Hydrogel Dressing Market Size, Share, Trends and Forecast by Product, Material, Application, End User, and Region, 2025-2033

Hydrogel Dressing Market Size and Share:

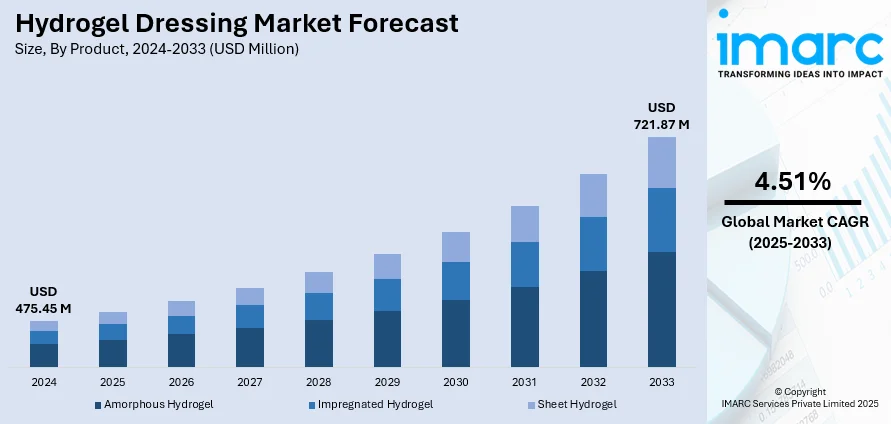

The global hydrogel dressing market size was valued at USD 475.45 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 721.87 Million by 2033, exhibiting a CAGR of 4.51% from 2025-2033. North America currently dominates the market, holding a market share of 43.5% in 2024. At present, diabetic foot ulcers, venous leg ulcers, and pressure sores are on the rise with the burden of diabetes, obesity, and vascular disorders. Moreover, technological innovations and product development are constantly revolutionizing hydrogel formulations. Furthermore, heightened focus of healthcare professionals on patient comfort and budget-friendly solutions for wound management is expanding the hydrogel dressing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 475.45 Million |

|

Market Forecast in 2033

|

USD 721.87 Million |

| Market Growth Rate 2025-2033 | 4.51% |

The hydrogel dressing market is witnessing consistent growth as healthcare professionals are progressively embracing innovative wound care options. Demand is increasing because of the higher frequency of chronic wounds, burns, diabetic ulcers, and pressure sores, necessitating more effective and patient-centered treatments. The market is growing as hydrogel dressings provide advantages like sustaining a moist wound condition, alleviating pain, and enhancing quicker healing. The sector is experiencing technological progress as producers are creating groundbreaking items with better absorption, antimicrobial features, and superior biocompatibility. Businesses are persistently allocating funds to research and development, and partnerships with healthcare organizations are fostering product innovation. The market is reaping the rewards of heightened awareness regarding advanced wound care treatments, particularly in developing nations where healthcare systems are enhancing.

To get more information on this market, Request Sample

The United States hydrogel dressing market is experiencing consistent growth as demand for advanced wound care products is increasing across hospitals, clinics, and home healthcare settings. The market is benefiting from a rising prevalence of chronic conditions such as diabetes and obesity, which are leading to higher incidences of diabetic foot ulcers and pressure sores. Healthcare providers are increasingly adopting hydrogel dressings as these products are maintaining a moist wound environment, supporting faster healing, and improving patient comfort. The industry is witnessing continuous innovation as manufacturers are introducing hydrogel dressings with enhanced antimicrobial properties, better absorption capacity, and greater ease of application. Research and development (R&D) activities are expanding, while strategic collaborations between medical device companies and healthcare institutions are encouraging product advancements. The market is also strengthening as awareness of the benefits of advanced wound care solutions is growing among both healthcare professionals and patients. In 2024, The U.S. Food and Drug Administration authorized TRAUMAGEL, a revolutionary plant-based hemostatic gel Created to assist EMS teams, trauma centers, and 1st responders to manage moderate to severe bleeding cases.

