Hemostats Market Size, Share, Trends and Forecast by Product, Application, Formulation, and Region, 2025-2033

Hemostats Market Size & Share:

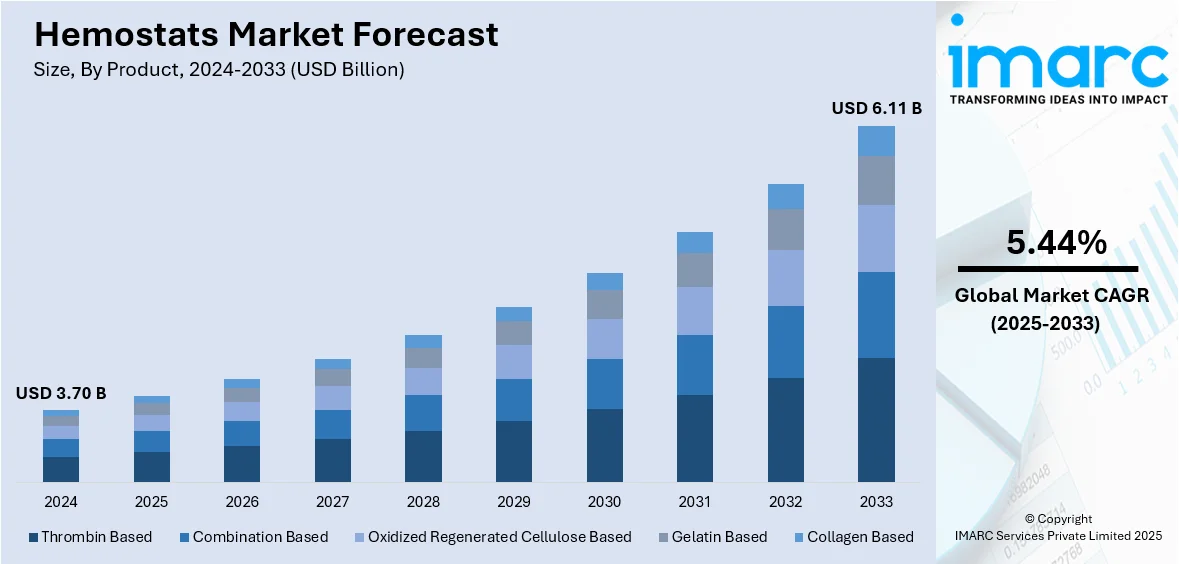

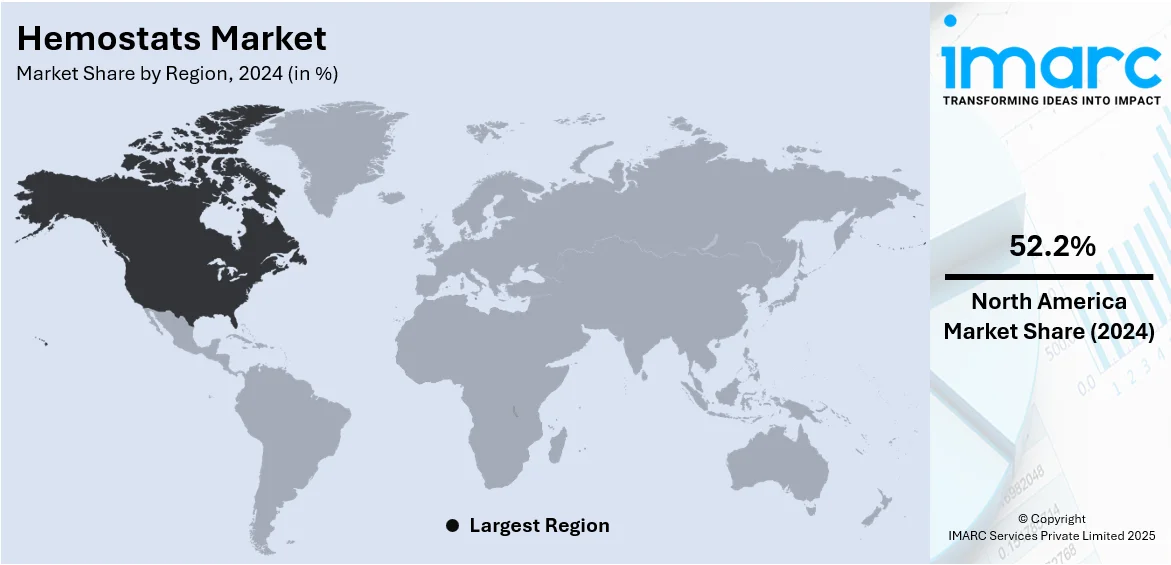

The global hemostats market size was valued at USD 3.70 Billion in 2024. The market is projected to reach USD 6.11 Billion by 2033, exhibiting a CAGR of 5.44% during 2025-2033. North America currently dominates the market, holding a significant market share of around 52.2% in 2024. The market is driven by the rising incidences of surgical procedures and trauma cases globally, necessitating effective blood loss management solutions. Along with this, the increasing adoption of minimally invasive surgeries and advancements in hemostatic agents, such as faster acting and bioabsorbable formulations, further support market expansion. Additionally, growing healthcare infrastructure in emerging economies and rising awareness among medical professionals regarding efficient wound care are some of the key factors augmenting the hemostats market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.70 Billion |

| Market Forecast in 2033 | USD 6.11 Billion |

| Market Growth Rate 2025-2033 | 5.44% |

The market is experiencing growth due to the increasing number of complex surgical procedures requiring effective intraoperative blood management. Moreover, advancements in biomaterial science have led to the development of next-generation hemostatic agents that offer enhanced safety, reduced immune response, and faster action. The market also benefits from growing awareness and training programs among surgical professionals regarding advanced hemostatic products. Additionally, rising investments in healthcare infrastructure in emerging economies are expanding access to surgical care, further driving demand. For instance, foreign investments in the Indian healthcare sector reached USD 1.5 Billion in 2024, with close to 50% directed toward hospitals, according to an industry report. Apart from this, regulatory support for safer surgical practices and the incorporation of hemostats into standardized surgical kits are also contributing to the broader adoption of these products across varied medical disciplines.

In the United States, the market is driven by the rising incidence of trauma and emergency surgeries, necessitating rapid blood loss control solutions. According to an industry report, there are currently approximately 62 million Americans aged 65 and above, making up 18% of the total population. This figure is projected to grow to 84 million by 2054, which will comprise 23% of the population. The growing elderly population, which often presents with comorbidities requiring surgical interventions, further strengthens product demand. Besides