Hair Oil Market Size, Share, Trends and Forecast by Type, Product Type, Category, Application, Distribution Channel, and Region, 2025-2033

Hair Oil Market Overview:

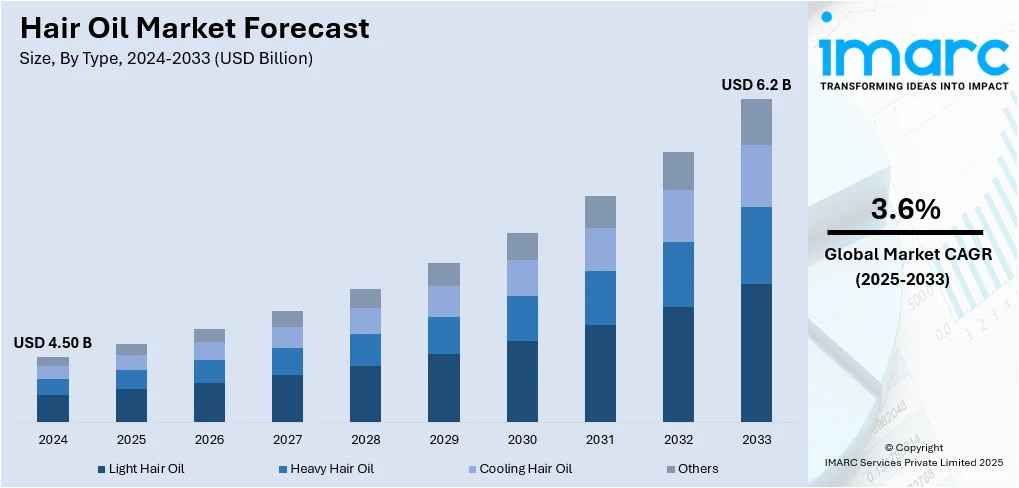

The global hair oil market size was valued at USD 4.50 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.2 Billion by 2033, exhibiting a CAGR of 3.6% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 38.0% in 2024. The dominance of the region is attributed to its cultural emphasis on hair care and widespread use of hair oil in daily routines. The region also benefits from the growing availability of diverse products catering to local preferences, driving consistent demand across both urban and rural areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.50 Billion |

|

Market Forecast in 2033

|

USD 6.2 Billion |

| Market Growth Rate 2025-2033 | 3.6% |

Shoppers are becoming more aware about the importance of healthy hair and scalp, resulting in a rise in the need for products that combat hair loss, dandruff, and dryness. Hair oil is seen as a natural and efficient remedy for these issues. This growing awareness is promoting consistent usage, enhancing overall market demand among various age groups and demographics. Furthermore, a movement towards natural and herbal components is influencing buying habits, as shoppers look for safer options compared to chemical-laden products. Hair oils made with plant extracts and conventional treatments are becoming more popular. This inclination fosters the development of niche and organic brands while also encouraging larger producers to reformulate or diversify their products.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, supported by a shift towards clean, chemical-free beauty as individuals eagerly pursue natural options. Hair oils formulated with natural ingredients and devoid of harmful additives are becoming more popular. The preference for transparency in formulations and ethical sourcing practices is driving the demand for niche and sustainable hair oil brands. Moreover, the rise of e-commerce in the country is enhancing the availability of hair oil, allowing users to easily browse, compare, and buy products online. Numerous brands currently employ direct-to-consumer (DTC) strategies to provide tailored experiences and foster deeper connections with clients. In line with this trend, the U.S. Census Bureau indicated that retail e-commerce sales hit $300.2 Billion in Q1 2025, underscoring the growing influence of digital platforms on hair oil market growth.

Hair Oil Market Trends:

Increasing Awareness about Hair and Scalp Health

Individuals are becoming more aware about the harmful impacts of pollution, stress, unhealthy diets, and the overuse of heat and chemical-based hair styling products. As a result, many people are opting for hair oils as a preventive and revitalizing remedy. Hair oils are viewed as a natural, gentle method to nourish, hydrate, and restore hair, resulting in steady use among various age demographics. This consciousness goes beyond beauty issues to encompass scalp wellness, hair durability, and the upkeep of hair over time. Brands are reacting by providing specialized products that tackle particular problems like dryness, dandruff, or hair thinning, for specific hair types, including curly, straight, and wavy. For example, in 2025, Sky Organics launched two new certified organic products to support curly hair and scalp health, including Organic Castor Oil with Rosemary Oil and Organic Shea & Babassu Moisture Butter. These products are designed to nourish, hydrate, and strengthen curls while promoting scalp health. They are available at Walmart and online retailers like Amazon.

