Herbicides Market Size, Share, Trends and Forecast by Type, Mode of Action, Application, and Region, 2025-2033

Herbicides Market Size and Share:

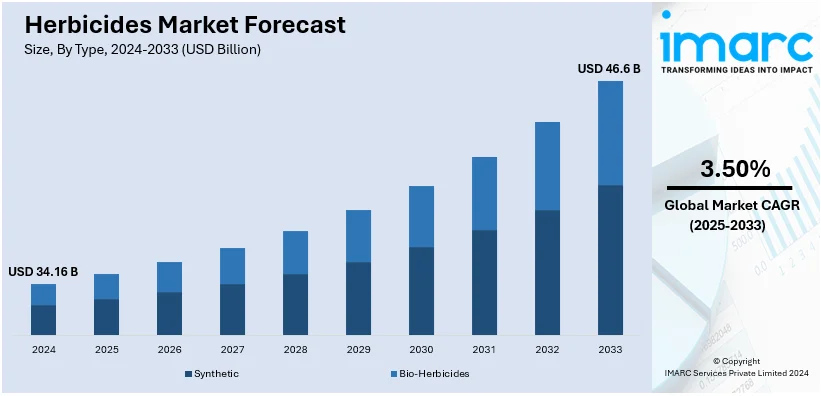

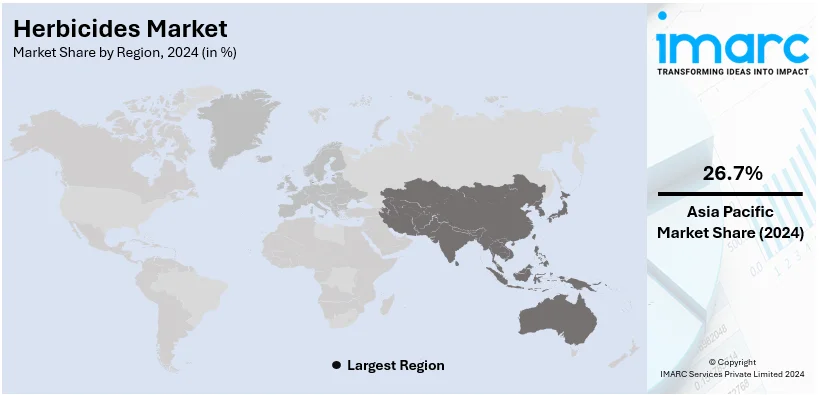

The global herbicides market size was valued at USD 34.16 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 46.6 Billion by 2033, exhibiting a CAGR of 3.50% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 26.7% in 2024. The growth of the Asia Pacific region is driven by extensive agricultural activities, government support for modern farming, increasing crop protection awareness, and advancements in herbicide formulations for sustainable practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 34.16 Billion |

|

Market Forecast in 2033

|

USD 46.6 Billion |

| Market Growth Rate (2025-2033) | 3.50% |

The growing global population is driving the need for food, forcing farmers to enhance crop production from constrained agricultural land. Herbicides are crucial for this purpose as they efficiently control weeds that vie with crops for necessary resources, such as sunlight, nutrients, and water. Besides this, improvements in agricultural methods, like precision agriculture and integrated weed management, are boosting the effectiveness and accuracy of herbicide use. These advancements allow for precise weed management, minimizing waste and ecological effects while enhancing output. Additionally, the increasing recognition among farmers regarding the benefits of herbicides in improving crop quality, boosting yield, and reducing the necessity for labor-intensive manual weeding, is presenting a positive market perspective.

The United States is a key region in the market, driven by the growing adoption of precision agriculture tools and technologies to enhance the effectiveness of herbicide applications, reducing wastage and enhancing targeted weed control. In addition, companies are concentrating on creating autonomous spraying systems and precision instruments that maximize herbicide efficiency, greatly minimizing waste and improving application precision. These innovations enhance input efficiency and also support sustainable farming methods by reducing environmental effects. These advancements allow farmers to oversee extensive operations from a distance, enhancing productivity and efficiency while meeting the increasing demand for sustainable farming practices. In 2024, John Deere and GUSS Automation launched Electric GUSS, the inaugural fully electric autonomous herbicide sprayer for orchards, at the World Ag Expo in California, USA. This sprayer provides accurate spot spraying, minimizing material consumption by as much as 90%, and allows for remote management of several units, boosting productivity and sustainability. Additionally, Smart Apply upgrades for Orchard and mini GUSS sprayers provide improved input efficiency and precision.

