High Content Screening Market Report by Product (Instruments, Consumables, Software, Services, Accessories), Application (Target Identification and Validation, Primary Screening and Secondary Screening, Toxicity Studies, Compound Profiling, and Others), End-User (Pharmaceutical and Biotechnology Companies, Academic and Government Institutes, Contract Research Organizations (CROs)), and Region 2025-2033

High Content Screening Market Overview:

The global high content screening market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.7 Billion by 2033, exhibiting a growth rate (CAGR) of 7.13% during 2025-2033. The market is experiencing significant growth driven by rapid advancements in drug discovery applications through the use of integrated imaging technologies, heightening investments in pharmaceutical research, escalating demand for a screening method while minimizing time and cost, and the establishment of automated system in laboratories.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.4 Billion |

|

Market Forecast in 2033

|

USD 2.7 Billion |

| Market Growth Rate (2025-2033) | 7.13% |

High Content Screening Market Analysis:

- Major Market Drivers: The high content screening market growth is driven largely by the growing demand from drug discovery and development, progress in imaging technologies featuring high-throughput production, and large investments allocation to pharmaceuticals and biotechnology studies. Besides, the demand for expeditious and productive screening techniques, aiding the identification and understanding of active drug candidates, also adds fuel to the market growth.

- Key Market Trends: The market trends include the rapid digitization of AI and machine learning algorithms that use data analysis, incorporating 3D cell models that produce more physiologically relevant results, and the development of multiparadigm assays for various cellular models.

- Geographical Trends: North America dominate the market due to rapid development in the pharmaceutical and biotechnology industries, ongoing investments in research and development, advanced healthcare infrastructure which connects to the presence of market key players and academic research institutions.

- Competitive Landscape: Some of the major market players in the industry include Becton, Dickinson and Company, Bio-Rad Laboratories Inc., Biotek Instruments Inc., Danaher Corporation, GE Healthcare, Merck Millipore, Perkinelmer Inc., Tecan Group Ltd., Thermo Fisher Scientific, Yokogawa Electric Corporation, among many others.

- Challenges and Opportunities: The market faces challenges such as the high cost of equipment and reagents, the complexity of data analysis and standards. On the other hand, high content screening market opportunities are enormous in terms of developing new innovative imaging technologies or broadening their range of applications beyond drug discovery and making collaborative studies between academia and industry easier for research and development.

High Content Screening Market Trends:

Increasing Demand for Drug Discovery:

The market is primarily driven by the increasing need for fast and effective drug discovery approaches. For instance, NIH reports that the global pharmaceutical market is anticipated to almost double and stand at 1.5 trillion dollars in 2025 thus urging for advanced screening technologies. HCS in turn enables the analyses of many parameters at the same time and the earlier identification of potential drug candidates, hence allowing shorter time to develop them. As a result, pharmaceutical organizations are forced to put their trust in HCSs which consequently makes the research market size larger and improves the discovery process of drugs.

Ongoing Advancements in Imaging Technologies:

The imaging technologies are continuously developed by companies, that help to provide more accurate, detailed, and specialized diagnostic tools, creating a positive high content screening market outlook. For instance, the National Science Foundation (NSF) report shows the annual growth of 6.2%, which means more and more laboratories are adopting the operatories of advanced imaging modalities for application in high content screening of cellular analysis. Researchers can now make high-quality images of the structures and workings of cells in real time via super-resolution microscopy, confocal imaging, and live-cell imaging facilities. Such technical innovations upgrade the high content screening systems with better analytical precision and more detailed results in the future, thus the work of identifying cellular processes and response to stimuli becomes more advanced and thorough. Hence, the supply of cleaner and more efficient high content screening systems, incorporating the latest imaging technics is rising which is responsible for the market development.

Rising Investments in Biotechnology Research

The high content screening market revenue is experiencing significant growth due to rising investments in biotechnology around the world. As per Biotechnology Innovation Organization (BIO), global spending on biotechnological R&D exceeded $210 billion in 2020 showing the investments made in advancing scientific knowledge as well as development of new therapeutic options. High content screening takes a central position in biotechnology research by speeding up the investigating process of wondering what the cells do and the interactions among the molecules. Biotech firms and research institutions utilizing new discovery targets for drug development, as well as assessing compound efficacy and toxicity, and elucidating disease mechanisms are some of the factors driving an increased high content screening market demand. As a result, this tendency will lead to market growth and further research on high content screening techniques will be done.

