Human Insulin Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Disease Type, and Region, 2025-2033

Human Insulin Market Size and Share:

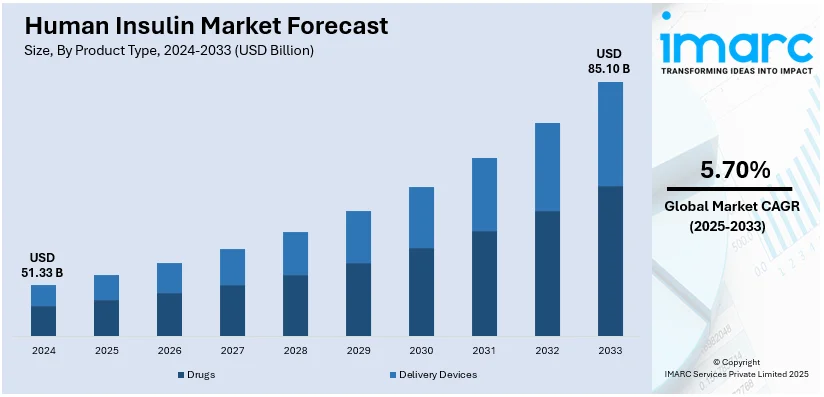

The global human insulin market size was valued at USD 51.33 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 85.10 Billion by 2033, exhibiting a CAGR of 5.70% from 2025-2033. North America currently dominates the market, holding a market share of over 46.5% in 2024. The growing incidences of diabetes, rising geriatric population, rapid advancements in human insulin production, extensive research and development (R&D) activities, and the implementation of supportive government policies are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 51.33 Billion |

|

Market Forecast in 2033

|

USD 85.10 Billion |

| Market Growth Rate 2025-2033 | 5.70% |

The human insulin market is growing steadily due to the increasing incidence of diabetes, the development of new insulin types, and the growing health consciousness in the populace. The rising incidences of diabetes result from the increasing number of people aging and adoption of inactive lifestyle, hence increasing need for efficient insulin therapies. Technological advancements in the treatment, namely long-acting insulin analogs and in the delivery systems via insulin pens and pumps have improved the treatment effect and patient compliance. Further, innovation in the biosimilar insulin products is resolving durability issues and improving market accessibility, mainly in the developing economies. In addition, market expansion through governmental initiatives and investments in healthcare further supports the market based on early diagnostics and effective management of diabetes.

In the United States, the size of the market for human insulin maintains prominence owing to high incidence of diabetes and a developed healthcare industry. The development of the insulin analogs as well as the innovative delivery systems serve the heterogeneous demand, whereas the attempts to control the price also pursue to strike an optimum balance. In addition, regulatory changes and initiatives to cap insulin costs, alongside a focus on patient-centric solutions, are shaping market dynamics. The U.S. market obtains further gains from robust research and development activities, catalyzing innovation and setting global standards for diabetes care. For instance, in April 2024, Vertex Pharmaceuticals, a U.S based company, secured an exclusive license for TreeFrog Therapeutics' C-Stem technology to enhance the production of cell therapies for type 1 diabetes. This collaboration aims to scale up cell manufacturing, addressing the significant unmet needs of T1D patients.

Human Insulin Market Trends:

The growing incidences of diabetes

Human insulin plays a vital role in the treatment and management of diabetes, a chronic metabolic disorder characterized by elevated blood sugar levels. According to the World Health Organization (WHO), The number of diabetics worldwide increased from 200 million in 1990 to 830 million in 2022, underscoring the increasing demand for management techniques and healthcare solutions. It is widely used in insulin replacement, individualized therapy, and the management of specific conditions. In addition, the increased use of products in the treatment of type 1 diabetes to supply insulin that the body cannot produce to control the amount of glucose circulating in the blood and to avoid hyperglycemia enhances the growth of the market. Additionally, it is prescribed to be taken orally, especially for enhancing the body’s ability to use up glucose with the help of insulin shots. Apart from this, the rising product adoption in insulin pump therapy to deliver a continuous supply of insulin throughout the day, mimicking the basal insulin secretion of a healthy pancreas, is contributing to the market growth. Moreover, human insulin plays a critical role in preoperative and critical care settings to prevent glucose fluctuations and reduce the risks of surgical complications.