Hydrogel Dressing Market Trends:

Increased Incidence of Chronic Wounds

The market for hydrogel dressing is growing with the increasing incidence of chronic wounds across the world. Diabetic foot ulcers, venous leg ulcers, and pressure sores are on the rise with the burden of diabetes, obesity, and vascular disorders. The most recent International Diabetes Federation (IDF) Diabetes Atlas (2025) indicates that 11.1%, equivalent to 1 in 9 of adults (ages 20-79) are affected by diabetes, with more than 40% unaware of their diagnosis. Patients are demanding wound care products that are offering moisture balance, pain relief, and infection prevention, which hydrogel dressings are offering effectively. Healthcare practitioners are increasingly prescribing hydrogel dressings since these products are speeding up healing and reducing patient discomfort. The population of the world is aging, and older patients are more susceptible to having slow-healing and often resistant chronic wounds. This demographic change is also boosting market demand. Moreover, lifestyle conditions are increasing and hospital-acquired wounds are continuing, thus contributing to the hydrogel dressing market growth. With rising awareness about chronic wound care management, hydrogel dressings are increasingly being accepted in wider clinical circles.

Technological Advancements and Product Innovation

The market is experiencing robust growth with technological innovations and product development constantly revolutionizing hydrogel dressings. The manufacturers are creating next-generation hydrogel dressings with enhanced absorption, antimicrobial properties, and increased biocompatibility. These are facilitating better wound healing results with minimal risks of infection. Companies are making a long-term investment in research and development to create products that are convenient to use, long-lasting, and compatible with various wound types. Smart material and bioactive compound integration is opening opportunities for more efficient and targeted healing processes, thereby offering a favorable hydrogel dressing market outlook. Partnerships between healthcare providers and medical device companies are fostering product validation and clinical trials, which in turn is driving adoption. Regulatory approvals are helping to quickly commercialize new hydrogel dressings, and competition in the market is promoting ongoing product development improvements. As technology continues to advance at a breakneck pace, the market for hydrogel dressings is picking up speed as new products are better addressing both patient and healthcare system demands. In 2024, A team of researchers headed by Deepa Ghosh at the Institute of Nano Science and Technology (INST) in Mohali has developed a groundbreaking self-sustaining dressing aid for persistent wounds. This dressing possesses antibacterial properties and can enhance wound healing, presenting a compelling all-in-one option for those with diabetic foot ulcers. To tackle these deficiencies, the researchers created an innovative dressing aid that comprises two elements: an electroactive powder constructed from hydrogel microparticles for direct application on the wound, and an electroactive PVDF (polyvinylidene fluoride) membrane designed to cover the wound.

Increased Emphasis on Patient Comfort and Cost-Efficient Care

One of the major hydrogel dressing market trends includes the heightened focus of healthcare professionals on patient comfort and budget-friendly solutions for wound management. Conventional dressings are actually causing pain, more frequent changes, and longer healing times, but hydrogel dressings are minimizing pain by providing a moist healing environment and fewer changes. Patients are demanding treatments that are reducing pain and allowing for faster recovery, which hydrogel dressings are effectively fulfilling. Healthcare systems are also focusing on cost-cutting and efficiency, as the cost of chronic wound care is causing financial pressures on hospitals and insurers. Hydrogel dressings are lowering the cost of treatment overall by minimizing the risk of infection, reducing hospital stays, and limiting complications. The trend towards home healthcare is reaffirming this tendency, with patients treated for wounds with hydrogel dressings being able to do so more conveniently and cheaply. Being both clinically effective and economically efficient, hydrogel dressings are increasingly being adopted across various care environments. IMARC Group predicts that the global wound care market is expected to exhibit a growth rate (CAGR) of 4.28% during 2025-2033.