this, continuous innovation supported by strong R&D funding from public and private entities is accelerating the development of high-performance formulations. The integration of hemostatic products into minimally invasive surgical procedures, driven by patient preference and clinical efficiency, is also boosting market growth. Also, stringent patient safety regulations are encouraging hospitals to adopt proven blood loss management solutions.

Hemostats Market Trends:

Increasing Surgical Procedures

The growing number of surgical procedures across the world is significantly driving the growth of the market. For instance, according to an industry study, each year, 310 million major surgeries are performed worldwide, with 40 to 50 million in the United States and 20 million in Europe. Furthermore, according to estimates, 15% experience serious postoperative morbidity, and 5-15% are readmitted within 30 days. In addition to this, the rising geriatric population, who are more susceptible to age-related diseases leading to surgeries, is also contributing to hemostats market growth. For instance, an industry study published in the National Library of Medicine, United States, estimated that approximately 53% of all surgical procedures are performed on patients over the age of 65. Projections estimate that approximately half of the population over the age of 65 will require surgery once in their lives. Consequently, an increasing number of surgeries performed across the globe is anticipated to boost the market demand, as these products play a vital role in wound healing.

Ongoing Technological Advancements

Advances in medical technology have played a pivotal role in the market expansion. These innovations are resulting in the development of more effective and safer hemostatic products. For example, newer hemostats often incorporate biocompatible and bioabsorbable materials, reducing the risk of adverse reactions. Moreover, various key market players are increasingly investing in research and development (R&D) activities to introduce new hemostats with improved functionality, which is anticipated to propel the hemostats market revenue. For instance, in November 2023, Ethicon, a Johnson & Johnson MedTech company, announced the approval of ETHIZIA, an adjunctive hemostat solution that has been clinically proven to achieve sustained hemostasis in difficult-to-control bleeding situations. It is comprised of unique synthetic polymer technology, ETHIZIA™ Hemostatic Sealing Patch, which is the first and only hemostatic matrix designed to be equally active and efficacious on both sides. Designed for maximum adaptability, it can be stuffed, rolled, pulled apart, trimmed, and tailored, making it easy to handle in both open and minimally invasive surgeries.

