High Purity Alumina Market Size, Share, Trends and Forecast by Purity Level, Production Method, Application, and Region, 2026-2034

High Purity Alumina Market Overview:

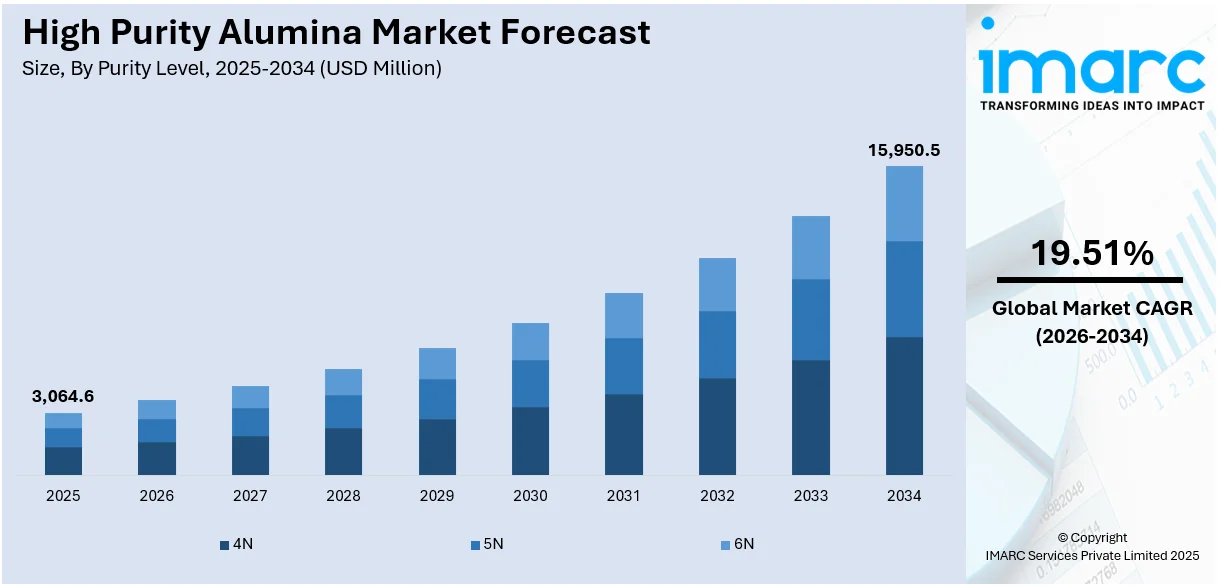

The global high purity alumina market size was valued at USD 3,064.6 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 15,950.5 Million by 2034, exhibiting a CAGR of 19.51% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 75.0% in 2025. The leadership can be attributed to the region’s strong presence in electronics manufacturing, rising demand for LED lighting, and rapid electric vehicle adoption. Government support for clean technologies and large-scale battery production in countries like China and Japan further boost regional dominance in high purity alumina market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3,064.6 Million |

|

Market Forecast in 2034

|

USD 15,950.5 Million |

| Market Growth Rate 2026-2034 | 19.51% |

The market is driven by increasing demand from industries such as LED lighting, electric vehicles, and semiconductors, where superior thermal and mechanical properties are critical. The rising preference for energy-efficient lighting systems has significantly boosted the consumption of HPA in LED manufacturing. Additionally, the growing adoption of lithium-ion batteries in portable electronics and EVs fuels the need for HPA-coated separators to enhance safety and performance. The expansion of advanced ceramics applications in medical, aerospace, and defense industries further contributes to market growth. Strategic investments in refining technologies and the emergence of cost-effective production methods are also encouraging wider adoption.

To get more information on this market Request Sample

The United States high purity alumina market growth is propelled by advancements in the domestic electric vehicle sector, which is increasingly dependent on HPA for battery separators. The growing demand for high-performance electronics and LED displays drives local consumption due to the superior optical and thermal characteristics of HPA. For instance, the U.S. Energy Department anticipates that by 2035, the nation will complete most of its lighting installation projects, with LED lighting technology, particularly ENERGY STAR-certified products, becoming widespread in the residential sector. These ENERGY STAR-qualified products are designed to use approximately 75% less energy compared to traditional LCD lighting. Government incentives promoting clean energy technologies and domestic manufacturing further stimulate market expansion. Increased research and development initiatives within U.S. technology firms are accelerating innovations in semiconductors and sapphire substrates, both of which require HPA. Additionally, the country’s focus on securing raw material supply chains and developing sustainable production processes strengthens its market position.