Hydrogel Dressing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hydrogel dressing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, material, application, and end user.

Analysis by Product:

- Amorphous Hydrogel

- Impregnated Hydrogel

- Sheet Hydrogel

Amorphous hydrogel stands as the largest component in 2024, holding 48.7% of the market. It offers several meaningful advantages in wound care, and thus they are a meaningful option in the advanced dressing category. Hydrogels are made up of free-flowing, viscous preparations that are directly applied to wounds and covered by secondary dressings, and are providing flexibility and conformity to various wound types. One major advantage is moisture donation since amorphous hydrogels are rehydrating dry and necrotic tissue, facilitating autolytic debridement and speeding up healing of wounds. This characteristic is rendering them extremely appropriate for exudate minimal wounds, burns, and dry ulcers. They have another benefit, which is pain relief, as the moisturizing effect is calming wound beds and suppressing pain, a fact particularly significant in chronic or painful wound patients. Amorphous hydrogels are also offering versatility since they can be applied to irregular shapes of wounds and cavities where sheet or impregnated hydrogel dressings would not be feasible.

Analysis by Material:

- Natural

- Synthetic

- Semi-synthetic

Synthetic stand as the largest component in 2024, holding 60.5% of the market. Synthetic hydrogel dressings are presenting unique advantages that are making them progressively important in advanced wound care management. Synthetic hydrogel variants are designed to offer greater consistency, strength, and functionality compared to hydrogels of natural origin, thus providing more consistent clinical results. One of the primary advantages is controlled composition and quality. Since they are produced with synthetic polymers, such dressings are being preserved in uniform structure and stable performance. This stability is minimizing variability in healing results in wounds, which is particularly valuable for hospital and clinical use. A second significant benefit is increased durability and stability. Synthetic hydrogels are now withstanding degradation for longer durations, meaning they can stay functional on wounds without having to be changed often. This characteristic is reducing the workload for healthcare workers and patients by limiting dressing replacement.

Analysis by Application:

- Diabetic Foot Ulcer

- Pressure Ulcer

- Venous Leg Ulcer

- Burn Wounds

- Others

Diabetic foot ulcer leads the market as it is one of the most serious diabetes complications, and it necessitates expert wound care techniques to avert infection, amputation, and disability. Hydrogel dressings are being increasingly acknowledged as a viable solution in addressing the multifaceted needs of such wounds because of their distinct characteristics. One of the most important requirements is moist wound healing since diabetic ulcers may be dry or necrotic. Hydrogel dressings are delivering much-needed hydration to rehydrate devitalized tissue, aiding autolytic debridement, and establishing a milieu that facilitates quicker granulation and epithelialization. Pain management is yet another important requirement. Diabetic foot ulcer patients are often in great pain, and hydrogel dressings are calming wound beds, decreasing pain, and causing less trauma upon dressing change because they are not adherent.

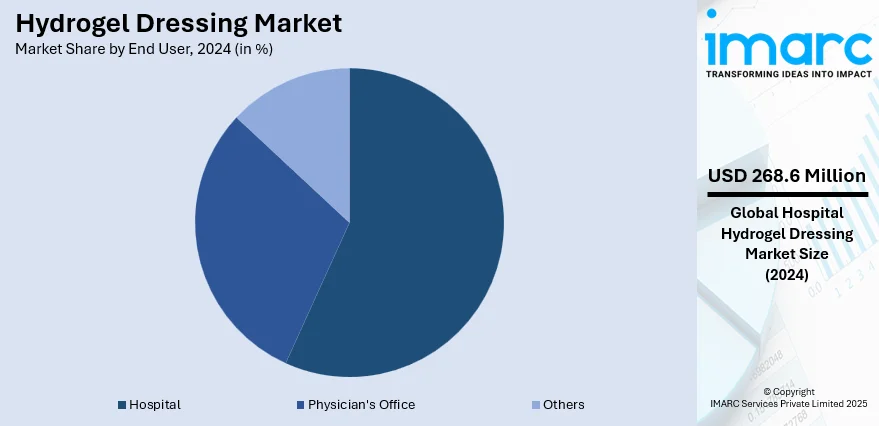

Analysis by End User:

- Hospital

- Physician's Office

- Others

Hospital leads the market with 56.5% of market share in 2024. Hospitals are insisting on hydrogel dressings as a standard part of their advanced wound care regimes because these items are meeting severe needs in the treatment of both chronic and acute wounds. The increasing pressure of pressure ulcers, surgical wounds, diabetic foot ulcers, and burns is leading to a need for dressings that are promoting effective healing, patient comfort, and cost-effectiveness. One of the key requisites is creating a moist wound environment, which is scientifically established to increase the healing process. Hydrogel dressings are delivering maximum hydration, facilitating autolytic debridement, and promoting tissue regeneration and are, therefore, ideal for wounds with low to moderate exudate. Hospitals are also focusing on pain minimization and patient comfort. As hydrogel dressings are soothing and non-adherent, they are reducing trauma at dressing changes and overall discomfort, enhancing patient recovery experiences.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 43.5%. The hydrogel dressing sector in the region is experiencing steady expansion as healthcare providers are increasingly adopting advanced wound care solutions to manage a rising number of chronic and acute wounds. The prevalence of diabetes, obesity, and pressure ulcers is growing, and these conditions are driving the demand for wound dressings that are maintaining moisture balance, accelerating healing, and reducing patient discomfort. Hospitals, outpatient facilities, and home healthcare providers are widely incorporating hydrogel dressings as part of standard wound management protocols. The market is also witnessing significant innovation as manufacturers are developing synthetic and bioengineered hydrogels with improved durability, antimicrobial capabilities, and drug delivery features. Research collaborations between medical device companies and healthcare institutions are supporting clinical studies, while regulatory approvals are facilitating the commercialization of novel products. The aging population across North America is further increasing the incidence of chronic wounds, creating consistent demand for effective wound care options.

Key Regional Takeaways:

United States Hydrogel Dressing Market Analysis

The United States market, holding a share of 88.90%, is primarily driven by the growing number of surgical procedures, which necessitate efficient and sterile wound management solutions. In line with this, the expansion of outpatient services and ambulatory surgical centers, which favor advanced dressings for quicker recovery, is impelling the market. According to the Ambulatory Surgical Center Services Status Report, in 2023, approximately 6,300 ASCs treated 3.4 million Medicare fee-for-service beneficiaries, resulting in total spending of USD 6.8 Billion. Procedure volume per beneficiary rose by 5.7% in 2023, with an average annual growth of 0.6% from 2018 to 2022. The increasing preference for moisture-retentive and non-adherent materials among patients and clinicians is further propelling market growth. Furthermore, the heightened demand for home healthcare products in the U.S., highlighting the ongoing shift toward self-managed wound care, is strengthening market demand. Similarly, favorable reimbursement policies for advanced wound treatments are supporting the adoption of these treatments in medical settings. The increasing focus on infection prevention in chronic wound management is driving the use of hydrogels. Besides this, strategic alliances between manufacturers and healthcare providers are expanding product accessibility and facilitating clinical integration.

Europe Hydrogel Dressing Market Analysis

The European market is experiencing growth due to the rising incidence of chronic wounds associated with aging populations and lifestyle-related diseases. An industry report states that over 10 million people in Europe suffer from skin ulcers annually, costing healthcare systems more than EUR 4 Billion. Over 60% of cases occur in individuals over 65, often linked to chronic conditions like diabetes, vascular issues, heart disease, and obesity. In line with this, the growing number of pressure ulcers in long-term care settings is driving demand for advanced moisture-retaining dressings. Similarly, strong regulatory frameworks supporting clinical safety and efficacy are fostering product innovation and encouraging new entrants. The expansion of government-backed research programs and clinical trials is accelerating advancements in hydrogel formulation. Additionally, the rapid integration of hydrogel dressings into national health service protocols, particularly in countries with universal healthcare, is improving procurement and utilization. The growing emphasis on digital wound monitoring and telemedicine platforms, which increase access to specialized treatments, is stimulating market appeal. Moreover, rising healthcare investments across EU nations, supporting infrastructure upgrades, and the availability of advanced wound care products in both hospital and home care settings are impacting market trends.

