High-frequency Trading Server Market Report by Processor (X-86-based, ARM-based, Non-X86-based (MIPS, Imagination)), Form Factor (1U, 2U, 4U, and Others), Application (Equity Trading, Forex Markets, Commodity Markets, and Others), and Region 2025-2033

Market Overview:

The global high-frequency trading server market size reached USD 470.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 738.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.63% during 2025-2033. The global market is majorly driven by high liquidity and market volatility, the increasing access to real-time market information, the evolution of cloud-based trading infrastructure, the rising investment in financial technology, and the growing need for efficient trade execution are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 470.1 Million |

| Market Forecast in 2033 | USD 738.1 Million |

| Market Growth Rate 2025-2033 | 4.63% |

A high-frequency trading (HFT) server is a powerful, sophisticated computer system that executes financial transactions at extremely high speeds. These servers use complex algorithms to analyze market data and execute trades in fractions of a second. They are strategically located near stock exchanges to minimize latency and gain a competitive edge. HFT servers require specialized hardware, such as fast processors, high-speed network connections, and advanced cooling systems, to handle the intense computational demands. It aims to capitalize on small price discrepancies and market inefficiencies, often making multiple trades quickly. The success of HFT relies on the server's ability to process data rapidly and make split-second decisions, contributing to the evolution of modern financial markets.

The global market is majorly driven by rapid technological advancements in hardware and software. In line with this, the expansion of global financial markets is significantly contributing to the market. Furthermore, the increasing adoption of algorithmic trading is positively influencing the market. Apart from this, the rising demand for low-latency trading solutions is catalyzing the market. Moreover, the growing availability of high-speed data feeds and the development of advanced trading algorithms are propelling the market. Besides, the regulatory changes shaping trading practices and the availability of co-location services near exchanges are strengthening the market. Additionally, the enhanced risk management tools and the growing integration of artificial intelligence in trading strategies are providing a boost to the market.

High-frequency Trading Server Market Trends/Drivers:

Increasing competition among trading firms for speed and accuracy

The intensifying competition among trading firms for speed and accuracy is stimulating the market. Firms relentlessly strive to gain a competitive edge by reducing execution times and enhancing precision in their trading strategies. This heightened competition has spurred innovation and investment in cutting-edge technologies, leading to faster and more efficient trading algorithms, high-speed data feeds, and advanced execution platforms. Trading firms are driven to optimize their infrastructure, employing state-of-the-art hardware and software solutions to achieve millisecond-level transaction speeds. This dynamic environment has resulted in a continuous cycle of advancements as firms push the boundaries of technological capabilities to outperform their rivals. The pursuit of speed and accuracy benefits individual firms and contributes to the evolution of high-frequency trading practices. As a result, the competitive landscape's intensity catalyzes sustained growth and innovation within the market.

The rising availability of high-frequency data analytics

The increasing availability of high-frequency data analytics is bolstering the market. With the advent of advanced data analytics tools, trading firms can extract valuable insights from vast volumes of real-time market data at microsecond intervals. This data-driven approach enables traders to uncover patterns, trends, and correlations that were previously inaccessible. As a result, firms can refine their trading algorithms, enhance decision-making processes, and develop more accurate predictive models. High-frequency data analytics empowers traders to adapt swiftly to market changes and capitalize on fleeting opportunities. The ability to process and interpret data quickly gives traders a competitive edge in devising strategies that capitalize on minute price discrepancies and volatility. Consequently, the growing availability of high-frequency data analytics propels the efficiency and profitability of individual trading operations and accelerates market growth.

The growing use of machine learning in trading models

The expanding utilization of machine learning in trading models offers numerous market opportunities. Machine learning algorithms excel at analyzing large volumes of complex market data to identify patterns, trends, and anomalies that human analysis might overlook. This capability enhances the accuracy of trading decisions and allows for the development of highly adaptive strategies. Machine learning enables trading firms to continuously refine their models based on real-time data, adapting swiftly to changing market conditions. These algorithms can recognize nuanced correlations between variables and optimize trading strategies accordingly. This approach significantly boosts the potential for profit while managing risks more effectively. As more firms integrate machine learning into their HFT operations, the market witnesses an accelerated pace of innovation and competitiveness. The incorporation of advanced technology not only elevates the capabilities of individual trading entities but also contributes to the overall expansion and dynamism of the high-frequency trading market.