The rising geriatric population

Human insulin plays a vital role in maintaining the desired levels of glycose in elderly group patients suffering from diabetes. According to reports, the global share of people aged 65 and over has increased from 5.5% in 1974 to 10.3% in 2024, with projections reaching 20.7% by 2074, highlighting a rising geriatric population and a growing demand for age-related healthcare services. It allows for individualized therapy and precise dosage adjustments to meet the specific needs of aging individuals based on factors such as age, medical history, renal function, and overall health status. Furthermore, human insulin has a well-established safety profile and has been used for decades in the treatment of diabetes, making it less risky for the geriatric population compared to newer treatments. Additionally, it aids in minimizing the risk of hypoglycemia in the elderly population compared to certain other diabetes medications. Apart from this, human insulin can be administered through various methods, including insulin pens, syringes, and insulin pumps, which allows healthcare providers to choose the most appropriate insulin delivery method based on the needs and preferences of geriatric individuals.

Rapid advancements in human insulin production

The introduction of recombinant deoxyribonucleic acid (DNA) technology eliminates the need for animal-based insulin extraction and provides a consistent and reliable source of insulin; these positively influence market growth. In addition, the implementation of the continuous manufacturing process, which provides efficient and effective production of insulin that is constantly and uninterruptedly manufactured within the shortest time possible with less cost and ability to meet fluctuations in market demand is adding to the market growth. Additionally, the recent improvements in the bioprocessing technology, such as the optimization of the fermentation conditions, media formulation, and cell culture processes, which help in minimizing the cost of production while at the same time maximizing the quality of the final products, are fueling this market. According to industry reports, researchers from Universidade de São Paulo and the University of Illinois Urbana-Champaign have created the first transgenic cow that can produce human insulin in her milk. This groundbreaking advancement could significantly alleviate insulin shortages and reduce costs for diabetes patients, with the potential for a small herd to sustainably meet the insulin needs of an entire nation. Moreover, the integration of advanced processing techniques, such as chromatography, filtration, and affinity-based separations, to improve the efficiency and effectiveness of insulin purification is strengthening the market growth.

Human Insulin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global human insulin market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, distribution channel, and disease type.

Analysis by Product Type:

- Drugs

- Human Insulin Analogs and Biosimilars

- Rapid Acting

- Long Acting

- Premixed

- Human Insulin Biologics

- Short Acting

- Intermediate Acting

- Premixed

- Human Insulin Analogs and Biosimilars

- Delivery Devices

- Pens

- Reusable Pens

- Disposable Pens

- Pen Needles

- Standard Pen Needles

- Safety Pen Needles

- Syringes

- Others

- Pens

Drugs are dominating the market growth as they have been extensively researched and proven to be effective in managing diabetes. Furthermore, their established market presence has created familiarity and confidence among prescribers, leading to their continued dominance. Apart from this, human insulin drugs are easier to obtain and more affordable than newer types of insulin in the market that are patented. These are easily available and affordable, attributing to their widespread use, particularly in parts with limited resources settings. Apart from this, they have also gained health authority clearances in different parts of the world, helping guarantee the quality and efficiency of human insulin drugs. However, human insulin drugs have been more accepted by patients with diabetes because of their long history of use and proven effectiveness.

Analysis by Distribution Channel:

- Retail Pharmacies

- Hospital Pharmacies

- Online Retail Stores

- Others

Retail pharmacies lead the market with around 59.2% of market share in 2024. Retail pharmacies are located in strategic areas such as shopping centers, in different neighborhoods, and some areas within the blend of urban centers, which makes it easy for patients with diabetes to easily access their prescribed medications. Furthermore, they have numerous outlets with stores in cities, regions, and countries, making it easier for the patients to access a nearest retail store where they refill human insulin prescriptions regardless of the location. Additionally, a network of many retail pharmacies has existed with different insurance companies and other government healthcare schemes to ensure efficient reimbursement processes. In addition, they offer other facilities in addition to prescription dispensing, such as proper use of human insulin, injection techniques, monitoring of blood glucose levels, and lifestyle modification.

