Global Healthcare Cold Chain Logistics Market Report & Forecast 2026-2034

Healthcare Cold Chain Logistics Market Size:

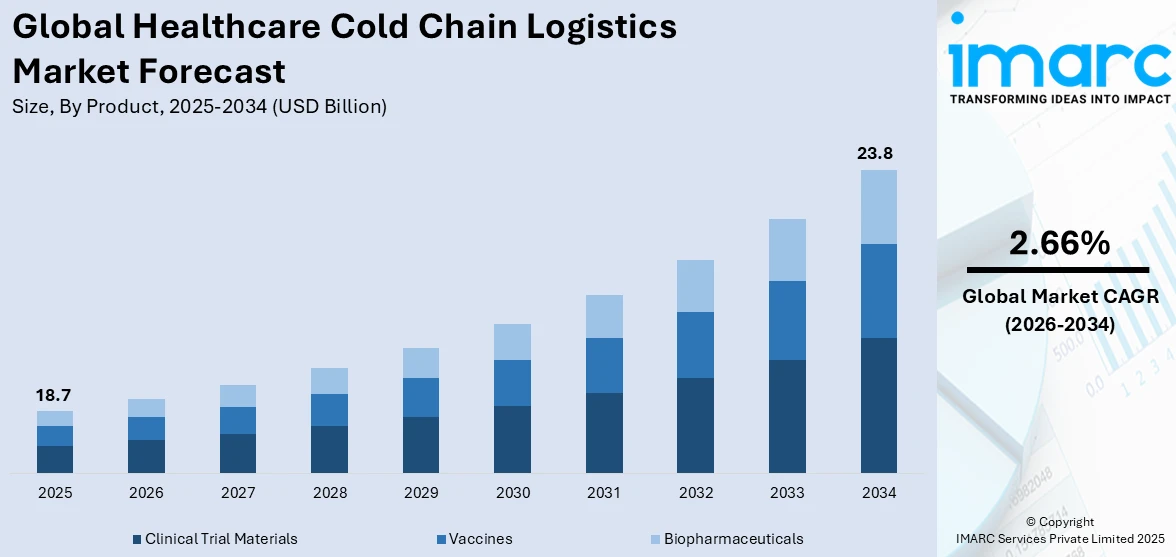

The global healthcare cold chain logistics market size reached USD 18.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 23.8 Billion by 2034, exhibiting a growth rate (CAGR) of 2.66% during 2026-2034. The market is expanding due to rising global demand for biopharmaceuticals that are sensitive to temperature, growing vaccine industry, increasing clinical trials, and technological developments in refrigeration and monitoring systems that guarantee the safe distribution of pharmaceuticals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 18.7 Billion |

|

Market Forecast in 2034

|

USD 23.8 Billion |

| Market Growth Rate (2026-2034) | 2.66% |

Healthcare Cold Chain Logistics Market Analysis:

- Major Market Drivers: The growing demand for biopharmaceuticals, vaccines, and customized medicine that requires sophisticated cold chain logistics to ensure product efficacy and safety of the products is propelling the market growth. Moreover, technical advancements like enhanced refrigeration technologies and Internet of Things-enabled monitoring systems boost cold chain logistics' dependability and efficiency while lowering the risk of spoilage and guaranteeing adherence to strict regulations.

- Key Market Trends: The market is expanding due to the integration of machine learning and artificial intelligence for cold chain operations optimization. These technologies enable better predictive analytics and real-time monitoring, which improve operational efficiency and reduce wastage. Besides, the trend toward outsourcing cold chain logistics to specialized third-party providers is growing, allowing healthcare companies to focus on their core activities while leveraging the expertise and resources of logistics specialists.

- Geographical Trends: Asia-Pacific region is the leading market due to the growing pharmaceutical output, increasing healthcare investments, and growing public health awareness. In addition, the China and India market are also emerging due to the increased need for cold chain logistics services. Moreover, the North American region is experiencing rapid growth due to its established cold chain logistics networks, strict regulatory requirements, and advanced healthcare infrastructure.

- Competitive Landscape: Some of the major healthcare cold chain logistics companies include American Airlines, Inc., C.H. Robinson Worldwide, Inc., Cencora, Inc., CEVA Logistics, Continental Carriers Pvt. Ltd., DB Schenker, Deutsche Post AG, DSV A/S, FedEx, Kuehne + Nagel International AG, United Parcel Service of America, Inc., etc., among many others.

- Challenges and Opportunities: Compliance with diverse and stringent regulatory requirements poses a significant challenge, as non-compliance can result in penalties and damage to reputation while adapting to varying regional conditions and regulatory environments, which requires flexibility and innovation in logistics solutions. On the other hand, the healthcare cold chain logistics market recent opportunities allow companies to differentiate themselves by providing superior compliance and quality assurance while expanding healthcare infrastructure in cold chain logistics services.

