Hand Tools Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Hand Tools Market Size and Share:

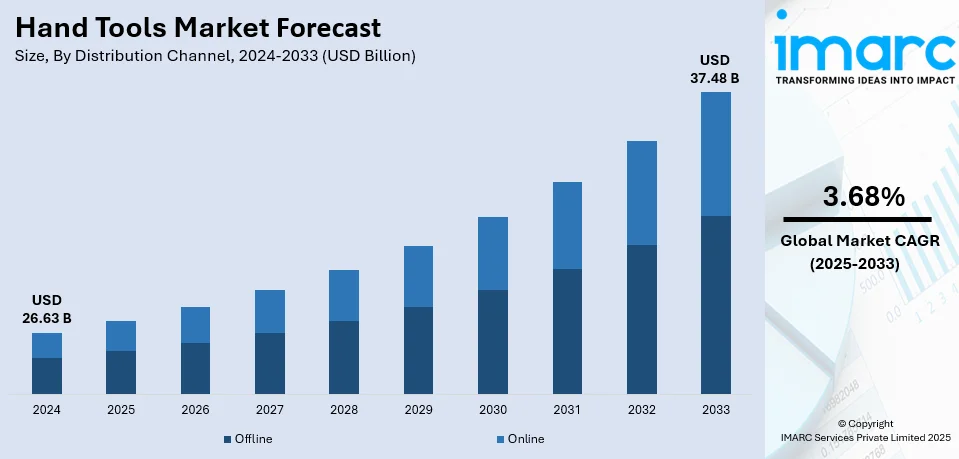

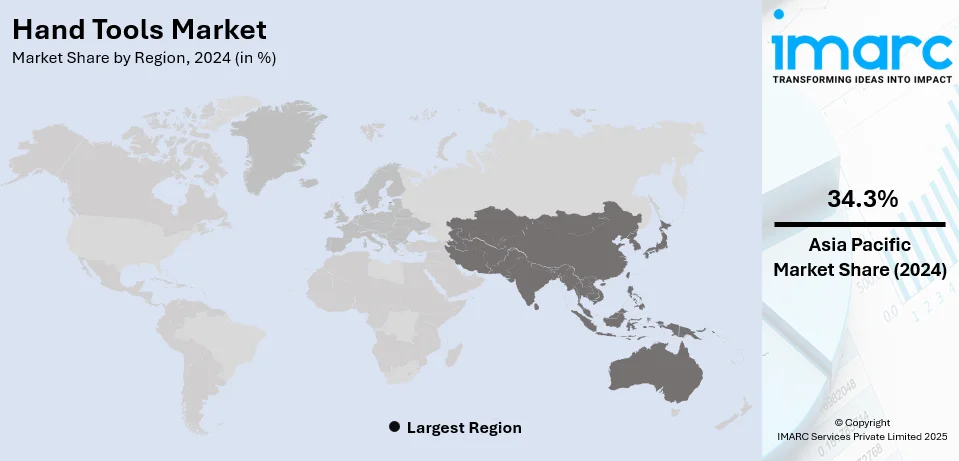

The global hand tools market size was valued at USD 26.63 Billion in 2024. The market is projected to reach USD 37.48 Billion by 2033, exhibiting a CAGR of 3.68% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 34.3% in 2024. The market is propelled by increased construction and manufacturing activities, as they inevitably require numerous hand tools for different applications. Apart from this, continuous technological developments and innovations in tool design are ensuring further improvement in the efficiency of the products. In addition to this, increasing activity in DIY projects and home improvement is also expanding the hand tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 26.63 Billion |

|

Market Forecast in 2033

|

USD 37.48 Billion |

| Market Growth Rate 2025-2033 | 3.68% |

The global market is majorly driven by the rising demand for hand tools across numerous end-use sectors, particularly the construction and automotive industries. Additionally, continual advancements in tool design and materials have led to the production of lightweight, durable, and ergonomically designed tools, which have enhanced efficiency and user satisfaction. For example, On September 16, 2024, DEWALT announced an extensive range of innovative hand tools and accessories for trade professionals that are designed to enhance productivity. The key highlights include the 20V MAX* GRABO Lifter, featuring an electric vacuum pump for lifting heavy materials and other tools focused on durability, performance, and precision. These advancements underscore DEWALT's commitment to meeting the changing demands of the construction and trade industries. Moreover, the growing trend of DIY (Do-It-Yourself) activities, particularly in developed economies, is significantly providing an impetus to the demand for hand tools among individuals. Furthermore, the expansion of e-commerce platforms has facilitated the availability of a wide variety of tools, enabling manufacturers to reach broader markets and cater to diverse customer needs.