Herbicides Market Trends:

Increasing Demand for Food Production

Herbicides play an essential role in modern agriculture by effectively controlling weeds that compete with crops for critical resources like sunlight, water, and nutrients. Managing weeds not only ensures ideal plant development but also enhances overall productivity, leading to higher food production per hectare. Keeping fields free from weeds with herbicide application improves resource efficiency and supports sustainable agricultural practices, crucial for addressing the challenges of limited arable land and rising food demand. According to the UK government, in 2023, 58% of the food eaten locally came from domestic production, highlighting the importance of effective farming practices like herbicide use for ensuring food security. Additionally, herbicides assist in reducing the labor-intensive methods of weed removal, allowing farmers to focus on improved crop management. As global populations increase and resources become scarce, herbicides remain crucial for creating sustainable agricultural methods that align productivity with environmental care.

Adoption of Genetically Modified (GM) Crops

GM crops and the corresponding herbicides are widely used due to their compatibility. The combined features of herbicide tolerance and insect resistance grew by 6%, according to the International Service for the Acquisition of Agri-biotech Applications (ISAAA), and now account for 85.1 Million hectares, or 45% of all agricultural land worldwide. It demonstrates the preference of farmers for ecologically friendly agricultural practices, such as no-till planting and less use of pesticides. Herbicide tolerance continued to be the most common feature in crops such as cotton, soybeans, canola, maize, and alfalfa until 2018. Besides this, genetically modified (GM) crop integration has revolutionized current agriculture, especially regarding the dynamics of pesticide use. Genetically modified crops, designed to withstand herbicides, enable farmers to use herbicides without endangering the crop. Additionally, the area cultivated with biotech crops has expanded exponentially, reaching millions of hectares globally. The trait of herbicide resistance simplifies weed control and enhances the effectiveness of agricultural practices by reducing the labor and cost involved in traditional weeding methods. Consequently, this drives the demand for genetically modified seeds and their compatible herbicides, marking a significant shift in agricultural methodologies.

Rising Incidence of Weed Resistance

The extensive application of herbicides is greatly enhancing agricultural output, yet it is also causing a concerning increase in instances of weed resistance. This occurrence takes place when weeds gain the capacity to endure herbicide applications, diminishing the effectiveness of these solutions over time and threatening crop productivity. Tackling weed resistance is essential for ensuring food security, necessitating ongoing innovation in herbicide creation and the implementation of sustainable agricultural methods. Integrated Weed Management (IWM) has become a vital strategy, merging chemical, cultural, and mechanical techniques to tackle resistant weed populations. As per a 2024 survey, Diflufenican, an innovative preemergence herbicide for corn, has shown encouraging effectiveness in managing water hemp (Amaranthus tuberculatus), a weed that is resistant to several herbicides. Its capability to serve as a key element of IWM strategies underscores the continuous initiatives to combat weed resistance while providing sustainable and efficient crop management options.

Herbicides Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global herbicides market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, mode of action, and application.

Analysis by Type:

- Synthetic

- Glyphosate

- Atrazine

- 2,4-Dichlorophenoxyacetic Acid

- Acetochlor

- Paraquat

- Others

- Bio-Herbicides

Synthetic (glyphosate, atrazine, 2,4-dichlorophenoxyacetic acid, acetochlor, paraquat, and others) leads the market due to its proven effectiveness in managing a broad spectrum of weeds, ensuring higher crop yields and quality. Synthetic herbicide delivers reliable effectiveness across various climate conditions and crop varieties, aiding extensive agricultural businesses. It is especially appreciated for its capacity to target certain weed types or offer non-selective weed management, based on the formulation. Continuous developments in synthetic herbicide technologies are enhancing their ecological compatibility and lowering application rates, tackling sustainability issues while preserving efficacy. Furthermore, robust regulatory endorsements and thorough investigations into safer, more precise formulations persist in reinforcing their market stance. The ease of availability and compatibility with modern farming equipment further boost their adoption, making synthetic herbicide a critical component in enhancing agricultural productivity and ensuring food security.

Analysis by Mode of Action:

- Selective Herbicides

- Non-Selective Herbicides

Selective herbicides dominate the market, owing to their ability to target specific weeds while leaving desired crops unharmed, enhancing agricultural efficiency and productivity. These herbicides are commonly applied to several crops, such as grains, cereals, and fruits, providing accurate weed management while reducing harm to nearby plants. Their function in encouraging healthier crop development and minimizing competition for resources such as nutrients and water renders them essential for farmers. The increasing use of sophisticated agricultural methods, like precision farming, enhances the need for selective herbicides since they enable customized applications to particular regions, maximizing effectiveness and minimizing waste. Ongoing advancements in formulations, such as eco-friendly and bio-based selective herbicides, tackle sustainability issues while ensuring effectiveness. Government initiatives supporting sustainable farming practices and the rising need for higher crop yields to meet food security goals also support the segment's growth.