Increasing Prevalence of Chronic Blood Disorders

The rising cases of chronic blood disorders are creating a positive hemostats market outlook. For instance, as per an industry survey, a total number of 347,026 people were affected by bleeding disorders in 2020. Additionally, according to an industry report, around 10 million new cases of venous thromboembolism occur globally each year. Also, in Europe, there are 544,000 Deep Vein Thrombosis (VTE) related deaths every year. Moreover, a report by the American Society of Hematology states that nearly 900,000 people are affected by blood clots each year, leading to approximately 100,000 blood clot-related deaths annually. This growing patient pool necessitates timely diagnosis and effective surgical interventions, further propelling the demand for advanced hemostatic agents. Thus, such an increase in the number of patients suffering from blood disorders is likely to impel the market share in the coming years.

Hemostats Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hemostats market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and formulation.

Analysis by Product:

- Thrombin Based

- Combination Based

- Oxidized Regenerated Cellulose Based

- Gelatin Based

- Collagen Based

Oxidized regenerated cellulose based leads the market with around 27.0% of market share in 2024. These products possess good hemostatic properties and a wide range of applications across many surgical procedures. The products work by creating a gelatinous mass when they come into contact with blood, which helps to facilitate the clotting process and achieve localized hemostasis. ORC-based hemostats are known for their absorbability, biocompatibility, and bactericidal nature, which makes them compatible with use in open as well as minimally invasive surgeries. Their capability to model irregular surfaces of wounds increases their effectiveness in intricate or sensitive operations. Also, their compatibility with a broad spectrum of tissue types has helped popularize them among general, cardiovascular, and orthopedic surgeries. The increasing demand for newer hemostatic agents that decrease operation time and postoperative morbidity further adds to the demand for ORC-based hemostats. With healthcare organizations prioritizing better patient outcomes and greater surgical efficiency, ORC-based products continue to occupy an important place in contemporary surgical practice.

Analysis by Application:

- Orthopedic Surgery

- General Surgery

- Neurological Surgery

- Cardiovascular Surgery

- Reconstructive Surgery

- Gynecological Surgery

- Others

Orthopedic surgery leads the market with around 28.2% of market share in 2024. The segment is driven by the prevalence of musculoskeletal trauma, fractures, and degenerative bone disorders associated with aging. Surgical procedures such as joint replacements, spinal surgeries, and trauma-related procedures frequently involve significant blood loss owing to the vascular structure of bone and adjacent tissues. Hemostatic agents are indispensable for controlling intraoperative hemorrhage, maintaining an uncluttered surgical field, reducing blood loss, and lowering transfusion requirements. In orthopedic procedures, where accuracy and visibility are crucial, successful hemostasis contributes to better surgical outcomes and earlier patient recovery. The increasing elderly population in the global world and the growing number of elective orthopedic procedures further spur demand for enhanced hemostatic products. Moreover, the shift toward minimally invasive orthopedic techniques has amplified the need for hemostats that are easy to apply and rapidly effective. As a result, orthopedic surgery continues to be a vital area of focus in the market.

