Healthcare Additive Manufacturing Market Size, Share, Trends and Forecast by Technology, Material, Application, and Region, 2025-2033

Healthcare Additive Manufacturing Market Size and Share:

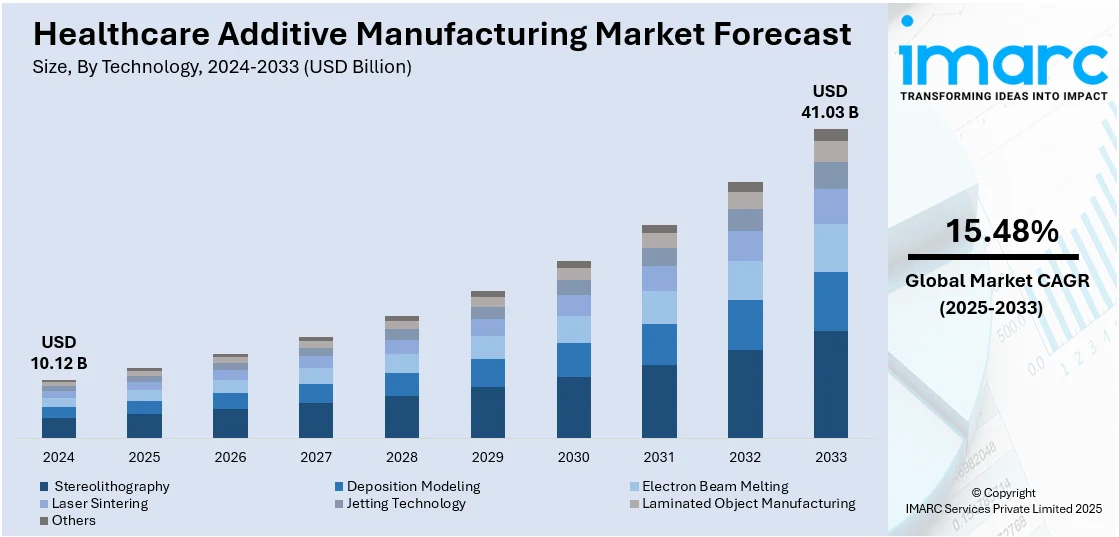

The global healthcare additive manufacturing market size was valued at USD 10.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.03 Billion by 2033, exhibiting a CAGR of 15.48% from 2025-2033. North America currently dominates the market, holding a market share of 38.2% in 2024. The dominance of the region is because of its well-established medical infrastructure, elevated healthcare costs, and a robust presence of top industry leaders. The area benefits from notable funding for research and development (R&D), favorable initiatives by the governing body, and early adoption of advanced technologies. Additionally, the escalating demand for customized medical devices, implants, and prosthetics, coupled with skilled professionals and academic research institutions, further contributes to the expansion of the healthcare additive manufacturing market share in the North American region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.12 Billion |

|

Market Forecast in 2033

|

USD 41.03 Billion |

| Market Growth Rate 2025-2033 | 15.48% |

Conventional manufacturing techniques typically incur significant expenses associated with tooling, labor, and waste of materials. Additive manufacturing lowers these expenses by enabling more efficient production. With 3D printing, costly molds or tools are unnecessary, and material waste is reduced as only the required amount of material is utilized. This results in reduced overhead expenses, potentially making the manufacturing of tailored and intricate medical devices less costly. In addition, advancements in technology concerning 3D printing techniques, materials, and software are enhancing the precision, efficiency, and versatility of additive manufacturing in healthcare. Innovative materials, including biocompatible polymers, metals, and bioinks for 3D bioprinting, facilitate the creation of intricate medical devices and tissues. The increased precision in printing allows for more accurate replicas of patient anatomy and better-designed implants, ensuring better clinical outcomes.

