Healthcare–associated Pneumonia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

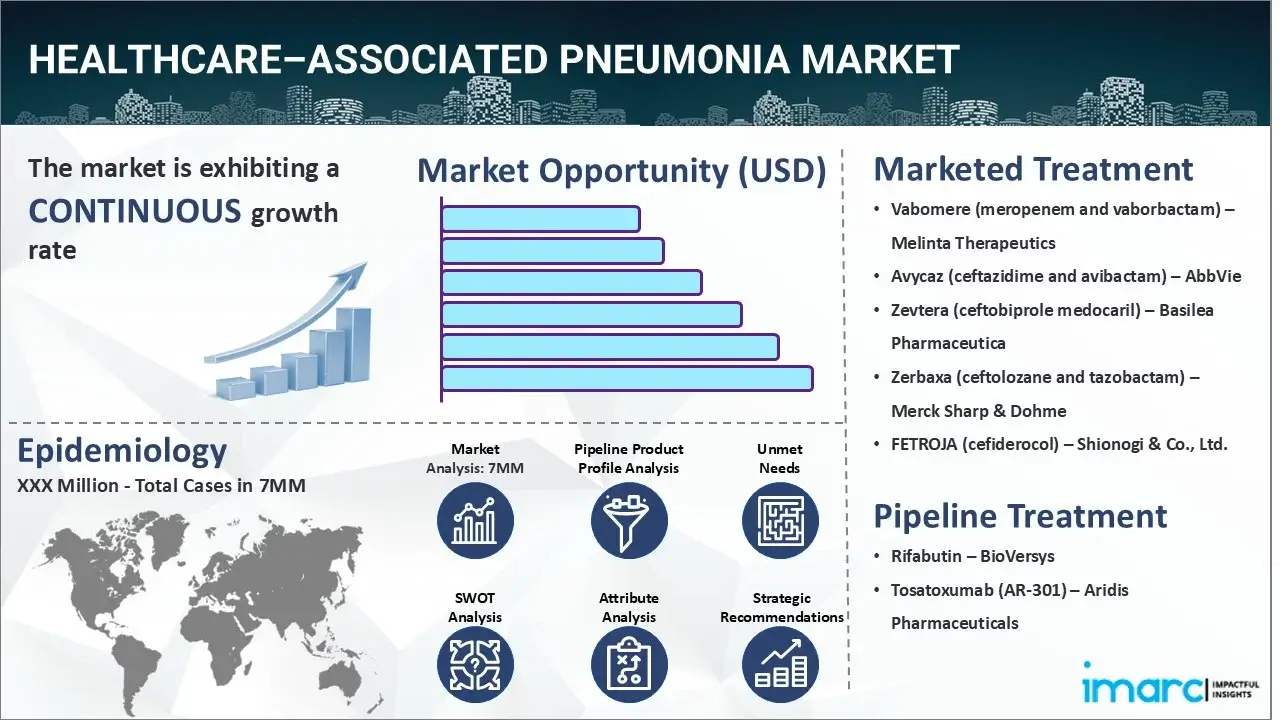

The healthcare-associated pneumonia market reached a value of USD 690.1 Million across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 1,055.1 Million by 2035, exhibiting a growth rate (CAGR) of 3.96% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 690.1 Million |

|

Market Forecast in 2035

|

USD 1,055.1 Million |

| Market Growth Rate 2025-2035 | 3.96% |

The healthcare–associated pneumonia market has been comprehensively analyzed in IMARC’s new report titled "Healthcare–associated Pneumonia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Healthcare-associated pneumonia (HCAP) refers to a type of pneumonia that occurs due to prior contact with a healthcare environment. It is associated with the presence of several risk factors, including hospitalization in the past, home infusion therapy, dialysis, residing in a nursing center, immunocompromised state, etc. Bacterial infection, as opposed to a virus, is the predominant source of this form of pneumonia. Most symptoms of healthcare-associated pneumonia are equivalent to those seen in pneumonia developed outside hospitals. This condition is characterized by unpleasantness, a sense of unease, reduced appetite, cough with greenish or mucus-like phlegm, abdominal discomfort, and difficulty in breathing. Some other symptoms include sharp chest pain that exacerbates with inhalation and exhalation or coughing, as well as diminished blood pressure and an increased heart rate. The diagnosis of healthcare-associated pneumonia begins with a chest x-ray or CT scan to inspect the lungs and arterial blood gases to measure respiratory rate. It is accompanied by a sputum culture to detect the microorganisms causing pneumonia and a pulse oximetry test to monitor blood oxygen levels. The diagnosis also involves bronchoscopy, which is essential to avoid the possibility of an incorrect prognosis.

