High Pressure Washer Market Size, Share, Trends and Forecast by Product Type, Temperature, PSI, Driving Force, Application, and Region, 2025-2033

High Pressure Washer Market Size and Share:

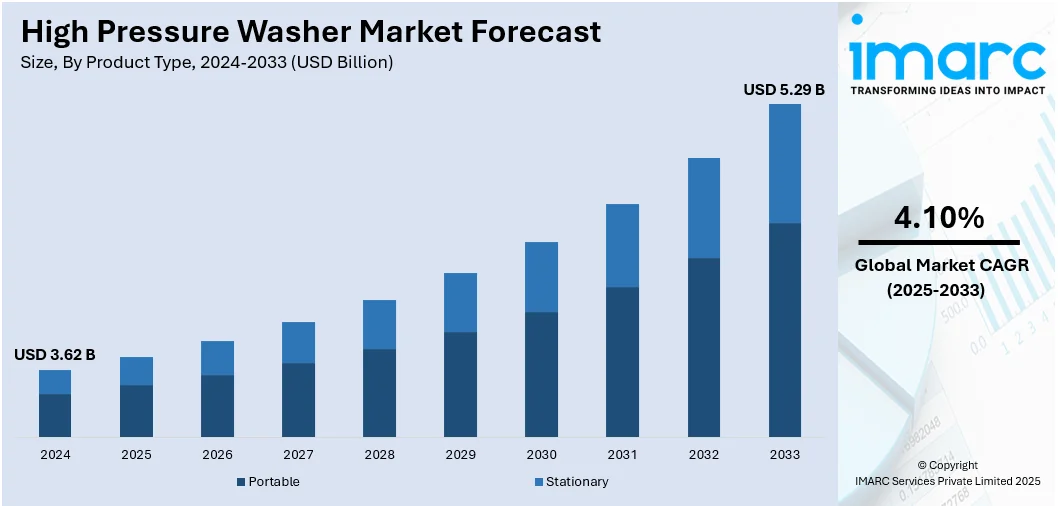

The global high pressure washer market size was valued at USD 3.62 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.29 Billion by 2033, exhibiting a CAGR of 4.10% from 2025-2033. North America currently dominates the market, holding a market share of 36.7% in 2024. The market is primarily driven by the escalating demand for efficient cleaning solutions that save time, water, and labor compared to traditional methods. Rising adoption across construction and automotive industries further supports high pressure washer market share, as these sectors require reliable equipment for maintaining cleanliness, durability, and performance. Additionally, continuous technological advancements, including eco-friendly models, cordless options, and adjustable pressure settings, enhance product efficiency and user convenience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.62 Billion |

|

Market Forecast in 2033

|

USD 5.29 Billion |

| Market Growth Rate 2025-2033 | 4.10% |

One major driver in the high-pressure washer market is the growing demand for efficient cleaning solutions across residential, commercial, and industrial sectors. Rising urbanization and higher hygiene standards are increasing the need for advanced cleaning equipment that saves time, labor, and resources. For example, high-efficiency household washers can reduce water use by 20%–66% and energy consumption by 20%–50% compared to traditional models, showcasing the value of resource-saving technologies. Similarly, modern pressure washers support eco-friendly cleaning by consuming less water and reducing reliance on harsh chemicals. This combination of efficiency, sustainability, and performance is fueling the market’s steady high pressure washer market growth.

To get more information on this market, Request Sample

The United States high-pressure washer industry holds a share of 87.50% owing to the rising demand from residential, commercial, and industrial customers in need of efficient and time-saving cleaning tools. Increased awareness regarding hygiene, and growing usage within industries including automotive, construction, and farming, drives market growth. Owners of homes also play an important role and use pressure washers for exterior cleaning activities such as driveways, decks, and patios. Besides, the nation's interest in water saving and environmental-friendly cleaning is driving the demand for newer, energy-efficient models. Technological advancements, the availability of electric and gas-powered equipment, and the availability of leading manufacturers make the U.S. high pressure washer market outlook even stronger.

High Pressure Washer Market Trends:

Rising Demand for Efficient and Time-Saving Cleaning Solutions

The growing demand for speedy, efficient, and economical cleaning processes is a key driver of the high-pressure washer industry. Existing cleaning processes involve manual labor that takes a lot of time, heavy water consumption, and longer cleaning cycles. Compared to these, high-pressure washers provide rugged cleaning performance, considerably saving time and effort. Industries including automotive, construction, manufacturing, and agricultural rely significantly on these machines to service equipment, sweep surfaces, and provide smooth operations. Moreover, the home market is also experiencing increasing demand for these products since homeowners utilize them in cleaning vehicles, driveways, decks, and patios. The consumers appreciate their capability to provide professional-grade cleaning outcomes with a limited amount of resources. The movement toward productivity and convenience is thus driving massive adoption, making high-pressure washers a necessary tool in residential, commercial, and industrial use.