Shift Toward Natural and Herbal Ingredients

People are becoming increasingly cautious about the long-term effects of synthetic chemicals and artificial additives in personal care items. Hair oils made from plant-based ingredients are viewed as safer and more effective alternatives that align with clean beauty standards. This shift is not limited to any one region but is reflected in global purchasing behavior. Users are seeking transparency in product labels and gravitating toward oils with minimal processing and recognizable, botanical ingredients. This is encouraging brands to reformulate existing products or develop new lines emphasizing purity and sustainability. The trend is also leading to a rise in ethical sourcing, eco-friendly packaging, and cruelty-free testing practices. In 2024, Delhi-based natural beauty brand Fenufit launched its Fenugreek and Onion Hair Oil, expanding its clean beauty portfolio. The oil combined fenugreek and onion extracts to promote hair growth, reduce dandruff, and nourish the scalp. The product was toxin-free, dermatologist-approved, and aligned with the brand’s focus on natural, chemical-free solutions.

Demand for Multi-Functional Products

Individuals are progressively looking for versatile hair oils that provide multiple advantages in a single use, including nourishment, styling, heat protection, and scalp care. This request stems from the need for streamlined processes and efficient solutions, particularly among those with busy schedules. Versatile hair oils decrease the necessity for various products, making them economical and convenient for everyday use. As a result, brands are creating multifunctional oils that merge various active components, delivering hydration, repair, protection, and shine all in one product. These options attract a wide range of individuals, such as minimalists and those with restricted shelf space or travel requirements. In 2025, Shed Salon Hair Every Day launched Tropic-Oil, a unique hair oil featuring a blend of coconut oil and cocoa butter in a melting whip formula. This innovative product nourishes and tames frizz while leaving hair soft, shiny, and manageable. It can also double as a body moisturizer and is available exclusively through Alan Howard.

Hair Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hair oil market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, product type, category, application, and distribution channel.

Analysis by Type:

- Light Hair Oil

- Heavy Hair Oil

- Cooling Hair Oil

- Others

Ligh hair oil represents the largest segment attributed to its non-greasy texture, simple application, and appropriateness for everyday use. People are increasingly drawn to hair care products that do not weigh hair down or create a sticky residue, making lightweight hair oil a popular choice. This oil penetrates the scalp and hair swiftly, delivering nourishment without sacrificing style or comfort. It is favored by city dwellers with hectic lifestyles who desire effective hair care options that require minimal maintenance. Light oil is also ideal for every hair type, such as fine and oily hair, broadening their attractiveness to a larger audience. Moreover, increasing understanding about scalp health and the necessity for light hydration is further supporting the demand for this segment. Producers are creating innovative formulations that blend a light texture with advantageous components, improving product effectiveness and user contentment.

Analysis by Product Type:

- Coconut Oil

- Almond Oil

- Argan Oil

- Others

Coconut oil stands as the largest component in 2024, holding 35.0% of the market due to its longstanding reputation for enhancing hair health and its profound cultural importance in various areas. Recognized for its hydrating and nourishing qualities, coconut oil is widely relied upon for fortifying hair, minimizing protein loss, and averting damage. Its adaptability and natural source attract individuals looking for efficient yet mild hair care options. The oil's lightweight consistency, lovely scent, and capacity to absorb into the hair shaft make it a favored option for both everyday use and deep treatments. Moreover, increasing awareness regarding the advantages of natural ingredients is solidified user preference for coconut oil in place of synthetic options. It is also easily obtainable and inexpensive, making it accessible to a wide range of people. Brands persist in innovating in this sector by improving formulations or combining it with other ingredients, further strengthening its leadership in the market.

Analysis by Category:

- Non-Medicated

- Medicated

Medicated dominates the market, as user awareness about hair and scalp health concerns like dandruff, hair loss, and dryness rises. These products contain active ingredients designed to address particular issues, providing practical advantages beyond mere nourishment. The increasing appeal of targeted therapies is driving the need for medicated alternatives that guarantee noticeable outcomes. Individuals are progressively looking for solutions supported by scientific studies or traditional medical wisdom, leading to the rise in popularity of this segment. Confidence in formulations that are clinically tested or endorsed by dermatologists significantly influences buying choices. Moreover, the growing worries about pollution, hair problems linked to stress, and the regular application of chemical-laden styling products are making medicated hair oils more significant. Producers are taking advantage of this trend by broadening their medicated product offerings and informing individuals about the advantages via digital platforms and endorsements from healthcare professionals.