Analysis by Application:

- Grains and Cereals

- Pulses and Oilseeds

- Commercial Crops

- Fruits and Vegetables

- Turf and Ornamentals

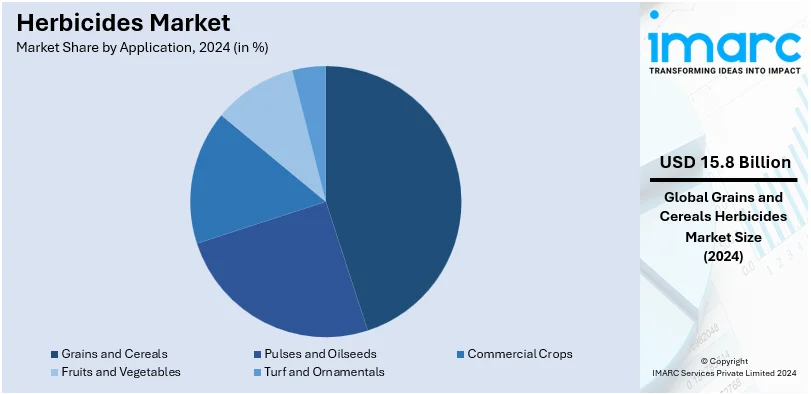

In 2024, grains and cereals dominate the market, holding 46.4% of the share. Grains and cereals hold the biggest share because of their essential function in satisfying worldwide food needs. These essential crops, such as wheat, rice, and corn, need efficient weed control to guarantee high quality and yields. Herbicides are crucial in minimizing competition from weeds for vital resources such as nutrients, water, and sunlight, which results in improved crop growth. The growing use of contemporary farming methods, like precision agriculture and integrated pest control, improves the effectiveness of herbicide use, subsequently boosting the demand in this area. Additionally, government backing and programs that encourage food security and sustainable agricultural methods play a role in the prevalent application of herbicides in grain and cereal production. Ongoing improvements in herbicide formulations, such as selective and bio-based options, are additionally promoting growth in this area, allowing farmers to enhance productivity while tackling environmental issues.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia Pacific region held 26.7% of the total market share. The Asia Pacific region leads the market, driven by significant agricultural operations and its vital contribution to worldwide food production. Due to a large population and varying climatic conditions, there is a significant need for effective weed management strategies to enhance crop yield and quality. Governments throughout the area are actively encouraging contemporary farming methods and offering financial support for agricultural supplies, such as herbicides. The implementation of new crop protection methods, along with progress in bio-based herbicides, is becoming increasingly popular. Nations with substantial agricultural industries are concentrating on boosting productivity via sustainable methods, driving the need for herbicides. In October 2024, FMC, a prominent global firm in agricultural sciences, unveiled the introduction of Ambriva® herbicide for application in wheat in the forthcoming growing season during a customer event held in Chandigarh, India. Ambriva® herbicide contains Isoflex® active, a group 13 herbicide that introduces a new mode of action in cereal cultivation, offering Indian farmers an innovative option for managing resistance.

Key Regional Takeaways:

United States Herbicides Market Analysis

The United States represented 84.90% of the overall market share in North America. The market for herbicides in the United States is propelled by the growing implementation of modern agricultural methods intended to boost crop yields and minimize reliance on labor due to escalating labor expenses. Farmers are increasingly adopting precision farming methods, which are driving the need for specific herbicides to manage weeds effectively while protecting crops. The market is experiencing a rise in demand for bio-based and organic herbicides as consumers and regulatory agencies are prioritizing sustainable and environmentally friendly farming methods. At the same time, the emergence of genetically modified (GM) crops that tolerate herbicides is allowing farmers to apply certain herbicides compatible with these crop systems, thereby increasing sales. The increasing occurrence of herbicide-resistant weeds is driving research and development efforts for stronger herbicide formulations, thereby speeding up product innovation and market growth. Moreover, the rising investments from major stakeholders in distribution systems and the expanding inclination for ready-to-use products among small and medium-sized farmers are enhancing market access. As reported by the U.S. Department of Agriculture (USDA), a survey revealed that in 2023, there were 1.89 million farms in the United States. The government is actively offering subsidies and technical assistance for integrated weed management initiatives, thus promoting herbicide use even more. These elements, combined with the increasing farmland for valuable crops like corn and soybeans, are driving the expansion of the herbicides market in the United States.

