Heart Pump Device Market Size, Share, Trends and Forecast by Product, Type, Therapy, End User, and Region, 2025-2033

Heart Pump Device Market Size and Share:

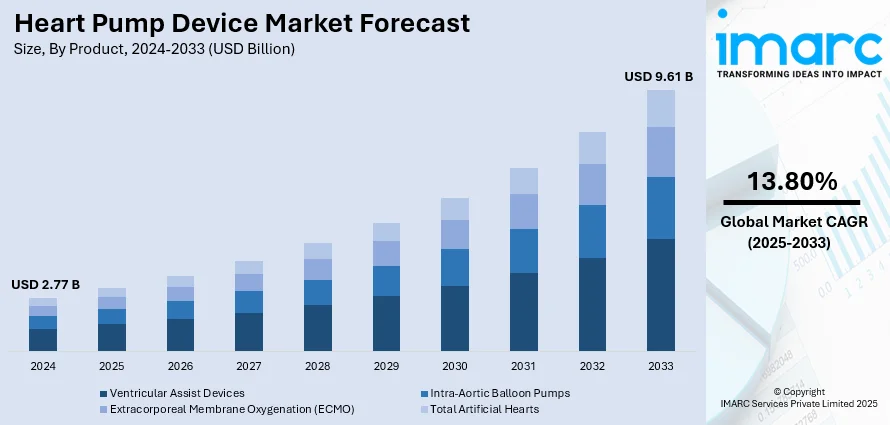

The global heart pump device market size was valued at USD 2.77 Billion in 2024. Looking forward, the market is projected to reach USD 9.61 Billion by 2033, exhibiting a CAGR of 13.80% during 2025-2033. North America currently dominates the market, holding a significant market share of around 38.8% in 2024. The market is driven by the growing incidence of heart failure and improving medical technology. Growing healthcare investments and government programs enhancing access to treatment are also driving growth in the market. The requirement for innovative, efficient, and minimally invasive heart pumps along with the positive reimbursement policies as well as enhanced healthcare infrastructure are further supporting the heart pump device market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.77 Billion |

| Market Forecast in 2033 | USD 9.61 Billion |

| Market Growth Rate (2025-2033) | 13.80% |

The market is primarily driven by the increasing prevalence of heart diseases, particularly heart failure, across the global population. In line with this, the widespread advancements in medical technologies and innovations in heart pump devices are also providing an impetus to the market. Moreover, the considerable rise in healthcare investments and government initiatives aimed at improving access to advanced treatments is acting as a significant growth-inducing factor for the market. In April 2025, CorWave announced the successful completion of a six-month chronic in vivo study for its implantable heart pump, showing no device failure or thrombosis. The study, which involved nine chronic ovine implants, demonstrated the pump’s effective pulsatile operation, adapting to patients' activity levels and maintaining thromboresistance and hemocompatibility. These results mark the final preclinical milestone, paving the way for CorWave's First-In-Human clinical trials and positioning the company to advance its novel technology in the LVAD market.

To get more information on this market, Request Sample

The United States stands out as a key regional market, which is primarily driven by the growing awareness about the benefits of early-stage treatment options for heart failure. Also, the increasing influence of healthcare professionals and patient advocacy groups in promoting heart pump treatments is resulting in heart pump device market growth. The market is further driven by the implementation of favorable reimbursement policies and health insurance coverage for heart failure therapies. In addition to this, the expanding geriatric population, which is more susceptible to cardiovascular issues, is resulting in higher demand for heart pump devices. In August 2024, Abbott announced that the FDA approved an update to the HeartMate 3™ LVAD label, eliminating aspirin from the routine medication regimen for patients, following positive results from the ARIES-HM3 trial. The trial showed that removing aspirin led to a 40% reduction in bleeding complications and a 47% decrease in hospital stays without increasing the risk of blood clot formation. Some of the other factors contributing to the market include rapid urbanization, the rising number of cardiovascular surgeries, and extensive research and development (R&D) activities.

Heart Pump Device Market Trends:

Advancements in Heart Pump Technology

The modernization of heart pump technology is driving the global heart pump device market toward growth and innovations. Improved device functionality, new materials, and downsizing methods have led to the development of heart pump devices that are more robust, biocompatible, and efficient. SynCardia, for instance, is always coming up with new ideas for its total artificial heart (TAH). Their next-generation TAH designs for patients with end-stage biventricular failure awaiting a heart transplant have earned them a new patent. Moreover, the customization of patient management and remote monitoring has been made possible by the integration of modern monitoring systems and data analytics, improving overall patient care and safety. Heart pump technology is still being researched and developed, and as per the heart pump device market forecast, the market for these life-saving devices is expanding.

