Hydrogen Energy Storage Market Size, Share, Trends and Forecast by Product Type, Technology, Application, End User, and Region, 2025-2033

Hydrogen Energy Storage Market Size and Share:

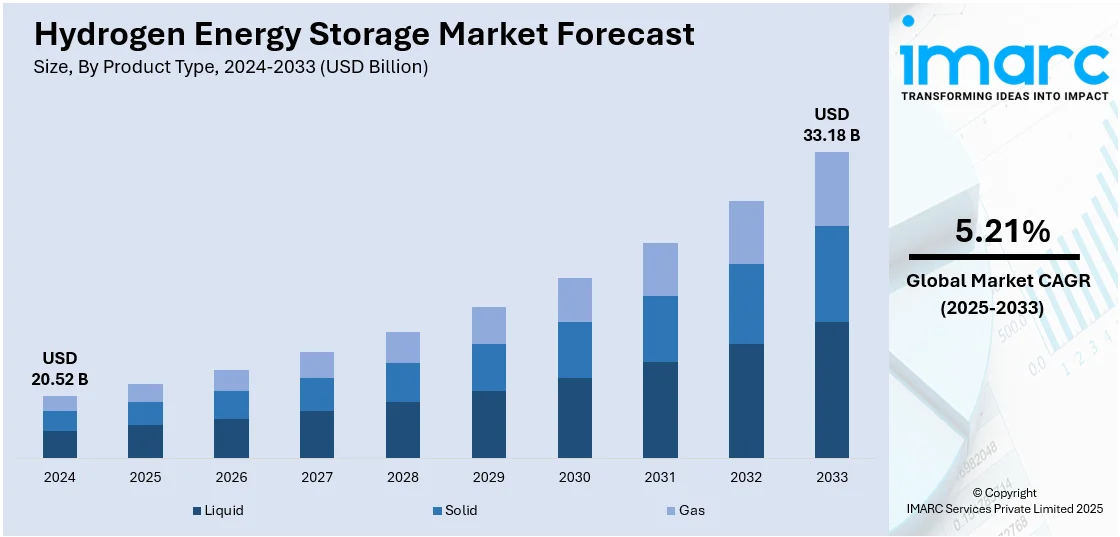

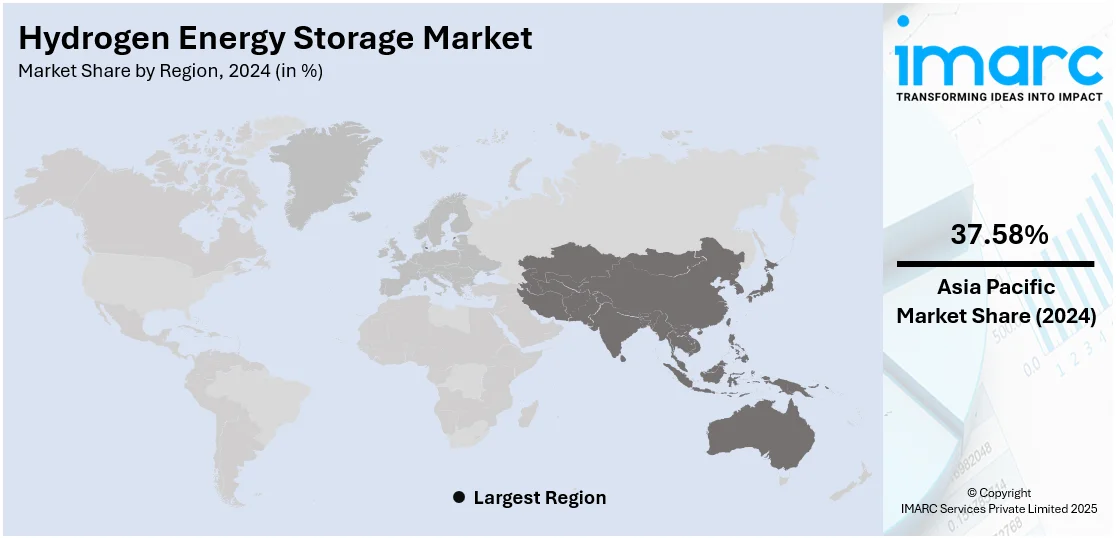

The global hydrogen energy storage market size was valued at USD 20.52 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 33.18 Billion by 2033, exhibiting a CAGR of 5.21% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 37.58% in 2024. The transition toward renewable energy resources, including solar and wind, is playing an important role in driving the market. This trend, along with continuous support from governments around the globe for fully backing hydrogen energy storage development through supportive policies and subsidies and technological advancements, is contributing to the overall growth of the hydrogen energy storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 20.52 Billion |

|

Market Forecast in 2033

|

USD 33.18 Billion |

| Market Growth Rate 2025-2033 | 5.21% |

The market for hydrogen energy storage is growing strongly at present, fueled by the rising need for clean energy solutions. Advances in technology are constantly enhancing hydrogen storage systems to be more efficient and economical. Businesses and research organizations are working towards improving hydrogen production techniques, including electrolysis, as well as optimizing storage techniques like metal hydrides and compressed gas systems. These developments are fueling the potential of the market and driving the world towards cleaner sources of energy. Governments and industries are applying policies and regulations directed at lowering carbon emissions, further increasing the use of hydrogen energy storage solutions. Investment in infrastructure such as hydrogen refueling stations and distribution systems is rising, enabling the usage of hydrogen energy storage in different sectors like transportation, power generation, and industrial processes.

To get more information on this market, Request Sample

