Hopped Malt Extract Market Size, Share, Trends and Forecast by Type, Source, Nature, End User, and Region, 2025-2033

Hopped Malt Extract Market Size and Share:

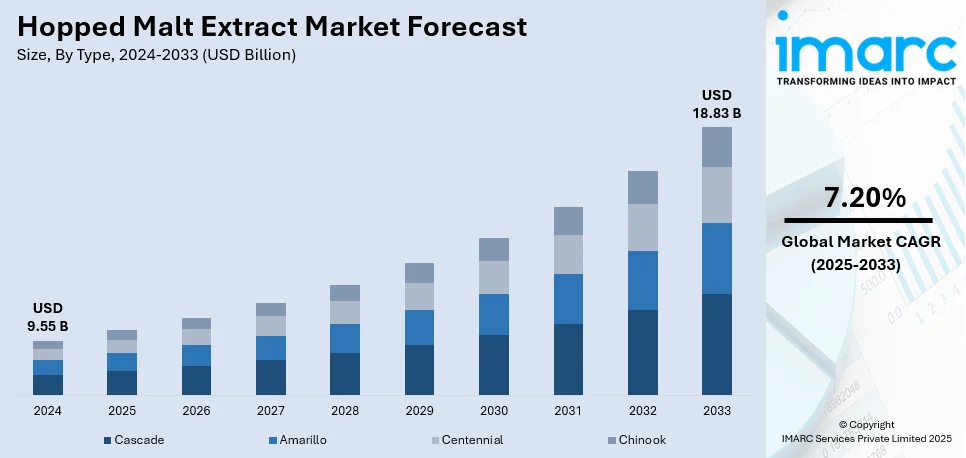

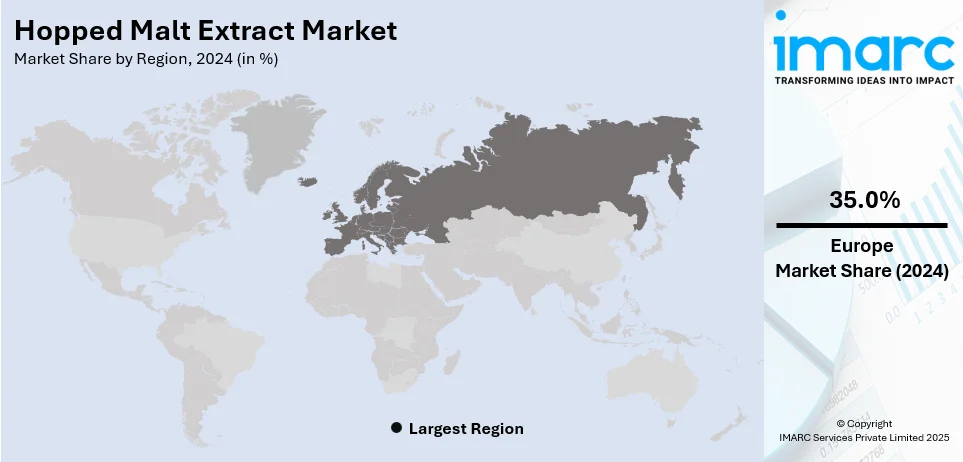

The global hopped malt extract market size was valued at USD 9.55 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.83 Billion by 2033, exhibiting a CAGR of 7.20% from 2025-2033. Europe currently dominates the market, holding a market share of over 35.0% in 2024. A considerable rise in craft brewing establishments across the globe, the augmenting demand for tailored brewing ingredients, and growing regulatory support and government initiatives promoting local products and small-scale brewers are some of the factors that are propelling the market.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.55 Billion |

| Market Forecast in 2033 | USD 18.83 Billion |

| Market Growth Rate (2025-2033) | 7.20% |

The global hopped malt extract market is significantly propelled by the rising demand for craft beer. In 2023, the European Union produced approximately 34.3 billion liters of beer containing alcohol, reflecting a 5% decrease from the previous year. Notably, the production of non-alcoholic beer increased by 13.5% during the same period. In the United Kingdom, the craft beer market was valued at £1.7 billion in 2023, with expectations to reach £1.8 billion by the end of 2024. Furthermore, the increasing consumer preference for unique flavors and artisanal brewing methods has led to a proliferation of microbreweries and homebrewing activities. Hopped malt extracts offer a convenient and consistent solution for these brewers, ensuring quality and efficiency in production. As the craft beer movement continues to gain momentum globally, the demand for hopped malt extracts is anticipated to grow correspondingly.