The United States is a crucial segment in the market, driven by a well-developed healthcare system with cutting-edge medical facilities, hospitals, and research institutions. This robust infrastructure supports the adoption of advanced technologies like additive manufacturing, which can enhance patient care through customized solutions such as implants, prosthetics, and surgical tools. Furthermore, the creation of advanced manufacturing facilities equipped with specialized technologies is vital for progressing the healthcare additive manufacturing market growth. By utilizing cutting-edge technology and providing comprehensive services, businesses guarantee the production of highly accurate, tailored medical devices with enhanced productivity. In 2024, Armadillo Additive inaugurated a new additive manufacturing plant in Granbury, Texas, focusing on titanium medical devices with AddUp’s FormUp 350 Laser Beam Powder Bed Fusion technology. The facility specialized in manufacturing Ti-6Al-4V Grade 23 components, such as spinal implants and provided comprehensive services, including heat treatment and laser marking. This configuration allowed for rapid, accurate manufacturing customized for the healthcare industry.

Healthcare Additive Manufacturing Market Trends:

Increasing Chronic Diseases and Aging Population

A worldwide rise in chronic illnesses, coupled with a swiftly aging demographic, is driving the need for long-term, personalized medical treatments, an area where additive manufacturing is ideally suited to respond. Ailments like arthritis, cardiovascular issues, and degenerative diseases often necessitate custom implants, orthotics, and surgical tools, which additive manufacturing can create with great accuracy and short turnaround times. Older patients frequently exhibit intricate anatomical differences, rendering uniform approaches less efficient. The capacity of additive manufacturing to produce tailored devices as needed tackles this issue head-on. The World Health Organization (WHO) predicts that by 2030, one in every six individuals worldwide will be aged 60 or more, and by 2050, this number will rise to 2.1 billion, with the population over 80 anticipated to hit 426 million. This change in demographics puts significant strain on healthcare systems to provide affordable, scalable, and individualized care. The adaptability and quick response of additive manufacturing position it as a crucial facilitator of these changing healthcare requirements.

Rise in Point-of-Care (POC) Manufacturing Capabilities

The growth of point-of-care (POC) manufacturing is accelerating the integration of additive manufacturing in healthcare, as hospitals and clinics more frequently implement in-house 3D printing capabilities. This trend allows facilities to create medical instruments, anatomical models, and personalized devices on-site, improving responsiveness and customization while decreasing dependence on outside suppliers. POC manufacturing reduces lead times, facilitates urgent interventions, and enables rapid design changes influenced by real-time clinical input. For example, in 2025, 3D Systems announced the creation of the world’s first MDR-compliant 3D-printed PEEK facial implant using additive manufacturing at the point-of-care (POC) in collaboration with University Hospital Basel. The EXT 220 MED system enabled the on-site production of the custom implant, which was successfully used in a surgery on March 18, 2025. This breakthrough highlights the potential of additive manufacturing for personalized, on-demand medical device production directly in healthcare settings.

Growing Investment and Industry Collaboration

Substantial funding from both private and public sectors continues to accelerate innovation and scalability in healthcare additive manufacturing. The growing recognition of additive manufacturing potential is resulting in increased funding, strategic alliances, and infrastructure development aimed at expanding its application across medical fields. In 2025, HBD, a Chinese metal 3D printing firm, launched a cutting-edge production plant in Guangdong, funded by a $60 million Series A financing round. This significant investment boosts HBD’s manufacturing abilities for industries, such as healthcare, emphasizing smart industry innovation, sustainability, and AI-enabled processes. These initiatives demonstrate a wider trend of collaboration across industries, as technology companies, healthcare organizations, and investors unite to promote progress in additive manufacturing. These collaborations aid not only in research and commercialization but also facilitate quicker regulatory processes and scalable implementation. With the ongoing alignment of financial and technological resources, additive manufacturing is integrated into healthcare systems, strengthening sustained expansion and international competitiveness.

Healthcare Additive Manufacturing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global healthcare additive manufacturing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, material, and application.

