Hydroxyapatite Market Size, Share, Trends, and Forecast by Type, Application, and Region 2025-2033

Hydroxyapatite Market Size and Share:

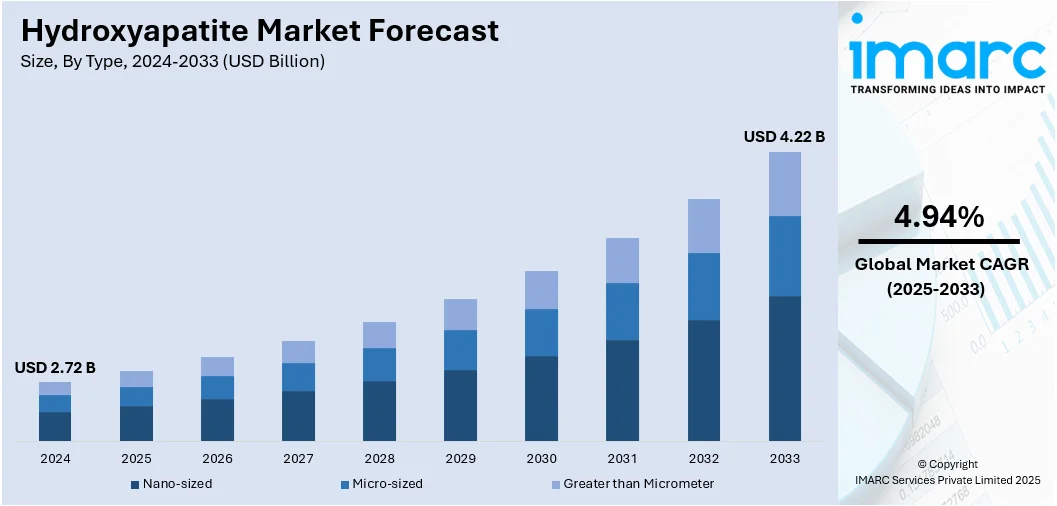

The global hydroxyapatite market size was valued at USD 2.72 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.22 Billion by 2033, exhibiting a CAGR of 4.94% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of 52.0% in 2024. The demand for advanced biomaterials in orthopedic and dental applications is driving market expansion. Rising healthcare needs, particularly in bone regeneration and implant technologies, are contributing to this trend. Innovations in 3D printing and personalized treatments further support the rise of the hydroxyapatite market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.72 Billion |

| Market Forecast in 2033 | USD 4.22 Billion |

| Market Growth Rate 2025-2033 | 4.94% |

The hydroxyapatite market is expanding as biocompatible implants are being increasingly demanded for use in orthopedic processes. Joint replacements, bone grafts, and dental procedures are becoming increasingly prevalent with more individuals choosing to undergo them, and hydroxyapatite-coated implants are becoming the preferred implants due to their greater capability of integrating into bone. Hydroxyapatite's ability to mimic bone mineral structure renders it ideal for enhancing osseointegration, the process by which bone tissue and implant integrate perfectly. The trend is propelling demand for hydroxyapatite products, rendering them a vital component of advancements in orthopedic surgeries, thereby influencing hydroxyapatite market growth.

To get more information on this market, Request Sample

In the United States, the industry is witnessing tremendous growth with the increasing cases of bone disease and the fast-paced adoption of advanced medical procedures. With growing Americans undergoing orthopedic interventions like joint replacement, spinal operations, and bone grafts, the role of hydroxyapatite in the success of implants is also gaining prominence. In addition, the US is at the forefront of adopting new technologies like 3D printing and customized medicine, which enable the creation of tailored hydroxyapatite-based implants according to the needs of individual patients. This innovation is also propelling the hydroxyapatite market in the region, boosted by increasing healthcare expenditure and need for effective treatments.