Asia Pacific Hydrogel Dressing Market Analysis

The Asia Pacific market is largely propelled by the rising prevalence of diabetes and chronic wounds, particularly in densely populated countries. According to the National Family Health Survey (2019–2021), the prevalence of diabetes among Indian adults stands at 6.5%. An expanded analysis of the same data, including both diagnosed and undiagnosed individuals, suggests the actual prevalence may be around 16.1%, reflecting broader awareness and detection efforts. In addition to this, improved access to healthcare in rural areas is supporting the adoption of advanced wound care products across wider demographics. Similarly, significant investments in healthcare infrastructure across India, China, and Southeast Asia are enabling broader availability of modern dressings in public and private hospitals. Furthermore, rising demand for non-invasive, cost-effective treatments among middle- and low-income patients is extending market acceptance. Apart from this, increased emphasis on home-based care solutions is encouraging the use of user-friendly hydrogel dressings across outpatient and chronic care scenarios.

Latin America Hydrogel Dressing Market Analysis

In Latin America, the market is growing due to the expansion of government-led healthcare modernization initiatives aimed at improving access to advanced wound care in underserved areas. Similarly, the increasing clinical awareness of moist wound healing techniques among medical professionals is driving the adoption of hydrogel-based solutions in hospitals and outpatient care settings. The rising burden of chronic conditions such as diabetes and peripheral vascular disease is further supporting the demand for effective and gentle wound care products. According to NCBI, around 16 million people in Brazil were diagnosed with diabetes mellitus in 2019. Furthermore, strategic collaborations between regional healthcare providers and global wound care manufacturers are enhancing distribution channels and ensuring greater availability of high-quality hydrogel dressings throughout both public and private healthcare systems.

Middle East and Africa Hydrogel Dressing Market Analysis

The market in the Middle East and Africa is experiencing growth due to increased investment in healthcare infrastructure, particularly in high-income economies like the UAE and Saudi Arabia. As such, the Saudi Arabian government committed over USD 65 Billion to enhancing the nation’s healthcare infrastructure, highlighting its focus on building a strong, resilient system to address the changing healthcare needs of its population. Furthermore, the rise of public-private healthcare partnerships is enhancing the distribution and availability of advanced wound care products. Similarly, targeted diabetes awareness and management programs are promoting timely treatment and preventative care. Moreover, the expansion of medical tourism, particularly in countries with advanced clinical capabilities, is encouraging the adoption of innovative, patient-friendly solutions, thereby providing an impetus to the market.

Competitive Landscape:

Market players in the hydrogel dressing industry are actively engaging in product innovation, strategic collaborations, and geographical expansion to strengthen their competitive positions. Companies are investing heavily in research and development to introduce advanced hydrogel dressings with enhanced absorption, antimicrobial properties, and drug delivery capabilities. Partnerships with hospitals, clinics, and research institutions are supporting clinical validation and accelerating adoption in healthcare settings. Leading firms are also focusing on mergers, acquisitions, and licensing agreements to expand product portfolios and enter new regional markets. As per the hydrogel dressing market forecasts, manufacturers are expected to improve distribution networks and emphasize patient-friendly, cost-effective solutions to address growing demand across hospitals, outpatient facilities, and home healthcare environments.

The report provides a comprehensive analysis of the competitive landscape in the hydrogel dressing market with detailed profiles of all major companies, including:

- 3M Company

- Axelgaard Manufacturing Co., Ltd.