To get more information on this market Request Sample

Healthcare Cold Chain Logistics Market Trends:

Increasing Demand for Biopharmaceuticals

The surge in the biopharmaceutical sector is a critical driver for the healthcare cold chain logistics market. According to the IQVIA Institute the biopharmaceutical market will grow to between USD 1.750 and 1.780 Trillion by 2026, up nearly USD 350 Billion from the 2021 figure of USD 1.423 Trillion. This increase is primarily driven by the expansion of the market in emerging pharmaceutical countries and developed nations, along with the integration of new technologies. Additionally, biopharmaceuticals are large, complex molecules often derived from biological sources that require stringent temperature control to maintain their efficacy and safety. As the market for these products is expected to expand significantly, the logistics services catering to them must adapt to handle their sensitive nature. This involves sophisticated packaging solutions, real-time temperature monitoring, and specialized transportation methods. Furthermore, the demand for biopharmaceuticals, fueled by their efficacy in treating complex diseases is increasing the need for enhanced cold chain logistics to prevent product degradation during transit, ensuring that these vital medications reach patients in optimal condition, thus creating a positive healthcare cold chain logistics market outlook.

Growth in the Vaccines Market

According to the World Health Organization (WHO), COVID-19 vaccines still represent a significant portion, accounting for 60% of the total global vaccine market volume. The primary high-volume vaccines apart from COVID-19 include seasonal influenza, oral polio, and tetanus-diphtheria vaccines. For instance, measles-rubella (MR) vaccination volumes increased significantly due to the increased catch-up vaccination efforts. This expansion is primarily due to the large investments in vaccine research and the growing global emphasis on vaccination against common and emerging infectious diseases. Furthermore, cold chain logistics is essential in this industry as vaccinations frequently need to be kept at a certain temperature to remain effective. Moreover, temperature changes can damage the integrity of vaccinations, resulting in a loss of efficacy and ultimately, an ineffective immunization campaign. Moreover, as evident in the healthcare cold chain logistics market forecast, the escalating need of vaccine distribution especially in underdeveloped regions that face extreme climatic challenges will continue to propel the market.

Expansion of the Global Clinical Trials Market

The National Library of Medicine, published data of Clinical Trials Transformation Initiative Aggregate Analysis of ClinicalTrials.gov (AACT) database, focusing on trials (interventional studies) started between 1 January 2000 through 31 December 2020. The analysis included 274,043 registered interventional studies which were characterized as randomized (65%), conducted at a single site (60%), and utilized a parallel-group design (56%). Additionally, 65% of the trials were funded by various other sources such as individuals, universities, and community organizations, and 55% involved drug interventions. As of May 2022, ClinicalTrials.gov had over 400,000 registered studies from 220 countries, including observational and interventional research. Furthermore, clinical trials require the transportation of temperature-sensitive materials like blood, tissue, or experimental compounds that are essential to medical research and development (R&D). These samples need to be handled carefully and transported at regulated temperatures to guarantee that the trial findings are legitimate. As a result, the demand for dependable and effective cold chain logistics is rising due to the global expansion of clinical trials. These logistics providers must be able to handle the challenges of transporting sensitive clinical materials across a variety of geographic and climatic conditions, which is increasing the overall healthcare cold chain logistics market revenue.

Healthcare Cold Chain Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on product and segment.

Breakup by Product:

- Clinical Trial Materials

- Vaccines

- Biopharmaceuticals

Vaccines accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes clinical trial materials, vaccines, and biopharmaceuticals. According to the report, vaccines represented the largest segment.

Vaccines dominate the market due to the necessity of maintaining strict temperature controls to ensure vaccination effectiveness throughout storage and transit. Similarly, vaccines are extremely delicate biological materials, and they must be refrigerated constantly to avoid the deterioration of their active ingredients, which is crucial for maintaining public health. Furthermore, the development of novel vaccines due to the increasing health concerns and global vaccination campaigns fuel the dependable and effective healthcare cold chain logistics demand especially in developing regions. According to the International Air Transport Association (IATA), India is exporting approximately two-thirds of its vaccine output, and the remaining one-third is utilized within the country, with the universal immunization programme (UIP) facilitating nationwide distribution. This increasing exportation is catalyzing the market due to the growing need for continuous vaccines refrigeration technology and apparatus, such as customized packaging and temperature-monitoring systems to prevent the degradation of their active components.