To get more information on this market, Request Sample

The increasing prevalence of chronic ailments, such as cardiac arrest, brain stroke, kidney failure, etc., which require surgical intervention and prolonged hospital stays is primarily driving the global healthcare-associated pneumonia market. Additionally, the inflating number of patients admitted to medical facilities who have antibacterial resistance owing to the excessive usage of antibiotics is also positively influencing the market growth. Moreover, the escalating utilization of combination therapy to treat HCAP since it reduces the chances of resistance developed by the bacteria and provides a broad spectrum of coverage is also creating a positive outlook for the market. In addition to this, the widespread adoption of point-of-care testing products owing to their associated benefits, including convenience, quicker diagnosis, and improved patient outcomes, is acting as a significant growth-inducing factor. Furthermore, the ongoing development of resistant strains and the increasing resultant need for newer antibiotics are promoting extensive R&D activities. This, in turn, is also augmenting the global market. Besides this, the emerging popularity of multiplex PCR-based platforms for diagnosing healthcare-associated pneumonia, as it offers high detection efficiency, thereby reducing cost and time, is further propelling the market growth. Additionally, the rising emphasis of the key players on developing efficient vaccines and antibiotics by utilizing advanced clinical solutions is also expected to drive the global healthcare-associated pneumonia market in the coming years.

IMARC Group’s new report provides an exhaustive analysis of the healthcare–associated pneumonia market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report the United States has the largest patient pool forhealthcare–associated pneumonia and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario and unmet medical needs, etc. have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the healthcare–associated pneumonia market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the healthcare–associated pneumonia market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the healthcare–associated pneumonia market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current healthcare–associated pneumonia marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug overview

- Mechanism of action

- Regulatory status

- Clinical trial results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug overview

- Mechanism of action

- Regulatory status

- Clinical trial results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Vabomere (meropenem and vaborbactam) | Melinta Therapeutics |

| Avycaz (ceftazidime and avibactam) | AbbVie |

| Zevtera (ceftobiprole medocaril) | Basilea Pharmaceutica |

| Zerbaxa (ceftolozane and tazobactam) | Merck Sharp & Dohme |

| Fetroja (cefiderocol) | Shionogi & Co., Ltd. |

| Rifabutin | BioVersys |

| Tosatoxumab (AR-301) | Aridis Pharmaceuticals |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the healthcare–associated pneumonia market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the healthcare–associated pneumonia across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the healthcare–associated pneumonia across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of incident cases (2019-2035) of healthcare–associated pneumonia across the seven major markets?

- What is the number of incident cases (2019-2035) of healthcare–associated pneumonia by age across the seven major markets?

- What is the number of incident cases (2019-2035) of healthcare–associated pneumonia by gender across the seven major markets?

- What is the number of incident cases (2019-2035) of healthcare–associated pneumonia by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with healthcare–associated pneumonia across the seven major markets?

- What is the size of the healthcare–associated pneumonia patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend healthcare–associated pneumonia of?

- What will be the growth rate of patients across the seven major markets?

Healthcare–Associated Pneumonia: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for healthcare–associated pneumonia drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the healthcare–associated pneumonia market?

- What are the key regulatory events related to the healthcare–associated pneumonia market?

- What is the structure of clinical trial landscape by status related to the healthcare–associated pneumonia market?

- What is the structure of clinical trial landscape by phase related to the healthcare–associated pneumonia market?

- What is the structure of clinical trial landscape by route of administration related to the healthcare–associated pneumonia market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)