High Content Screening Market Segmentation:

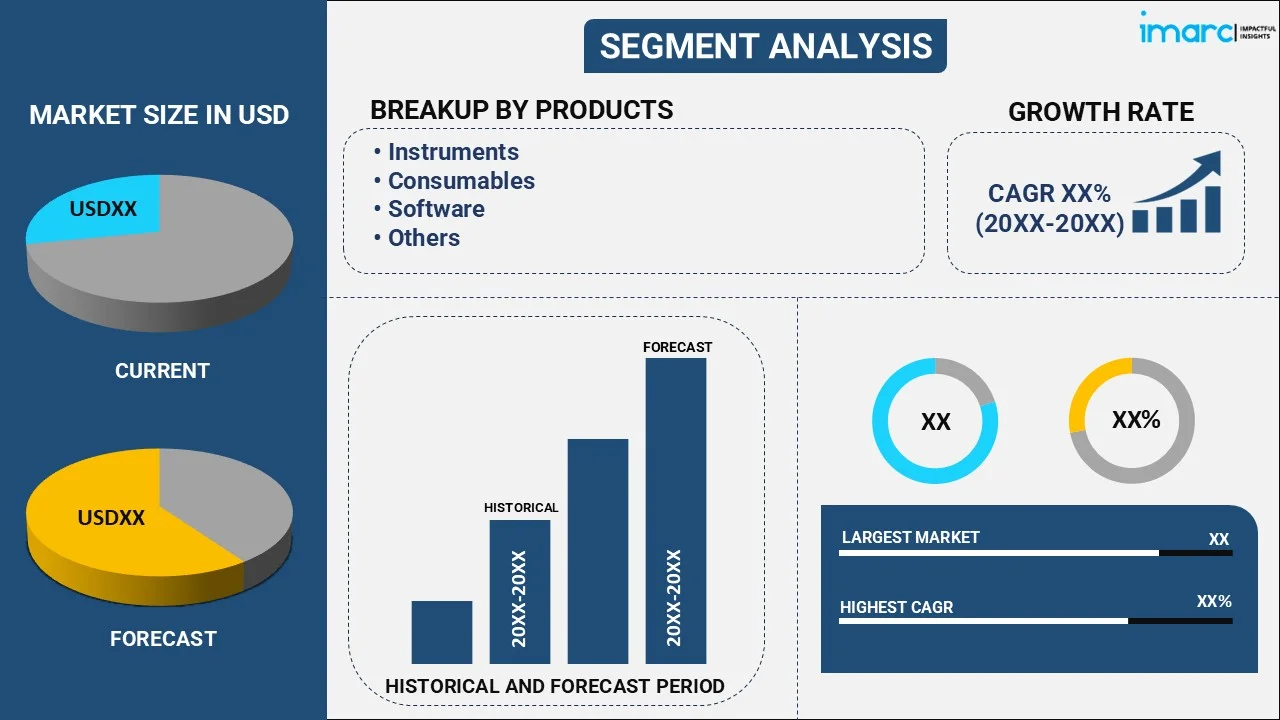

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, application, and end-user.

Breakup by Product:

- Instruments

- Cell Imaging and Analysis Systems

- Flow Cytometers

- Consumables

- Reagents & Assay Kits

- Microplates

- Others

- Software

- Services

- Accessories

Instruments accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes instruments (cell imaging and analysis systems and flow cytometers), consumables (reagents & assay kits, microplates, and others), software, services, and accessories. According to the report, instruments represented the largest segment.

Instruments dominate the market by assuring a precise and effective cellular analysis that leads to discovery of drugs and research. For instance, NIH projections forecast that the figures for worldwide purchases of the research equipment and instrumentation will pass $53 billion mark by 2025. This high magnitude investment thus accounts to the increasing demand for up-to-date technology equipment in biomedical research with high content screening instruments. However, major pharmaceutical and biotechnology firms have introduced screening platforms technologies in which drug discovery processes are accelerated that will lead to huge growth of high content screening instruments. As a result, those engaged in the manufacture of instruments are shifting their attention towards creating more modern tools that offer better imaging, automation, and data analysis features to satisfy the demand of scientists who are always looking for something new.

Breakup by Application:

- Target Identification and Validation

- Primary Screening and Secondary Screening

- Toxicity Studies

- Compound Profiling

- Others

Primary screening and secondary screening hold the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes target identification and validation, primary screening and secondary screening, toxicity studies, compound profiling, and others. According to the report, primary screening and secondary screening accounted for the largest market share.

Primary screening and secondary screening dominate the market due to the rising urgency of accelerating the drug discovery process. According to data from NIH, the global pharmaceutical industry is experiencing an accelerated growth and is expected to reach an estimate of $1,200 billion in sales in 2024. This is a leverage to invest in high content screening technologies for primary screening, as the ability to evaluate large amounts of compound libraries to identify potential drug candidates quickly becomes automated and systematic. Afterward, cell-based assays are indispensable for following up on hit compounds in the secondary screening step, characterizing their efficacy, safety, and mechanism of action. This accelerates primary and secondary high content screening solutions adoption.

Breakup by End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Government Institutes

- Contract Research Organizations (CROs)

Pharmaceutical and biotechnology companies represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes pharmaceutical and biotechnology companies, academic and government institutes, and contract research organizations (CROs). According to the report, pharmaceutical and biotechnology companies represented the largest segment.