High-frequency Trading Server Industry Segmentation:

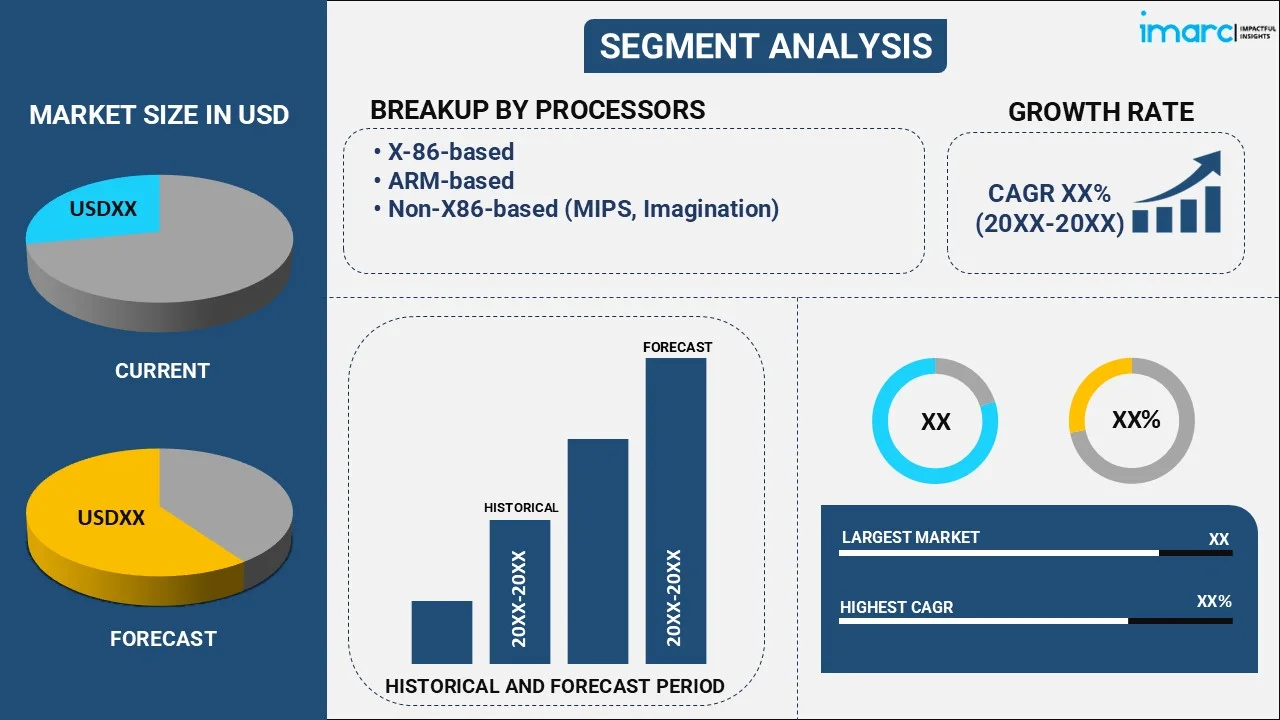

IMARC Group provides an analysis of the key trends in each segment of the global high-frequency trading server market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on the processor, form factor, and application.

Breakup by Processor:

- X-86-based

- ARM-based

- Non-x86-based (MIPS, Imagination)

X-86-based dominates the market

The report has provided a detailed breakup and analysis of the market based on processor. This includes X-86-based, ARM-based, and non-x86-based (MIPS, imagination). According to the report, X-86-based represented the largest segment.

X-86-based processors have long been the traditional choice for high-performance computing due to their robust processing power and compatibility with various software applications. Trading firms leveraging X-86-based processors benefit from established infrastructure, compatibility with existing algorithms, and access to a mature ecosystem of tools and resources. These processors continue to drive growth by enabling firms to enhance their trading strategies with advanced analytics, rapid data processing, and complex modeling.

On the other hand, the emergence of ARM-based processors represents a newer and increasingly relevant trend. ARM processors are known for their energy efficiency and scalability, making them suitable for applications requiring high processing power while minimizing power consumption. As HFT firms focus on reducing operational costs and environmental impact, ARM-based processors provide an appealing solution. Their efficiency facilitates real-time data analysis, making them well-suited for latency-sensitive trading operations.