To get more information on this market, Request Sample

The United States stands out as a key regional market, shaped by the increasing focus on home renovation and remodeling projects, driven by the increasing number of aging housing stock and a strong cultural preference for DIY home improvement. Additionally, considerable growth in skilled labor and specialized trade professions, such as plumbing, electrical work, and carpentry, increases the demand for professional-grade hand tools to address specific tasks, thereby fueling the market. Apart from this, the enhanced emphasis on sustainability and preference for keeping equipment in service rather than replacing results in embracing more tool usage throughout different industries. Furthermore, the presence of well-developed manufacturing centers and innovations within the United States facilitates the production of high-quality tools that are durable and satisfy keen safety and performance specifications. For example, on February 2, 2024, Mayhew Tools launched its new 14-piece Micro Hand Tool Set, which is manufactured in the United States. This innovative product line is designed for precision work in tight spaces, targeting professionals across various industries. The tools are crafted with high-quality materials and come with a lifetime warranty, emphasizing durability and reliability.

Hand Tools Market Trends

Rapid Industrialization

As industrial activities expand globally, the demand for hand tools used in manufacturing, assembly, and maintenance increases. For instance, as per an industry report, industrial production in India has risen to 3.8% in December 2023 from 2.4% in November 2023. Many businesses, including automotive, aerospace, and electronics, are major hand tool consumers. Moreover, according to an article published by Hi-Spec, hand tools are often used in automotive workshops and include items such as wrenches, screwdrivers, pliers, and hammers. Aside from industrial expansion, the growth in the application of smart manufacturing technologies and automation also significantly drives the demand for hand tools, as they are very fundamental to the maintenance and repair activities that take place in these advanced systems. The growing emphasis on worker safety and ergonomic design in industries has further spurred the market for hand tools, with manufacturers focusing on creating tools that reduce strain and increase efficiency. These factors are further bolstering the hand tools market revenue.

Increasing Construction Activities

The increasing construction activities are significantly driving the market growth. In addition to the general hand tools, cutting tools have emerged as a dominant category in the market due to their widespread use in various construction applications. These tools, including saws, utility knives, and cutters, are essential for tasks such as cutting wood, metal, and other materials required for building and renovation projects. The versatility and efficiency of cutting tools make them indispensable in construction activities. In addition, the increasing penetration toward rebuilding buildings is also escalating demand for such products. Moreover, the rising penetration towards renovating buildings is also proliferating the demand for such tools. For example, according to an industry report in 2020, Americans allocated approximately USD 363 Billion on home improvements, renovations, and repair projects, followed by USD 406 Billion in 2021. That was a rise of 11.8% from 2020, which nearly trebled the average annual growth rate of 4.4%. By 2022, homeowner expenditure had risen to USD 472 Billion. These factors are further contributing to the hand tools market share.

Technological Advancements

Advanced manufacturing technologies require equally advanced hand tools for tasks such as precision machining, calibration, and quality control. Tools with enhanced durability, precision, and ergonomic designs become essential in modern manufacturing environments. Moreover, various manufacturers are innovating in manufacturing precision tools. For instance, in May 2024, Sonic Tools launched its new Basic, Intermediate, and Advanced Manufacturing Toolsets, which have been specially created to redefine efficiency and precision in manufacturing. Sonic Manufacturing Toolsets are designed to transform asset management, cleanroom operations, and Lean 5S solutions. These toolsets, which combine cutting-edge design with exceptional functionality, assist to streamline operations, increase efficiency, and improve overall performance in manufacturing plants throughout the world. These factors are further positively influencing the hand tools market forecast.

Hand Tools Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hand tools market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, distribution channel, and end user.

