-up pouches is helping companies reduce their environmental impact, as they require less material compared to traditional rigid containers. They are also promoting longer shelf life by providing superior barrier protection against moisture, light, and air, which is preserving product freshness. With features like resealable zippers, stand-up pouches are offering added convenience for customers, allowing for repeated use.

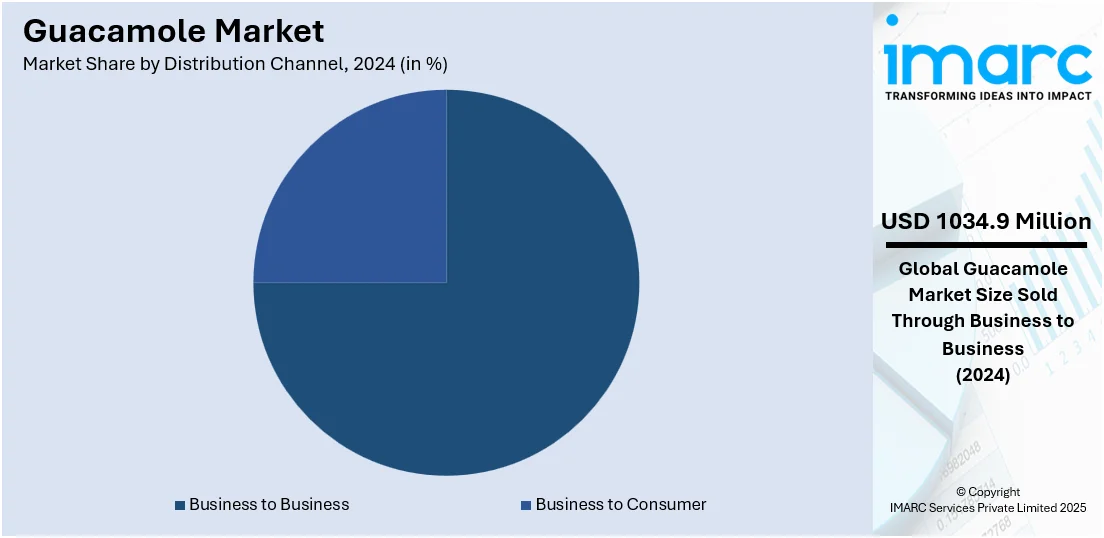

Analysis by Distribution Channel:

- Business to Business

- Business to Consumer

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

Business to business leads the market with 75.0% of market share in 2024. Businesses are increasingly incorporating guacamole into their product offerings, responding to the growing demand for convenient, high-quality food items. Food manufacturers are partnering with suppliers to source avocados and create pre-made guacamole products for retailers, expanding their reach in the consumer market. These products are often used as ingredients in ready-to-eat meals, snack items, or as a base for various culinary creations in food processing. Additionally, food service suppliers are providing bulk guacamole to restaurants, catering services, and cafeterias, ensuring consistent, high-quality offerings. As the demand for Mexican-inspired flavors continues to rise, businesses are also offering guacamole as a part of meal kits or as an ingredient for food brands creating packaged snacks.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of 40.3%. The North American sector is currently witnessing significant growth, driven by various guacamole market trends like heightened demand for healthy and convenient consumable options. As individuals are becoming more health-conscious, guacamole is gaining popularity due to its rich nutritional profile. Consumers are actively seeking out plant-based, nutrient-dense snacks, and guacamole is aligning well with these preferences. With its high content of heart-healthy fats, fiber, and essential vitamins, guacamole is meeting the rising demand for clean, wholesome food. In response to busy lifestyles, food manufacturers are offering ready-to-eat guacamole products, providing consumers with convenient solutions that save time in meal preparation. These pre-packaged options are particularly appealing to individuals who are looking for quick, nutritious snacks. Moreover, the trend of clean labels and organic food products is actively shaping the market, as consumers are increasingly opting for guacamole made from organic avocados without artificial preservatives.

