Hub Motor Market Size, Share, Trends and Forecast by Installation, Vehicle Type, Motor Type, Power Output, Sales Channel, and Region, 2025-2033

Hub Motor Market Size and Share:

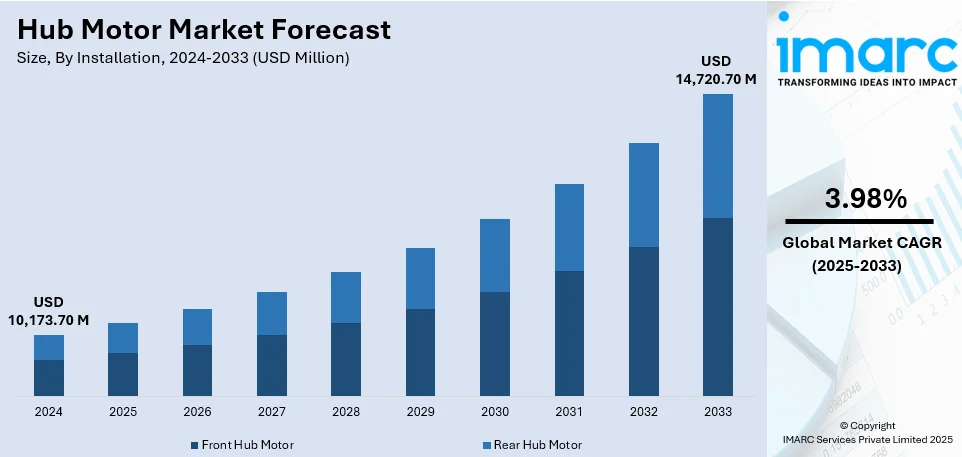

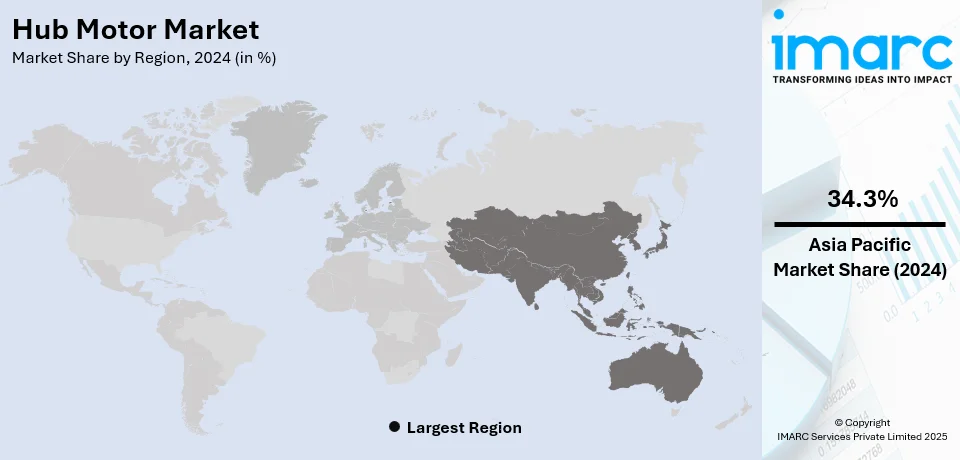

The global hub motor market size was valued at USD 10,173.70 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 14,720.70 Million by 2033, exhibiting a CAGR of 3.98% from 2025-2033. Asia Pacific currently dominates the market, holding a hub motor market share of over 34.3% in 2024. The increasing shift towards electric vehicles (EVs), ongoing technological advancements, and continuous government efforts to promote EVs are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10,173.70 Million |

|

Market Forecast in 2033

|

USD 14,720.70 Million |

| Market Growth Rate 2025-2033 | 3.98% |

Some significant trends driving the global hub motor market are increasing adoptions of EVs, their higher efficiency levels, fewer component counts of a drivetrain in comparison with any typical electric vehicle architecture, and overall flexibility of their design. Rising demands for low emission and environmentally safe transportation alternatives resonate well with increased global concerns related to carbon reduction. Other growth factors are furthered through generous government incentives to adopt cleaner engines and harsh rules on emission releases across national borders. Hub motors are the best choice because of their compact design and lesser maintenance requirements for manufacturers and consumers. They seem to be more favorable in electric two-wheelers, e-bikes, and compact urban vehicles.