The market for hydrogen energy storage in the United States is growing significantly, propelled by government policies and technological advancements. Improved technologies for producing and storing hydrogen are making energy storage systems increasingly efficient and economical. Organizations are continually endeavoring to enhance electrolysis methods and develop new materials for hydrogen storage like metal hydrides and carbon nanotubes. These advancements in technology are contributing to the reduction of costs and overall feasibility of using hydrogen as a viable energy storage option. The federal government is actively encouraging the development of the hydrogen energy storage industry through policy and funding initiatives intended to decrease carbon emissions and encourage clean energy options. In 2024, the U.S. Department of Energy (DOE) made historic strides in promoting clean energy, cementing the country's position as a leader in fighting climate change and moving toward a sustainable future. With record investments and cutting-edge programs, the DOE collaborated to lower emissions, increase energy availability, and hasten the deployment of renewable technology in the nation. Infrastructure investments in hydrogen refueling stations and transport networks are also rising, enabling wider use of hydrogen across different industries, including transport and industrial processes.

Hydrogen Energy Storage Market Trends:

Increasing Need for Renewable Energy Integration

The heightened shift toward renewable energy resources, including solar and wind, is playing an important role in driving the market for hydrogen energy storage. Because these sources are intermittent, the storage of hydrogen is important in managing imbalances in supply and demand for energy. Businesses and governments continue to invest in technologies that enable excess energy from renewables to be stored as hydrogen, with this being used for a stable and secure energy supply when production is low. This blending is improving grid resilience, as well as lowering dependency on fossil fuels. In addition, hydrogen storage is being envisioned as a low-cost solution to decarbonizing hard-to-abate industries like transportation and industry, as hydrogen can be applied in fuel cells or combustion engines. The greater uptake of renewable energy policies all over the world is driving even more investments into hydrogen storage facilities, so hydrogen will be pivotal in meeting goals for sustainability. In 2024, Houpu Clean Energy Group Co., Ltd. unveiled its unique clean energy sources, highlighting the advanced hydrogen storage technology at the Oil & Gas Vietnam Expo 2024 held at AURORA EVENT CENTER in Vung Tau, Vietnam.