The growth of the hopped malt extract market in the United States is primarily driven by the expanding craft brewing industry, shifting consumer preferences, and strong economic contributions from the beer sector. As of June 2024, the country had 9,358 active craft breweries, reflecting continuous growth and demand for high-quality brewing ingredients such as hopped malt extracts. The craft brewing industry contributed approximately $77.1 billion to the U.S. economy in 2023 and supported nearly 460,000 jobs, further emphasizing its role in market expansion. Additionally, consumer preferences are evolving, with non-alcoholic beer sales increasing by over 30% year-over-year from January to October 2024, prompting brewers to innovate with malt extracts to meet demand for diverse beer options. Despite a slight decline in overall beer production, craft beer retail sales grew by 3% in 2023, reaching $28.9 billion, largely driven by pricing adjustments and stronger on-site sales. These market dynamics, coupled with the resilience of the brewing sector, continue to propel the demand for hopped malt extracts in the U.S.

Hopped Malt Extract Market Trends:

Rise in Consumer Health Consciousness

The rise in consumer health consciousness is a significant shift in the way individuals select and consume food and beverages. Today's consumers are well-informed and increasingly particular about what they consume. Many seek products that are natural, authentic, and free from artificial additives. As hopped malt extract is made from natural grains and hops, it aligns perfectly with this desire for wholesome ingredients. This has not only increased its appeal among health-conscious consumers but also compelled brewers to include it in their offerings. For instance, in November 2022, Abstrax, a California-based company, launched the Hop Profile Master Kit for home brewing. The kit contains 12 hop varietals from around the world, including Cascade, Centennial, Chinook, and Willamette, further promoting the use of high-quality, natural ingredients. Furthermore, the connection between diet and well-being is now firmly established, leading to a greater focus on the quality and origin of ingredients. This emphasis on health and quality creates a strong demand for the product, positioning it as not just an option but a preference for both consumers and producers in the brewing industry.

Rising Partnerships and Acquisitions Amongst Key Players

In the increasingly competitive landscape of the brewing industry, strategic collaborations and partnerships have become vital for growth and innovation. These alliances often involve brewing companies, suppliers of ingredients like Hopped Malt Extract, and even academic and research institutions. Through such collaborations, new techniques, flavors, and product lines can be developed. They facilitate knowledge sharing, optimize manufacturing processes, and enable companies to enter new markets or strengthen their position in existing ones. For example, a partnership between a supplier of the extract and a brewer can lead to a unique product that appeals to a specific market segment. These relationships are not merely transactional but strategic, aimed at creating value beyond the immediate business goals. By leveraging shared resources and expertise, such collaborations enhance the market presence and competitiveness of the extract, adding a multifaceted layer of growth to its market. In line with this, Monster Beverage Company made a strategic move in January 2022 by acquiring Canarchy Craft Brewery for USD 330 Million. This acquisition allows Monster Beverage to expand its product offerings internationally, further strengthening its position in the competitive beverage market. The inclusion of Canarchy and its brands into Monster's portfolio is a clear example of how partnerships and acquisitions can drive growth and innovation within the industry.

Regulatory Compliance and Standardization

The importance of regulatory compliance and standardization cannot be overstated in the food and beverage industry. Governments and regulatory bodies across the world have implemented stringent quality standards to ensure the safety, consistency, and quality of products. These standards apply to all aspects of production, from sourcing raw materials to manufacturing and labeling. For example, in the United States, the Food and Drug Administration (FDA) and in Europe, the European Food Safety Authority (EFSA) have guidelines for food ingredients, such as hopped malt extract, to ensure they are safe for consumption. Adherence to these regulations is not just a legal obligation but a marker of trust and reliability. In the context of Hopped Malt Extract, compliance with these standards underscores its quality and safety, making it a preferred choice among brewers. Additionally, standardization helps in achieving consistency across different batches of brewing, a key factor in maintaining brand reputation and customer loyalty. In an environment where consumers are increasingly discerning, adherence to regulations and standards provides a competitive edge, contributing significantly to the market growth of the extract.

Hopped Malt Extract Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hopped malt extract market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, source, nature, and end user.