Analysis by Application:

- Individual

- Commercial

Individual is a crucial segment in the market, influenced by grooming practices and a growing awareness about scalp and hair wellness. Hair oil is commonly used by people for upkeep, nutrition, and addressing typical issues like dryness, hair loss, or dandruff. As interest in self-care and natural beauty routines increases, people are purchasing different hair oils that meet particular requirements. Digital platforms, beauty influencers, and focused marketing strategies significantly impact individual decisions.

Commercial comprises salons, spas, wellness facilities, and healthcare organizations that incorporate hair oils into their professional services and treatments. This sector is fueled by the rising need for tailored hair care services and high-quality oil treatments. Experts frequently select high-performance or therapeutic items tailored for particular results, including scalp relaxation, damage repair, or intense conditioning. The use of hair oil in commercial settings enhances brand reputation and client confidence, as users frequently persist with suggested products at home.

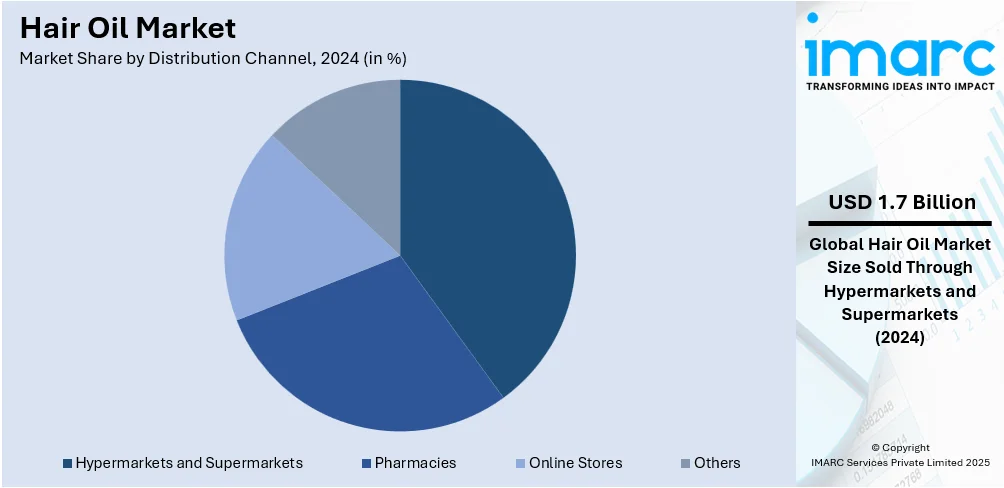

Analysis by Distribution Channel:

- Hypermarkets and Supermarkets

- Pharmacies

- Online Stores

- Others

Hypermarkets and supermarkets lead the market with 38.7% of market share in 2024 because of their broad reach, vast product selection, and capacity to provide attractive pricing. These retail formats offer shoppers the ease of one-stop shopping and a wide selection of brands and varieties in a single location. Their structured arrangement, product accessibility, and special promotions draw a significant clientele, particularly in city regions. Buyers frequently choose these stores owing to their reliability, convenience for comparison, and the chance to inspect items in person prior to buying. Furthermore, solid connections between manufacturers and retailers guarantee prompt inventory updates and the rollout of new products. The existence of loyalty programs and in-store promotions boosts buyer involvement and brand memory. Consistent foot traffic and increasing user inclination towards organized retail ensure that hypermarkets and supermarkets remain a crucial segment, significantly driving sales.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 38.0%, due to a mix of cultural practices, significant user involvement in personal care, and a strong inclination towards natural hair care products. Hair oiling is an integral aspect of the grooming rituals in numerous communities throughout the area, establishing it as a regular component of everyday and weekly self-care. The extensive population supports continuous demand, and the variety of hair types promotes the creation of different formulations designed for particular requirements. Moreover, robust distribution networks and efficient marketing strategies support the area's leadership in the market. For instance, in 2024, KLF Nirmal launched India’s first Oudh-infused coconut hair oil, blending premium Kerala coconut oil with the luxurious fragrance of Oudh. The non-sticky, lightweight formula is suitable for all hair types and enhances nourishment with a rich, lingering scent. The product is available online and in select retail stores across India.