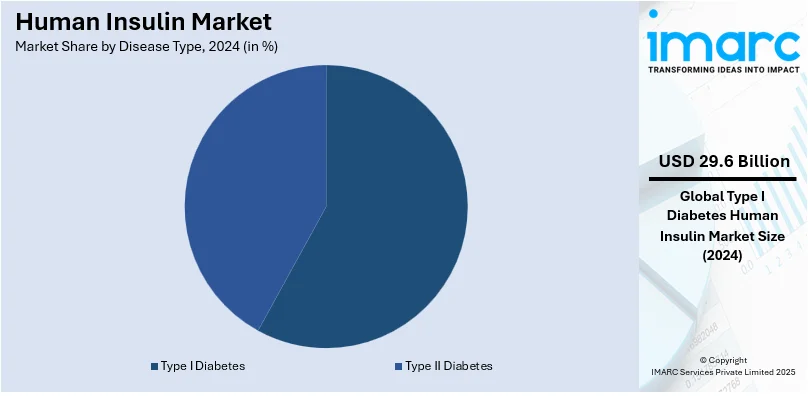

Analysis by Disease Type:

- Type I Diabetes

- Type II Diabetes

Type I diabetes leads the market with around 57.6% of market share in 2024. It holds the majority market share due to its versatility in the global market. In addition, patients with type 1 diabetes depend on insulin injections from the time of diagnosis up to the remaining part of their lifespan. This high requirements for human insulin make it mandatory to have a constant supply to counter the increasing demand of insulin replacement therapy. Furthermore, the lack of natural insulin production in type 1 diabetes has opened a very significant market demand as the primary source for insulin replacement. Besides this, human insulin maintains more accurate resemblance to the insulin demand of patients with type 1 diabetes compared to other insulin analogs because it is characterized and produced similarly to the natural insulin produced in the human body.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 46.5%. The region is dominating the market as it has a significant burden of diabetes, with both type 1 and type 2 diabetes being prevalent in the region. Furthermore, it boasts a well-developed healthcare infrastructure characterized by advanced medical facilities, research institutions, and pharmaceutical companies, which supports the production, distribution, and accessibility of human insulin. Additionally, North America is at the forefront of technological advancements in the healthcare sector, including the development of innovative insulin delivery systems, such as insulin pens and insulin pumps, which enhance the administration and effectiveness of human insulin. Moreover, the presence of several leading pharmaceutical companies that are actively engaged in the production and distribution of human insulin is acting as another growth-inducing factor. Apart from this, North America has well-established regulatory bodies which ensure the safety, efficacy, and quality of pharmaceutical products, including human insulin.

Key Regional Takeaways:

United States Human Insulin Market Analysis

In 2024, United States accounted for 88.50% of the market share in North America. The growing adoption of human insulin in the United States is largely driven by increasing investment in healthcare. For instance, U.S. health spending rose 4.1% in 2022 to USD 4.5 Trillion, benefiting human insulin development by boosting investment in healthcare innovation and accessibility. Significant investment is allocated to the healthcare industry with the goal of strengthening the infrastructure of medical treatment, including increasing the accessibility and availability of necessary drugs like insulin. With this surge in healthcare investments, there has been a marked improvement in healthcare accessibility, especially for chronic conditions such as diabetes. As a result, more individuals are gaining access to affordable and effective treatments, leading to higher adoption rates of human insulin. This trend is further supported by advancements in medical technologies, increasing awareness about diabetes management, and government initiatives to provide better healthcare services. Enhanced healthcare access allows patients to better manage their conditions with insulin therapies, contributing to overall improved health outcomes. Increased attention to healthcare in the public and private sectors is accelerating the integration of insulin into treatment plans for diabetes patients, particularly those with type 1 and type 2 diabetes, driving its growing adoption.

Europe Human Insulin Market Analysis

In Europe, the growing adoption of human insulin is significantly driven by the expanding aging population. According to WHO, the aging population in the European Region is rapidly increasing, with the number of people aged 60 and older rising from 215 Million in 2021 to over 300 Million by 2050, offering a growing market for human insulin. As life expectancy increases, the elderly population is growing, which in turn is leading to higher incidences of chronic conditions such as diabetes. Older individuals are more prone to developing both type 1 and type 2 diabetes, creating a greater need for effective management solutions like insulin. Healthcare systems are responding to this demand by ensuring that insulin is more accessible to elderly patients, who often require long-term treatment. The focus on providing specialized care for older individuals, including those with diabetes, has contributed to the growing use of human insulin. The advent of more convenient advanced delivery devices, like insulin pens and pumps, for older patients further encourages the use of insulin. Additionally, public health initiatives aimed at addressing age-related chronic conditions have created a more favorable environment for insulin use. This combination of an aging demographic and healthcare sector adaptation is fueling the adoption of human insulin across European countries.