Growing Acceptance of Mechanical Circulatory Support

The growing acceptance of mechanical circulatory support (MCS) has emerged as a key driver in the global heart pump device market. For instance, mechanical circulatory support using a pCF pump in children was associated with a positive outcome in 78% of patients in a contemporary cohort. With an increasing prevalence of heart failure and limited availability of donor organs for transplantation, MCS devices such as VADs are becoming essential therapeutic options for patients. For instance, in 2025, it is estimated that heart failure has been affecting over 60 million people worldwide, with the global burden continuing to rise due to an aging population. Consequently, there is an increased reliance of healthcare providers and patients on MCS, which holds the promise of lengthening survival, improving quality of life, and serving as a bridge to transplantation or destination therapy. This is turn is creating a positive heart pump device market outlook.

Bridge to Transplant and Destination Therapy

One major factor propelling the worldwide market for heart pump devices is the need for these devices as a palliative before transplant and destination therapies. VADs are used to treat patients who are waiting for a heart transplant or who are not eligible for one as a temporary or permanent remedy. The demand for efficient bridge-to-transplant and destination therapy alternatives grows as the prevalence of heart failure continues to rise, with estimates predicting that over 6.5 Million Americans over the age of 20 have heart failure. Furthermore, 960,000 new cases of heart failure are reported each year, according to another study, which increases the need for heart pump devices in these therapeutic settings.

Heart Pump Device Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global heart pump device market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, type, therapy, and end user.

Analysis by Product:

- Ventricular Assist Devices

- Left Ventricular Assist Devices (LVAD)

- Percutaneous Ventricular Assist Devices (PVAD)

- Biventricular Ventricular Assist Devices (BIVAD)

- Right Ventricular Assist Devices (RVAD)

- Intra-Aortic Balloon Pumps

- Extracorporeal Membrane Oxygenation (ECMO)

- Total Artificial Hearts

Ventricular Assist Devices (VADs) lead the market with around 68.7% of market share in 2024. The demand for VADs, including LVADs, PVADs, BIVADs, and RVADs, is primarily propelled by their critical role in providing life-saving circulatory support for patients with advanced heart failure. LVADs, in particular, are increasingly utilized as bridge-to-transplantation or destination therapy, offering a viable alternative for patients ineligible for heart transplantation. The rise in the prevalence of heart failure, coupled with advancements in device technology enhancing durability and efficacy, has expanded the indications for VAD therapy, driving demand across various product categories within the heart pump device market.

Analysis by Type:

- Implanted Heart Pump Device

- Extracorporeal Heart Pump Device

Implanted heart pump devices lead the market with around 69.2% of market share in 2024. The demand for implanted heart pump devices fueled by their effectiveness in providing long-term circulatory support for patients with end-stage heart failure is fostering market expansion. These devices, such as VADs and TAHs, offer a crucial lifeline for individuals awaiting heart transplantation or ineligible for the procedure. As the prevalence of heart failure continues to rise globally, the need for durable and reliable solutions for long-term support grows. Besides this, implanted heart pump devices also provide patients with improved quality of life and increased survival rates, driving their demand as a vital therapeutic option in the management of advanced heart failure.

Analysis by Therapy:

- Bridge-To-Transplant (BTT)

- Bridge-To-Candidacy (BTC)

- Destination Therapy (DT)

- Others

Bridge-to-transplant (BTT) leads the market with around 46.7% of market share in 2024. The demand for heart pump devices in the BTT therapy segment is primarily driven by the critical role these devices play in providing temporary circulatory support for patients awaiting heart transplantation. With the limited availability of donor organs and increasing wait times for transplantation, VADs serve as a vital bridge, sustaining patients' lives until a suitable donor heart becomes available. Additionally, advancements in device technology have improved the durability and reliability of VADs, enhancing patient outcomes and expanding the eligible patient population for BTT therapy. As a result, the demand for heart pump devices in the BTT therapy segment continues to grow, addressing the urgent need for effective solutions in the management of end-stage heart failure.

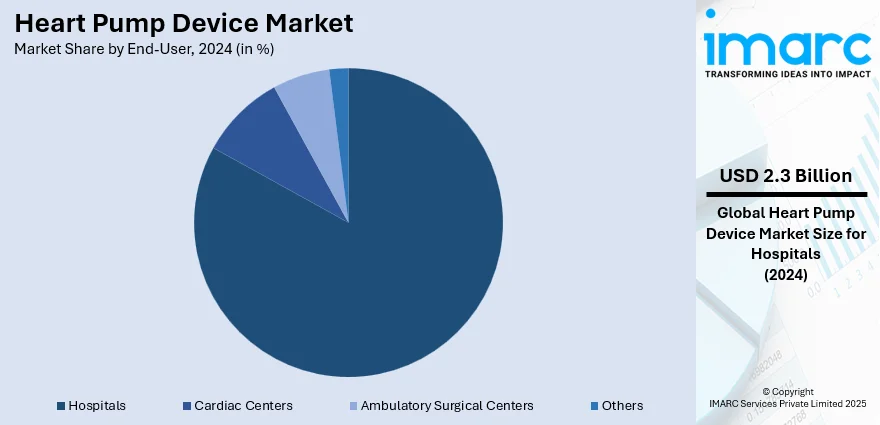

Analysis by End-User:

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

- Others

Hospitals lead the market with around 83.2% of market share in 2024. The demand for heart pump devices among hospitals spurred by the increasing prevalence of CVDs and the rising number of heart failure cases requiring advanced cardiac support is providing an impetus to the market growth. Hospitals serve as crucial centers for the diagnosis, treatment, and management of heart failure, and the adoption of heart pump devices enables them to offer comprehensive care to patients with complex cardiac conditions. Additionally, advancements in device technology and surgical techniques have made the implantation of heart pump devices safer and more accessible, leading to a higher acceptance rate among healthcare providers and patients alike. As hospitals strive to enhance their cardiac care capabilities and improve patient outcomes, the demand for heart pump devices as a critical component of cardiovascular therapy continues to rise.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of around 38.8%. In North America, the demand for heart pump devices is driven by several factors, including the high prevalence of CVDs, a rapidly aging population, and robust healthcare infrastructure. The region witnesses a significant burden of heart failure cases, necessitating advanced treatment options such as VADs and TAHs. Moreover, favorable reimbursement policies and increasing investments in healthcare technology contribute to the widespread adoption of heart pump devices across healthcare facilities. Additionally, the presence of key market players and research institutions focused on cardiac care fosters innovation and drives the development of next-generation devices, further propelling the demand for heart pump devices in North America.

Key Regional Takeaways:

United States Heart Pump Device Market Analysis

The United States accounts for 88.80% of the North America heart pump device market. United States has witnessed rising heart pump device adoption driven by the increasing prevalence of cardiovascular diseases (CVDs). According to the Association's 2025 statistics, nearly 47% of U.S. adults have high blood pressure. With sedentary lifestyles, rising obesity, and hypertension cases, CVDs have become a significant health burden. Hospitals are incorporating heart pump device technology as a critical part of advanced cardiac care protocols. Physicians are also increasingly recommending heart pump devices as a bridge-to-transplant or long-term support option. Furthermore, continuous innovations in heart pump device designs and favorable reimbursement policies are accelerating their usage. Heart failure patients are benefiting from improved outcomes with mechanical circulatory support. Strategic collaborations between device manufacturers and healthcare providers are further ensuring broader availability of heart pump devices to manage chronic CVDs across diverse patient groups, reinforcing demand within the United States.

Asia Pacific Heart Pump Device Market Analysis

Asia-Pacific is experiencing a rise in heart pump device usage due to growing incidences of heart transplant procedures and heart diseases. For instance, approximately 90–100 heart transplants are performed each year across more than 70 specialized centers in India. Rising pollution, lifestyle changes, and dietary patterns are contributing to early onset of cardiac conditions. Heart pump devices are being adopted to support critical cases where heart transplant is either delayed or unavailable. The demand is reinforced by greater awareness among cardiologists and patients, as well as improving surgical capacities. Investments in cardiac specialty centers and access to advanced treatment are helping integrate heart pump devices into care pathways. As cases of heart failure and cardiomyopathy increase, heart pump devices offer a vital lifeline.

Europe Heart Pump Device Market Analysis

Europe is seeing expanding adoption of heart pump devices primarily due to its growing geriatric population. According to WHO, the population aged 60 and older is rapidly growing in the WHO European Region. In 2021, there were 215 Million by 2030, it is projected to be 247 Million, and by 2050, over 300 Million. As age increases, the risk of heart failure and other chronic cardiovascular conditions also rises. The aging demographic is contributing to a higher need for long-term cardiac support systems. Heart pump devices serve as effective interventions for elderly patients who may not qualify for heart transplant. Advancements in miniaturized and patient-friendly heart pump technologies are easing adoption among older individuals.

Latin America Heart Pump Device Market Analysis

Latin America is witnessing a rise in heart pump device adoption due to growing government investment on healthcare infrastructure. For instance, budget allocation for Brazil’s Unified Health System to increase by 6.2% in 2025. Modernization of public hospitals and emphasis on critical care services are improving accessibility to advanced cardiac devices. Health authorities are supporting initiatives to equip cardiac centers with heart pump device capabilities. This investment trend is boosting the availability and awareness of heart pump interventions across tertiary care institutions.