Analysis by Type:

- Cascade

- Amarillo

- Centennial

- Chinook

Cascade hops have clearly entrenched themselves in the hopped malt extract market with a share of 37.6% of market. This strong hold is owed primarily to its signature aromatic flavor that is a characteristic of floral and citrus and even a hint of grapefruit, giving way to being typical of an American pale ale or India Pale Ales (IPAs). The versatility of Cascade hops allows brewers to craft beers with a balanced bitterness and refreshing finish, catering to a wide range of consumer palates. The craft beer movement's emphasis on unique and robust flavors has further propelled the demand for Cascade hops, as they provide both the aromatic qualities and the consistent bitterness essential for these beer styles. In addition, the robustness of Cascade hops to a range of brewing procedures makes them more favorite for use among both commercial breweries and homebrewers. Since the demand for craft beers remains high worldwide, the use of Cascade hops in malt extracts will also continue to remain highly marketed, thereby strengthening its position as part of the brewing industry.

Analysis by Source:

- Wheat

- Barley

- Rice

- Rye

- Others

Barley remains the leading source in the hopped malt extract market with 42.6% of the market share because it possesses better malting qualities and can easily be sourced. Since barley is the most significant grain used by brewers, barley malt extract is fundamental for delivering fermentable sugars and enzymatic activity in beer production. High starch in barley malting is what provides good efficiency for malt extraction. This implies ensuring a balanced mix of fermentable and non-fermentable sugars, which contribute to the final beer's mouthfeel, foam stability, and overall sensory profile. Barley cultivation for brewing is supported by governments and other relevant regulatory bodies, thus further rooting its market dominance. Furthermore, craft beers and specialty malt beverages are increasingly used to further drive the demand for high-quality malted barley extracts, particularly in premium and artisanal brewing.

Analysis by Nature:

- Organic

- Conventional

Conventional hopped malt extracts are the most popular in the market because they are cheaper, widely available, and have a well-established supply chain. Organic variants, on the other hand, are produced with strict adherence to certification standards, which makes them less accessible to large-scale brewers and microbreweries. The main reason behind this segment's dominance is that conventional farming practices are efficient for the production of barley and hops as raw materials to extract malt. Farmers can employ fertilizers and pesticides to ensure proper crop quality and resistance to diseases, which contributes to lower costs of production and stable prices. These help conventional extracts be a popular option for frugal brewers who hope to run a consistent quality operation at affordable production costs.

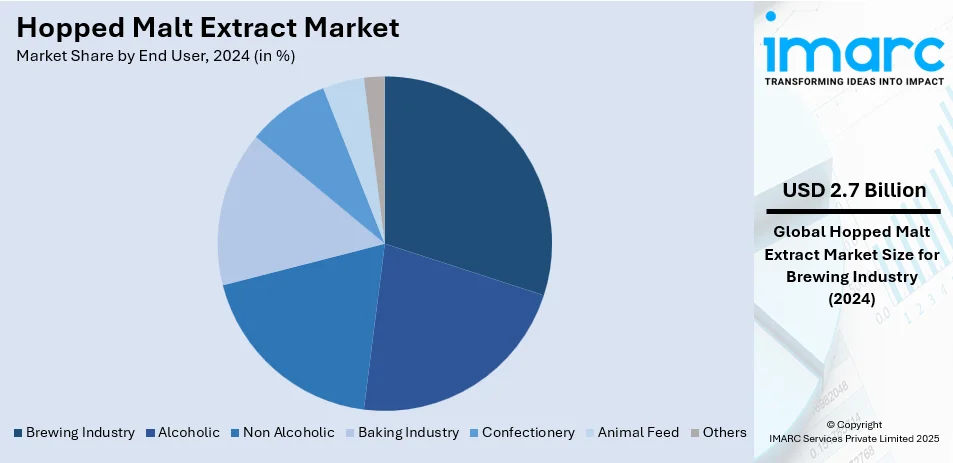

Analysis by End User:

- Brewing Industry

- Alcoholic

- Non Alcoholic

- Baking Industry

- Confectionery

- Animal Feed

- Others

The brewing industry accounts for 28.7% of the global hopped malt extract market share. These shares are influenced by the rise in demand for craft beer, increasing the number of microbreweries, and rising preference for uniform quality ingredients for brewing. Hopped malt extracts help brewers, regardless of their size, control bitterness, aroma, and flavor without the complexity associated with traditional hop additions. Hopped malt extracts are very useful in large-scale breweries since they ensure the consistency of beer batches, thus reducing brewing time and costs. Standardization of bitterness and aroma profiles is very helpful for multinational beer brands, which need to be uniform across markets worldwide. Additionally, hopped malt extracts improve shelf stability, thus helping large breweries maintain product quality during storage and distribution.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe dominates the global hopped malt extract market, accounting for 35.0% of the total share. This leadership is primarily driven by the region’s deep-rooted brewing traditions, strong beer culture, and well-established brewery infrastructure. Countries in the region have long histories of beer production, fostering continuous demand for high-quality malt extracts. The European market benefits from advanced brewing technologies, stringent quality standards, and a strong regulatory framework, ensuring consistent product quality and innovation. Additionally, the rising popularity of craft beer and microbreweries across the continent has intensified the need for specialty malt extracts that enhance flavor profiles, bitterness, and aroma. Furthermore, sustainability trends in the brewing industry, including reduced water usage and carbon footprint, are encouraging breweries to adopt malt extracts for improved efficiency and environmental benefits. With a strong beer culture and continuous innovation, Europe is expected to maintain its market leadership in the coming years.

Key Regional Takeaways:

United States Hopped Malt Extract Market Analysis

The United States hopped malt extract market is witnessing tremendous growth, with the increasing demand for craft beers. According to a report by the Brewers Association, there were about 9,812 craft breweries operating in the U.S. by 2023, which depicts the growing craft beer industry. Craft beer, for example, took the largest share of beer sales in the U.S. to stand at 27 percent of USD 100 billion in 2021. Many consumers now prefer unusual and artisanal beers or beverages. Hopped malt extract offers the convenience and consistency needed by brewers in producing these beers and even whiskeys because of its unique and bittersweet characteristic flavor profile. Demand in the craft beer market and flavored whiskies also spurred the market growth for hopped malt extract as an increasing amount of consumers turned their attention towards superior quality natural products. More American breweries started taking interest in innovations in the products and the art of brewing thereby fueling further demand for the commodity in the American market.

Europe Hopped Malt Extract Market Analysis

The European hopped malt extract market is growing steadily, mainly supported by the resurgence and growth of the beer sector. In 2022, EU countries brewed nearly 34.3 billion litres of alcoholic beer and 1.6 billion litres of non-alcoholic or low-alcohol beer, said the European Commission. This represented a 7% upswing in alcohol-containing beer production over what was seen in 2021 and more closely resembled the pre-pandemic numbers seen in 2019. As the beer market experiences improvements, especially in the craft beer industry, demand for premium ingredients of high quality and consistency, such as hopped malt extract, increases. Hopped malt extract is popular due to its unique flavoring properties that will add depth to either alcoholic or non-alcoholic beverages. In addition, the fact that consumers continue to prefer premium and innovative beers in combination with increased demand for healthy, low alcohol beverages is adding pressure on specific brewing ingredients such as hopped malt extract, therefore, it shall be a crucial growth driver of European market.

Asia Pacific Hopped Malt Extract Market Analysis

The Asia Pacific hopped malt extract market is experiencing growth at a substantial pace due to evolving beer culture in the region and innovations in brewing. According to manufacturers, the demand for new, exciting products is gaining momentum, inspired by traditional regional beverages. For example, in 2022, Bira 91, an Indian brewery, released a limited edition of four seasonal beers inspired by India's diverse regional ingredients and creative culture, which demonstrates the region's growing interest in unique and artisanal brews. Furthermore, beer production in China, a leading beer market in the Asia-Pacific region, increased from 34.11 billion liters in the year 2020 to around 35.6 billion liters in the year 2021, from the statistics of the National Bureau of Statistics of China. The raising availability and variety of beer in the market in the Asia Pacific region have led to high demand for quality brewing ingredients like hopped malt extract. Therefore, as breweries introduce new products catering to changing tastes among consumers, the market in the region would witness increased growth with an elevated demand for products made of hops.