Breakup by Segment:

Access the comprehensive market breakdown Request Sample

- Transportation

- Packaging

- Instrumentation

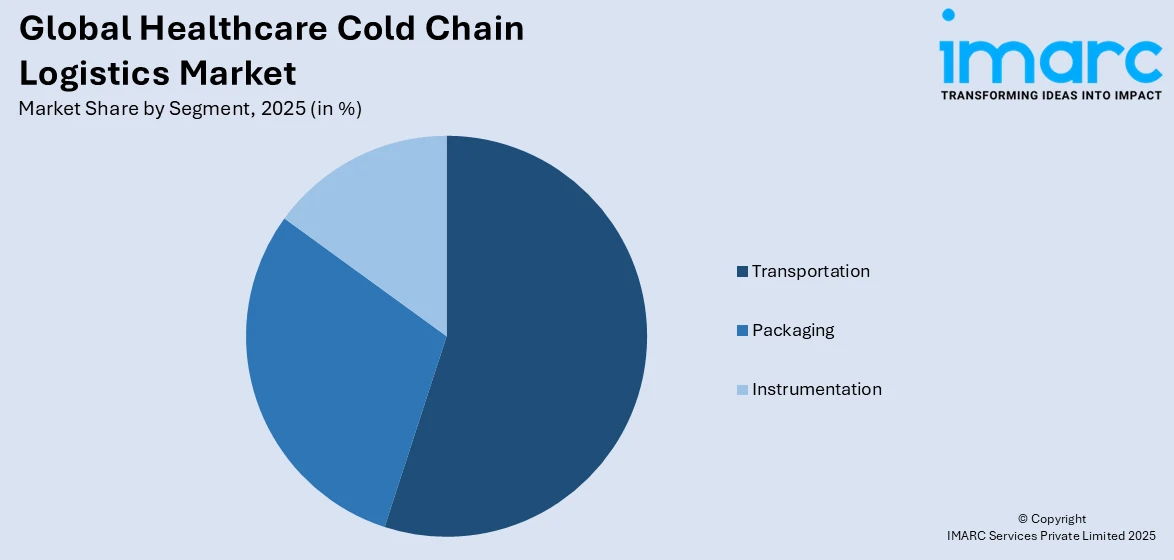

Packaging holds the largest share of the industry

A detailed breakup and analysis of the market based on the segment have also been provided in the report. This includes transportation, packaging, and instrumentation. According to the report, packaging accounted for the largest market share.

Packaging plays a critical role in maintaining the integrity, efficacy, and safety of temperature-sensitive pharmaceuticals and biologics. Advanced packaging solutions, including insulated containers and temperature-controlled boxes, are vital for the successful transportation of products such as vaccines, biopharmaceuticals, clinical trial materials, and biologics that require strict temperature regulation throughout the distribution chain. The demand for robust packaging solutions is driven by the increasing complexity of new pharmaceutical products, stringent regulatory requirements, and the global expansion of pharmaceutical companies into new markets requiring reliable logistics solutions. As healthcare continues to globalize and the pipeline of temperature-sensitive products expands, the packaging sector within cold chain logistics is growing thus impacting the healthcare cold chain logistics market growth. For instance, on 3 June 2024, the Deutsche Post DHL Group (DHL) supply chain enhances pharma logistics in France. DHL supply chain will manage picking and packing, warehousing, inventory handling, and order fulfillment at three principal locations in France, Amilly Distribution, Croissy-Beaubourg, and Saint-Loubes. This collaboration significantly impacts the French market and strategically positions DHL within the pharmaceutical sector.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Rest of the world

Asia Pacific leads the market, accounting for the largest healthcare cold chain logistics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, and the rest of the world. According to the report, Asia Pacific was the largest regional market for healthcare cold chain logistics.

According to the healthcare cold chain logistics market overview, the Asia Pacific region emerges as the largest segment, primarily due to its robust pharmaceutical growth, increasing healthcare expenditures, and rising demand for quality healthcare products. Additionally, the proliferation of biopharmaceuticals and the expansion of clinical trial activities further amplify the need for sophisticated cold chain solutions in this region. Moreover, the Asia Pacific benefits from a growing middle-class population and enhanced healthcare infrastructure, which are key to the development of cold chain systems. Furthermore, government initiatives across various countries to improve healthcare access and regulatory compliance regarding the distribution of temperature-sensitive products also significantly contribute to the dominance of the Asia Pacific in the global healthcare cold chain logistics market. For instance, on 21 March 2024, UPS, a leading global logistics company, increased its investment commitments in the Asia Pacific region to over $250 Million since early 2023. This includes a recent agreement with The Luzon International Premiere Airport Development Corporation (LIPAD) to enhance its operations at Clark Airport (CRK) in the Philippines. This expansion will allow UPS to further develop its comprehensive suite of services, including integrated express, supply chain, and healthcare logistics.