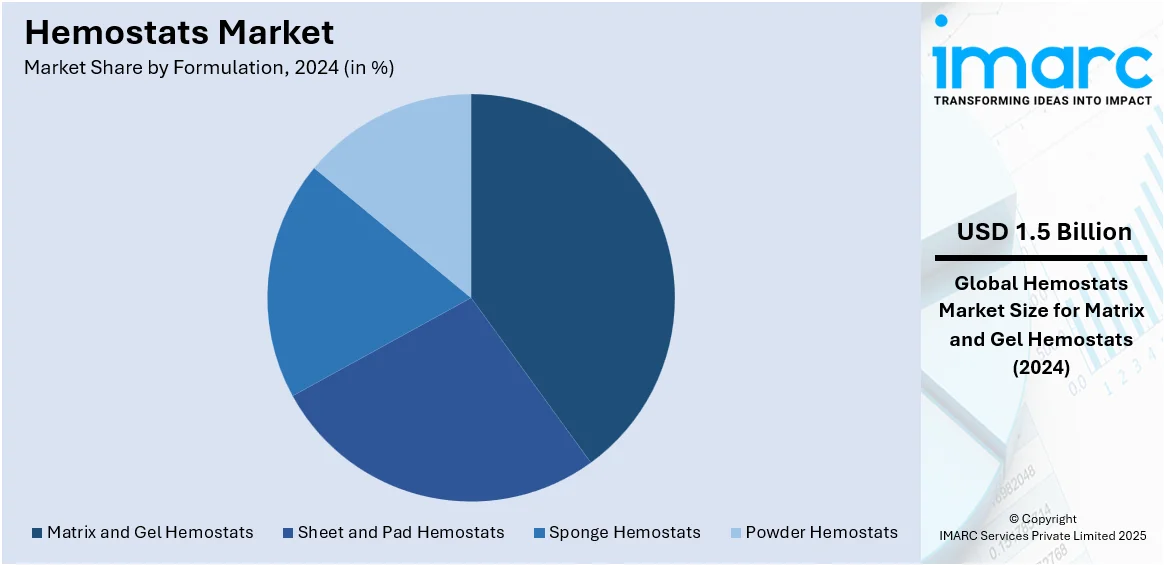

Analysis by Formulation:

- Matrix and Gel Hemostats

- Sheet and Pad Hemostats

- Sponge Hemostats

- Powder Hemostats

Matrix and gel hemostats lead the market with around 40.3% of market share in 2024. They are versatile, user-friendly, and act quickly to achieve hemostasis. Matrix and gel hemostats find special utility in managing diffuse or irregular bleeding in complicated or minimally accessible surgical fields. These hemostats, usually made of collagen, gelatin, or synthetic polymers, are simple to place over the surface of wounds, which fit into anatomical shapes and cause prompt hemostasis. Their biocompatibility and absorbable nature minimize the risk of side effects, and they can be used in a broad variety of surgical specialties such as orthopedic, cardiovascular, and general surgery. These formulations are favored by surgeons for their potential to minimize operative time, improve surgical accuracy, and enhance patient outcomes. The increasing usage is driven by advances in formulation technologies that enhance shelf stability, adherence, and viscosity. While surgical techniques advance and need greater control of intraoperative bleeding, matrix and gel hemostats remain an essential component of contemporary surgical care.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 52.2% due to developed healthcare infrastructure, high volume of surgeries, and robust adoption of newer medical technologies. The region is aided by a well-developed network of surgical facilities and hospitals that regularly conduct intricate surgeries, resulting in regular demand for efficient hemostatic products. Also, favorable reimbursement policies and increased awareness among healthcare providers about the advantages of sophisticated hemostatic agents support market growth. The increasing prevalence of chronic conditions, such as cardiovascular diseases and orthopedic disorders, further amplifies the need for surgical interventions requiring reliable blood loss management. Moreover, ongoing research and development (R&D) activities, along with the presence of key market players, support continuous innovation and product availability. North America's emphasis on patient safety, surgical efficiency, and outcome optimization makes it a leading consumer of hemostatic products, maintaining its critical role in shaping the market landscape.

Key Regional Takeaways:

United States Hemostats Market Analysis

In 2024, the United States holds a substantial share of around 86.20% of the market share in North America. The market in the United States is primarily driven by the increasing number of surgeries, particularly those involving trauma, orthopedic procedures, and cardiovascular diseases. For instance, according to the Detroit Medical Center (DMC), an estimated 500,000 individuals go through open-heart surgeries due to various cardiovascular diseases in the United States every year. Overall, more than 900,000 cardiac surgeries are carried out in the United States each year, according to Mass General Brigham. As the geriatric population grows, the demand for surgical interventions is rising, leading to a higher requirement for hemostats to manage bleeding during surgeries. Advancements in medical technology and the development of innovative hemostatic products that offer better performance, such as absorbable and non-absorbable hemostats, are also contributing substantially to industry expansion. As per the hemostats market trends, the rising preference for minimally invasive surgeries, which often require precise bleeding control, is increasing the demand in hospitals and surgical centers. Furthermore, the growing awareness about the benefits of hemostats in controlling blood loss, combined with the increased adoption of advanced medical products in surgical practices, is fueling market growth. Regulatory approvals and the introduction of new hemostatic agents, such as biological and synthetic hemostats, are also enhancing the market’s prospects.