The hub motor market of the U.S. holds 77.90% of the market share, highly influenced by a growing penetration of electric vehicles and electric bicycles. In 2024, the U.S. electric vehicle (EV) market experienced significant growth, with EVs accounting for around 8.9% of total light-duty vehicle sales in Q3 compared to 7.4% in Q2. This increasing adoption of EVs has boosted the demand for hub motors, which are light, compact, and easy to integrate into EVs and e-bikes. With consumers increasingly emphasizing sustainable and efficient transportation, the market is also fueled by government incentives and stringent environmental regulations. Additionally, the increased use of micromobility solutions in urban settings, coupled with advancements in hub motor technology including efficiency and durability, continues to drive the hub motor market demand.

Hub Motor Market Trends:

Rising Demand for Electric Vehicles

The surging demand for electric vehicles is one of the key factors propelling the electric vehicles market growth. For example, the International Energy Agency (IEA) reported that more than 3 million electric vehicles were sold in the first quarter of 2024, marking a 25% increase compared to the same period the previous year. Additionally, the electric car sales will be around 17 Million by the end of 2024 and more than 20% year-on-year growth with new purchases. In such a scenario, where the automobile sector is changing into electric, there is an increasing demand for compact and efficient propulsion systems such as hub motors. Hub motors provide a direct drive solution, eliminating the need for complex transmission systems. These factors are further contributing to the hub motor market share.

Numerous Government Initiatives

Another hub motor market trend is that the governments of most countries are enforcing strong emission standards to minimize pollution from vehicles. For example, the European Union sanctioned the law in March 2023, banning new sales of new cars producing greenhouse gases starting 2035. Also, in 2035, according to EU rules, newly sold cars shall emit no CO2 while starting in 2030, emissions have to be cut down to at least 55% lower compared to the figures from 2021. Due to its efficiency and ability for a direct drive, most EVs utilize hub motors that make EVs efficient vehicles to use, as far as achieving zero greenhouse emissions by any automaker. Besides, many governments are providing financial benefits to consumers in order to boost the sales of electric vehicles. All these are further supporting the hub motor market growth.

Technological Advancements

Technological innovations are driving the expansion of the hub motor market. Improvements in motor design, such as improved magnet materials and lightweight motors, have made it possible for the hub motor to be very efficient. Thus, manufacturers can build more compact and lightweight motors with no performance compromises, especially critical for electric bicycles, scooters, and small electric vehicles. For example, Mahle released its latest hub-drive motor, X30, in June 2024. This new hub motor promises great performance regardless of the terrain with a torque of 45 Nm (comparable to mid-drive motor) and a weight of 1.9kg. This rear hub motor design provides for full system synergy due to fewer energy losses, increasing energy efficiency by 15% compared with a mid-drive motor, with this facilitating the user's activity in an environmentally friendly manner to be extended up to nearly 190 kilometers. These factors are further positively impacting the hub motor market outlook.

Hub Motor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hub motor market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on installation, vehicle type, motor type, power output, and sales channel.

Analysis by Installation:

- Front Hub Motor

- Rear Hub Motor

Rear hub motor stands as the largest component in 2024, holding around 70.0% of the market due to their superior performance in terms of power distribution and traction. These motors are located in the rear wheel and offer the advantage of having better stability; especially in an electric bicycle or scooter, there is an added acceleration and more handling, especially on uphills or rough terrains. In addition, hub motors mounted on the rear result in a weight distribution that creates a more level ride. Due to their uniform power delivery, they are sometimes used for top-of-the-line performance e-bikes. The rear hub motor design enhances system synergy by reducing energy losses, improving energy efficiency by 15% compared to mid-drive motors. This increase in efficiency allows users to extend their activities in an environmentally friendly way, covering up to nearly 190 kilometers.

Analysis by Vehicle Type:

- E-bikes

- Electric Two-wheelers

- Passenger Cars

- Others

Based on the hub motor market forecast, e-bikes led the market with around 28.5% of the market share in 2024 owing to their efficiency, eco-friendliness, and convenience for urban commuting. E-bikes with hub motors are probably the best mix of lightweight construction, low maintenance, and usability, making it a very desirable alternative to travel short distances instead of using regular bicycles or cars. Moreover, the growing anxiety over environmental sustainability and the more pervasive use of environmentally friendly transportation systems also fuel demand for e-bikes. Government incentives and subsidies, alongside bike lanes and charging stations development, further assist the growth of e-bike sales and adoption. This aspect helps them take up a higher market share as time progresses along with changing mobility trends in the city.