Competitive Landscape:

At present, key players are implementing strategies to strengthen market growth and enhance service delivery. Additionally, the healthcare cold chain logistics market recent developments include investment in advanced technologies, such as IoT-enabled tracking systems and temperature-monitoring solutions, to ensure the integrity and timely delivery of sensitive healthcare products. Additionally, companies are focusing on sustainability by integrating eco-friendly practices in their operations to reduce carbon footprints and appeal to a broader base of environmentally conscious stakeholders. Besides, partnerships and collaborations with biopharmaceutical companies are aiming to optimize the distribution process for vaccines, biologics, and clinical trial materials. These players are expanding their geographical reach by establishing more robust logistics networks in emerging markets, where healthcare needs are rapidly growing. For instance, on 13 July 2023, the DHL supply chain announced a significant commitment of €500 Million toward the strategically vital Latin America market. This funding, which will be deployed by 2028, aims to bolster DHL’s operations across the region. This investment forms a crucial part of DHL Supply Chain's strategic plan to enhance its logistics services in sectors with growing demand, including healthcare, automotive, technology, retail, and e-commerce.

The report provides a comprehensive analysis of the competitive landscape in the global healthcare cold chain logistics market with detailed profiles of all major companies, including:

- American Airlines Inc.

- C.H. Robinson Worldwide Inc.

- Cencora Inc.

- CEVA Logistics

- Continental Carriers Pvt. Ltd.

- DB Schenker

- Deutsche Post AG

- DSV A/S

- FedEx

- Kuehne + Nagel International AG

- United Parcel Service of America Inc.

Healthcare Cold Chain Logistics Market News:

- 10 April 2023, UPS Healthcare launches its first specialized facility in Giessen, Germany. The specialized healthcare logistics center spans 293,000 square foot (27,200 m2) and the facility meets GMP and GDP standards and accommodates over 30,000 pallet positions for various healthcare products, maintaining temperatures of 2C to 8C, 15C to 25C, and as low as -20C degrees.

- 28 May 2024, the DHL supply chain increases capacity with a new logistics facility at leipzig/halle multi-user campus. The newly established logistics center will provide ample space for clients needing effective logistics solutions in Germany, Europe, or globally. The facility spans 34,000 square meters and represents a state-of-the-art expansion of the company's existing capacities at the multi-user campus in Leipzig/Halle. The DHL supply chain caters to a diverse range of industries and sectors, taking advantage of the region’s excellent transportation links for domestic and international distribution.

Healthcare Cold Chain Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Clinical Trial Materials, Vaccines, Biopharmaceuticals |

| Segments Covered | Transportation, Packaging, Instrumentation |

| Regions Covered | North America, Europe, Asia Pacific, Rest of the World |

| Companies Covered | American Airlines Inc., C.H. Robinson Worldwide Inc., Cencora Inc., CEVA Logistics, Continental Carriers Pvt. Ltd., DB Schenker, Deutsche Post AG, DSV A/S, FedEx, Kuehne + Nagel International AG, United Parcel Service of America Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the healthcare cold chain logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global healthcare cold chain logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the healthcare cold chain logistics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global healthcare cold chain logistics market was valued at USD 18.7 Billion in 2025.

We expect the global healthcare cold chain logistics market to exhibit a CAGR of 2.66% during 2026-2034.

The rising demand for outsourcing operations in the pharmaceutical and biopharmaceutical sector for drugs, vaccines, clinical trial materials, etc., is primarily driving the global healthcare cold chain logistics market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing utilization of healthcare cold chain logistics for storing and transporting various temperature-sensitive healthcare products and vaccines across numerous countries.

Based on the product, the global healthcare cold chain logistics market has been segmented into clinical trial materials, vaccines, and biopharmaceuticals. Currently, vaccines hold the majority of the total market share.

Based on the segment, the global healthcare cold chain logistics market can be divided into transportation, packaging, and instrumentation. Among these, packaging currently exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, and Rest of the World, where Asia Pacific currently dominates the global market.

Some of the major players in the global healthcare cold chain logistics market include

American Airlines, Inc., C.H. Robinson Worldwide, Inc., Cencora, Inc., CEVA Logistics, Continental Carriers Pvt. Ltd., DB Schenker, Deutsche Post AG, DSV A/S, FedEx, Kuehne + Nagel International AG, and United Parcel Service of America, Inc.

Cold chain logistics is the complex network of systems and processes that ensure perishable products including food, pharmaceuticals, and biological materials are transported and stored at the correct temperature from the point of origin to the final destination. This is crucial for maintaining product quality, safety, and efficacy.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)