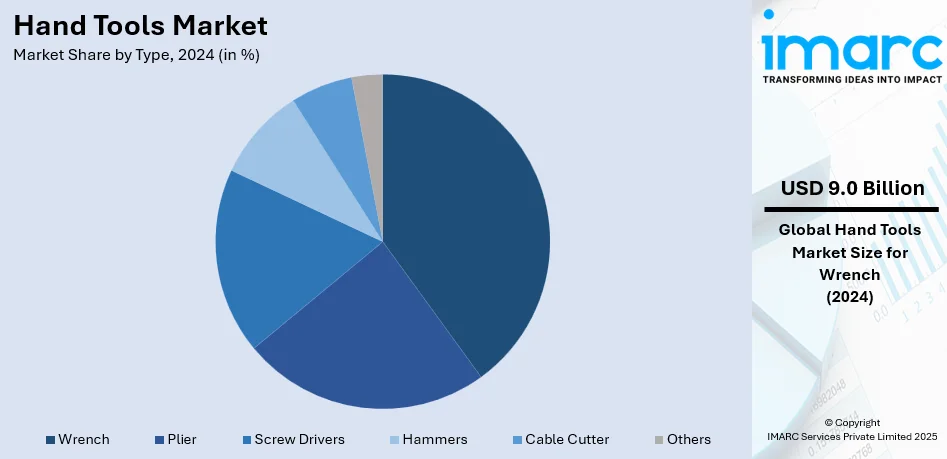

Analysis by Type:

- Wrench

- Plier

- Screw Drivers

- Hammers

- Cable Cutter

- Others

Wrenches lead the market with around 33.8% of market share in 2024. Wrenches are essential to any mechanical operation, automotive repairing, construction, and servicing as they majorly serve as fasteners, including nuts, bolts, and screws to be turned on or tightened. The diverseness of types, including wrenches such as adjustable, socket, spanner, and pipe wrenches, ensures widespread utilization in a great number of diverse tasks. The demand for wrenches worldwide is continuously high due to the ever-growing sectors of automotive manufacturing, home improvement, and infrastructure development. This, in turn, pushes the hand tools market forward, with wrenches consistently being a significant share. As the global industries develop, the importance of wrenches in the hand tools market rises. Modern wrenches are designed with ergonomic designs and innovative materials to meet the changing consumer preferences and provide better performance. Additionally, the trend of DIY projects among consumers increases the need for high-quality wrenches. Thus, wrenches remain an essential and dynamic component within the global hand tools market, with innovations continuing to improve their usability and marketability.

Analysis by Distribution Channel:

- Offline

- Online

The offline distribution channel has been an integral part of the global hand tools market for years, with traditional retail outlets, hardware stores, and wholesalers playing an important role in reaching consumers and businesses. It provides a physical touchpoint between customers and their hand tools in terms of viewing, testing, and purchasing the product. It also provides personalized customer care and expert advisory, which are particularly valuable for industries that involve highly specialized or professional-grade equipment. Offline sales are still strong, especially where physical stores happen to be the primary source of procurement, and the immediacy of in-store purchases is preferable. In-store tool purchases help customers assess the quality and fit of the tools before making a purchase, hence making this distribution channel highly sought after by industrial clients and professional users who demand high-performance hand tools.

The online distribution channel has become highly significant in recent times and has reshaped the global hand tools market. E-commerce, online retailers, and direct-to-consumer websites have broadened access to hand tools: one can source more varieties not available in local markets on e-commerce sites. Both individual customers and businesses are increasingly drawn to such platforms due to easy price comparison and customer review features that enhance convenience. This channel also caters to the increasing trend of DIY projects and home improvement. Also, with the rise of global shipping and logistics networks, manufacturers and retailers are able to reach a much wider audience and even customers from remote regions. Online sales are likely at the forefront in shaping the future of the hand tools market as the digital landscape continues to evolve.

Analysis by End User:

- DIY

- Commercial

- Industrial

Industrial leads the market with around 35.7% of market share in 2024 as it has the widest use of hand tools in terms of global scale. Industrial sectors range from very heavy manufacturing processes to precision engineering and require multiple types of hand tools. Daily activities such as assembly, repair, and service of machinery and structures require some tools like wrenches, pliers, hammers, screwdrivers, or saws, among others. The growth of the automotive, aerospace, and energy sectors results in a high need for durable, high-performance hand tools. The industrial end-user segment requires precision, strength, and durability in tools, as reliability is critical in a high-stress environment. Additionally, the ongoing focus on automation and process improvement fuels demand in the global industrial hand tools market. Even with increasing levels of automation in the world, the need for manual hand tools is on the rise. The industrial sector is a major part of the hand tools market. It influences the course of evolution considerably by making innovations toward higher productivity and safer working.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 34.3%. According to the hand tools market statistics, the region's rapid industrialization, particularly across countries like China, India, Japan, and other Southeast Asian nations, is a significant driver. For instance, according to Statista, in 2023, China's industrial production increased by nearly 4.6% compared to 2022. As manufacturing sectors expand, there is a growing demand for hand tools across various industries, such as automotive, electronics, construction, and aerospace. Moreover, governments in Asia Pacific are investing heavily in infrastructure projects, including transportation networks, energy infrastructure, and residential/commercial construction. This fuels demand for hand tools used in construction, maintenance, and renovation activities.