Latin America Hopped Malt Extract Market Analysis

Growth in the Latin America hopped malt extract market is mainly induced by the rising requirement from consumers and innovation within the brewing sector. Manufacturers are repeatedly launching newer products to attract choosy consumers. For instance, Diageo launched its premium Irish beer, Guinness, in Argentina on November 2021 offering two flavors: Guinness Extra Stout, the classic favorite to satisfy local taste and elevate the experience of the beer. Additionally, the Latin American craft beer sector is gaining force as shown in data from Ministry of Agriculture, Livestock, and Supply (MAPA), indicating a high jump of craft breweries in Brazil from 50 in 2002 to 1,178 in 2019. Such a surge of craft breweries puts forward the requirement for quality brewing ingredients such as hopped malt extract as these breweries rely on uniqueness of flavors and innovation in beer style. The craft beer industry is therefore a massive growth driver for the market of hopped malt extract in Latin America.

Middle East and Africa Hopped Malt Extract Market Analysis

The Middle East and Africa hopped malt extract market is expected to grow with expanding industries in the beverage sector combined with changing consumer preferences. For example, in August 2022, African Eastern and MMI launched a new legal home delivery service for wines, whiskey, spirits, and beers in Dubai, United Arab Emirates, to meet the rising demand for convenient premium alcoholic beverages in the region. More so, with 55.40 liters as annual per capita consumption and with South Africa having emerged in a 2020 study published by the World Population Review among the world's biggest beer consuming nations, rising consumer preference is increasing demand on craft beers to provide unique flavours with quality such as hopped malt extract, the demand may thus be strong. With the adoption of a more diverse drinking culture and an increased demand for innovative products, the hopped malt extract market is likely to grow further, as innovation and market growth are fueled by established and emerging breweries.

Competitive Landscape:

The key players in the market are employing various strategies to ensure growth, adapt to changing dynamics, and remain competitive. Many companies are heavily investing in R&D to innovate new products, improve existing ones, and create more efficient production methods. This approach not only helps in meeting consumer demands but also in maintaining a technological edge over competitors. By entering into strategic partnerships, acquisitions, or joint ventures with local businesses, the companies are focusing on expanding their customer base and diversifying their revenue streams. With growing global awareness around environmental issues, key players are focusing on sustainable practices in sourcing, manufacturing, and packaging. Furthermore, the major companies are investing in improving their supply chain logistics to ensure timely delivery, minimize waste, and respond to market fluctuations.

The report provides a comprehensive analysis of the competitive landscape in the hopped malt extract market with detailed profiles of all major companies, including:

- Brewtec Bulk Malt

- CereX

- Demon Brewing Co. Inc

- Muntons plc

Latest News and Developments:

- July 2024: iGulu, a US-based brewery company, launched the iGulu S1, an innovative home brewing system that fuses modern technology with user-friendly features for a more enjoyable brewing experience.

- May 2023: The DSM-Firmenich merger was finalized, solidifying their food and beverage portfolio, which includes hopped malt extract products, and further driving innovation in natural brewing ingredients.

- March 2022: Döhler introduced their HopStar HMA hop extract, which is made from Hallertau Blanc hops using a delicate extraction method to improve the quality of beer.

Hopped Malt Extract Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cascade, Amarillo, Centennial, Chinook |

| Sources Covered | Wheat, Barley, Rice, Rye, Others |

| Natures Covered | Organic, Conventional |

| End Users Covered | Brewing Industry, Alcoholic, Non Alcoholic, Baking Industry, Confectionery, Animal Feed, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Brewtec Bulk Malt, CereX, Demon Brewing Co. Inc, Muntons plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hopped malt extract market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hopped malt extract market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hopped malt extract industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hopped malt extract market was valued at USD 9.55 Billion in 2024.

IMARC estimates the hopped malt extract market to exhibit a CAGR of 7.20% during 2025-2033, reaching USD 18.83 Billion in 2033.

The hopped malt extract market is driven by rising demand for craft beer, home brewing trends, and convenience in brewing processes. Increasing consumer preference for premium, customizable beer flavors and the growing popularity of microbreweries further fuel market growth. Sustainability and eco-friendly production also enhance its appeal.

Asia Pacific currently dominates the market, driven by the region’s deep-rooted brewing traditions, strong beer culture, and well-established brewery infrastructure.

Some of the major players in the hopped malt extract market include Brewtec Bulk Malt, CereX, Demon Brewing Co. Inc, Muntons plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)