Increasing Focus on Water Conservation and Eco-Friendly Cleaning

Environmental concerns and the growing focus on sustainable practices are key drivers in the high-pressure washer market trends. Traditional cleaning methods consume large amounts of water and often rely on chemical detergents, increasing environmental impact. High-pressure washers, however, use advanced technology to deliver powerful cleaning while significantly reducing water consumption—up to 80% less than standard garden hoses. For instance, cleaning patio furniture requires only 20 liters with a pressure washer compared to 100 liters with a hose. Many models also minimize chemical usage, supporting eco-friendly cleaning practices. In regions like North America and Europe, where water conservation policies are emphasized, demand for these solutions is particularly strong. Adoption aligns with both regulatory requirements and consumer preferences for sustainable products. As households and industries prioritize efficiency and eco-conscious solutions, high-pressure washers continue to grow as essential tools for environmentally responsible cleaning.

Technological Advancements and Product Innovation

Technological changes and ongoing product innovation are revolutionizing the high-pressure washer market analysis. Companies are launching models with better features like variable pressure setting, hot and cold water, comfortable designs, and intelligent connectivity for a better user experience. Battery-operated and cordless models are also becoming popular, particularly for homes and light commercial purposes, with increased convenience and portability. Moreover, industrial machines are being modernized with energy-saving motors, sound-reduction systems, and durable components to keep pace with heavy-duty requirements. Customization is also being made possible through innovation, enabling customers to select washers that suit their unique cleaning requirements. Not only do these improvements yield better performance but also draw a broader consumer base from various industries. With increasing consumer demands for durability, efficiency, and versatility, continued innovation is a key motivator driving market growth and competitive differentiation.

High Pressure Washer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global high pressure washer market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, temperature, PSI, driving force, and application.

Analysis by Product Type:

- Portable

- Stationary

Portable high-pressure washers are compact, lightweight, and easy to move, making them highly suitable for residential and light commercial applications. They are ideal for cleaning vehicles, patios, and small outdoor areas. Their affordability, convenience, and versatility drive widespread adoption among households and small businesses seeking efficient cleaning solutions.

Besides this, the stationary high-pressure washers are heavy-duty systems designed for industrial and large-scale commercial use. Installed at fixed locations, they deliver consistent, powerful performance for cleaning machinery, equipment, and large surfaces. Known for durability and high capacity, they are preferred in sectors like manufacturing, agriculture, and construction, where continuous, intensive cleaning is required.

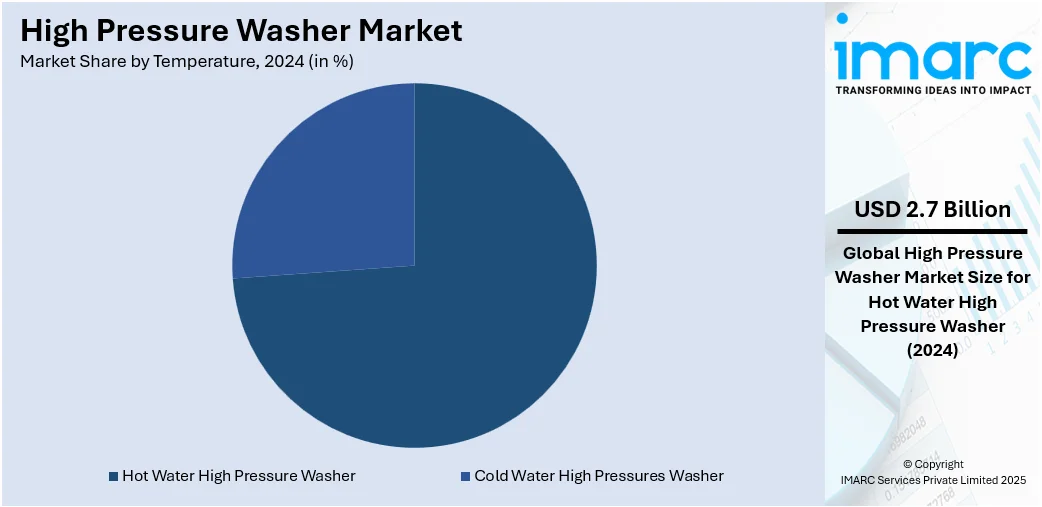

Analysis by Temperature:

- Cold Water High Pressures Washer

- Hot Water High Pressure Washer

Based on the high-pressure washer market forecast, the hot water high-pressure washers account for the majority of shares of 73.5% driven by their superior cleaning efficiency and ability to remove grease, oil, and stubborn residues that cold water models cannot easily tackle. They are widely adopted across industries such as automotive, agriculture, food processing, and construction, where deep cleaning and sanitation are critical. Hot water models not only improve cleaning effectiveness but also reduce the need for harsh detergents, aligning with the growing demand for eco-friendly solutions. Their ability to deliver faster results enhances productivity and lowers operational costs, making them highly attractive for commercial and industrial users. This combination of performance, sustainability, and cost-effectiveness drives their dominance in the global high-pressure washer market.

Analysis by PSI:

- Upto 1,500

- 1,500-3,000

- 3,001-6,000

- 6,001-10,000

- Above 10,000

The 3,001–6,000 PSI range is the most shares held in the high-pressure washer industry due to its adaptability and applicability on both commercial and industrial uses. This pressure range gives optimal cleaning performance suitable for heavy-duty applications like cleaning tough dirt, grease, paint, and debris from construction machines, cars, and large areas. It achieves a balance between safety and efficiency, which makes it more versatile than lower PSI models and does not have the excessive force of higher ranges that could hurt surfaces. Automotive, agriculture, and construction sectors are among those that depend on this range for daily operations and maintenance. Its widespread usage, long lifespan, and high demand in various industries make the 3,001–6,000 PSI range the leading category in the market.

Analysis by Driving Force:

- Electric Based

- Gasoline Based

Electrical high-pressure washers hold most of the shares because they are convenient to use, not expensive, and environmentally friendly compared to gas-powered washers. They are highly used in residential and light commercial settings because they are light, easy to operate, and need little maintenance. Their quieter operation and absence of direct emissions make them ideal for indoor and city use in line with the increasing demand for clean and sustainable cleaning solutions. In addition, technological advancements in electric technology, such as cordless type, greater motor efficiency, and variable pressure settings, have increased their applicability in various applications. Having a broad range of products available at affordable prices further supports consumer choice, making electric-based washers hold the largest market share worldwide.

Analysis by Application:

- Construction

- Municipal

- Mining

- Agriculture

- CVCC (Commercial Vehicle Cleaning Centers)

- Oil and Gas

- Homeowner

- Food and Pharmaceuticals

- Others

Agriculture accounts for the majority of shares in the high-pressure washer market, driven by the sector’s extensive need for reliable and efficient cleaning equipment. Farms and agricultural facilities require frequent cleaning of machinery, vehicles, animal shelters, and storage areas to ensure smooth operations, prevent contamination, and maintain hygiene standards. High-pressure washers provide an effective solution by removing dirt, mud, and residues quickly while reducing water consumption compared to traditional cleaning methods. Their ability to improve productivity, extend equipment lifespan, and support compliance with health and safety regulations makes them highly valuable in agriculture. As farms modernize and adopt advanced technologies, the demand for durable, high-capacity pressure washers continues to grow, solidifying agriculture’s dominant share in the market.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America is the leading region in the high-pressure washer market due to its strong industrial base, advanced infrastructure, and widespread adoption across residential, commercial, and industrial sectors. The region’s construction and automotive industries significantly drive demand, as high-pressure washers are essential for equipment maintenance, vehicle cleaning, and surface preparation. Growing awareness of hygiene, water conservation, and eco-friendly cleaning practices further fuels adoption. Technological advancements, such as cordless and energy-efficient models, are quickly embraced by North American consumers, enhancing market growth. Additionally, the presence of a large consumer base, higher disposable incomes, and well-established distribution channels strengthen the region’s dominance, making North America a key hub for innovation and demand in the high-pressure washer industry.

Key Regional Takeaways:

United States High Pressure Washer Market Analysis

United States is witnessing rising high pressure washer adoption due to increasing construction projects across commercial, industrial, and residential sectors. For instance, total new construction spending is projected to reach USD 2.15 Trillion in 2025, hitting USD 2.34 Trillion by 2028 in the US. The demand for efficient cleaning equipment on construction sites has surged, as contractors emphasize surface preparation, machinery maintenance, and debris removal. Expansion in infrastructure development such as roads, bridges, and buildings is contributing to frequent high-pressure cleaning requirements. Seasonal maintenance and post-construction cleaning further drive usage. High pressure washers support operational efficiency and reduce labour-intensive processes, making them a preferred choice for construction contractors. Integration of advanced pressure control technologies and portable washer units aligns well with the evolving needs of construction projects.