Europe Herbicides Market Analysis

The market for herbicides in Europe is presently influenced by various distinct factors. Farmers are progressively embracing sophisticated weed management techniques to address the growing occurrence of herbicide-resistant weed varieties, prompting them to search for more efficient chemical remedies. Additionally, the increasing desire for greater crop outputs amid the reduction of arable land availability is encouraging farmers to invest in herbicides that boost crop productivity. There is a noteworthy increase in organic agriculture, which is driving the need for herbicides that meet organic farming regulations. As per the UK government, in 2023, 498 thousand hectares were cultivated organically in the UK. Innovations in herbicide formulations are meeting the demand for more selective and less toxic options, which are becoming increasingly popular with European farmers. Furthermore, the growing emphasis on sustainability is driving the creation of environmentally-friendly herbicides, aimed at reducing environmental effects. Regulatory pressure is driving the discontinuation of older, more harmful herbicide chemicals, further boosting the development of innovative, safer options. Furthermore, as European consumers persist in seeking pesticide-free food, producers are rolling out herbicides that enhance efficiency while adhering to strict food safety standards, contributing to market expansion.

Asia Pacific Herbicides Market Analysis

The herbicide market in the Asia Pacific is undergoing swift expansion owing to multiple region-specific factors. Farming methods are changing, as farmers are progressively embracing innovative agricultural techniques, such as precision farming, which is greatly increasing the demand for herbicides. The area is experiencing an increase in pest and weed resistance, resulting in an escalating dependence on stronger herbicides to sustain crop production. Concurrently, there is a movement towards sustainable agriculture, where governments and farmers are adopting integrated pest management (IPM) techniques that include targeted herbicide application to minimize chemical residues and lessen environmental effects. The growth of urban areas and the rise of extensive agricultural practices are boosting the need for herbicides, as they facilitate greater output despite the decline in available farmland. As per UN Habitat, China's average urbanization rate was 59.6% in 2018, with Zhejiang Province exceeding 68% and Guizhou Province at 46%. In nations such as India and China, the increasing recognition of the advantages of using herbicides, along with government subsidies and assistance for contemporary farming equipment, is further driving market expansion. Additionally, the evolving dietary trends in the area are encouraging the growth of high-value crops that necessitate efficient weed management, leading to an increased reliance on herbicides in both conventional and commercial agriculture.

Latin America Herbicides Market Analysis

The herbicides market in Latin America is currently experiencing growth due to several key factors. Farmers are increasingly adopting herbicides to manage weed resistance, which is becoming a significant challenge in crops such as soybeans, maize, and sugarcane. According to the U.S. Department of Agriculture (USDA), agriculture employs 15.1 Million people in rural establishments, equivalent to 15 percent of the labor force. Agricultural productivity is rising as large-scale farms are intensifying their focus on optimizing yields, and herbicides are playing a crucial role in this process. Governments in the region are also actively promoting modern farming techniques, including the use of chemical solutions to combat pests and weeds, which is driving the demand for herbicides. Concurrently, there is a growing trend of adopting precision agriculture, where herbicides are being applied more efficiently through technology like drones and automated systems, reducing waste and increasing application accuracy. Additionally, Latin America’s expanding biofuel production is increasing the need for herbicides to ensure the protection of crops like sugarcane and corn. Climate change is accelerating the spread of invasive weed species, prompting farmers to use more herbicides to safeguard their crops. Lastly, the region is witnessing an increase in export-driven agricultural production, pushing the demand for herbicides to meet global standards of crop protection and quality. These factors are collectively propelling the herbicides market forward in Latin America.

Middle East and Africa Herbicides Market Analysis

The herbicides market in the Middle East and Africa is currently experiencing significant growth due to a combination of region-specific factors. Increasing agricultural productivity to meet the growing food demand in countries like Egypt, South Africa, and Saudi Arabia is driving the adoption of herbicides. According to the U.S. Department of Agriculture (USDA), in 2019, the gross value of South African agricultural production by province is USD 14.91 Billion. Farmers are increasingly relying on herbicides to control weed proliferation, which is enhancing crop yields and reducing labor costs. The ongoing shift towards modern farming practices is leading to the adoption of more efficient herbicide formulations that minimize environmental impact while maximizing crop protection. Furthermore, government initiatives in several countries are promoting the use of agricultural chemicals to boost food security, with subsidies and incentives encouraging herbicide usage. Climate change is also playing a role, with irregular rainfall patterns and extreme weather conditions, which are pushing farmers to seek more reliable solutions for managing weed infestations. As a result, there is a growing demand for herbicides that are specifically designed to tackle the unique environmental challenges faced by farmers in the region. Moreover, the increasing awareness among farmers about the benefits of herbicides is leading to an expanding market for these products across both large-scale commercial farms and smallholder farms.