Key Regional Takeaways:

United States Guacamole Market Analysis

The United States holds 85.00% share in North America. The United States market is primarily driven by the high requirement for healthier, plant-based food options as consumers become more health-conscious. Avocados, the key ingredient in guacamole, are rich in healthy fats, fiber, and essential nutrients, aligning with the growing preference for nutrient-dense foods. Moreover, the rise in popularity of Mexican and Latin American cuisine in the U.S. has contributed significantly to guacamole's widespread consumption, particularly in casual dining, fast food, and snack sectors. For instance, on any given day, 13% of adults aged 20 years and older consume at least one Mexican food, according to the U.S. Department of Agriculture (USDA). Furthermore, approximately 11% of restaurants in the U.S. serve Mexican cuisine, according to a study by the Pew Research Center. Additionally, the growth of the snacking culture, with consumers opting for ready-to-eat options, has also heightened the demand for pre-packaged guacamole. The convenience factor of ready-made guacamole, often available in single-serve or family-sized portions, caters to the busy, on-the-go lifestyle of modern consumers. The growth of retail outlets offering fresh and organic guacamole options, along with expanding online grocery shopping, is also supporting industry expansion. Other than this, the rise in social media and food trends, such as "avocado toast" and guacamole as a staple in healthy diets, has played a key role in driving consumer awareness and demand for this popular dip.

Asia Pacific Guacamole Market Analysis

The Asia Pacific market is expanding due to the increasing adoption of Western dining habits and the rising popularity of Mexican cuisine across the region. As international cuisines become more mainstream, particularly in urban centers, guacamole is gaining recognition as a versatile, flavorful dip or topping. With urbanization and rising disposable incomes, the Asia-Pacific region is seeing a shift toward more westernized eating habits, including the growing popularity of avocado and guacamole. Furthermore, the increasing popularity of plant-based and vegetarian diets in countries such as India and Australia is contributing substantially to industry expansion as guacamole aligns well with these dietary preferences. According to industry research, 2.5 Million Australians consume diets of which the food is entirely, or almost all, vegetarian or vegan. Besides this, improved avocado supply chains and the introduction of more cost-effective packaging are making guacamole more affordable and widely available, helping drive its market growth across the Asia Pacific.

Europe Guacamole Market Analysis

The growth of the Europe market is largely fueled by an increasing need for healthier and more nutritious food options among European consumers. As health-conscious eating habits rise, avocados, known for their rich nutrient profile, including healthy fats, fiber, and vitamins, have gained popularity as a key ingredient in various diets. The rising interest in plant-based and vegan diets and the shift away from traditional dairy or meat-based snacks is further fueling guacamole consumption, as it is a versatile, plant-based dip. According to a recent survey, 5% of the population of Austria follows vegan diets. Moreover, 40% of Europeans expressed interest in consuming more plant-based foods. Additionally, the focus on clean eating and the demand for simple, natural ingredients in food products is propelling the popularity of guacamole, as it is perceived as a wholesome, minimally processed snack or condiment. The rise in meal personalization and the popularity of "DIY" food kits are also influencing the market, with numerous consumers seeking versatile ingredients such as guacamole to enhance their meals. Innovations in guacamole product offerings, such as flavor varieties, are also attracting a broader consumer base. Other than this, the expanding presence of avocado importers and producers in Europe also supports the market’s growth trajectory.

Latin America Guacamole Market Analysis

The Latin America market is significantly influenced by the strong cultural affinity for avocados and Mexican cuisine, where guacamole is a staple. As the popularity of traditional Mexican foods spreads, both within and outside the region, the demand for guacamole is steadily rising. The increasing health consciousness among consumers, particularly in countries such as Brazil and Argentina, is also boosting the popularity of healthy foods such as guacamole due to its nutrient-rich profile, offering healthy fats and vitamins. Overall, Brazil is regarded as the fifth most significant market for healthy foods globally, growing at a rate of 20% annually in comparison to the global average of 8%. Besides this, the rise of modern retail channels and foodservice chains is also increasing access to guacamole, supporting industry expansion in Latin America.

Middle East and Africa Guacamole Market Analysis

The Middle East and Africa market is experiencing robust growth, driven by the growing need for healthier, plant-based food options, as individuals become more health-conscious. For instance, the plant-based food market in Saudi Arabia reached USD 0.11 Billion in 2024 and is forecasted to grow at a CAGR of 11.28% during 2025-2033, according to a report by the IMARC Group. Furthermore, the region's growing young population, along with the rising trend of convenience and ready-to-eat foods, is propelling the demand for packaged guacamole. The expanding food service industry, including casual dining and fast food, is also introducing guacamole as a key menu item, further propelling market growth in the region.