Asia Pacific High Pressure Washer Market Analysis

Asia-Pacific has observed growing high pressure washer adoption supported by expanding investment in water treatment facilities. For instance, Indian Investment Grid showcases 566 investment projects in Water Treatment Plants subsector in India worth USD 60.46 Billion. Increasing industrialization and urbanization are driving demand for water purification and wastewater treatment solutions, where high pressure washers are vital for cleaning tanks, pipelines, and filters. Governments and private entities are injecting capital into upgrading water infrastructure, leading to consistent use of durable and high-performance cleaning equipment. Rapid industrial discharge and regulatory pressure for clean water standards necessitate efficient cleaning in treatment units. High pressure washers enable quick removal of biofilms, sediments, and scaling, ensuring smooth operation of filtration systems.

Europe High Pressure Washer Market Analysis

Europe is experiencing increasing high pressure washer adoption due to the expanding food and pharmaceuticals sector. For instance, in 2025, there are 3,731 food processing startups in Europe which include Novozymes, Butternut Box, Bella and Duke, Lesaffre, Greencore. Out of these, 998 startups are funded, with 645 having secured Series A+ funding. As hygiene and compliance remain critical in both industries, the demand for powerful cleaning systems is rising. High pressure washers play a pivotal role in maintaining cleanliness across food production units, pharmaceutical plants, and packaging facilities. Strict health regulations require periodic deep cleaning of equipment and surfaces, where these washers ensure minimal residue and contamination. The growth of food processing hubs and pharmaceutical manufacturing plants fuels demand for efficient sanitation solutions. In sensitive environments, electrically driven and noise-reduced washer models are gaining popularity.

Latin America High Pressure Washer Market Analysis

Latin America is registering increasing high pressure washer adoption driven by expanding mining activities. According to International Energy Association, Latin America, rich in critical minerals, is projected to reach USD 154 Billion in mining and refining value amid regulatory reforms to attract foreign capital. As mining operations intensify, the need for heavy-duty cleaning of machinery, vehicles, and extraction zones becomes vital. High pressure washers offer efficient removal of dirt, grease, and residues, ensuring uninterrupted equipment performance. Their ability to function under rugged conditions supports mining operations in both surface and underground environments.

Middle East and Africa High Pressure Washer Market Analysis

Middle East and Africa are seeing greater high pressure washer adoption propelled by expanding oil and gas projects. According to International Energy Association, the Middle East is set to invest about USD 130 Billion in oil and gas supply in 2025, around 15% of the global total. Regular maintenance of pipelines, rigs, and processing units demands effective cleaning solutions that withstand harsh industrial conditions. High pressure washers are valued for their ability to eliminate oil residues, sediments, and corrosive buildup.

Competitive Landscape:

The competitive landscape of the high-pressure washer market is characterized by strong rivalry among global, regional, and local manufacturers offering a wide range of products across residential, commercial, and industrial segments. Competition is largely driven by innovation, product differentiation, pricing strategies, and distribution networks. Companies focus on developing advanced, eco-friendly, and energy-efficient models to meet growing consumer demand for sustainable cleaning solutions. Technological advancements, such as smart connectivity, ergonomic designs, and cordless options, are intensifying market competition. Additionally, firms compete by enhancing after-sales services, expanding e-commerce presence, and strengthening global supply chains. The market also sees fragmentation, with premium brands targeting industrial applications and cost-effective players catering to price-sensitive customers. Overall, innovation, sustainability, and customer-centric solutions remain the key factors shaping competitive strategies and defining success in the high-pressure washer market.

The report provides a comprehensive analysis of the competitive landscape in the high-pressure washer market with detailed profiles of all major companies, including:

- Alfred Kärcher SE & Co. KG

- Annovi Reverberi Spa

- Brigs & Stratton AG

- Deere & Company

- Generac Power System Inc.

- IPC Tools Spa (Tennant Company)

- Koki Holdings Co. Ltd.

- Lavorwash S.p.A

- Makita Corporation

- Nilfisk Group

- Robert Bosch GmbH

- Simpson

- Stanley Black & Decker Ltd.

Latest News and Developments:

- July 2025: SHIWO High Pressure Washer Factory launched two new high pressure washer models, W21 and W22, in China to meet growing demand for efficient, portable cleaning equipment. The W21 featured a real-time pressure gauge and easy-maintenance design aimed at enhancing user safety and reducing upkeep costs.