Analysis by Technology:

- Stereolithography

- Deposition Modeling

- Electron Beam Melting

- Laser Sintering

- Jetting Technology

- Laminated Object Manufacturing

- Others

Stereolithography (SLA) leads the market with 29.5%, because of its remarkable accuracy, fine resolution, and capability to create intricate, detailed medical models and devices. This technology employs a laser to solidify liquid resin into hardened plastic through a layer-by-layer method, enabling precise and smooth surface finishes, which are essential in medical applications like surgical guides, dental restorations, and anatomical models. The ability of SLA to utilize biocompatible materials further enables its extensive application in developing personalized implants and prosthetics. Additionally, it provides quicker prototyping and production times than many other 3D printing techniques, improving clinical efficiency. Its alignment with digital workflows enhances the design-to-print process, establishing it as a favored option in laboratories and medical facilities. With healthcare providers placing greater emphasis on precision, personalization, and speed, SLA remains a prominent and efficient solution in the changing realm of medical 3D printing.

Analysis by Material:

- Metals and Alloys

- Polymers

- Biological Cells

- Others

Polymers represent the largest segment owing to their adaptability, affordability, and extensive variety of medical uses. These substances can be effortlessly shaped and altered to fulfill particular design needs, rendering them ideal for creating tailored medical instruments like prosthetics, orthotic aids, dental apparatus, and surgical equipment. Polymers provide outstanding biocompatibility, enabling their safe application in contact with human tissues, which is crucial for implants and wearable technologies. Their lightweight and capacity for sterilization further improve their appropriateness for clinical settings. Moreover, polymers facilitate several additive manufacturing methods, such as SLA, selective laser sintering (SLS), and fused deposition modeling (FDM), enhancing their versatility in various technologies. Ongoing advancements in polymer formulations are resulting in materials boasting enhanced mechanical properties and durability, broadening their application in functional end-use components. The healthcare additive manufacturing market research report highlights the growing role of polymers in revolutionizing the medical field, with continued innovation driving their use in more sophisticated and durable medical applications.

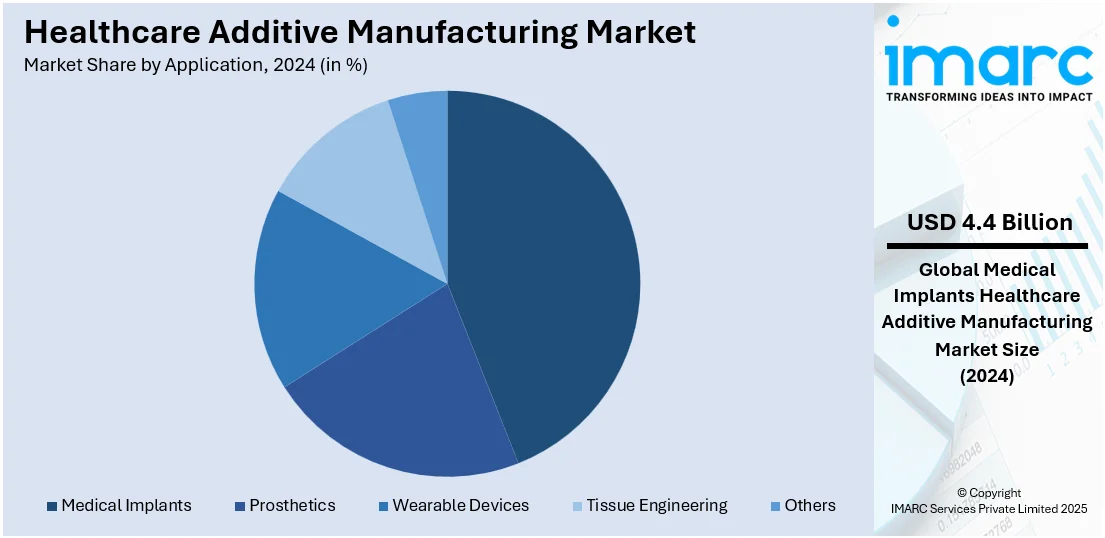

Analysis by Application:

- Medical Implants

- Prosthetics

- Wearable Devices

- Tissue Engineering

- Others

Medical implants hold the biggest market share, accounting 43.8%, because of the growing need for customized, accurate, and effective medical solutions. Additive manufacturing enables the creation of implants that are custom-designed for a patient's anatomy, which guarantees improved fit, comfort, and functionality in comparison to conventional techniques. This degree of personalization minimizes complications and enhances recovery periods, making it extremely beneficial in areas like orthopedics, dental implants, and joint replacements. Moreover, 3D printing allows for the incorporation of innovative materials, including bioresorbable polymers and titanium alloys, known for their biocompatibility and long-term durability. The capability to create intricate, geometrically refined designs that conventional manufacturing techniques cannot accomplish also improves the functionality and durability of implants. Ongoing progress in technology and material science is transforming the field of additive manufacturing for medical implants, providing solutions that are more efficient, economical, and focused on patient needs.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America is the leading segment with 38.2%, attributed to sophisticated medical facilities, substantial investment in research activities, and a robust presence of leading industry companies. The area advantages from high-tech capabilities and a strong medical device sector that fosters innovation and the implementation of state-of-the-art solutions. Moreover, the rising need for personalized medicine and tailored healthcare solutions fuels the expansion of additive manufacturing in areas, such as prosthetics, implants, and surgical instruments. Governing bodies in North America are also encouraging innovation, offering financial support and regulatory structures that promote technological progress. Additionally, the count of individuals aged 65 and above in America is anticipated to grow from 58 million in 2022 to 82 million by 2050 (a 47% rise), while the proportion of the 65-and-older age demographic within the overall population is anticipated to climb from 17% to 23%. This rising geriatric population and the prevalence of chronic illnesses are driving the need for more sophisticated, customized medical solutions.

Key Regional Takeaways:

United States Healthcare Additive Manufacturing Market Analysis

The healthcare additive manufacturing market in the United States is experiencing substantial growth, accounting 88.20% market share, fueled by an emphasis on innovative patient-specific solutions and the incorporation of AI and digital processes in medical design. The region is supported by a well-developed ecosystem that promotes quick prototyping and the smooth movement of ideas into clinical applications. The use of additive manufacturing for customized surgical planning models and personalized prosthetics is growing, especially in specialized healthcare environments. Importantly, Bassett Healthcare Network indicates that annually, over 2 million cataract operations take place in the United States, ranking it among the most commonly executed surgical procedures nationwide. This increase in demand is encouraging the use of additive manufacturing to produce more accurate surgical instruments and implants for these operations. Investment in bioprinting for regenerative medicine is rising, driven by partnerships between research institutions and healthcare organizations. The growing prevalence of ambulatory surgical centers is driving a need for on-site 3D printing solutions, facilitating faster production of tailored instruments and implants. Regulatory consistency, cutting-edge medical technologies, and scholarly research boost additive manufacturing in healthcare. The United States serves as a crucial market for ongoing growth, incorporating technology to enhance processes and boost patient outcomes.

Europe Healthcare Additive Manufacturing Market Analysis

The additive manufacturing market for healthcare in Europe is experiencing growth, bolstered by robust partnerships between public and private sectors in medical innovation, along with a rising focus on eco-friendly production techniques. The area is promoting a transition towards decentralized production of medical devices within healthcare networks, improving responsiveness to individual patient requirements. Significant advancements are being made in employing additive manufacturing for dental restorations and orthopedic uses, demonstrating the region's dedication to precision healthcare. As stated by MedTech Europe, the area dedicates an average of around 11% of its gross domestic product (GDP) to healthcare, creating a robust financial base for the incorporation of cutting-edge technologies, such as 3D printing. Cutting-edge materials for human tissues are propelling the use of 3D printing in biomedical engineering curricula. In-house additive laboratories and digital twin technology are becoming more popular. The digitization of healthcare in Europe enables data-informed personalization in prosthetics and surgical instruments. Encouraging regulatory structures and international R&D efforts aid in creating scalable manufacturing systems.