Asia Pacific Human Insulin Market Analysis

In the Asia-Pacific region, the rising adoption of human insulin can be attributed to the increasing prevalence of diabetes. According to reports, India, home to the world’s second-highest number of diabetics, is projected to see a rise from 74.9 Million in 2021 to 124.9 Million by 2045, boosting demand for human insulin. With the rapid rise in lifestyle-related diseases, particularly diabetes, the demand for effective treatments like human insulin has surged. Rising healthcare awareness and the growing focus on diabetes management have led to greater accessibility to insulin therapy. Several countries in this region are witnessing a surge in diabetic populations due to dietary changes, sedentary lifestyles, and an aging population. In response, better access to insulin is being made possible by healthcare systems, which will improve diabetes control. Governments and healthcare providers are focusing on increasing awareness about diabetes prevention and management, thus contributing to higher adoption rates of human insulin. The financial strain that diabetes places on healthcare systems is also encouraging the adoption of insulin by promoting its wider availability. The increasing number of healthcare programs and initiatives designed to address the growing burden of diabetes has further facilitated the accessibility and use of insulin.

Latin America Human Insulin Market Analysis

The growing use of human insulin in Latin America is also influenced by the increasing availability of online retail pharmacy stores. For instance, the number of pharmacies in Latin America surged by 7% from 2020 to 2023, adding 14,598 new outlets, a sharp increase compared to the 18,858 stores added from 2010 to 2020. This rapid expansion, especially in online retail pharmacy stores, is improving accessibility to vital medications like human insulin, benefiting patients with easier access and convenience. As digital transformation spreads throughout the region, more individuals are turning to online platforms to access their healthcare needs, including medications such as insulin. Online pharmacies are making it simpler for patients to obtain insulin and have it supplied directly to their places, often at more lower costs. This shift towards e-commerce in healthcare is particularly important in regions where traditional pharmacy networks are less widespread. The convenience and affordability offered by online retail pharmacies are accelerating the adoption of insulin as patients are empowered to manage their diabetes more effectively. Moreover, these platforms often provide more flexible payment options, making insulin more accessible to a broader population.

Middle East and Africa Human Insulin Market Analysis

In the Middle East and Africa, the growing adoption of human insulin is being propelled by the expansion of healthcare facilities. According to International Trade Administration, Saudi Arabia allocates 16.96% of its 2023 budget, or USD 50.4 Billion, to healthcare, accounting for 60% of the GCC's healthcare expenditure. This significant investment in healthcare facilities enhances access to critical treatments, including human insulin, benefiting the nation's health outcomes. As countries in this region focus on improving their healthcare infrastructure, there has been a significant increase in the number and quality of healthcare facilities offering diabetes care. With more clinics and hospitals equipped to diagnose and treat diabetes, there is greater availability of insulin for patients. Enhanced healthcare services are also enabling better diabetes management, contributing to the growing adoption of insulin therapies. As healthcare access improves, patients can receive timely insulin treatments, leading to better outcomes. The development of healthcare facilities across the region is playing a key role in increasing insulin adoption, especially as governments and organizations prioritize healthcare improvements to address the rising burden of diabetes. This development is revolutionizing access to healthcare by increasing the availability of insulin for individuals in need.

Competitive Landscape:

This global human insulin market is noted for competitive landscape, with the major players holding huge market shares and remains challenging for aspiring entrants. Increased incidences of diabetes have been fueling the demand for novel therapeutic insulin-delivery devices. Companies are working toward products' differentiation with the inventions of biosimilars and optimal formulations to serve better patient accessibility and treatment outcomes. For instance, according to industry reports, Novo Nordisk created Icodec, a weekly insulin approved by the European Medicines Agency (EMA) and nearing approval in India by the Subject Expert Committee (SEC), offering reduced injection frequency and improved compliance for individuals needing daily insulin therapy. In addition to this, collaborations and strategic alliances help an enterprise enter new markets.. Government regulations and reimbursement favorable policies, further boost increased market transformation as entry of new players into the field increases competition in the industry, thereby inciting innovations within the sector.

The report provides a comprehensive analysis of the competitive landscape in the human insulin market with detailed profiles of all major companies, including:

- B. Braun Melsungen AG

- Becton, Dickinson and Company (BD)

- Biocon

- Eli Lilly and Company

- Gulf Pharmaceutical Industries (Julphar)

- Novo Nordisk A/S

- Pfizer Inc.