Government Policies and Incentives

Governments around the globe are fully backing hydrogen energy storage development through supportive policies and subsidies. In the United States, for example, the federal government is continually issuing funding initiatives and tax credits that encourage research and marketing of hydrogen storage technology. These policies are breaking down barriers to market entry, lowering up-front capital expenditure, and speeding the roll-out of hydrogen infrastructure. Governments in Europe and Asia are also actively promoting hydrogen in their green energy agendas. To this end, governments are establishing regulatory environments that encourage hydrogen storage as a clean and scalable alternative to fossil fuels. With governments imposing carbon neutrality and net-zero emissions by the mid-century mark, their support for hydrogen energy storage is making a supportive climate for industry participants and fueling the hydrogen energy storage market growth. The 2024 Budget brought positive news for the hydrogen industry with a £2 billion investment in 11 new hydrogen projects throughout the UK. The investment ensures the development of the hydrogen economy positions hydrogen at the center of the UK's clean energy strategy.

Technological Advancements in Hydrogen Storage

Technological innovations are continuously driving the market by making storage systems more efficient and cost-effective. Ongoing research is improving hydrogen production methods, such as electrolysis, and enhancing storage techniques like compressed gas, liquid hydrogen, and metal hydrides. These advancements are reducing the energy loss during storage and increasing the overall capacity of hydrogen storage systems. Researchers are also exploring new materials and nanotechnologies to make storage more energy-dense and secure. As companies and research institutions make progress in these areas, the cost of hydrogen storage is steadily declining, making it a more competitive option compared to traditional energy storage systems like batteries. With these technological improvements, hydrogen is becoming a more viable solution for long-duration energy storage, thus increasing its adoption across various industries, including power generation, transportation, and industrial processes. In 2025, a research team created a new proton exchange membrane (PEM) in Korea that dramatically improves the efficiency of electrochemical hydrogen storage systems. This outstanding PEM for LOHC-based electrochemical hydrogen storage is created based on a hydrocarbon polymer SPAES.

Hydrogen Energy Storage Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hydrogen energy storage market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, technology, application, and end user.

Analysis by Product Type:

- Liquid

- Solid

- Gas

Gas stands as the largest component in 2024 as hydrogen gas storage stores hydrogen in its gaseous state at high pressure, usually in pressure vessels or tanks that can withstand the high pressure of up to 700 bar. It is one of the most widely used and prevalent methods of storage, especially where there is fuel cell vehicle use, industrial hydrogen supply, and energy storage. The cost-effectiveness and simplicity of gas hydrogen storage, along with its generally low infrastructure demands, contribute to its popularity in most industries. Advances in materials and tank designs are constantly enhancing the safety, efficiency, and durability of gas storage systems. Compressed gas storage is also picking up speed because of its scalability, as it can be applied to small-scale applications, such as portable energy devices, and large-scale installations for renewable energy integration and grid balancing. With the increasing adoption of hydrogen in different sectors, the segment of gas storage continues to be a pillar of the overall market for hydrogen energy storage.

Analysis by Technology:

- Compression

- Liquefaction

- Material Based

Compression leads the market with 42.2% of market share in 2024. Compression technology is also important in the storage of hydrogen energy by densifying hydrogen gas for cost-effective storage and transport. Hydrogen gas is compressed into high pressure, usually 200 to 700 bar, and then stored in special cylinders or pressure vessels. Compressed hydrogen storage is commonly employed in applications such as fuel cell vehicles and small-scale energy storage methods because of its relatively low cost of operation and established technology. The development of new materials, including lightweight high-strength composite materials for the storage tank, is steadily enhancing the safety, efficiency, and cost-effectiveness of compressed hydrogen storage. Compression technology is especially prized for its scalability and is thus used throughout an array of industries, from transportation to industrial hydrogen supply. With increasing demand for hydrogen throughout the world, compression technology is still integral in offering a flexible and efficient means for short-term and long-term energy storage demands.