The processor segmentation encourages healthy competition between X-86-based and ARM-based solutions, prompting innovation and driving market growth. Trading firms can choose the processor type that aligns best with their specific needs, leading to a diversified market landscape where established players and newcomers contribute to the evolution of HFT technology. This dynamic environment fosters continuous advancements in hardware and software, ultimately propelling the high-frequency trading market's expansion and sophistication.

Breakup by Form Factor:

- 1U

- 2U

- 4U

- Others

2U dominates the market

The report has provided a detailed breakup and analysis of the market based on form factor. This includes 1U, 2U, 4U, and others. According to the report, 2U represented the largest segment.

2U servers provide a balance between compactness and expandability. They offer additional room for hardware components, making them suitable for HFT firms that require more processing power, memory, or storage. 2U servers are often used for complex algorithmic trading strategies that demand intensive computational resources.

1U servers, known for their compact design, on the other hand, offer high density in a limited space. They are favored by firms looking to maximize their server count in data centers, enhancing their processing capabilities without requiring excessive physical space. These servers are well-suited for strategies that require a high frequency of trades within minimal latency periods.

Moreover, 4U servers, with their larger size, offer the most scalability and expandability. They are ideal for trading firms engaging in extremely data-intensive operations, such as analyzing vast amounts of historical data or running intricate simulations. These servers are commonly used for research and quantitative analysis, allowing firms to develop and test new trading strategies.

Breakup by Application:

- Equity Trading

- Forex Markets

- Commodity Markets

- Others

Equity trading dominates the market

The report has provided a detailed breakup and analysis of the market based on application. This includes equity trading, forex markets, commodity markets, and others. According to the report, equity trading represented the largest segment.

Equity trading remains a primary driver of HFT market growth. High-frequency trading in equity markets is characterized by rapid execution of buy and sell orders, leveraging algorithms that capitalize on fleeting price discrepancies. Processing and responding to market data within milliseconds enables traders to execute trades at optimal prices, enhancing profitability. The constant quest for speed, accuracy, and efficiency fuels the adoption of cutting-edge technologies in equity-focused HFT operations, driving the market forward.

Furthermore, forex HFT relies on real-time analysis of currency pairs, allowing traders to capitalize on minuscule exchange rate fluctuations. The global nature of forex trading necessitates swift execution across different time zones, making high-frequency strategies particularly advantageous. The ability to process vast amounts of data and execute trades at lightning speeds is crucial in this segment, contributing to market growth.