Key Regional Takeaways:

United States Hand Tools Market Analysis

The United States is a significant region in the hand tools market with the market share of 84.80%, supported by a thriving construction industry, which is a significant driver of demand. In 2023, the U.S. construction equipment market reached a size of USD 43.53 Billion, and it is expected to grow at a CAGR of 4.60%, reaching USD 68.11 Billion by 2032. This construction growth drives demand for more hand tools; hand tools would be needed during both residential and commercial building sites. The continued growth of the automotive industry and growth in consumer interest in DIY continue to fuel further expansion. The trends in home improvements, as people develop homes to include offices and consider more work at home, serve as another contributing factor to hand tool sales. Moreover, advancements in tool design, such as ergonomic features and durable materials, are aligning with consumer preferences for quality and comfort. The growing availability of tools through e-commerce platforms has further increased accessibility, driving hand tools market growth. With technological innovations like smart tools becoming more prominent, the U.S. market for hand tools is expected to maintain its growth trajectory, benefiting from the continued development of construction and manufacturing industries.

Asia Pacific Hand Tools Market Analysis

In the Asia-Pacific region, the hand tools market is significantly influenced by rapid urbanization and industrialization. According to UN-HABITAT, 54% of the global urban population, or more than 2.2 Billion people, reside in Asia. By 2050, this urban population is expected to grow by 50%, adding an additional 1.2 Billion people. There is an increase in the demand for hand tools in construction, infrastructure development, and home improvement activities. As economies expand in countries like China, India, and Southeast Asia, the demand for professional as well as consumer DIY tools increases. The demand for home improvement products is further bolstered by the expanding middle class and inflating disposable incomes. Consumerism is also witnessing a rise, due to the growth of e-commerce platforms popularity, which enhances the availability of hand tools. This, therefore, accelerates the growth within the market. Technological aspects, such as smart tools' integration, contribute to the more attractive nature of hand tools for the region's consumers, driving further growth for the APAC market.

Europe Hand Tools Market Analysis

The market for hand tools in Europe is expanding rapidly due to high demand from industries like manufacturing, automotive, and construction. Economic expansion, particularly in countries such as Germany, the UK, and France, is boosting the need for high-quality hand tools for both commercial and residential applications. A significant driver is the increasing focus on sustainability, with 1.2 Million people in Europe adopting a proactive stance on environmental practices, as reported by Meaningful Planet. This shift toward sustainable living is influencing consumer preferences for eco-friendly and durable tools. There is an increasing focus on home improvement, driven by increasing homeownership and a culture of DIY, which increases the demand for hand tools. Technological advancements, including the integration of smart features into tools, enhance their appeal and functionality. The need for precision hand tools in the automotive sector also supports market growth. Regulatory standards for safety and product quality are further boosting demand for reliable, high-performance tools. According to the hand tools market forecast, the presence of established manufacturers and a well-developed distribution network within the region is expected to position it strongly for sustained growth.

Latin America Hand Tools Market Analysis

Latin America is an important region in the global hand tools market due to the diverse economies that ensure a steady demand for hand tools. Construction, agriculture, and manufacturing sectors are key sectors in the region that contribute to the market growth. The Argentina construction market, for example, is projected to grow at a CAGR of 3.50% during 2024-2032, which is expected to drive demand for hand tools, particularly in residential and commercial building projects. In addition, rising disposable incomes in Brazil and Mexico are inducing consumers to spend more on home improvement products. E-commerce platforms also widen access to hand tools across the region. The largest markets for hand tools are countries like Brazil, Argentina, and Mexico, where they have made heavy investments in urban development and agriculture. The growth of the middle class and small businesses involved in carpentry, plumbing, and mechanical repairs further increases demand for affordable and reliable hand tools. The market also experiences a cultural shift towards DIY projects.

Middle East and Africa Hand Tools Market Analysis

The Middle East and Africa region has a significant position in the global hand tools market, with the growth of construction, automotive, and industrial sectors. According to the World Bank, the Middle East and North Africa (MENA) region is already 64% urbanized, contributing to an increased need for construction and renovation tools. Major construction projects in countries such as the UAE, Saudi Arabia, and South Africa further boost market growth. Apart from this, the automotive repair and maintenance sectors have been key demand drivers for hand tools. In addition to this, the growing workforce in the region and the ever-increasing DIY culture among homeowners also creates a need for affordable, durable hand tools. The MEA region also holds strategic manufacturing and distribution hubs that bridge Asian and European markets. Countries like Turkey and Egypt also gain prominence in the tool-manufacturing business with favorable trade policies and reduced production costs. The MEA market remains an integral part of global hand tool supply chains because of high returns potential and expanding market opportunities.