Asia Pacific Hemostats Market Analysis

The market in the Asia Pacific region is growing due to the region's increasing surgical procedures and rapidly expanding healthcare infrastructure. For instance, as of March 31, 2023, India reached a total number of 1,69,615 Sub-Centres (SCs), 31,882 Primary Health Centres (PHCs), 6,359 Community Health Centres (CHCs), 1,340 Sub-Divisional/District Hospitals (SDHs), 714 District Hospitals (DHs), and 362 Medical Colleges (MCs) serving both rural and urban areas, highlighting a rapidly expanding healthcare infrastructure, as per the Ministry of Health and Family Welfare. Additionally, the growing population and a significant rise in the geriatric demographic are contributing substantially to an increased need for medical interventions. Advancements in healthcare technology and the adoption of minimally invasive surgeries are further driving the market, as these procedures often require effective bleeding control. Furthermore, the increasing awareness about patient safety and the growing adoption of advanced hemostatic agents in hospitals and surgical centers are playing a vital role in market growth.

Europe Hemostats Market Analysis

In Europe, the market is largely fueled by the rising demand for advanced surgical technologies and the increased focus on patient safety and surgical precision. With the growing number of outpatient procedures and an emphasis on reducing hospital stay durations, hemostatic agents are increasingly being viewed as essential tools in improving surgical efficiency and minimizing blood loss. Moreover, regulatory advancements across European countries are encouraging the use of more effective hemostats, particularly in complex surgeries, leading to higher adoption rates. Countries, such as Germany, UK and France have advanced healthcare infrastructure and significant healthcare spending, which contributes to industry expansion by ensuring the availability and accessibility of cutting-edge hemostatic products. Overall, healthcare expenditure in the European Union reached EUR 1,648 Billion (about USD 1,885.15 Billion) in 2022, equating to 10.4% of the GDP in the region. In relation to population size, healthcare expenditure was estimated at EUR 3,685 (about USD 4,215.27) per inhabitant in 2022. Additionally, there is a growing shift toward personalized medicine and tailored surgical interventions, which requires more specialized hemostatic solutions to address the unique needs of patients. The rise of ambulatory surgical centers and their focus on reducing operating costs while improving patient outcomes has also led to greater use of advanced hemostatic products.

Latin America Hemostats Market Analysis

The market in Latin America is experiencing robust growth, driven by advancements in medical research and the increasing availability of advanced hemostatic products. The region’s growing healthcare expenditure is leading to the introduction of innovative hemostatic solutions, such as sealants and bioactive hemostats, which offer superior performance in controlling bleeding during surgeries. For instance, Brazil spends 9.47% of its GDP on healthcare, equating to USD 161 Billion and making it the largest healthcare market in Latin America, as per an industry report. Additionally, the growing focus on improving surgical outcomes, combined with better training for healthcare professionals, is encouraging the use of more effective hemostatic agents. Increased partnerships with global medical device manufacturers are also expanding the availability of high-quality hemostatic products in the region.

Middle East and Africa Hemostats Market Analysis

The market in Middle East and Africa is significantly influenced by the rapid growth of medical tourism in the region, attracting patients seeking advanced surgical procedures. According to an industry report, the medical tourism market in the Middle East reached USD 6,392.6 Million in 2024 and is expected to grow at a CAGR of 8.35% during 2025-2033. Moreover, the rise in trauma-related injuries, particularly in conflict-prone areas, is also increasing the need for effective bleeding control during emergency surgeries. Additionally, the expansion of healthcare insurance coverage in certain regions is improving access to advanced medical treatments, including hemostatic products. The increasing availability of training programs for healthcare professionals is further enhancing the adoption of effective hemostatic solutions, helping to improve surgical precision and reduce complications.

Competitive Landscape:

The market is characterized by intense innovation and evolving product differentiation strategies. Key players are increasingly investing in research and development (R&D) activities to introduce next-generation hemostatic agents featuring enhanced biocompatibility, rapid action, and ease of application. Furthermore, strategic alliances, mergers, and acquisitions are frequently employed to expand product portfolios and gain market share, especially in emerging regions with growing surgical volumes. Also, regulatory compliance and intellectual property protection are critical elements, driving firms to navigate complex approval pathways while safeguarding proprietary technologies. Distribution networks are being optimized via partnerships with medical distributors and direct hospital outreach, ensuring broader access to advanced solutions. According to the hemostats market forecast, the anticipated global adoption of minimally invasive procedures and digital health integrations is expected to intensify competition, prompting accelerated launches of automated and point-of-care hemostatic systems. Apart from this, manufacturing scale and cost-efficiency also play a significant role, as companies aim to balance pricing pressures with high-quality output.