- B. Braun SE

- Cardinal Health

- Convatec

- DermaRite Industries, LLC

- Essity Health & Medical

- Lohmann & Rauscher USA INC.

- McKesson Medical-Surgical Inc.

- Medline Industries, LP.

- Procyon Corporation

- Smith+Nephew

Latest News and Developments:

- July 2025: Hannox International launched its new Wound Hydrogel at MEDICALL 2025. Designed for chronic wounds, diabetic ulcers, and burns, the sterile, alcohol-free dressing absorbs exudate, blocks bacteria, and promotes healing. Safe for sensitive skin, it highlights Hannox’s commitment to effective, user-friendly wound care solutions.

- June 2025: Lavior launched its botanical-based Multipurpose Hydrogel Wound Dressing on Target.com. The clean, antibiotic-free gel features Inula AGS-RIED and is designed for use on cuts, burns, tattoos, and other skin conditions. Safe for all ages, it promotes healing without harsh chemicals, offering a modern alternative to traditional first-aid products.

- February 2025: Biomiq launched PureGel, a nanotechnology-based hydrogel made in Kitchener, Ontario. It delivers stable hypochlorous acid (HOCl) to treat wounds, killing 99.99999% of biofilm bacteria. Now licensed and available across Canada, it supports local healthcare with effective, non-cytotoxic, antimicrobial wound care.

- November 2024: BioStem Technologies signed a Letter of Intent to acquire ProgenaCare’s wound care products, including ProgenaMatrix and Revyve Antimicrobial Wound Gel. The move expands BioStem’s portfolio with FDA-cleared, science-backed treatments, enhancing its reach in hospital care and early-stage wound management through the use of keratin and hydrogel-based technologies.

- March 2024: Researchers from the University of Sheffield and the University of South Australia developed plasma-activated hydrogel dressings to treat chronic wounds without the need for antibiotics. Using ionized gas to generate reactive oxidants, the dressings kill bacteria and promote healing, offering a safer and more effective alternative amid rising concerns about antibiotic resistance and silver toxicity.

Hydrogel Dressing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Amorphous Hydrogel, Impregnated Hydrogel, Sheet Hydrogel |

| Materials Covered | Natural, Synthetic, Semi-synthetic |

| Applications Covered | Diabetic Foot Ulcer, Pressure Ulcer, Venous Leg Ulcer, Burn Wounds, Others |

| End Users Covered | Hospital, Physician's Office, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Axelgaard Manufacturing Co., Ltd., B. Braun SE, Cardinal Health, Convatec, DermaRite Industries, LLC, Essity Health & Medical, Lohmann & Rauscher USA INC., McKesson Medical-Surgical Inc., Medline Industries, LP., Procyon Corporation, Smith+Nephew, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hydrogel dressing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hydrogel dressing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydrogel dressing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydrogel dressing market was valued at USD 475.45 Million in 2024.

The hydrogel dressing market is projected to exhibit a CAGR of 4.51% during 2025-2033, reaching a value of USD 721.87 Million by 2033.

The hydrogel dressing market is being driven by the increasing prevalence of chronic wounds such as diabetic foot ulcers, pressure sores, and venous leg ulcers, coupled with technological advancements in product innovation. Rising demand for patient comfort, infection prevention, and cost-efficient wound management is further propelling market growth.

North America currently dominates the hydrogel dressing industry holding 43.5% of the market share, driven by rising diabetes prevalence, aging population, and strong healthcare infrastructure.

Some of the major players in the hydrogel dressing market include 3M Company, Axelgaard Manufacturing Co., Ltd., B. Braun SE, Cardinal Health, Convatec, DermaRite Industries, LLC, Essity Health & Medical, Lohmann & Rauscher USA INC., McKesson Medical-Surgical Inc., Medline Industries, LP., Procyon Corporation, Smith+Nephew, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)