Human Immunodeficiency Virus Type 1 Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

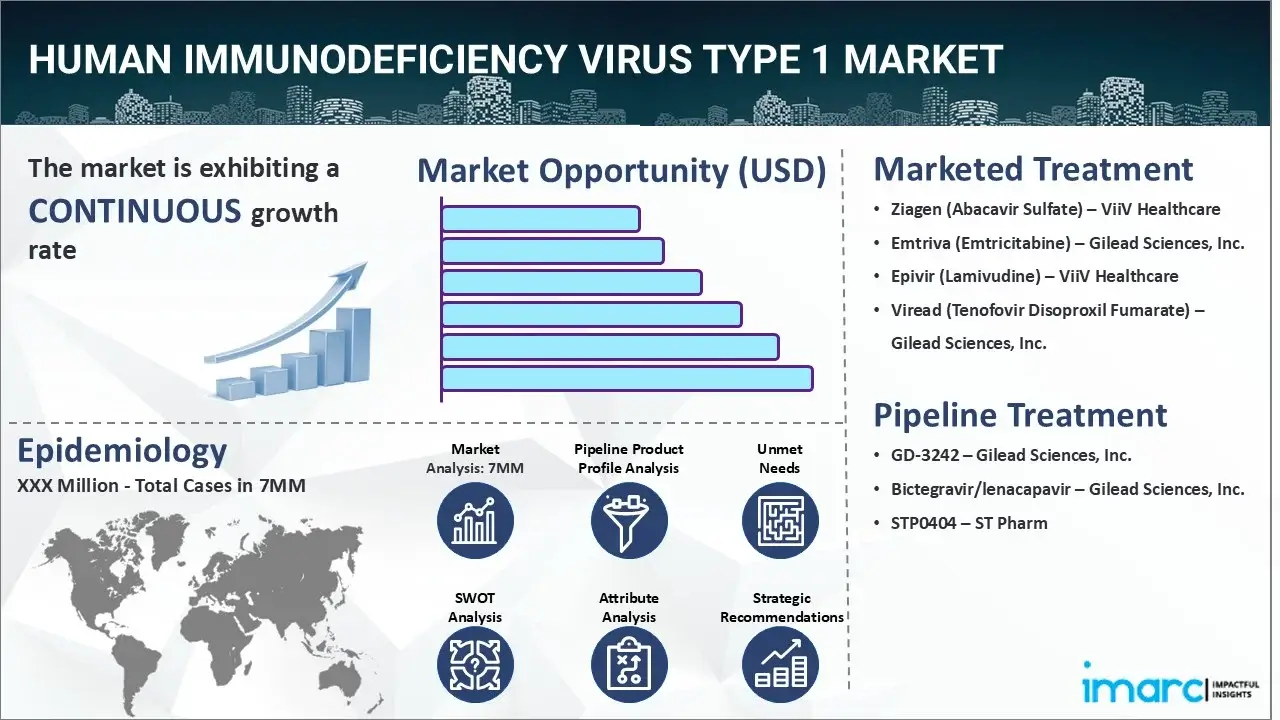

The human immunodeficiency virus type 1 market reached a value of USD 25.2 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 42.7 Billion by 2035, exhibiting a growth rate (CAGR) of 4.81% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year | 2024 |

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 25.2 Billion |

|

Market Forecast in 2035

|

USD 42.7 Billion |

|

Market Growth Rate 2025-2035

|

4.81% |

The Human immunodeficiency virus type 1 market has been comprehensively analyzed in IMARC's new report titled "Human Immunodeficiency Virus Type 1 Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Human immunodeficiency virus type 1 (HIV-1) is a retrovirus that primarily targets cells of the immune system, particularly CD4+ T-helper cells, which play a crucial role in coordinating the immune response against infections. It is spread via direct contact of a mucosal membrane or the bloodstream with a bodily fluid containing HIV, such as semen, blood, vaginal secretions, and breast milk. The symptoms of this ailment can vary from person to person, and some patients may not experience any indications during the initial stages of infection. However, as the virus progresses and the immune system becomes severely compromised, the illness manifests as swollen lymph nodes, extreme fatigue, weakness, skin lesions, coughing, shortness of breath, rapid weight loss, persistent diarrhea, etc. The diagnosis of this ailment is typically based on the patient’s clinical features, medical history, and laboratory investigations. A healthcare provider may also perform several workups, including nucleic acid tests, enzyme-linked immunosorbent assay (ELISA), western blot, etc., to confirm the presence of HIV antibodies or viral antigens in the blood sample.

To get more information on this market, Request Sample

The increasing cases of intravenous drug use, which involves sharing needles and syringes, thereby enhancing the risk of viral transmission, are primarily driving the human immunodeficiency virus type 1 market. In addition to this, the rising incidence of unprotected sexual intercourse, that allows the pathogen to enter the bloodstream through tiny cuts, tears, or abrasions in the mucous membranes of the vagina, rectum, penis, or mouth, is also creating a positive outlook for the market. Moreover, the widespread adoption of integrase strand transfer inhibitors, including raltegravir, dolutegravir, elvitegravir, etc., since they help to prevent the integration of viral DNA into the host’s genetic material, is further bolstering the market growth. In line with this, the inflating application of pharmacokinetic enhancers, like ritonavir and cobicistat, in combination with various other antiretroviral drugs to improve treatment outcomes is acting as another significant growth-inducing factor. Additionally, the emerging popularity of therapeutic HIV vaccines, which aim to stimulate an immune response against the pathogen, thereby controlling the infection and slowing down the disease progression, is expected to drive the human immunodeficiency virus type 1 market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the Human immunodeficiency virus type 1 market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for Human immunodeficiency virus type 1 and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the Human immunodeficiency virus type 1 market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the Human immunodeficiency virus type 1 market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the Human immunodeficiency virus type 1 market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current human immunodeficiency virus type 1 marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Ziagen (Abacavir Sulfate) | ViiV Healthcare |

| Emtriva (Emtricitabine) | Gilead Sciences, Inc. |

| Epivir (Lamivudine) | ViiV Healthcare |

| Viread (Tenofovir Disoproxil Fumarate) | Gilead Sciences, Inc. |

| GD-3242 | Gilead Sciences, Inc. |

| Bictegravir/lenacapavir | Gilead Sciences, Inc. |

| STP0404 | ST Pharm |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the Human immunodeficiency virus type 1 market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the Human immunodeficiency virus type 1 across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the Human immunodeficiency virus type 1 across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of Human immunodeficiency virus type 1 across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Human immunodeficiency virus type 1 by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Human immunodeficiency virus type 1 by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Human immunodeficiency virus type 1 by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with Human immunodeficiency virus type 1 across the seven major markets?

- What is the size of the Human immunodeficiency virus type 1’ patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend Human immunodeficiency virus type 1 of?

- What will be the growth rate of patients across the seven major markets?

Human Immunodeficiency Virus Type 1: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for Human immunodeficiency virus type 1 drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the Human immunodeficiency virus type 1 market?

- What are the key regulatory events related to the Human immunodeficiency virus type 1 market?

- What is the structure of clinical trial landscape by status related to the Human immunodeficiency virus type 1 market?

- What is the structure of clinical trial landscape by phase related to the Human immunodeficiency virus type 1 market?

- What is the structure of clinical trial landscape by route of administration related to the Human immunodeficiency virus type 1 market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)