The report provides a comprehensive analysis of the competitive landscape in the hemostats market with detailed profiles of all major companies, including:

- Advanced Medical Solutions Group PLC

- B. Braun SE

- Baxter International Inc.

- Becton, Dickinson and Company

- Hemostasis, LLC

- Johnson & Johnson MedTech

- Medtronic PLC

- Pfizer Inc.

- Stryker Corporation

- Teleflex Incorporated

Latest News and Developments:

- April 2025: Baxter International Inc. announced the launch of Hemopatch Sealing Hemostat with room temperature storage at a conference in Austria. The product's development maximizes accessibility in the surgical environment, giving surgeons a quick fix to stop bleeding or reduce leakage. Orders for the product are currently being accepted throughout Europe.

- April 2025: A patent for "A Hemostatic Patch and a Method of Preparation Thereof" was granted to a collaborative research team from Banaras Hindu University and IIT BHU, Varanasi. This innovative method controls bleeding by using a homogeneous polymer and an Ayurvedic medication via nanotechnology.

- January 2025: The commercial introduction of TRAUMAGEL in the United States was announced by Cresilon Inc., a biotechnology company based in Brooklyn that specializes in hemostatic medical device innovations. TRAUMAGEL is a novel plant-based hemostatic gel that can be applied to a wound at the point of care to stop bleeding in a matter of seconds.

- September 2024: BC3 Technologies established a partnership with First Aid Only for the exclusive distribution of its SEAL Hemostatic Spray, the very first aerosolized chitosan that can manage critical arterial bleeding. As part of this agreement, First Aid Only will distribute SEAL through its expansive network of more than 1,000 partners to various consumers, including law enforcement agencies, EMS, and fire-rescue services.

- August 2024: Pakistan created and patented the world's first hemostat dressing, which can halt bleeding in a matter of seconds. Under the direction of Dr. Muhammad Yar, a group at the COMSATS University Islamabad Lahore Campus's Interdisciplinary Research Center in Biomedical Materials (IRCBM) developed the dressing using inexpensive biopolymer chitosan that was obtained from marine life.

Hemostats Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Thrombin Based, Combination Based, Oxidized Regenerated Cellulose Based, Gelatin Based, Collagen Based |

| Applications Covered | Orthopedic Surgery, General Surgery, Neurological Surgery, Cardiovascular Surgery, Reconstructive Surgery, Gynecological Surgery, Others |

| Formulations Covered | Matrix and Gel Hemostats, Sheet and Pad Hemostats, Sponge Hemostats, Powder Hemostats |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Medical Solutions Group PLC, B. Braun SE, Baxter International Inc., Becton, Dickinson and Company, Hemostasis, LLC, Johnson & Johnson MedTech, Medtronic PLC, Pfizer Inc., Stryker Corporation, Teleflex Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hemostats market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global hemostats market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hemostats industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hemostats market was valued at USD 3.70 Billion in 2024.

The hemostats market is projected to exhibit a CAGR of 5.44% during 2025-2033, reaching a value of USD 6.11 Billion by 2033.

The market is driven by the rising volume of surgical procedures globally, increasing awareness regarding effective blood loss management, and advancements in bioengineered hemostatic agents. Additionally, a growing elderly population and greater adoption of minimally invasive surgeries are further accelerating demand for innovative and reliable hemostatic solutions.

North America currently dominates the hemostats market with a market share of around 52.2%. The dominance is fueled by a well-established healthcare infrastructure, high surgical case volume, favorable reimbursement systems, and ongoing investments in surgical technology innovations, alongside the rapid adoption of advanced hemostatic products across medical specialties.

Some of the major players in the hemostats market include Advanced Medical Solutions Group PLC, B. Braun SE, Baxter International Inc., Becton, Dickinson and Company, Hemostasis, LLC, Johnson & Johnson MedTech, Medtronic PLC, Pfizer Inc., Stryker Corporation, Teleflex Incorporated, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)