Key Regional Takeaways:

United States Hair Oil Market Analysis

In North America, the market portion held by the United States is 84.90%, owing to the growing prevalence of hair-related problems and conditions, including alopecia areata, telogen effluvium, dandruff, and scalp inflammations. Approximately 7 million individuals in the US and 160 million globally suffer from alopecia areata or have experienced it, or will experience it. These worries are encouraging individuals to seek out hair oil treatments and preventive solutions that provide nourishment and promote scalp health. The growing understanding about hair care practices and the healing properties of plant-based oils is leading to increased usage among various groups. The presence of clinically supported and dermatologically tested formulations reinforces this trend. The demand for hair oil is also being supported by a transition from chemical products to safer options. Advancements in scalp-focused products and marketing focused on scalp recovery and anti-hair loss advantages are increasing use among various genders and age demographics, offering a favorable hair oil market outlook in the United States.

North America Hair Oil Market Analysis

The expansion of the North America hair oil market is attributed to the heightened user awareness regarding hair care and grooming, a rise in demand for natural and organic personal care items, and the growing impact of digital marketing and e-commerce channels. People are increasingly prioritizing hair health, addressing concerns like hair loss, dryness, and scalp troubles, resulting in a rise in the demand for hair oils infused with essential oils, herbs, and vitamins. The area's diverse population is catalyzing the demand for various hair care options, particularly those designed for textured and curly hair. Furthermore, the growing number of e-commerce channels is greatly improving product availability and user access. For example, according to the International Trade Administration (ITA), e-commerce represented 6.1% of all Canadian retail sales in December 2024, with online retail sales reaching around US$3.14 Billion, underscoring the essential impact of online platforms on market expansion and consumer interaction.

Europe Hair Oil Market Analysis

Europe is experiencing an increasing use of hair oil as a result of the broader accessibility of various hair oils through both online and offline retail outlets. For example, Germany is the biggest e-commerce market in Europe, expected to hit USD 125.56 Billion by 2025. Supermarkets, pharmacies, beauty retailers, and online shopping sites are enhancing the visibility and availability of products. User experimentation is also being accelerated by digital marketing campaigns, endorsements from influencers, and trial-sized packs available through retail. A wider variety of specialized oils target hair restoration, moisture, or scalp wellness to meet different user demands. Product placements on premium shelves and the use of bundling strategies with hair care kits are increasing trials. The expansion of e-commerce is facilitating international brand expansions and improved user convenience.

Asia Pacific Hair Oil Market Analysis

The Asia-Pacific region is seeing a rise in hair oil usage supported by a growing user inclination towards herbal hair care items. For example, 92% of households in India bought ayurvedic products in 2024-25, up from 89% five years earlier. In the region, individuals are placing more importance on traditional remedies based on natural extracts, which is catalyzing the demand for herbal hair oil products that include ingredients, such as amla, bhringraj, neem, and coconut. Furthermore, the increasing worries about hair damage caused by pollution and regular chemical treatments are heightening the significance of preventive care. Herbal oils are gaining popularity for their versatile benefits like enhancing strength, providing conditioning, and encouraging hair growth. Health-aware individuals are favoring ingredient openness, which aligns perfectly with plant-derived, organic hair oils.

Latin America Hair Oil Market Analysis

Latin America is experiencing a rise in hair oil usage driven by growing urbanization and higher disposable incomes. For example, in 2025, it is reported that Latin America will be among the most urbanized areas globally, with more than 80% of its inhabitants residing in urban areas. Quick urban expansion is resulting in shifts in living habits and a growing focus on self-care. Higher disposable income enables individuals to investigate a broader selection of hair care options. This socio-economic change is driving the need for hair oils that focus on nourishment, shine, and preventing breakage, especially in young adults.

Middle East and Africa Hair Oil Market Analysis

The adoption of hair oil in the Middle East and Africa is rising, attributed to the growth of hypermarkets and supermarkets. As of May 5, 2025, the United Arab Emirates has 2,370 Supermarkets, reflecting a 3.58% rise since 2023. These retail formats provide simpler access to a range of branded and specialty hair oils. Increasing shelf visibility, special promotions, and in-store guidance have motivated new users and additional purchases. The growing number of e-commerce platforms, which offer a broad variety of products from the comfort of one’s home, is positively influencing the market.