Asia Pacific Healthcare Additive Manufacturing Market Analysis

The Asia Pacific healthcare additive manufacturing sector is growing due to increased investments in healthcare infrastructure and a rising emphasis on medical advancements in developing countries. A notable instance is India, which allocated USD 11.48 Billion to healthcare in the Union Budget 2025–26, according to the India Brand Equity Foundation, demonstrating a strong dedication to healthcare progress throughout the area. The region is seeing a rise in the application of 3D printing for anatomical modeling and preoperative preparation, enhancing surgical accuracy and decreasing operation duration. Educational organizations are integrating additive manufacturing into medical education, fostering a new wave of technologically skilled healthcare workers. Moreover, the growth of minimally invasive techniques is catalyzing the demand for micro-scale 3D-printed medical devices designed for intricate anatomical configurations. Government-supported research centers in the Asia Pacific are incorporating additive manufacturing into regenerative treatments, tissue scaffolding, and decentralized production of medical components, showcasing the area's innovative potential. As a result, the healthcare additive manufacturing market value in the region is experiencing substantial growth, driven by innovation, investment, and expanding clinical applications.

Latin America Healthcare Additive Manufacturing Market Analysis

The healthcare additive manufacturing market in Latin America is gaining traction due to a heightened emphasis on modernizing public health and producing essential medical supplies locally. Initiatives to lessen reliance on imports are fostering the establishment of regional additive manufacturing hubs focused on creating tailored implants and surgical instruments. As per the Brazilian National Renewable (NR) plan, Brazil's local manufacturing of medical supplies presently fulfills 42% of the population's requirements, with the New Industry Brazil (NIB) initiative aiming for a rise to 50% by 2026 and 70% by 2033. This policy approach is bolstering investments in digital manufacturing skills, particularly in additive technologies aimed at healthcare. 3D printing in medical education simulations is closing training gaps, as universities' innovation centers create cost-effective devices. Telemedicine services and affordable digital manufacturing solutions are improving home care and precision healthcare in Latin America.

Middle East and Africa Healthcare Additive Manufacturing Market Analysis

The healthcare additive manufacturing market in the Middle East and Africa is expanding because of strategic investments in health technology and innovation. It’s attracting interest for personalized splints and braces, 3D printing in healthcare education, and on-site production for faster delivery of medical tools in resource-limited environments. The area is also experiencing interest in 3D-printed wearable health devices designed to enhance chronic disease tracking. The Ministry of External Affairs states that Saudi Arabia is making substantial investments in digital healthcare to improve efficiency and patient results, potentially unlocking as much as USD 27 Billion by 2030. This drive for digital innovation closely aligns with the implementation of additive manufacturing technologies, strengthening their significance in evolving healthcare delivery. The incorporation of additive manufacturing into healthcare advancement is accelerating, providing prompt, tailored, and flexible solutions for diverse medical needs.

Competitive Landscape:

Major participants in the market are concentrating on enhancing their technological abilities by engaging in ongoing research operations to devise more accurate, affordable, and tailored medical solutions for patients. They are putting money into advanced materials and improving 3D printing methods to boost the functionality of implants, prosthetics, and bioprinted tissues. For instance, in 2024, Ricoh launched its Point of Care 3D medical device manufacturing facility in Winston-Salem, NC, using additive manufacturing to produce patient-specific anatomic models. These models supported surgical planning and education by transforming medical images into 3D-printed diagnostics. The facility enhanced personalized care through on-site design, production, and collaboration. Efforts are being made to establish strategic collaborations and partnerships with research institutions, healthcare organizations, and technology companies to enhance innovation and expand market access. Furthermore, initiatives are underway to inform stakeholders and raise awareness regarding the advantages of additive manufacturing in enhancing clinical results.

