Hemolytic Anemia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

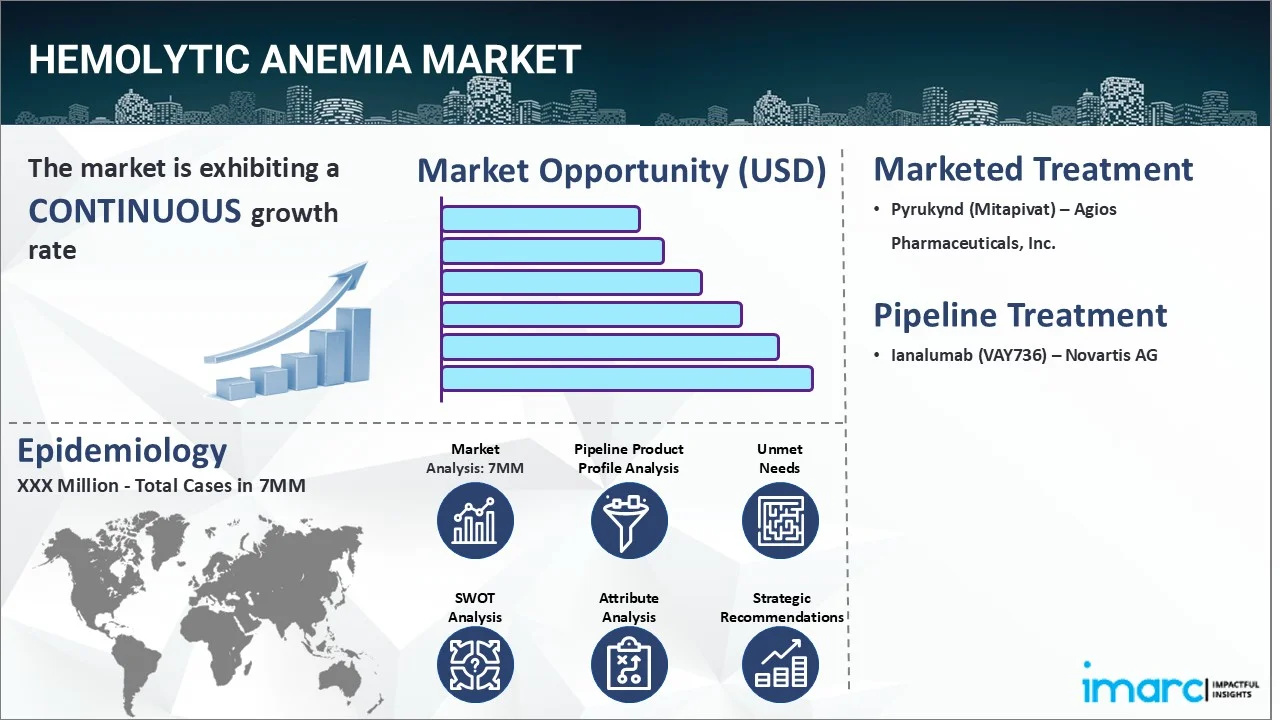

The top 7 (US, EU4, UK, and Japan) hemolytic anemia markets are expected to exhibit a CAGR of 4.02% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2035

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2035 | 4.02% |

The Hemolytic anemia market has been comprehensively analyzed in IMARC's new report titled "Hemolytic Anemia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Hemolytic anemia refers to a medical condition distinguished by the premature destruction of red blood cells in the bloodstream, spleen, or liver. This can lead to a decrease in the number of circulating cells, which are in charge of carrying oxygen from the lungs to the rest of the body. The common symptoms of the ailment may include fatigue, weakness, yellowish discoloration of the skin and eyes, shortness of breath, dizziness, an increased heart rate, dark or tea-colored urine, leg ulcers, etc. Individuals suffering from this illness may also experience an enlarged spleen, causing discomfort or pain in the left upper quadrant of the abdomen. The diagnosis of hemolytic anemia is typically made based on a combination of the patient's medical history, clinical features, and physical examination. A complete blood count test is also recommended to determine the number and characteristics of various blood cells, like platelets, red blood cells, and white blood cells. Depending on the suspected causative factor of the disease, the healthcare provider may conduct further investigations, such as ultrasounds and CT scans, to examine the spleen or liver.

To get more information on this market, Request Sample

The increasing prevalence of inherited genetic abnormalities affecting the function and anatomy of red blood cells within the body is primarily driving the hemolytic anemia market. In addition to this, the rising incidence of various associated risk factors, including cancer, infections, chemical exposure, certain toxins or venoms, etc., is creating a positive outlook for the market. Moreover, the widespread adoption of anti-inflammatory medications that can help to suppress the body's defense system and reduce the destruction of red blood cells is further bolstering the market growth. Apart from this, the inflating application of intravenous immunoglobulin (IVIG) therapy on account of its several advantages, like symptom relief, stabilized levels of hemoglobin, and rapid results compared to conventional treatments, is acting as another significant growth-inducing factor. Additionally, the emerging popularity of erythropoietin therapy, since it stimulates the bone marrow to form new red blood cells, thereby enhancing the patient's overall quality of life due to improved oxygen delivery to tissues and organs, is expected to drive the hemolytic anemia market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the Hemolytic Anemia market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for Hemolytic Anemia and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the Hemolytic Anemia market in any manner.

Recent Developments:

- In February 2024, Johnson & Johnson announced that the U.S. FDA had granted nipocalimab Breakthrough Therapy Designation (BTD) for the treatment of alloimmunized pregnant women who are at high risk of severe hemolytic illness of the fetus and newborn.

Key Highlights:

- Hemolytic anemia accounts for approximately 5% of all anemias.

- An examination of the Nationwide Inpatient Sample database revealed that nonimmune hemolytic anemia was present in 0.17% of all hospitalized patients with alcoholic liver disease.

- Hemolytic anemia is more frequent in adults than in children.

- The worldwide prevalence of autoimmune hemolytic anemia is 17 per 100,000 people.

- Worldwide, the probability of drug-induced hemolytic anemia is 0.1 per 100,000 people.

Drugs:

PYRUKYND is a pyruvate kinase activator prescribed to treat hemolytic anemia in people with pyruvate kinase (PK) deficiency. The beginning dose for PYRUKYND is 5 mg orally twice daily. To progressively increase hemoglobin, titrate PYRUKYND from 5 mg twice daily to 20 mg twice daily, then to the maximum recommended dose of 50 mg twice daily, increasing every 4 weeks.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the Hemolytic Anemia market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the Hemolytic Anemia market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current hemolytic anemia marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Pyrukynd (Mitapivat) | Agios Pharmaceuticals, Inc. |

| Ianalumab (VAY736) | Novartis AG |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the Hemolytic Anemia market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the Hemolytic Anemia across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the Hemolytic Anemia across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of Hemolytic Anemia across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Hemolytic Anemia by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Hemolytic Anemia by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Hemolytic Anemia by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with Hemolytic Anemia across the seven major markets?

- What is the size of the Hemolytic Anemia’ patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend Hemolytic Anemia of?

- What will be the growth rate of patients across the seven major markets?

Hemolytic Anemia: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for hemolytic anemia drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the hemolytic anemia market?

- What are the key regulatory events related to the hemolytic anemia market?

- What is the structure of clinical trial landscape by status related to the hemolytic anemia market?

- What is the structure of clinical trial landscape by phase related to the hemolytic anemia market?

- What is the structure of clinical trial landscape by route of administration related to the hemolytic anemia market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)