High Purity Alumina Market Trends:

Rising Demand from the Electronics Industry

Significant growth in the electronics industry is a major trend shaping the high purity alumina (HPA) market. The global consumer electronics market, valued at USD 1,214.11 billion in 2024, is expected to grow at a CAGR of 6.6% from 2025 to 2030. HPA is critical for manufacturing semiconductors used in personal computers, tablets, gaming consoles, televisions, and servers. Additionally, the surge in LED lighting demand, driven by the global transition from incandescent bulbs to energy-efficient LED variants, has strengthened HPA consumption. Its role in ensuring superior thermal performance and high durability makes it indispensable in electronics manufacturing, while ongoing technological advancements and miniaturization of devices further create a favorable high purity alumina market outlook.

Expansion of Electric Vehicles and Battery Technologies

The rapid adoption of electric vehicles (EVs) is boosting the demand for HPA, which is extensively used in coating lithium-ion (Li-ion) battery separators to enhance efficiency, safety, and longevity. According to the International Energy Agency (IEA), global electric car sales reached nearly 14 million units in 2024, marking a 35% increase compared to 2022. HPA improves the thermal stability and mechanical strength of EV batteries, reducing risks of overheating while optimizing performance. As nations implement stricter emission standards and offer incentives for EV adoption, manufacturers are increasing battery production capacities, thereby driving the consumption of HPA. The shift towards sustainable mobility solutions is expected to further fuel market growth.

Advancements in Medical and Sapphire Applications

Innovations in medical bio-ceramics and sapphire production are emerging as key market trends for HPA. The development of ready-to-use bio-ceramics for orthopedic and dental implants highlights its growing use in healthcare due to superior purity and biocompatibility. Additionally, HPA’s application in producing defect-free sapphire, a material widely utilized in LED substrates, optical components, and high-performance watch crystals, is expanding. Sapphire’s durability and scratch resistance are enhancing its adoption in smartphones and luxury products. For instance, in March 2024, Advanced Energy Minerals (AEM) announced significant progress in producing low-emission High Purity Alumina (HPA), a key material for manufacturing sapphire components used in LED lighting and watch covers. The Québec-based facility, powered entirely by renewable energy, has reduced CO₂ emissions from traditional levels of 12.3 tons per ton of HPA to nearly zero. The increasing focus on research and development (R&D) to create advanced ceramics and improve crystal lattice quality is further boosting HPA demand across diverse industrial applications, including aerospace and defense sectors.

High Purity Alumina Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global high purity alumina market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on purity level, production method, and application.

Analysis by Purity Level:

- 4N

- 5N

- 6N

4N stands as the largest segment in 2025, holding around 42.0% of the market. The 4N segment dominates the high purity alumina (HPA) market due to its widespread use in key applications that demand high thermal stability, superior chemical resistance, and exceptional optical clarity. It is a critical material for manufacturing LED substrates, lithium-ion battery separators, and advanced electronic components, where even minor impurities can affect performance and efficiency. The rapid growth of the LED lighting industry and electric vehicle sector has further amplified its demand. Moreover, 4N HPA offers a cost-effective balance between ultra-high purity and performance, making it the preferred choice for industries seeking reliability and scalability.

Analysis by Production Method:

- Hydrolysis of Aluminium Alkoxide

- Hydrochloric Acid Leaching

- Others

Hydrolysis of aluminium alkoxide stand as the largest component in 2025. The hydrolysis of aluminium alkoxide segment dominates the high purity alumina (HPA) market due to its ability to produce HPA with superior purity levels, typically exceeding 99.99%, which is critical for high-end applications such as LEDs, semiconductors, and lithium-ion batteries. This process offers greater control over particle size, morphology, and surface area, ensuring high consistency and quality of the final product. Additionally, the method is energy-efficient and generates fewer impurities compared to alternatives like the thermal decomposition of aluminium salts. Its scalability and cost-effectiveness make it the preferred production route, driving its widespread adoption in the HPA industry.