The report provides a comprehensive analysis of the competitive landscape in the healthcare additive manufacturing market with detailed profiles of all major companies, including:

- 3D Systems Inc.

- 3T Additive Manufacturing Ltd.

- Allevi Inc.

- EnvisionTEC GmbH

- EOS GmbH

- Fathom

- General Electric

- Materialise

- Nanoscribe GmbH & Co. KG

- RegenHU

- Stratasys Ltd.

Latest News and Developments:

- April 2025: Stratasys launched the Neo800+ stereolithography printer, enhancing healthcare additive manufacturing processes. With 50% faster print speeds and advanced features like ScanControl+, it produces high-fidelity, precise parts for medical prototypes and end-use applications.

- April 2025: Materialise unveiled its 2025 Magics software. It integrates nTop's implicit modeling, reducing complex part preparation from days to seconds. New Build Processors support intricate medical designs, improving printability and precision. Collaborations with Raplas and One Click Metal further streamline workflows, enabling faster, cost-effective production of patient-specific implants and devices.

- April 2025: Artec 3D launched the Artec Point 3D scanner in collaboration with Altem Technologies. This metrology-grade scanner, with 20-micron accuracy, is ideal for healthcare applications like medical device iteration and additive manufacturing. Its precise data capture and ease of use aim to support India’s growing medical and manufacturing sectors.

- April 2025: The Electron Beam Consortium (EBC) was founded to advance Electron Beam Powder Bed Fusion (PBF-EB) technology. Comprising companies like ALD Vacuum Technologies and Freemelt, the consortium aims to enhance applications in healthcare and other industries, focusing on improving manufacturing, sustainability, and performance in medical device production.

- March 2025: Flow Science launched FLOW-3D 2025R1, integrating FLOW-3D AM for laser-based additive manufacturing processes. The platform enhanced healthcare additive manufacturing simulations, supporting Powder Bed Fusion (PBF) and Directed Energy Deposition (DED). With high-performance computing (HPC) capabilities, it accelerates simulations, enabling faster development and optimization of medical device manufacturing processes.

Healthcare Additive Manufacturing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Stereolithography, Deposition Modeling, Electron Beam Melting, Laser Sintering, Jetting Technology, Laminated Object Manufacturing. Others |

| Materials Covered | Metals and Alloys, Polymers, Biological Cells, Others |

| Applications Covered | Medical Implants, Prosthetics, Wearable Devices, Tissue Engineering, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3D Systems Inc., 3T Additive Manufacturing Ltd., Allevi Inc., EnvisionTEC GmbH, EOS GmbH, Fathom, General Electric, Materialise, Nanoscribe GmbH & Co. KG, RegenHU, Stratasys Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the healthcare additive manufacturing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global healthcare additive manufacturing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the healthcare additive manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthcare additive manufacturing market was valued at USD 10.12 Billion in 2024.

The healthcare additive manufacturing market is projected to exhibit a CAGR of 15.48% during 2025-2033, reaching a value of USD 41.03 Billion by 2033.

The healthcare additive manufacturing market is driven by advancements in 3D printing technology, rising demand for patient-specific implants, increased adoption in dental and orthopedic applications, and growing investments in research. Customization, faster prototyping, and cost efficiency also contribute significantly to its expanding role in medical innovation.

North America currently dominates the healthcare additive manufacturing market, accounting for a share of 38.2%. The dominance of the region is because of sophisticated medical facilities, strong involvement of major industry participants, high investment in R&D, and rapid adoption of innovative technologies. Supportive regulatory frameworks and increasing demand for personalized medical solutions further strengthen the region’s market leadership.

Some of the major players in the healthcare additive manufacturing market include 3D Systems Inc., 3T Additive Manufacturing Ltd., Allevi Inc., EnvisionTEC GmbH, EOS GmbH, Fathom, General Electric, Materialise, Nanoscribe GmbH & Co. KG, RegenHU, Stratasys Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)