Competitive Landscape:

Key players are innovating and expanding their product portfolios for meet the escalating demand for effective weed control solutions. They are investing in research and development (R&D) to create advanced formulations, including bio-based and environmentally friendly herbicides, to address sustainability concerns. Strategic collaborations, mergers, and acquisitions are helping these companies strengthen their market presence and geographic reach. Additionally, they are leveraging digital technologies and precision agriculture tools to offer tailored solutions that enhance application efficiency and reduce environmental impact. In 2024, Bayer acknowledged the EPA approval of Vios FX herbicide. This addition expands Bayer's cereal herbicides lineup, offering clients more options for managing weeds effectively. Vios™ FX combines Group 2 (thiencarbazone-methyl) and Group 4 (fluroxypyr) active ingredients to combat resilient weeds like Group 1-resistant foxtail, wild oats, and Kochia. Its versatile tank mix options empower growers to customize weed control while maintaining crop rotation flexibility.

The report provides a comprehensive analysis of the competitive landscape in the herbicides market with detailed profiles of all major companies, including:

- BASF SE

- Bayer AG

- Corteva Inc.

- Drexel Chemical Co. Inc.

- FMC Corporation

- Heranba Industries Ltd.

- Nissan Chemical Corporation

- Nufarm

- Sumitomo Chemical Co. Ltd.

- Syngenta Group

- UPL Limited

- Wilbur-Ellis Company LLC.

Latest News and Developments:

- October 2024: Insecticides (India) Limited. (IIL) introduced Torry Super, an innovative post-emergence herbicide aimed at transforming weed management while maintaining the safety of crops. Moreover, this is based on the SPF technology developed by the IIL’s R&D team.

- May 2024: Food Machinery Corporation (FMC) secured registration in Brazil for its herbicides Azugro and Ezanya, intended for application in cotton, tobacco, and wheat agriculture. These herbicides utilize the strength of Isoflex active, FMC’s exclusive bixlozone formulation. Isoflex Active is an innovative herbicide for cereal use and is categorized by the Herbicide Resistance Action Committee (HRAC) as a Group 13 herbicide. The launch of these two new formulations will provide growers with cutting-edge tools to successfully address herbicide resistance in a wide range of agricultural practices.

Herbicides Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Mode of Actions Covered | Selective Herbicides, Non-Selective Herbicides |

| Applications Covered | Grains And Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, Turf and Ornamentals |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Bayer AG, Corteva Inc., Drexel Chemical Co. Inc., FMC Corporation, Heranba Industries Ltd., Nissan Chemical Corporation, Nufarm, Sumitomo Chemical Co. Ltd., Syngenta Group, UPL Limited, Wilbur-Ellis Company LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the herbicides market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global herbicides market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the herbicides industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Herbicides are chemicals designed to manage or eliminate weeds, aiding agriculture and landscaping. They can be selective, targeting specific plants, or non-selective, affecting all vegetation. They play a crucial role in agriculture, landscaping, and gardening by targeting specific plant species while leaving desired crops or vegetation unharmed.

The herbicides market was valued at USD 34.16 Billion in 2024.

IMARC estimates the global herbicides market to exhibit a CAGR of 3.50% during 2025-2033.

The global herbicides market is driven by rising demand for higher agricultural productivity, increased adoption of advanced farming techniques, and growing awareness about weed control's role in crop yield. Expanding population, shrinking arable land, and the need for sustainable farming solutions are further driving the demand. Additionally, innovations in bio-herbicides and government initiatives supporting agriculture are strengthening the market growth.

In 2024, synthetic represented the largest segment by type, driven by their effectiveness in controlling a wide range of weeds, ease of application, and cost-efficiency compared to organic alternatives, catering to large-scale agricultural needs.

Selective herbicides lead the market by mode of action owing to their ability to target specific weeds without harming desired crops, enhancing agricultural productivity and efficiency.

Grains and cereals are the leading segment by application attributed to their importance, with effective weed control ensuring higher yields, improved quality, and meeting the growing demand for staple foods.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global herbicides market include BASF SE, Bayer AG, Corteva Inc., Drexel Chemical Co. Inc., FMC Corporation, Heranba Industries Ltd., Nissan Chemical Corporation, Nufarm, Sumitomo Chemical Co. Ltd., Syngenta Group, UPL Limited, Wilbur-Ellis Company LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)