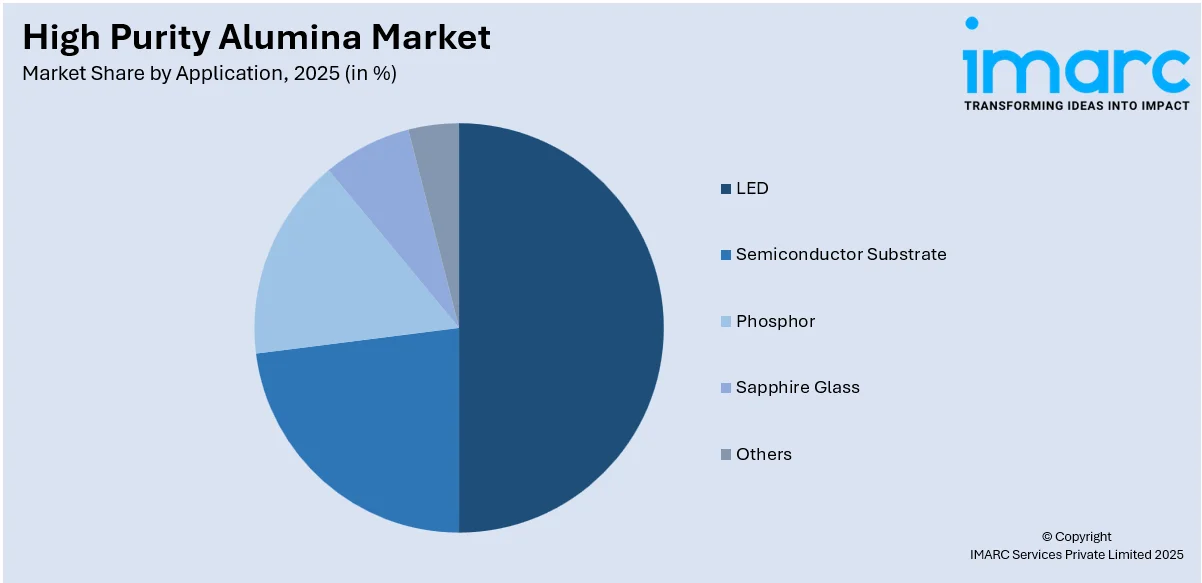

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- LED

- Semiconductor Substrate

- Phosphor

- Sapphire Glass

- Others

LED leads the market with around 49.6% of market share in 2025. The LED segment dominates the high purity alumina (HPA) market due to the critical role of HPA in producing high-quality sapphire substrates, which are essential for LED manufacturing. HPA ensures exceptional thermal conductivity, durability, and optical clarity, making it indispensable for energy-efficient LED lighting. The global shift toward sustainable lighting solutions, driven by rising environmental awareness and stringent regulations to phase out incandescent and fluorescent bulbs, has accelerated LED adoption. Additionally, the demand for LEDs in automotive, consumer electronics, and display technologies continues to rise, further solidifying the segment’s leadership in the HPA market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 75.0%. The Asia-Pacific segment dominates the high purity alumina (HPA) market due to the region’s strong presence of consumer electronics, LED manufacturing, and electric vehicle (EV) industries. Countries like China, Japan, and South Korea are global leaders in semiconductor and battery production, both of which rely heavily on HPA for superior performance and efficiency. The rising demand for energy-efficient LED lighting, coupled with government initiatives supporting clean energy and EV adoption, further drives consumption. For instance, in April 2024, Australia’s federal Labor government approved AUD 400 Million (USD 256 Million) in loans for a high-purity alumina (HPA) processing facility under its Future Made in Australia policy. Additionally, the availability of cost-effective raw materials, advanced manufacturing facilities, and robust R&D investments strengthen the region’s leadership in HPA production and utilization.

Key Regional Takeaways:

United States High Purity Alumina Market Analysis

In 2025, the United States held a market share of around 75.0% in North America. The United States' high-purity alumina market is primarily driven by the growing demand for HPA in semiconductor manufacturing. The CHIPS and Science Act positioned the U.S. to capture a larger share of private investment in semiconductor manufacturing. As of August 2024, over 90 new projects were announced, amounting to nearly USD 450 Billion across 28 states. In line with this, the critical use of the mineral in LED lighting and sapphire substrates for advanced technologies such as AI and 5G is propelling market growth. The expansion of electric vehicle production and lithium-ion battery manufacturing is fueling the demand for HPA in battery separators. Furthermore, favorable government initiatives focused on critical minerals, including U.S. Department of Energy funding for HPA projects, are driving the market forward. The increasing shift toward energy-efficient and sustainable lighting solutions is also encouraging the uptake of HPA in the lighting sector. The U.S. Department of Energy awarded USD 11.5 Million for LED lighting projects in various public spaces, including parks and police stations, as part of a USD 17.7 Million initiative to enhance energy efficiency across 25 states. Moreover, ongoing innovations in extraction and production technologies are reducing costs and enhancing efficiency, contributing to a more competitive and scalable market.