Hydroxyapatite Market Trends:

Growing Advancements in Biomedical Applications

The increasing advancements in biomedical applications are significantly driving the growth of the hydroxyapatite market. Hydroxyapatite plays a crucial role in bone tissue engineering, where it is commonly used as a scaffold material to facilitate the growth of new bone tissues. As the biomedical sector progresses, particularly in the medical device industry, the demand for hydroxyapatite has surged. In 2025, the medical device sector saw a remarkable boost with a record USD 2.6 Billion in first-quarter funding, marking the highest quarterly funding in three years. These investments are fueling the development of more sophisticated bone scaffolds that closely mimic the natural bone structure, encouraging superior tissue regeneration. Hydroxyapatite coatings are also used in orthopedic implants to improve osseointegration, the process by which the implant bonds with the bone, thereby reducing the likelihood of implant failure. As innovation in orthopedics progresses, the demand for hydroxyapatite-coated implants is increasing due to their enhanced performance and improved patient outcomes. These advancements are in line with hydroxyapatite market trends, which show growing interest in this material for its effectiveness in both medical devices and tissue engineering. The continued progress in this field promises to further boost the use of hydroxyapatite, driving its market expansion and broadening its applications.

Rising Focus on Regenerative Medicine

The growing focus on regenerative medicine is significantly influencing the expansion of the hydroxyapatite market. The global regenerative medicine market, valued at USD 26.7 Billion in 2024, is dedicated to developing therapies that stimulate the body’s natural healing processes to repair or regenerate damaged tissues and organs. Hydroxyapatite, being a biocompatible material, plays a key role in these therapies. It provides an ideal scaffold for new tissue growth, particularly in bone regeneration. In regenerative medicine, hydroxyapatite is increasingly used in bone grafts and implants, facilitating the regeneration of bone tissue. Its application ensures better integration with the surrounding tissue, promoting healing and reducing the likelihood of implant rejection or failure. The rising focus on using biomaterials for implant development is making hydroxyapatite a critical component in regenerative medicine. Specifically in orthopedics, where joint replacements and bone grafts are prevalent, hydroxyapatite’s ability to enhance bone regeneration is of great importance. As regenerative medicine continues to evolve, hydroxyapatite’s role in supporting tissue regeneration and improving patient recovery outcomes is expected to grow, driving the market’s growth in this sector.

Increasing Popularity of 3D Printing

The growing use of 3D printing technology in the healthcare sector is positively impacting the hydroxyapatite market. With the increasing demand for customized medical devices, 3D printing has proven to be an effective solution for creating patient-specific implants and scaffolds. Hydroxyapatite, a bioactive ceramic material, is particularly beneficial in bone tissue engineering and orthopedic implants due to its compatibility with natural bone. 3D printing enables precise fabrication of these hydroxyapatite-based implants, offering the ability to produce complex shapes and structures tailored to individual patient needs. This customization is critical in the medical field, especially for patients requiring unique or specialized implants. 3D printing also accelerates the prototyping process, allowing manufacturers to quickly iterate and refine designs, which in turn expedites the research and development of new hydroxyapatite-based products. For example, Northann secured USD 24 Million in funding to expand their 3D printing facilities, highlighting the growing interest and investment in this technology. The ability to quickly develop and produce hydroxyapatite-based implants will not only enhance medical device innovation but also improve patient care by ensuring that the implants meet specific patient requirements. As 3D printing technology continues to advance, its role in the hydroxyapatite market is expected to expand, further driving market growth and technological advancements in healthcare.

Hydroxyapatite Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hydroxyapatite market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Nano-sized

- Micro-sized

- Greater than Micrometer

As per the hydroxyapatite market outlook, in 2024, nano-sized segment led the market accounted for the market share of 58.6%, driven by the increasing adoption of nanotechnology in biomedical applications. Nano-sized hydroxyapatite offers several advantages, including enhanced surface area, improved bioactivity, and better interaction with bone tissues, making it ideal for bone regeneration and dental implants. The growing preference for minimally invasive procedures, which require biocompatible and highly effective materials, has contributed to the expansion of this segment. Additionally, the increasing use of nano-hydroxyapatite in drug delivery systems, cosmetics, and tissue engineering has further fueled its growth, with its ability to enhance the performance of various therapeutic applications positioning it as a key material in the market.