Analysis by Application:

- Stationary Power

- Transportation

Transportation leads the market in 2024 since Hydrogen storage for transportation is a rapidly growing application segment, primarily driven by the demand for zero-emission vehicles. Hydrogen fuel cell vehicles (FCVs), including cars, buses, trucks, and trains, are becoming more prevalent due to their ability to provide long-range, fast refueling capabilities compared to battery-electric vehicles. Hydrogen can be stored in high-pressure tanks and used in fuel cells to power electric motors, emitting only water vapor as a byproduct. This application segment is particularly relevant in sectors such as heavy-duty transport, where longer driving ranges and quicker refueling times are essential. The transportation sector’s adoption of hydrogen is further supported by government incentives, environmental regulations, and the increasing push for sustainable mobility solutions. Hydrogen fuel cell vehicles offer a promising substitute of conventional internal combustion engine automobiles, contributing to the lowering of greenhouse gas emissions in the transportation sector.

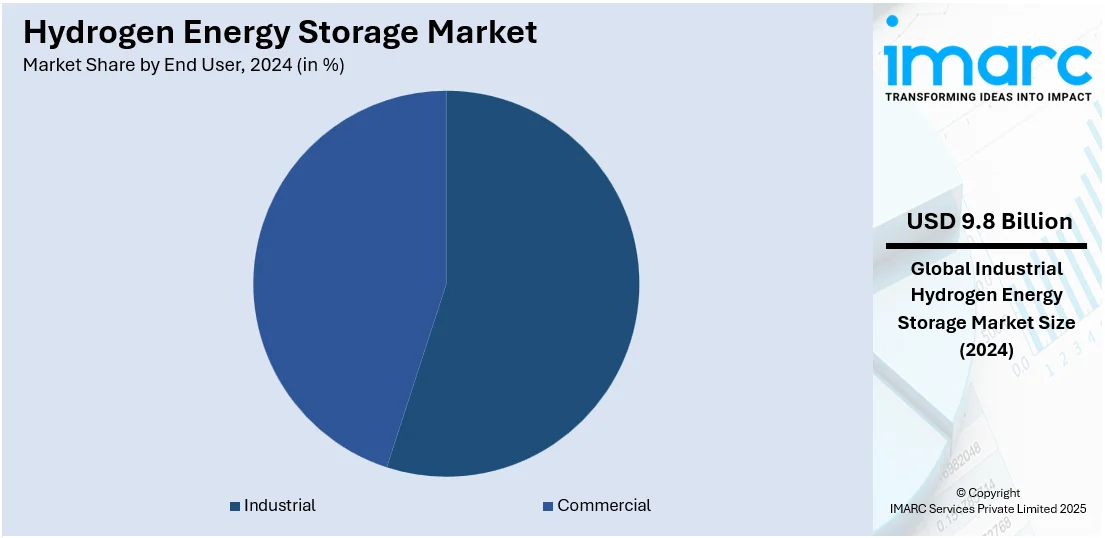

Analysis by End User:

- Industrial

- Commercial

Industrial leads the market with 47.8% of market share in 2024. The industrial segment is a large end-user of hydrogen energy storage, where hydrogen is utilized for several purposes like manufacturing, chemical production, and refining. Steel, cement, and chemicals are some of the industries that are using more hydrogen to reduce dependence on fossil fuels and decarbonize operations. Hydrogen is employed for processes such as hydrogenation, refining, and as a reductant in metal production. Moreover, hydrogen is a critical source of energy for heavy industries that demand high heat, providing a cleaner substitute for natural gas and coal. The move toward hydrogen in industrial applications is facilitated by tough environmental policies and the desire for sustainable processes. As firms work to reduce carbon emissions, hydrogen is at the forefront of helping them shift towards cleaner, more efficient processes.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 37.58%. The market is presently witnessing high growth with the region focusing on realizing sustainable energy targets. Governments in major markets of Japan, South Korea, China, and India are making increased investments in hydrogen infrastructure and technology as part of their overall plans to minimize carbon emissions and shift towards cleaner sources of energy. Countries are steadily deploying policies, incentives, and subsidies to encourage the use of hydrogen technologies, thereby offering a favorable hydrogen energy storage market outlook. Japan, for instance, is leading significantly in developing hydrogen infrastructure such as hydrogen refueling stations and hydrogen transportation use, whereas China is placing its emphasis on ramping up hydrogen production and storage solutions in support of its energy transition strategy. Apart from government incentives, industries in the Asia Pacific region are facilitating the development of hydrogen energy storage. The growing need for energy storage solutions to supplement renewable energy sources like solar and wind is making hydrogen a promising solution for long-term energy storage.