Europe High Purity Alumina Market Analysis

The European market is experiencing growth due to the rising demand for energy-efficient applications, including LED lighting and semiconductor substrates. In accordance with this, the increasing adoption of electric vehicles is driving the need for HPA in battery separators, further strengthening market demand. The European electric vehicle market is experiencing rapid growth in 2025, with over 2.2 million electrified vehicles registered from January to April, representing a 20% increase from the same period in 2024, according to the European Automobile Manufacturers' Association. The region's stringent environmental regulations are propelling the use of HPA in sustainable technologies, facilitating market expansion. Similarly, the emerging trend of urbanization and the increasing demand for advanced materials in construction and electronics are also driving growth in the market. Additionally, favorable government initiatives and funding programs, such as the EU's Green Deal and Horizon Europe, are encouraging investments in critical minerals. The ongoing innovations in HPA production technologies are reducing costs and increasing scalability, making the market more competitive. Apart from this, strategic partnerships within the industry are accelerating the adoption of HPA technologies across Europe.

Asia Pacific High Purity Alumina Market Analysis

The Asia Pacific market for high purity alumina is largely propelled by the rapid expansion of semiconductor manufacturing, as HPA is essential for producing high-performance components. Additionally, the growing adoption of electric vehicles across the region is significantly amplifying HPA demand for lithium-ion batteries. Similarly, government support for green energy projects, including energy-efficient lighting and electric mobility, is fueling market growth. According to the NDRC, over 40% of China’s total energy generation capacity now comes from clean energy sources, partly driven by a pricing system that guarantees fixed rates for renewable energy sold to the grid. The rising demand for solar panels, which use HPA in their production, is further influencing the market trend. Industry research forecasted that China's solar PV capacity will grow sixteenfold by 2060, reaching a remarkable 4 TW. Furthermore, continual advancements in HPA production techniques, focusing on efficiency and cost-effectiveness, are helping to expand the supply, thereby accelerating market adoption across multiple industries. Moreover, numerous regional collaborations and technological innovations are enhancing the market's competitiveness.

Latin America High Purity Alumina Market Analysis

In Latin America, the high purity alumina market is expanding due to increasing demand from the semiconductor industry, which requires advanced materials for high-performance applications. Furthermore, the growth of electric vehicle production, particularly in countries such as Brazil, is driving the demand for HPA in lithium-ion batteries. According to IEA data, Brazil registered 52,000 new electric vehicles (EVs) in 2023, marking a 181.1% increase over the previous year, with 33,000 more than the previous year, demonstrating the country's potential to support production and drive the transition to electromobility. Similarly, the rising adoption of LED lighting across the region is stimulating market accessibility, as it plays a key role in producing efficient phosphors. Moreover, favorable government incentives for renewable energy projects are fueling the market by driving the need for energy-efficient technologies, further promoting the use of HPA.

Middle East and Africa High Purity Alumina Market Analysis

The Middle East and Africa market is driven by the growing demand for advanced materials in semiconductor manufacturing, particularly for AI applications. Similarly, the region’s growing focus on energy-efficient LED lighting, is propelling HPA consumption. According to IMARC, the Saudi Arabia LED lights market size was valued at SAR 1492.9 Million in 2024 and is expected to grow at a CAGR of 12.03% during 2025-2033. As such. Furthermore, the rise of electric vehicle production and demand for lithium-ion batteries is stimulating the market appeal. Moreover, government efforts to diversify economies and invest in critical minerals are supporting the growth of HPA production capabilities across the region, also impelling the market development.

Competitive Landscape:

The competitive landscape of the high purity alumina market is characterized by continuous advancements in production technologies, strategic collaborations, and investments in research and development. Companies are focusing on developing cost-efficient processes to produce high-quality alumina with minimal environmental impact. The growing demand from sectors like LEDs, semiconductors, electric vehicles, and medical devices is encouraging manufacturers to expand their production capacities and diversify product grades. Key players are also targeting emerging markets in Asia-Pacific due to its robust electronics and automotive industries. The high purity alumina market forecast predicts increased competition, with new entrants adopting innovative techniques and sustainable production methods to meet the rising global demand for high-performance materials. For instance, in May 2024, Alpha HPA confirmed its final investment decision to launch large-scale High Purity Alumina (HPA) production in Gladstone, Queensland. The initiative was designed to develop the world’s largest single-site HPA refinery. Construction of the 10-hectare facility was scheduled to commence in mid-2024, generating 120 permanent local jobs and 300 additional roles during the construction phase. The project received significant financial backing from government bodies and private investors.