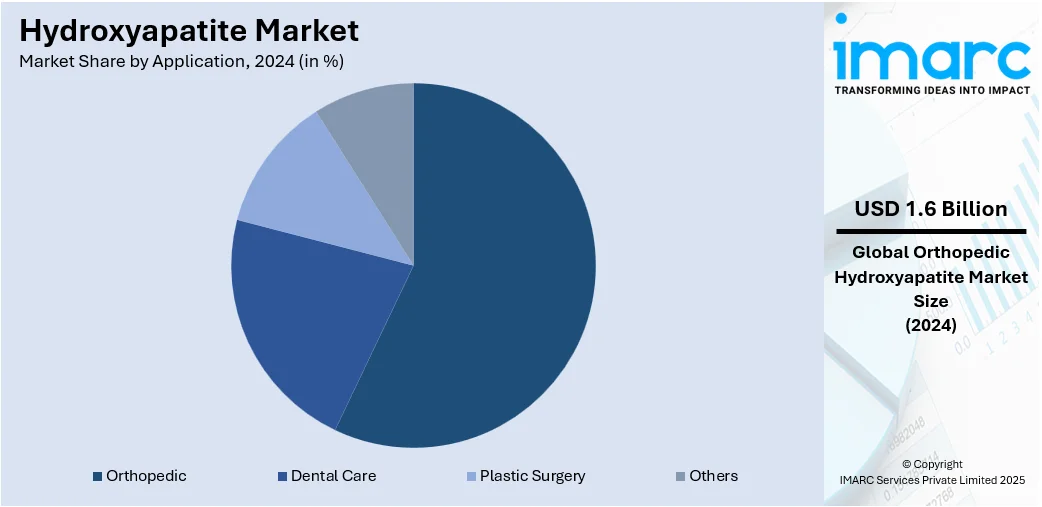

Analysis by Application:

- Orthopedic

- Dental Care

- Plastic Surgery

- Others

As per the hydroxyapatite market forecast, in 2024, the orthopedic led the hydroxyapatite market accounted for the market share of 57.2%, driven by the increasing prevalence of bone disorders, such as osteoporosis, osteoarthritis, and fractures, particularly in aging populations. Hydroxyapatite is widely used in orthopedic applications due to its excellent osteoconductivity, promoting bone growth and improving the integration of implants with the surrounding bone tissue. The rise in joint replacement surgeries and bone regeneration procedures, along with advancements in personalized medicine and minimally invasive surgical techniques, have significantly increased the demand for hydroxyapatite-based solutions. Moreover, the growing focus on improving the success rates of orthopedic implants and reducing the need for revision surgeries is further propelling the market for hydroxyapatite in orthopedics.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia Pacific led the hydroxyapatite market accounted for the market share of 52.0%. This dominance is driven by the region’s advanced healthcare infrastructure, robust research and development activities, and high demand for medical implants. Asia Pacific has seen a rising prevalence of bone-related diseases, particularly in the elderly population, leading to a growing need for hydroxyapatite-based solutions in orthopedics, dental implants, and tissue regeneration. The presence of leading market players, along with continuous technological advancements in medical devices and implants, has further bolstered market growth. Furthermore, increased healthcare spending, coupled with rising awareness of the benefits of hydroxyapatite in improving the success rates of surgeries, has solidified the region’s position as the dominant region in the hydroxyapatite market.

Key Regional Takeaways:

United States Hydroxyapatite Market Analysis

In 2024, the United States accounted for 88.50% of the hydroxyapatite market in North America, driven by multiple factors. United States is witnessing increased hydroxyapatite adoption owing to rising demand in plastic surgery applications. According to reports, on average, there were 35,333 individual payments made to 4,050 plastic surgeons, 1,336 payments made to 208 hand surgeons, and 1,091 payments made to 214 craniofacial surgeons each year. The material’s biocompatibility, osteoconductive properties, and ability to integrate with human tissue make it ideal for facial reconstructive procedures, breast augmentation, and cranial defect repairs. Surgeons are incorporating hydroxyapatite in facial contouring and orbital implants due to its superior integration with bone and soft tissue. The aesthetic procedures market is expanding, further supported by advancements in minimally invasive techniques and personalized implants. Rising consumer awareness, improved surgical outcomes, and patient preference for non-toxic, natural bone substitute materials continue to fuel its usage.

Asia Pacific Hydroxyapatite Market Analysis

Asia-Pacific is experiencing growing hydroxyapatite adoption driven by the expanding dental care sector. For instance, there are 65,421 dental clinics in India as of May 2025; which is an 5.26% increase from 2023. Increasing cases of dental caries, periodontal disease, and tooth sensitivity have created a surge in demand for biomimetic materials like hydroxyapatite in toothpastes, dental fillers, and enamel repair treatments. Its remineralization capability helps restore tooth enamel, while its bioactivity supports dental implant coatings for enhanced osseointegration. Rising oral healthcare awareness, increasing disposable income, and the popularity of cosmetic dental procedures are reinforcing this trend. Dental clinics and product manufacturers are increasingly integrating hydroxyapatite into preventive and restorative care formulations, leveraging its non-toxic profile and effectiveness in reducing plaque formation.