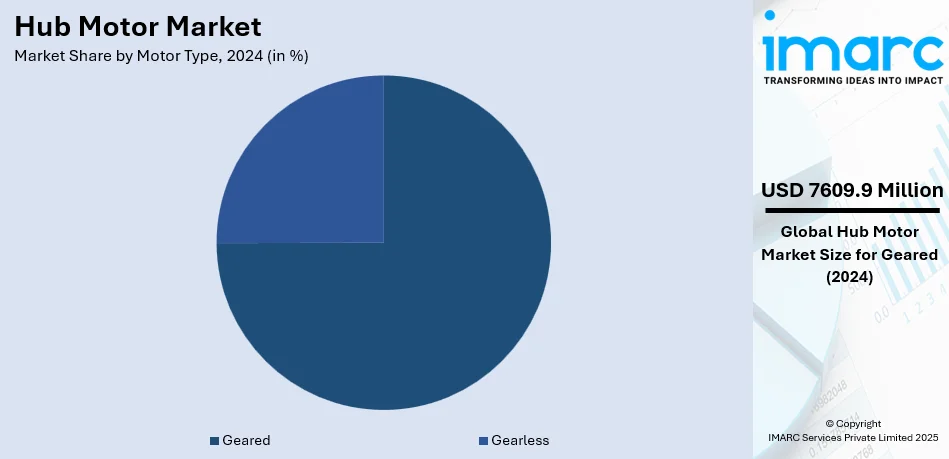

Analysis by Motor Type:

- Geared

- Gearless

In 2024, geared hub motor accounts for the majority of the market at around 74.8% reflecting their widespread adoption in electric bicycles (e-bikes), scooters, and other compact electric vehicles. The dominance of geared hub motors is attributed to their ability to deliver higher torque at lower speeds, making them ideal for uphill and off-road applications. Their lightweight design and efficiency in energy utilization further enhance their appeal among manufacturers and consumers. Geared hub motors offer smoother acceleration and improved performance, especially in urban commuting and micromobility solutions, where maneuverability and responsiveness are crucial. The rising demand for affordable and dependable electric mobility solutions has further boosted their popularity. Furthermore, ongoing advancements in materials and designs have enhanced the durability and efficiency of geared hub motors, solidifying their market leadership.

Analysis by Power Output:

- Below 1000 W

- 1000–3000 W

- Above 3000 W

Below 1000W represented the leading market segment driven by their widespread use in electric bicycles (e-bikes), scooters, and other micromobility vehicles, where lower power requirements align with cost and energy efficiency needs. These motors are lightweight, compact, and cost-effective, making them an ideal option for urban commuting and recreational activities. The rising demand for eco-friendly transportation solutions, particularly in densely populated cities, has further boosted the adoption of below 1000W motors. Also, advancements in motor technology have improved their efficiency and performance, ensuring smooth operation and extended battery life, thus supporting their continued market leadership.

Analysis by Sales Channel:

- OEM

- Aftermarket

OEMs led the market with around 85.4% of the market share in 2024 due to their established supply chains, large-scale production capabilities, and ability to integrate hub motors directly into EVs and micromobility products. Their strong partnerships with vehicle manufacturers enable them to deliver tailored solutions that meet specific performance, cost, and efficiency requirements. Furthermore, original equipment manufacturers (OEMs) can leverage substantial economies of scale, enabling them to provide competitive pricing without compromising on product quality. The growing demand for electric two-wheelers, e-bikes, and electric cars further strengthens their position. OEMs are also focusing on innovation and technological advancements to enhance motor efficiency, contributing to their market dominance and continued growth in the sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 34.3% driven by the rapid adoption of EVs and electric two-wheelers in countries like China, India, and Japan, where rising urbanization and increasing environmental awareness fueled demand for cleaner transportation solutions. Government initiatives, such as subsidies and incentives for electric vehicle adoption, along with strict emission regulations, have further fueled the growth of the market. The region's strong manufacturing base and access to low-cost raw materials also supported the large-scale production of hub motors. Moreover, advancements in battery technologies and the development of charging infrastructure enhanced the viability of EVs, solidifying Asia Pacific's position as a market leader.

Key Regional Takeaways:

North America Hub Motor Market Analysis

North America holds a significant position in the hub motor market due to increasing electric vehicle (EV) adoption and the growing popularity of micromobility solutions like e-bikes and e-scooters. The region's commitment to reducing greenhouse gas emissions and shifting towards sustainable transportation has fueled the demand for efficient, compact motor technologies like hub motors. Government incentives, including tax rebates and grants for electric vehicle purchases, further bolster market growth. The United States and Canada are leading this movement, supported by strong research and development efforts and technological advancements in electric mobility. The presence of key manufacturers and startups innovating in motor design and performance enhances the market’s competitive landscape. Furthermore, urban areas in North America are witnessing increased interest in last-mile transportation solutions, driving the adoption of e-bikes and scooters equipped with hub motors. With rising consumer awareness about environmental sustainability and growing investments in EV infrastructure, the North American hub motor market is poised for sustained growth.