Key Regional Takeaways:

United States Hydrogen Energy Storage Market Analysis

The United States holds 91.20% share in North America. The use of hydrogen energy storage in the US is gaining speed as the area puts an increasing focus on sustainable energy. For example, in February 2025, the United States sanctioned USD 338 Billion of financing for energy technologies, such as EVs, renewable energy, and power grid investment, an increase from USD 303 Billion in 2023. With renewable sources like solar and wind power increasing, the demand for efficient energy storage systems grows more imperative. Hydrogen energy storage is critical to increasing the resilience of renewable energy systems by storing excess energy produced during peak times and releasing it when demand is high. Cleaner energy sources fit into efforts aimed at decreasing greenhouse gas emissions and becoming energy independent. Moreover, hydrogen storage provides a workable solution to balance intermittent renewable energy sources and hence is an integral part of energy infrastructure plans in the future.

Asia Pacific Hydrogen Energy Storage Market Analysis

Growing energy consumption in the Asia-Pacific region is a major driver for the adoption of hydrogen energy storage. For instance, India witnessed the highest growth rate of its power generation in more than 30 years in FY23. As of January 2024, the country's power generation was recorded to be 1,452.43 billion kWh, up 6.80%. India's power consumption stood at 1,503.65 BU according to the Ministry of Power. As demand for electricity rises due to industrialization and urbanization, energy security becomes a pressing concern. Hydrogen energy storage presents an efficient means to store surplus energy and address supply-demand imbalances. This technology enables regions with high renewable energy potential to harness clean energy, store it for later use, and decrease reliance on fossil fuels. By adopting hydrogen storage, the region aims to foster energy sustainability while ensuring a stable energy supply.

Europe Hydrogen Energy Storage Market Analysis

Hydrogen energy storage is gaining traction in Europe as it helps increase the reliability of supply and contributes to reducing carbon emissions. For instance, the EU has a set target for 2030 of a 55% net reduction in greenhouse gas emissions. The region's commitment to achieving carbon neutrality and its ambitious renewable energy targets underscore the need for advanced energy storage solutions. Hydrogen storage plays a crucial role in supporting the adoption of renewable energy by providing a means to store surplus clean energy generated during peak periods. By reducing dependence on conventional petroleum fuels, hydrogen storage contributes to a more sustainable and reliable energy system, complementing the growth of renewable energy in Europe.

Latin America Hydrogen Energy Storage Market Analysis

The increasing use of renewable energy sources in Latin America is propelling the enhanced utilization of hydrogen energy storage. For example, from 2023 to 2028, Latin America will see the addition of over 165 GW of renewable energy capacity. Most of these additions, amounting to 90% of the region's total, will be in four major markets: Brazil (108 GW), Chile (25 GW), Mexico (10 GW), and Argentina (4 GW). With abundant natural resources and the push towards cleaner energy solutions, hydrogen storage offers a sustainable method to store excess renewable energy. This technology supports the integration of variable renewable energy sources, ensuring a consistent and reliable energy supply. As Latin America accelerates its transition to green energy, hydrogen energy storage is seen as a vital tool in achieving its renewable energy goals.

Middle East and Africa Hydrogen Energy Storage Market Analysis

The growing use of hydrogen as a fuel cell in electric vehicles (EVs) is fueling the adoption of hydrogen energy storage in the Middle East and Africa. According to the UAE Ministry of Energy and Infrastructure, there were approximately 8,000 electric vehicles registered in the country, as of 2024. As the region plans to expand its energy mix and decrease its dependence on conventional fossil fuels, hydrogen storage technology has become essential for supporting the shift towards clean transportation. Hydrogen storage allows for the efficient use of hydrogen in fuel cell vehicles, ensuring a reliable and scalable energy supply. This transition is part of broader efforts to enhance energy sustainability and reduce the environmental impact of the transportation sector.