Competitive Landscape:

Leading companies in the industry are concentrating on broadening their product lines by launching novel formulations and addressing particular hair issues. They are allocating resources to research operations to improve product effectiveness and meet changing user preferences. For instance, in 2024, Marico launched the Hair & Care Oil in Serum, combining the nourishment of almond hair oil with the styling benefits of a serum. The product was positioned as an affordable solution to tackle frizz and tangles while enhancing open-hair beauty. Besides this, marketing approaches are increasingly focused on natural and herbal components, emphasizing the creation of brand loyalty via digital channels. Businesses are enhancing their distribution systems to guarantee greater accessibility, especially in developing markets. Moreover, strategic partnerships, mergers, and localized adaptations are utilized to strengthen market presence and acquire a competitive advantage in the international arena.

The report provides a comprehensive analysis of the competitive landscape in the hair oil market with detailed profiles of all major companies, including:

- Amway Corp. (Alticor Inc.)

- Aveda Corporation (The Estée Lauder Companies) Bajaj Consumer Care Ltd

- CavinKare Group

- Dabur Ltd

- Emami Limited

- Himalaya Wellness Company

- Johnson & Johnson Private Limited

- Marico Limited

- Patanjali Ayurved Limited

- The Avon Company (Natura Co Holding S/A)

Latest News and Developments:

- May 2025: Hindustan Unilever launched Nexxus in India, marking its strategic entry into the prestige beauty segment with salon-grade offerings. The brand introduced science-driven products like the Oil Resurrection Serum hair oil, which was formulated to restore hair quality using advanced protein technology.

- May 2025: NovaTrio LLC officially launched D'Cherlane Goodness Hair Oil as a vegan, botanical hair oil formulated with 17 natural oils for scalp nourishment and healthy hair routines. The hair oil blended rosemary, argan, castor, and jojoba oils, and was made available via Amazon and TikTok Shop US as a Mother's Day gift option.

- January 2025: Shed reinvented hair oil with the launch of Tropic-Oil, a unique melting whip blend of coconut oil and cocoa butter that deeply nourished and conditioned hair. The product left hair soft, shiny, and frizz-free, while its tropical scent evoked summer holidays.

- January 2025: anthi launched its Anti-Thinning Hair Oil targeting individuals with thinning hair, featuring a lightweight, non-sticky formula. The hair oil was infused with 25 plant extracts, essential oils, and natural ingredients aimed at promoting thicker and fuller hair.

Hair Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light Hair Oil, Heavy Hair Oil, Cooling Hair Oil, Others |

| Product Types Covered | Coconut Oil, Almond Oil, Argan Oil, Others |

| Categories Covered | Non-medicated, Medicated |

| Applications Covered | Individual, Commercial |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amway Corp. (Alticor Inc.), Aveda Corporation (The Estée Lauder Companies) Bajaj Consumer Care Ltd, CavinKare Group, Dabur Ltd, Emami Limited, Himalaya Wellness Company, Johnson & Johnson Private Limited, Marico Limited, Patanjali Ayurved Limited, The Avon Company (Natura Co Holding S/A), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hair oil market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hair oil market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hair oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market

Key Questions Answered in This Report

The hair oil market was valued at USD 4.50 Billion in 2024.

The hair oil market is projected to exhibit a CAGR of 3.6% during 2025-2033, reaching a value of USD 6.2 Billion by 2033.

The hair oil market is growing because of the higher user awareness about hair health, increased demand for natural and organic products, and rising concerns over hair damage from pollution and styling. Additionally, changing grooming habits, product innovations, and aggressive marketing strategies contribute to the expanding market across various demographics and regions.

Asia Pacific currently dominates the hair oil market, accounting for a share of 38.0%. The dominance of the region is attributed to its large population, cultural emphasis on hair care, and widespread use of hair oil in daily routines. The region benefits from strong user loyalty, deeply rooted traditions, and the availability of diverse products catering to local preferences, driving consistent demand across both urban and rural areas.

Some of the major players in the hair oil market include Amway Corp. (Alticor Inc.), Aveda Corporation (The Estée Lauder Companies) Bajaj Consumer Care Ltd, CavinKare Group, Dabur Ltd, Emami Limited, Himalaya Wellness Company, Johnson & Johnson Private Limited, Marico Limited, Patanjali Ayurved Limited, The Avon Company (Natura Co Holding S/A), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)