Competitive Landscape:

Market players in the industry are actively focusing on product innovation, quality enhancement, and expanding their market reach. Many are introducing new variations of guacamole, such as flavored or organic options, to cater to evolving consumer preferences for healthier and more diverse food choices. Some companies are partnering with avocado growers to ensure a consistent and sustainable supply of high-quality avocados, while others are adopting advanced packaging techniques, such as stand-up pouches, to enhance product freshness and convenience. Additionally, major food service providers and retailers are increasingly offering pre-packaged guacamole to meet the growing demand for ready-to-eat products. As per the guacamole market forecast, these strategic efforts are expected to aid market players in strengthening their position in an increasingly competitive and health-conscious market.

The report provides a comprehensive analysis of the competitive landscape in the guacamole market with detailed profiles of all major companies, including:

- Avo-King

- Calavo Growers, Inc.

- Casa Sanchez Foods

- Conagra Brands, Inc.

- Hormel Foods Corporation

- Insignia International

- Sabra Dipping Company, LLC (PepsiCo, Inc.)

- Salud Foodgroup Europe B.V.

- Simplot

- Westfalia Fruit

Latest News and Developments:

- April 2025: Holy Moly, a British all-natural dip company, introduced its very first Guacamole Chip & Dip snack pot. Expected to significantly improve the convenience snack sector, the new product will be sold in more than 900 Sainsbury’s stores. Additionally, the product will be available on LNER trains starting on June 11, 2025, and in WHSmith Travel stores starting on June 28, 2025.

- September 2024: MegaMex Foods launched three additional WHOLLY Guacamole products, the WHOLLY Guacamole Jalapeño Garlic Guacamole, the WHOLLY Guacamole Serrano Lime Guacamole, and the WHOLLY Guacamole Cilantro Lime Guacamole, for foodservice operators. With this launch, the company’s WHOLLY Guacamole product portfolio now offers a total of five distinct flavors available for sale.

- May 2024: The WHOLLY Guacamole brand unveiled its newest product, the WHOLLY Guacamole Extra Chunky Restaurant Style Guacamole. Crafted with delicious chunks of real, 100% Hass avocados, the novel product is available in 7.5-ounce and 15-ounce bowls and minis, along with 4- and 6-packs of 2-ounce portions.

- May 2024: GoVerden, a manufacturer of all-natural, premade guacamole, announced an expansion of their distribution network following Cinco De Mayo in order to increase the availability of their goods in retail stores around the country. As part of this expansion, the company's distribution in Walmart will grow from 200 to an astounding 1,050 locations nationwide, providing their best-selling Guacamole Mild and Guacamole Spicy to a wider range of consumers.

Guacamole Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Frozen, Dried, Ready to Make |

| End Uses Covered | Food Processing Industry, Food Service Industry, Households |

| Packaging Covered | Glass Bottles, Plastic Containers, Stand Up Pouches |

| Distribution Channels Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Avo-King, Calavo Growers, Inc., Casa Sanchez Foods, Conagra Brands, Inc., Hormel Foods Corporation, Insignia International, Sabra Dipping Company, LLC (PepsiCo, Inc.), Salud Foodgroup Europe B.V., Simplot, Westfalia Fruit, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the guacamole market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global guacamole market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the guacamole industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The guacamole market was valued at USD 1,379.9 Million in 2024.

The guacamole market is projected to exhibit a CAGR of 7.0% during 2025-2033, reaching a value of USD 2,538.6 Million by 2033.

The key factors driving the guacamole market include rising health and wellness trends, increased demand for convenient and ready-to-eat food options, and the growing popularity of Mexican cuisine. Additionally, the clean label trend and the rise of plant-based diets are further supporting market growth.

North America currently dominates the guacamole market, accounting for a share of 40.3%. The region’s growth is driven by increasing consumer need for healthy, convenient, and Mexican-inspired food options.

Some of the major players in the guacamole market include Avo-King, Calavo Growers, Inc., Casa Sanchez Foods, Conagra Brands, Inc., Hormel Foods Corporation, Insignia International, Sabra Dipping Company, LLC (PepsiCo, Inc.), Salud Foodgroup Europe B.V., Simplot, Westfalia Fruit, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)