- Groupe Sanofi

- SEDICO Co.

- Wockhardt Limited

- Ypsomed AG

Latest News and Developments:

- December 2024: Lilly and EVA Pharma announced the regulatory approval of locally manufactured insulin glargine in Egypt, marking a substantial milestone in their partnership. By 2030, this collaboration hopes to supply one million diabetics in low- to middle-income nations with reasonably priced insulin each year. The approval follows EVA Pharma's first regulatory clearance for its insulin products, with Lilly supplying the active ingredient at reduced costs.

- December 2024: Cipla has received approval from the Central Drugs Standard Control Organization (CDSCO) to launch inhalation insulin in India. This novel therapeutic approach provides a substitute for conventional injectable insulin in the treatment of diabetes. Cipla's inhalation insulin will provide faster absorption and convenience for patients. The move aims to improve the overall management of diabetes in the country.

- December 2024: Sanofi pledged USD 1.04 Billion to construct a new insulin production facility in Beijing, marking its largest investment in China. With 140 million adults afflicted by diabetes as of 2021, this action attempts to solve the nation's worsening diabetes issue. The new site will be Sanofi's fourth in China, joining operations in Beijing, Shenzhen, and Hangzhou. The Beijing Economic and Technological Development Zone is where the facility will be situated.

- August 2024: Scientists have developed a revolutionary "smart insulin" that adapts in real time to fluctuating blood sugar levels. This invention offers a more individualized treatment method, which could greatly enhance diabetes care. The new insulin adjusts its activity based on blood sugar changes, offering better control for diabetic patients. This discovery has the potential to revolutionize the treatment of diabetes and lessen its effects.

- June 2024: Novo Nordisk has announced a USD 4.1 Billion investment to expand its US manufacturing capacity, specifically for injectable treatments for obesity and chronic diseases. This new facility in Clayton, North Carolina, will enhance production of human insulin and other treatments. The company plans to increase its total investment to USD 6.8 Billion in 2024, up from USD 3.9 Billion the previous year. The expansion supports Novo Nordisk’s commitment to meet growing global demand for its products.

Human Insulin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Retail Pharmacies, Hospital Pharmacies, Online Retail Stores, Others |

| Disease Types Covered | Type I Diabetes, Type II Diabetes |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B. Braun Melsungen AG, Becton, Dickinson and Company (BD), Biocon, Eli Lilly and Company, Gulf Pharmaceutical Industries (Julphar), Novo Nordisk A/S, Pfizer Inc., Groupe Sanofi, SEDICO Co., Wockhardt Limited, Ypsomed AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the human insulin market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global human insulin market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the human insulin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Human insulin is a lab-engineered hormone that mimics naturally occurring insulin produced by the pancreas. By facilitating the absorption of sugar by cells for storage or energy, it controls blood glucose levels. Widely used in diabetes treatment, it improves glycemic control through various formulations, including rapid-acting, intermediate-acting, and long-acting options.

The global human insulin market was valued at USD 51.33 Billion in 2024.

IMARC estimates the global human insulin market to exhibit a CAGR of 5.70% during 2025-2033.

The market grows due to rising diabetes cases, improved healthcare access, technological advancements in insulin delivery, and government support for biosimilar production, addressing affordability and increasing demand for effective diabetes management worldwide.

According to the report, drugs represented the largest segment by product type, driven by high demand for rapid-acting, intermediate-acting, and long-acting formulations, ensuring effective glycemic control and addressing the diverse needs of diabetes patients worldwide.

Retail pharmacies lead the market by distribution channel, offering widespread accessibility, convenience, and personalized patient support. They play a critical role in ensuring timely availability of insulin products for effective diabetes management worldwide.

According to the report, type I diabetes represented the largest segment by disease type, requiring lifelong insulin therapy for effective blood glucose control. Rising Type I diabetes prevalence drives demand for advanced insulin formulations to manage this autoimmune condition efficiently.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Human Insulin market include B. Braun Melsungen AG, Becton, Dickinson and Company (BD), Biocon, Eli Lilly and Company, Gulf Pharmaceutical Industries (Julphar), Novo Nordisk A/S, Pfizer Inc., Groupe Sanofi, SEDICO Co., Wockhardt Limited, Ypsomed AG,?etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)