United States Hub Motor Market Analysis

The hub motor market in the United States is set for significant growth, propelled by the growing demand for electric vehicles and a heightened emphasis on sustainable transportation solutions. According to the National Renewable Energy Laboratory, there could be between 30 Million to 42 Million EVs on U.S. roads by 2030, highlighting the significant shift toward electric mobility. Federal and state-level incentives, alongside advancements in battery technology, are facilitating the adoption of EVs, including electric two-wheelers that rely on hub motors. These motors offer compact, efficient, and quiet alternatives to traditional internal combustion engines, making them attractive to consumers. Urbanization trends are also promoting demand for hub motor-based vehicles, as they provide cost-effective and environmentally friendly mobility solutions for densely populated areas. Furthermore, the rise of e-commerce has fueled the need for last-mile delivery solutions, where hub motors play a vital role in electric delivery vehicles and drones. Environmental concerns and rising fuel prices are further accelerating the shift toward electric transportation, creating a favorable market environment for hub motors. This trend positions the U.S. as a major player in the global hub motor market, with increasing adoption across various sectors.

Europe Hub Motor Market Analysis

The hub motor market in Europe is expanding rapidly, driven by the region's strong commitment to sustainability and green technologies. According to the European Environment Agency (EEA), renewable energy sources accounted for an estimated 24.1% of the European Union's final energy use in 2023, underscoring the region's dedication to reducing carbon emissions. This focus on sustainability is propelling the adoption of EVs, including electric two-wheelers such as e-bikes and e-scooters, which rely on hub motors for efficient and quiet operation. National governments across Europe are offering subsidies and incentives to encourage the transition to electric mobility, further enhancing the demand for hub motors. Furthermore, the region's push for urban mobility solutions, especially in congested cities, is driving the need for compact and energy-efficient transportation options. The increasing demand for last-mile delivery solutions is also driving market growth, as companies seek environmentally friendly alternatives for their logistics needs. With continued advancements in electric motor technologies and increased consumer adoption of green mobility, Europe is well-positioned to lead the global shift toward electric transportation. The combination of government policies, technological innovation, and consumer demand for sustainable solutions is fostering the expansion of the hub motor market in the region.

Asia Pacific Hub Motor Market Analysis

The hub motor market in the Asia-Pacific (APAC) region is witnessing substantial growth, primarily fueled by the rapid expansion of the electric vehicle (EV) market. According to industry reports, China, for instance, accounted for 58% of global EV sales and a massive 70% of total EV production, positioning the country as a dominant player in the sector. Government policies in China, India, and Japan that encourage the adoption of green technologies are further fueling the demand for hub motors, particularly in electric two-wheelers like e-bikes and e-scooters. The region’s extensive manufacturing capabilities, especially in China, enable cost-effective production of these vehicles, creating a favorable market environment. In addition, the increasing demand for sustainable transportation in rapidly urbanizing areas is accelerating the adoption of hub motor-based solutions. The increasing focus on reducing carbon emissions and improving air quality across the region, combined with advancements in electric motor technologies, is accelerating the uptake of hub motors, making the APAC region a key growth area in the global market.

Latin America Hub Motor Market Analysis

Latin America offers a promising market for hub motors, fueled by the rising adoption of electric vehicles (EVs) and the region's growing emphasis on sustainable transportation. According to industry reports, 622 Million potential consumers across 20 countries make Latin America an attractive proposition for manufacturers of consumer electronics, including electric two-wheelers. Governments in countries such as Brazil and Mexico are implementing policies and incentives to promote electric mobility, further driving market growth. Moreover, rising fuel prices and environmental concerns are encouraging the shift toward electric transportation solutions, further boosting the demand for hub motors in the region.

Middle East and Africa Hub Motor Market Analysis

The Middle East and Africa region is witnessing a gradual shift toward sustainable mobility solutions, with the hub motor market benefiting from growing demand for electric vehicles (EVs). In the UAE, for example, the oil and gas market is projected to exhibit a growth rate (CAGR) of 6.30% from 2025 to 2033, reflecting the region’s ongoing economic development. As urban centers increasingly focus on reducing carbon emissions and addressing traffic congestion, the demand for efficient, eco-friendly transportation solutions like electric two-wheelers equipped with hub motors is expected to rise. This emerging trend positions the region as a significant market for hub motors.