- May 2025: Makita launched the DHW180 LXT high pressure washer, powered by an 18V LXT Li-ion battery, featuring five spray modes, 24-bar pressure, and up to 82 minutes run time, making it ideal for light-duty outdoor cleaning with versatile water sourcing options.

- March 2025: Greenworks unveiled its most powerful hybrid electric high pressure washer—the 60V 3000 PSI Hybrid Pressure Washer—offering both corded and battery-powered operation for unmatched portability and cleaning performance across surfaces like concrete, vehicles, and fences. Launched in March 2025, the model featured up to 2 GPM output and was made available through Walmart and Greenworks' official platforms.

- January 2025: Apellix launched the US1 Power Wash Drone, enhancing high pressure washer applications by offering safer and more efficient industrial cleaning with advanced navigation, collision avoidance, and improved water resistance, replacing hazardous manual labor.

- January 2025: DYNASET introduced its new EPW Electric High-Pressure Washer Pump Range, offering efficient, compact solutions for both mobile and static applications by converting electric power into high-pressure water; the DC version catered to battery-powered machinery like electric excavators and service vehicles without needing separate inverters.

High Pressure Washer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Portable, Stationary |

| Temperature Covered | Cold Water High Pressures Washer, Hot Water High Pressure Washer |

| PSI Covered | Upto 1,500, 1,500-3,000, 3,001-6,000, 6,001-10,000, Above 10,000 |

| Driving Forces Covered | Electric Based, Gasoline Based |

| Applications Covered | Construction, Municipal, Mining, Agriculture, CVCC (Commercial Vehicle Cleaning Centers), Oil and Gas, Homeowner, Food and Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alfred Kärcher SE & Co. KG, Annovi Reverberi Spa, Briggs & Stratton AG, Deere & Company, Generac Power System Inc., IPC Tools Spa (Tennant Company), Koki Holdings Co. Ltd., Lavorwash S.p.A, Makita Corporation, Nilfisk Group, Robert Bosch GmbH, Simpson, and Stanley Black & Decker Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the high pressure washer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global high pressure washer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the high pressure washer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The high-pressure washer market was valued at USD 3.62 Billion in 2024.

The high-pressure washer market is projected to exhibit a CAGR of 4.10% during 2025-2033, reaching a value of USD 5.29 Billion by 2033.

Key factors driving the high-pressure washer market include rising demand for efficient and time-saving cleaning solutions, growing adoption in residential, commercial, and industrial sectors, increasing focus on water conservation and eco-friendly practices, and rapid technological advancements offering enhanced features, energy efficiency, and user-friendly designs.

Hot water high-pressure washers dominate the market with a market share of 73.5% due to their superior cleaning power, effectively removing grease, oil, and tough residues. Their ability to sanitize surfaces and handle industrial cleaning tasks makes them essential in sectors like automotive, manufacturing, and food processing, driving higher adoption compared to cold water models.

The 3,001–6,000 PSI high-pressure washers lead the market because they offer optimal power for diverse cleaning tasks. Their versatility suits both commercial and industrial applications, efficiently handling heavy-duty grime, grease, and debris while remaining manageable, making them the preferred choice for businesses seeking performance and reliability.

Electric high-pressure washers dominate the market due to their ease of use, lower cost, and eco-friendly operation. They produce less noise, emit no direct pollutants, and require minimal maintenance, making them ideal for residential and light commercial applications, driving higher adoption compared to gas-powered alternatives.

Agriculture leads the high-pressure washer market due to its extensive cleaning demands. Farmers rely on these machines to maintain machinery, sanitize equipment, and clean livestock areas efficiently. High-pressure washers save time, reduce labor, and ensure hygiene, making them essential tools for agricultural operations and driving significant market adoption.

North America leads the high-pressure washer market with a market share of 36.7% owing to its robust industrial sector, advanced infrastructure, and high adoption across residential, commercial, and industrial applications. Strong demand for efficient cleaning solutions, coupled with technological innovation and eco-friendly practices, further drives market growth and maintains the region’s dominant position.

Some of the major players in the high-pressure washer market include Alfred Kärcher SE & Co. KG, Annovi Reverberi Spa, Briggs & Stratton AG, Deere & Company, Generac Power System Inc., IPC Tools Spa (Tennant Company), Koki Holdings Co. Ltd., Lavorwash S.p.A, Makita Corporation, Nilfisk Group, Robert Bosch GmbH, Simpson, and Stanley Black & Decker Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)