The report provides a comprehensive analysis of the competitive landscape in the high purity alumina market with detailed profiles of all major companies, including:

- Alcoa Corporation

- Altech Chemicals Limited

- Baikowski SAS

- Coorstek Inc. (Keystone Holdings LLC)

- Nippon Light Metal Holdings Company Ltd.

- Norsk Hydro ASA

- RusAL

- Sasol Limited

- Sumitomo Chemical Co. Ltd

- Zibo Honghe Chemical Co. Ltd.

Latest News and Developments:

- June 2025: Korea’s CIS Chemical secured investment from GENAXIS to expand its high-purity alumina and battery material production. Known for waste battery recycling and SSX technology, CIS Chemical plans factory expansion, new doping products, and global growth in semiconductors, displays, and rechargeable battery markets.

- June 2025: Alpha HPA awarded McCosker Contracting a USD 20 Million deal to build its USD 550 Million Stage 2 high-purity alumina plant in Gladstone. Backed by USD 400 Million in government debt and USD 180 Million equity, the facility will produce over 10,000 tonnes annually, augmenting regional jobs.

- May 2025: Andromeda Metals achieved a breakthrough by producing 99.9985% purity 4N High Purity Alumina using a cost-effective, low-carbon process. Backed by South Australia’s renewable energy, this positions Andromeda strongly in the growing global HPA market for semiconductors, LEDs, and batteries.

- April 2025: Impact Minerals secured a 50% joint venture stake in Hipura Proprietary Limited for USD 2.2 Million, acquiring solvent extraction technology and a nearly completed pilot plant. This accelerates Impact’s high-purity alumina production, positioning it as Australia’s second-leading HPA producer after Alpha HPA.

- March 2025: Alpha HPA expanded its high purity alumina supply for the booming semiconductor sector, driven by AI data centres and power electronics. CMP tests showed over 50% higher removal rates, securing Letters of Intent for commercial volumes from its Queensland facilities through 2027.

- March 2025: Australia’s Cadoux Ltd advanced its High Purity Alumina and Minhub rare earths projects through engineering studies and permitting. With AUD 2.69 Million cash, the company targets strong HPA demand in batteries and semiconductors, supporting Australia’s critical minerals strategy and global electrification goals.

High Purity Alumina Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Purity Levels Covered | 4N, 5N, 6N |

| Production Methods Covered | Hydrolysis of Aluminium Alkoxide, Hydrochloric Acid Leaching, Others |

| Applications Covered | LED, Semiconductor Substrate, Phosphor, Sapphire Glass, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alcoa Corporation, Altech Chemicals Limited, Baikowski SAS, Coorstek Inc. (Keystone Holdings LLC), Nippon Light Metal Holdings Company Ltd., Norsk Hydro ASA, RusAL, Sasol Limited, Sumitomo Chemical Co. Ltd and Zibo Honghe Chemical Co. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the high purity alumina market from 2020-2034.

- The high purity alumina market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the high purity alumina industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The high purity alumina (HPA) market was valued at USD 3,064.6 Million in 2025.

The high purity alumina market is projected to exhibit a CAGR of 19.51% during 2026-2034, reaching a value of USD 15,950.5 Million by 2034.

Key factors driving the HPA market include the rising demand for LED lighting, the rapid expansion of electric vehicles (EVs), and increasing adoption of lithium-ion batteries. Additionally, the material’s superior properties—such as high thermal resistance, corrosion resistance, and electrical insulation—are enhancing its use in semiconductors, optical components, and medical devices. The market also benefits from growing investments in clean energy technologies and sustainable materials.

Asia-Pacific currently dominates the high purity alumina market, holding a significant share of over 75.0% in 2025. This dominance is driven by the region’s strong manufacturing base, particularly in China, Japan, and South Korea, alongside robust demand for LEDs, EV batteries, and consumer electronics. Government initiatives supporting green energy and high-tech materials further contribute to the region's leadership in the HPA market.

Some of the major players in the high purity alumina market include Alcoa Corporation, Altech Chemicals Limited, Baikowski SAS, Coorstek Inc. (Keystone Holdings LLC), Nippon Light Metal Holdings Company Ltd., Norsk Hydro ASA, RusAL, Sasol Limited, Sumitomo Chemical Co. Ltd., Zibo Honghe Chemical Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)