Competitive Landscape:

Market players in the global hydrogen energy storage sector are actively engaging in various strategic activities to expand their presence and improve technology. Companies are continuously developing and refining hydrogen storage solutions, including compressed gas, liquid hydrogen, and material-based storage systems, to enhance efficiency and reduce costs. Many are collaborating with governments, research institutions, and industry leaders to accelerate innovation and infrastructure development, particularly in fuel cell technology and hydrogen refueling stations. Additionally, players are investing heavily in the scaling up of hydrogen production and storage capacity to meet the growing demand from sectors like transportation and industrial applications. According to hydrogen energy storage market forecast, these ongoing efforts are expected to help position hydrogen as a central component of the global transition to sustainable energy.

The report provides a comprehensive analysis of the competitive landscape in the hydrogen energy storage market with detailed profiles of all major companies, including:

- Air Liquide

- Air Products and Chemicals, Inc.

- Chart Industries

- Engie

- Gravitricity

- Hexagon Purus

- ITM Power plc

- Linde PLC

- McPhy Energy S.A.

- Plug Power Inc.

- Pragma Industries

- Steelhead Composites, Inc.

Latest News and Developments:

- April 2025: Energy Vault secured USD 28 million in project financing for the Calistoga Resiliency Center, an ultra-long duration hybrid green hydrogen energy storage microgrid. The facility exemplifies the integration of hydrogen energy storage with strategic infrastructure resilience.

- April 2025: The Asian Development Bank approved a USD 104 million loan to help Georgia establish its first energy storage facility and explore hydrogen energy storage through green hydrogen development. The project will integrate a 200MW/200MWh Battery Energy Storage System and support legal frameworks to promote hydrogen energy storage, boosting renewable energy capacity and energy security.

- April 2025: Energy Vault signed a 10-year agreement with India’s SPML Infra to license and manufacture over 30 GWh of its B-Vault battery energy storage systems (BESS), targeting USD 100 million in initial 500 MWh capacity deliveries within 12 months. The collaboration includes the deployment of VaultOS software and plans for hydrogen energy storage integration.

- January 2025: EQUANS and INOCEL formed a strategic partnership to develop a high-performance hydrogen energy storage and generation solution, targeting sectors such as ports, smart grids, data centers, and off-grid infrastructure. This scalable system, centered on carbon-free hydrogen fuel cells, enables load shedding, power grid balancing, and renewable energy storage, accelerating the shift toward low-carbon energy.

Hydrogen Energy Storage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Liquid, Solid, Gas |

| Technologies Covered | Compression, Liquefaction, Material Based |

| Applications Covered | Stationary Power, Transportation |

| End Users Covered | Industrial, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Liquide, Air Products and Chemicals, Inc., Chart Industries, Engie, Gravitricity, Hexagon Purus, ITM Power plc, Linde PLC, McPhy Energy S.A., Plug Power Inc., Pragma Industries, Steelhead Composites, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hydrogen energy storage market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hydrogen energy storage market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydrogen energy storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydrogen energy storage market was valued at USD 20.52 Billion in 2024.

The hydrogen energy storage market is projected to exhibit a CAGR of 5.21% during 2025-2033, reaching a value of USD 33.18 Billion by 2033.

The hydrogen energy storage market is being driven by the high demand for renewable energy integration, supportive government policies, and technological advancements in hydrogen storage and production methods. These factors are helping to reduce costs and improve the efficiency of hydrogen energy storage solutions.

Asia Pacific currently dominates the hydrogen energy storage market, accounting for a 37.58% share in 2024. The region's investments in hydrogen infrastructure and renewable energy integration are major drivers.

Some of the major players in the hydrogen energy storage market include Air Liquide, Air Products and Chemicals, Inc., Chart Industries, Engie, Gravitricity, Hexagon Purus, ITM Power plc, Linde PLC, McPhy Energy S.A., Plug Power Inc., Pragma Industries, Steelhead Composites, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)