Middle East and Africa Heart Pump Device Market Analysis

Middle East and Africa are registering growth in heart pump device demand driven by expanding hospitals and clinics facilities. For instance, in 2025, the UAE is currently home to over 150 hospitals and has more than 5,000 healthcare facilities. New multispecialty centers and cardiac units are being established with advanced cardiac care offerings. The expansion of healthcare infrastructure is facilitating the adoption of heart pump devices to manage severe cardiac cases. With a growing patient pool and better-trained cardiac specialists, hospitals are investing in heart pump systems.

Competitive Landscape:

Key players in the heart pump device market are focusing on technological advancements to drive growth, particularly through the development of more efficient, minimally invasive, and durable devices. There is a significant push toward improving the patient experience by reducing complications, such as bleeding risks, and enhancing ease of implantation. Furthermore, market growth is being fueled by the expansion of product offerings tailored for a broader range of heart failure patients, including those with advanced conditions. Additionally, efforts to secure regulatory approvals and expand reimbursement options are enabling wider access to these life-saving devices, while collaborations and partnerships are accelerating innovation and market reach.

The report provides a comprehensive analysis of the competitive landscape in the heart pump device market with detailed profiles of all major companies, including:

- Abbott Laboratories

- ABIOMED

- Getinge AB.

- Teleflex Incorporated

- Fresenius SE & Co. KGaA

- LivaNova PLC

- CorWave SA

- JARVIK HEART, INC.

- Medtronic Plc

- SynCardia Systems

Latest News and Developments:

- July 2025: CorWave’s heart pump device, using undulating membrane technology, was implanted for the first time in a patient with advanced heart failure at St Vincent’s Hospital, Australia. The device preserved natural heart pulsatility, showed promising early results, and the patient was discharged after 30 days without complications.

- May 2025: A multicenter U.S. clinical trial evaluated the safety and efficacy of the BrioVAD heart pump device as a new LVAD option for advanced heart failure, comparing it with the existing HeartMate 3. The trial assessed BrioVAD’s magnetically levitated pump technology at eight centers, including Cleveland Clinic.

- May 2025: Abbott received FDA approval for its Tendyne™ heart pump device, the first transcatheter system designed to replace the mitral valve without open-heart surgery, offering a minimally invasive solution for patients with severe mitral annular calcification who were not eligible for traditional surgical treatments.

- March 2025: Johnson & Johnson MedTech showcased the survival benefits of its Impella heart pump device at ACC.25, following its upgrade to Class 2a in the ACC/AHA treatment guidelines for cardiogenic shock secondary to STEMI. The update recognized Impella’s ability to improve patient outcomes and informed several guideline-driven care discussions.

- January 2025: The University of Michigan's Frankel Cardiovascular Center successfully implanted a new mechanical heart pump, the BrioVAD System, into a patient as part of a national clinical trial. The study compared the BrioVAD to the HeartMate 3, the only approved heart pump for advanced heart failure treatment.

Heart Pump Device Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Types Covered | Implanted Heart Pump Device, Extracorporeal Heart Pump Device |

| Therapies Covered | Bridge-To-Transplant (BTT), Bridge-To-Candidacy (BTC), Destination Therapy (DT), Others |

| End Users Covered | Hospitals, Cardiac Centers, Ambulatory Surgical Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, ABIOMED, Getinge AB., Teleflex Incorporated, Fresenius SE & Co. KGaA, LivaNova PLC, CorWave SA, JARVIK HEART, INC., Medtronic Plc, SynCardia Systems, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the heart pump device market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global heart pump device market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the heart pump device industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global heart pump device market was valued at USD 2.77 Billion in 2024.

The heart pump device market is projected to exhibit a CAGR of 13.80% during 2025-2033, reaching a value of USD 9.61 Billion by 2033.

The market is primarily driven by the rising prevalence of heart failure, technological advancements in heart pump devices, and increasing healthcare investments. Government initiatives to improve treatment access, coupled with growing awareness of heart health and the benefits of early-stage treatments, further contribute to market growth. Additionally, the demand for minimally invasive and innovative heart pumps, along with favorable reimbursement policies and expanding healthcare infrastructure, is strengthening the market.

North America currently dominates the heart pump device market in 2024 with 38.8% market share, supported by the high prevalence of cardiovascular diseases, an aging population, and robust healthcare infrastructure in the region.

Some of the major players in the heart pump device market include Abbott Laboratories, ABIOMED, Getinge AB., Teleflex Incorporated, Fresenius SE & Co. KGaA, LivaNova PLC, CorWave SA, JARVIK HEART, INC., Medtronic Plc, and SynCardia Systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)