Competitive Landscape:

The global hand tools market is highly competitive due to factors such as innovation, durability, and ergonomic design. The market has a mix of established manufacturers and emerging players who cater to different industries, such as construction, automotive, and DIY enthusiasts. The market is fragmented, and the companies concentrate on product differentiation through such developments as lightweight materials and multifunctional tools. The increased need for precision tools and sustainable manufacturing practices determines present and future trends in the market. Regional markets differ, with mature markets focusing more on quality and innovation while emerging markets focus more on affordability. According to hand tools market forecast, the adoption of e-commerce platforms is expected to increase competition as smaller brands can become more visible. Also, the technological integration of the Internet of Things (IoT) into smart tools plays a significant role, which presents an added layer of complexity for the competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the hand tools market with detailed profiles of all major companies, including:

- Channellock Inc

- Emerson Electric Co.

- Ideal Industries Inc.

- Ingersoll Rand

- Klein Tools, Inc.

- Knipex

- Martin Sprocket & Gear, Inc

- Snap-on Incorporated

- Stanley Black & Decker, Inc.

- Taparia Tools

- Techtronic Industries Co. Ltd.

- TOYA S.A.

Latest News and Developments:

- June 2024: Bosch Power Tools introduced new cordless tools, including an 18V deep cut band saw and PROFACTOR™ 18V impact wrench. Designed for efficiency and precision, the tools feature brushless motors, ergonomic designs, and innovations like tool-free blade changes and adjustable torque settings for demanding applications.

- May 2024: Sonic Tools introduced its Basic, Intermediate, and Advanced Manufacturing Toolsets, developed to enhance efficiency and precision in manufacturing operations. These toolsets are designed to support asset management, clean room operations, and Lean 5S practices, aiming to streamline workflows and improve productivity across facilities.

- May 2024: KNIPEX launched the StepCut XL, a cable cutter. The tool has two cutting sections that make it especially useful: a front cutting edge for cutting very large cables step by step, with an ergonomic grip width, and a stepped main cutting edge.

- April 2023: Milwaukee Tool introduced new Lineman’s, Diagonal, and Long Nose Pliers, along with Screwdrivers, designed to enhance performance and durability for trade professionals. Manufactured in Milwaukee's advanced facility in West Bend, WI, these tools prioritize ease of use, precision, and reliability. Covered by a lifetime guarantee, the products address user needs through extensive field research and feedback-driven development.

- May 2022: TIMCO launched a range of 150 hand tools, including spanners, screwdrivers, and spirit levels, designed for trade professionals. Introduced at the NBMS exhibition and in the latest catalogue, the tools expanded TIMCO's offering in the construction and industrial sectors.

Hand Tools Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wrench, Plier, Screw Drivers, Hammers, Cable Cutter, Others |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | DIY, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Channellock Inc, Emerson Electric Co., Ideal Industries Inc., Ingersoll Rand, Klein Tools, Inc., Knipex, Martin Sprocket & Gear, Inc, Snap-on Incorporated, Stanley Black & Decker, Inc., Taparia Tools, Techtronic Industries Co. Ltd., TOYA S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hand tools market from 2019-2033.

- The hand tools market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hand tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global hand tools market was valued at USD 26.63 Billion in 2024.

The hand tools market is projected to exhibit a CAGR of 3.68% during 2025-2033, reaching a value of USD 37.48 Billion by 2033.

The global hand tools market is driven by increasing construction activities, rising industrialization, and growing demand for home improvement projects. Advancements in ergonomic tool designs and a rise in DIY culture are also accelerating the market growth. Additionally, expanding manufacturing sectors in emerging economies further fuel demand, which is also supporting market expansion.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major Aptos (Body) players in the global hand tools market include Channellock Inc, Emerson Electric Co., Ideal Industries Inc., Ingersoll Rand, Klein Tools, Inc., Knipex, Martin Sprocket & Gear, Inc, Snap-on Incorporated, Stanley Black & Decker, Inc., Taparia Tools, Techtronic Industries Co. Ltd, and TOYA S.A., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)