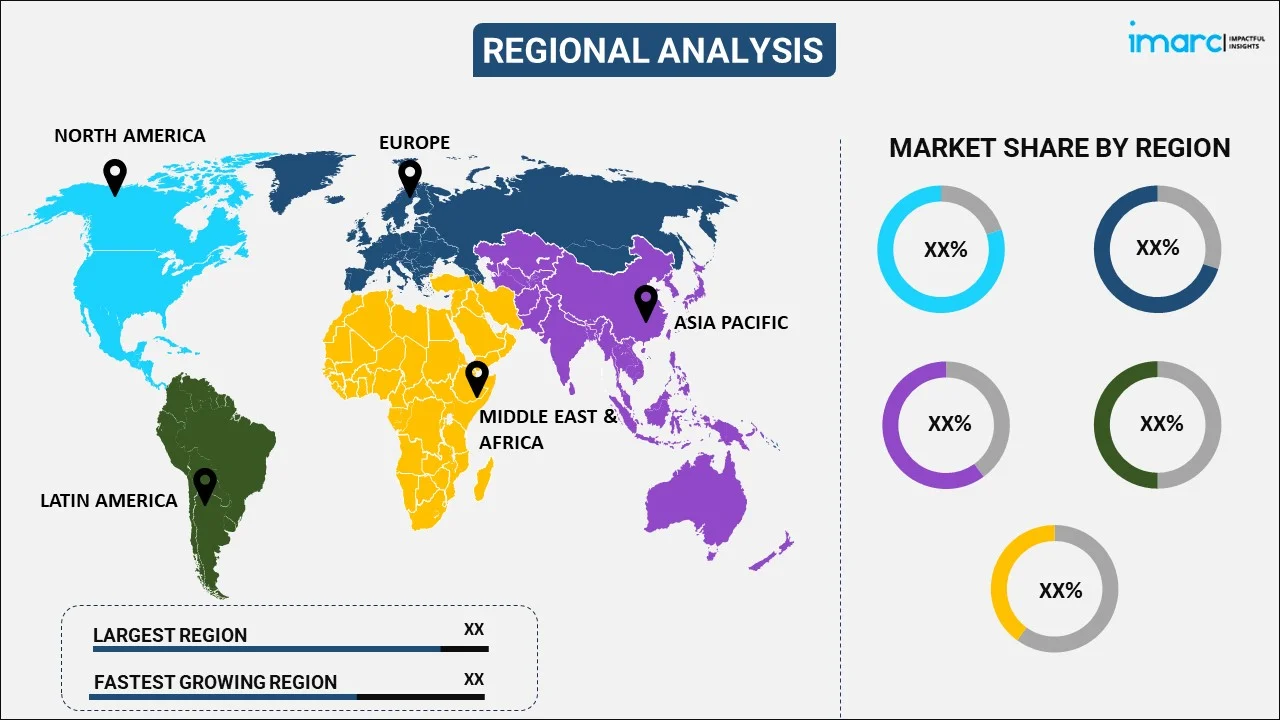

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America holds the leading position in the market.

North America, particularly the United States, has historically been a major hub for high-frequency trading. The presence of prominent stock exchanges, advanced technological infrastructure, and a robust regulatory framework has attracted substantial HFT activity. This region's emphasis on low-latency connections, high-speed data feeds, and proximity to exchanges has spurred innovation and technological advancements, driving market growth as trading firms vie for competitive advantage.

Furthermore, Europe has emerged as another significant contributor to HFT market growth. European financial markets offer diverse trading opportunities across various asset classes. The region's adoption of MiFID II regulations to increase market transparency and efficiency has fueled the demand for advanced trading technologies. The proximity of European financial centers to one another has fostered cross-border trading, prompting the development of high-speed trading strategies to capture arbitrage opportunities.

Competitive Landscape:

Top companies are strengthening the market by constantly pushing the boundaries of technological innovation. These companies invest heavily in research and development to engineer cutting-edge hardware and software solutions tailored to the demanding requirements of high-frequency trading. Trading firms can execute transactions with unparalleled speed and precision by providing powerful server systems with fast processors, high-speed network interfaces, and low-latency components. Additionally, these companies offer advanced co-location services, strategically positioning their servers near major stock exchanges to minimize latency. This proximity enhances execution speeds and responsiveness, giving traders a competitive advantage. Through continuous advancements in cooling systems, network infrastructure, and data analysis tools, top high-frequency trading server companies empower traders to make split-second decisions and capitalize on fleeting market opportunities.

The report has provided a comprehensive analysis of the competitive landscape in the high-frequency trading server market. Detailed profiles of all major companies have also been provided.

- ASA Computers Inc.

- Blackcore Technologies

- Business Systems International Ltd.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Hypershark Technologies Corp.

- Hypertec Group Inc.

- Xenon Systems Pty Ltd.

High-frequency Trading Server Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Processors Covered | X-86-based, ARM-based, Non-X86-based (MIPS, Imagination) |

| Form Factors Covered | 1U, 2U, 4U, Others |

| Applications Covered | Equity Trading, Forex Markets, Commodity Markets, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ASA Computers Inc., Blackcore Technologies, Business Systems International Ltd., Dell Inc., Hewlett Packard Enterprise Development LP, Hypershark Technologies Corp., Hypertec Group Inc., Xenon Systems Pty Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global high-frequency trading server market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global high-frequency trading server market?

- What is the impact of each driver, restraint, and opportunity on the global high-frequency trading server market?

- What are the key regional markets?

- Which countries represent the most attractive high-frequency trading server market?

- What is the breakup of the market based on the processor?

- Which is the most attractive processor in the global high-frequency trading server market?

- What is the breakup of the market based on the form factor?

- Which is the most attractive form factor in the global high-frequency trading server market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the global high-frequency trading server market?

- What is the competitive structure of the global high-frequency trading server market?

- Who are the key players/companies in the global high-frequency trading server market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the high-frequency trading server market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global high-frequency trading server market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the high-frequency trading server industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)