Competitive Landscape:

The competitive landscape of the hub motor market is marked by strong innovation and the involvement of both global and regional players. Companies are focusing on developing lightweight, efficient, and durable hub motors to meet the rising demand from electric vehicle (EV) and micromobility segments. Substantial investments in research and development have resulted in improvements in motor efficiency, thermal management, and power density. Strategic collaborations and partnerships with EV manufacturers are common, enabling companies to integrate their technologies seamlessly. Moreover, increasing production capacities and setting up local manufacturing facilities in high-demand regions are key strategies. Market players are also prioritizing sustainability by using eco-friendly materials and processes, aligning with global environmental objectives.

The report provides a comprehensive analysis of the competitive landscape in the hub motor market with detailed profiles of all major companies, including:

- Accell Group N.V.

- Cutler MAC (Shanghai) Brushless Motor Co. Ltd

- Elaphe Propulsion Technologies Ltd.

- Heinzmann GmbH & Co. KG

- Leaf Motor

- NTN Corporation

- QS Motor

- Schaeffler technologies AG & CO. KG

- Tajima Motor Corporation

- TDCM

Latest News and Developments:

- In June 2024, MAHLE SmartBike Systems launched the X30 drive system for eBikes, featuring a 1.9kg hub motor with 45 Nm torque for versatile performance. Compatible with the X20 ecosystem, it offered advanced technology for riders of all types, including kids.

- In April 2024, VinFast, an automaker based in Vietnam, launched VF DrgnFly electric bike to the American market. The bike is fully equipped with notable performance parts on the specification side. It has a torque sensor connected to a 750W rear hub motor.

- In April 2024, Hexlox, a German brand, introduced an e-bike anti-theft wheel nut specifically designed for bikes with rear hub motors, including models from Mahle, Bafang, and Zehus. This device acts as an additional deterrent against theft, although it does not replace a comprehensive lock system. With rising theft rates, especially of high-value e-bikes, the tool aims to prevent the theft of wheels in urban areas.

- In March 2023, Schaeffler introduced electric wheel hub motors for municipal vehicles, including sweepers and snowplows, offering zero local CO2 emissions and improved urban air quality. The integrated motors enhance agility and reduce noise, making them ideal for city use. Several manufacturers, including Jungo, are adopting the technology, which also provides low-maintenance solutions for utility vehicles on fixed routes.

- In November 2022, Weber Drivetrain, a technology-focused start-up, inaugurated its electric vehicle parts manufacturing facility in Chakan MIDC, Pune, Maharashtra. The company set up a highly automated, fully automated production line in Phase 1, producing locally made BLDC hub motors and controllers, ranging from 0.25 kW to 4 kW, for electric bicycles, e-scooters, and e-motorcycles.

Hub Motor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Front Hub Motor, Rear Hub Motor |

| Vehicle Types Covered | E-bikes, Electric Two-wheelers, Passenger Cars, Others |

| Motor Types Covered | Geared, Gearless |

| Power Outputs Covered | Below 1000 W, 1000–3000 W, Above 3000 W |

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accell Group N.V., Cutler MAC (Shanghai) Brushless Motor Co. Ltd, Elaphe Propulsion Technologies Ltd., Heinzmann GmbH & Co. KG, Leaf Motor, NTN Corporation, QS Motor, Schaeffler technologies AG & CO. KG, Tajima Motor Corporation, TDCM, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hub motor market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hub motor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hub motor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hub motor market was valued at USD 10,173.70 Million in 2024.

The hub motor market is projected to exhibit a CAGR of 3.98% during 2025-2033, reaching a value of USD 14,720.70 Million by 2033.

Key factors driving the hub motor market include increasing demand for electric vehicles (EVs) and micromobility solutions, government incentives for sustainable transport, advancements in motor efficiency and durability, compact design for easy integration, rising environmental concerns, and the growing adoption of e-bikes and electric scooters in urban areas.

Asia Pacific currently dominates the market, accounting for a share of over 34.3%, driven by government subsidies for EVs, advancements in motor technologies, expanding automotive manufacturing, growing environmental concerns, and strong infrastructure development drive Asia-Pacific's leadership in the hub motor market.

Some of the major players in the hub motor market include Accell Group N.V., Cutler MAC (Shanghai) Brushless Motor Co. Ltd, Elaphe Propulsion Technologies Ltd., Heinzmann GmbH & Co. KG, Leaf Motor, NTN Corporation, QS Motor, Schaeffler technologies AG & CO. KG, Tajima Motor Corporation, and TDCM, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)