Pharmaceutical and biotechnology firms are driven by the basic necessity to speed up drug discovery or development in the field of market. As per the National Institutes of Health (NIH), the global drugs industry is anticipated to go beyond 1.5 trillion dollars by the year 2025. This abundant market chance therefore entices firms to invest in the state-of-the-art screening technologies to screen drug candidates swiftly. Moreover, high-content screening allows drug and biotechnology companies to perform in-depth cellular assays, thus enabling the evaluation of drug candidates' effectiveness and side-effect profiles. With the use of high content screening methods, these companies can essentially automate their research workflow and therefore shorten development timelines to bring novel treatments to the market faster. Furthermore, progress in imaging technology and data analysis algorithms adds to the power of high content screening platforms to the discovery of unsuspected life behaviors and disease mechanisms. Thus, investments of pharmaceutical and biotechnology companies in the development of high content screening run high leading to innovation and improvement of patient outcome.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest high content screening market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for high content screening.

North America dominates the market due to the provision of massive government grant to biomedical industry. For instance, the National Institutes of Health or NIH reported that the US government covers up to $30 billion in its yearly budget for biomedical research. This sizeable incurred investment, however, stimulates innovation, therefore enhancing the use of more advanced screening technologies resulting in the market development. Further, the area enjoys well-established medicine infrastructure, a cluster of leading research institutes and a labor force with a high level of competence which provide additional prestige to the region in the high content screening market. As result North America stays at the forefront of the equipment used in the pharmaceutical and biological sectors’ research and development.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the high content screening industry include Becton, Dickinson and Company, Bio-Rad Laboratories Inc., Biotek Instruments Inc., Danaher Corporation, GE Healthcare, Merck Millipore, Perkinelmer Inc., Tecan Group Ltd., Thermo Fisher Scientific and Yokogawa Electric Corporation.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The high content screening market companies are investing in the research and development (R&D) of the product to upgrade the product and broaden the market. Thermo Fisher Scientific, PerkinElmer, and GE Healthcare, amongst others, leading the trend in imaging technologies for high-content screening. For instance, Thermo Fisher Scientific spent around 1.1 billion dollars in 2020 on R&D activities. These investments aim to develop new imaging technologies, automation solutions and software platforms that are capable of driving the growing market and meeting the ever-searching demand for advanced cellular analysis and drug discovery related applications. These businesses are developing microscopy systems with enhanced imaging, automation features, and data analysis algorithms that suit the emerging needs of pharmaceutical and biotechnology scientists in drug development and cellular analysis experiments.

High Content Screening Recent Developments:

- In September 2022, BD (Becton, Dickinson and Company) announced the launch of a cloud-based software solution called BD Research Cloud intended to automate the flow cytometry workflow. The motto of the project is to assisting scientists in diverse fields, such as immunology, virology, oncology, and infectious diseases control. While the modular and flexible approach of the BD Research Cloud improves both the quality of the experiments and the time-to-market by fastening the time to insight most needed aspects of scientific investigations BD Research Cloud strives to augment scientific research and innovation in these areas.

- In April 2022, Sysmex Europe launched the CE-IVD-marked Flow Cytometer XF-1600, catering to clinical flow cytometry laboratories. This system offers robust and reliable immunophenotyping capabilities, aiding in the precise characterization of cells for diagnostic and research purposes. With its advanced features and regulatory approval, the Flow Cytometer XF-1600 enhances efficiency and accuracy in clinical laboratory workflows, contributing to improved patient care and outcomes.

High Content Screening Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Target Identification and Validation, Primary Screening and Secondary Screening, Toxicity Studies, Compound Profiling, Others |

| End-Users Covered | Pharmaceutical and Biotechnology Companies, Academic and Government Institutes, Contract Research Organizations (CROs) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Becton, Dickinson and Company, Bio-Rad Laboratories Inc., Biotek Instruments Inc., Danaher Corporation, GE Healthcare, Merck Millipore, Perkinelmer Inc., Tecan Group Ltd., Thermo Fisher Scientific, Yokogawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, high content screening market forecast, and dynamics from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global high content screening market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the high content screening industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The high content screening market was valued at USD 1.4 Billion in 2024.

The high content screening market is projected to exhibit a CAGR of 7.13% during 2025-2033.

The high content screening market is driven by advancements in technology, increased demand for personalized medicine, and the growing focus on drug discovery and toxicity testing. Additionally, the need for efficient screening processes in cancer research, regenerative medicine, and neurodegenerative disease studies further propels market growth.

North America currently dominates the market driven by the provision of massive government grant to biomedical industry.

Some of the major players in the high content screening market include Becton, Dickinson and Company, Bio-Rad Laboratories Inc., Biotek Instruments Inc., Danaher Corporation, GE Healthcare, Merck Millipore, Perkinelmer Inc., Tecan Group Ltd., Thermo Fisher Scientific, Yokogawa Electric Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)