Europe Hydroxyapatite Market Analysis

Europe is experiencing heightened hydroxyapatite usage due to its expanding orthopedic implants market. For instance, there are 107 Orthopedics startups in Germany which include Otto Bock, Paradigm Spine, AAP Implantate AG, Syntellix AG, Bredent Group. Out of these, 34 startups are funded, with 15 having secured Series A+ funding, and 1 achieving unicorn status. With a growing elderly population and rising musculoskeletal disorders, orthopedic interventions such as joint replacements, spinal implants, and bone graft substitutes are increasing. Hydroxyapatite, known for its bone-bonding capability and bioactivity, is extensively used to coat metal prostheses to improve fixation and reduce implant loosening. Clinical preference for bioceramic coatings has led to its application in knee, hip, and trauma implants, supporting bone regeneration and reducing post-operative complications.

Latin America Hydroxyapatite Market Analysis

Latin America is seeing an increase in hydroxyapatite use driven by demand for regenerative medicine and 3D printing. According to research, The Latin America 3D Printing for Healthcare market accounted for USD 665.87 Million in 2024 and USD 801.64 Million in 2025 is expected to reach USD 5127.24 Million by 2035, growing at a CAGR of around 20.39% between 2025 and 2035. The region is leveraging hydroxyapatite in custom bone scaffolds, bio-inks, and tissue engineering for craniofacial and orthopedic reconstructions. Its compatibility with emerging 3D bioprinting technologies enhances precision in regenerative treatments. Integration of hydroxyapatite in cell-laden constructs is aiding the region’s shift toward personalized medicine.

Middle East and Africa Hydroxyapatite Market Analysis

Middle East and Africa is adopting hydroxyapatite more rapidly due to expanding healthcare facilities. For the 2025 fiscal year, the UAE allocated AED 5.745 Billion, equivalent to 8% of the federal budget, to healthcare and community prevention services, reflecting its sustained commitment to developing the health sector. As investment in hospitals, dental clinics, and surgical centers rises, the region is embracing biomaterials that support advanced treatments. Hydroxyapatite's use in orthopedic surgeries, dental implants, and bone regeneration is gaining traction amid growing healthcare access.

Competitive Landscape:

Companies operating in the hydroxyapatite market are implementing strategic measures to align with evolving healthcare demands and regulatory standards. Key initiatives include leveraging data analytics and digital platforms to enhance R&D efficiency, accelerate product development timelines, and improve material performance. Automation is being adopted to streamline manufacturing processes and ensure consistent product quality across different applications, such as orthopedic implants and dental products. Firms are also investing in integrated systems to manage regulatory compliance, quality control, and market access activities. These approaches enable faster responses to market needs, reduce operational inefficiencies, and support evidence-based decision-making, thereby ensuring the effective delivery of hydroxyapatite-based solutions in an increasingly competitive and compliance-driven market.

The report provides a comprehensive analysis of the competitive landscape in the hydroxyapatite market with detailed profiles of all major companies, including:

- APS Materials, Inc.

- Berkeley Advanced Biomaterials

- Bio-Rad Laboratories, Inc.

- CAM Bioceramics

- CGBIO Co., Ltd.

- Fluidinova S.A.

- Granulab (M) Sdn Bhd

- HOYA Technosurgical Corporation

- Medtronic

- Merz North America, Inc.

- SANGI Europe GmbH

- SigmaGraft Biomaterials

- Tomita Pharmaceutical Co., Ltd.

Latest News and Developments:

- June 2025: Davids Health Sciences launched its Fresh Breath Mouthwash in June 2025, featuring a fluoride-free and alcohol-free formula infused with nano hydroxyapatite under the Hydroxi line. The product, designed to support enamel health, gum detoxification, and freshness, was made available in a four-ounce concentrate and verified by EWG.

- June 2025: Researchers at UC Irvine, including Professor David Kisailus, converted human urine into hydroxyapatite using an engineered yeast platform, offering both environmental and biomedical benefits. The method, published in Nature Communications, was projected to support a USD 3.5 Billion industry by 2030 through its application in dental and bone implants.

- May 2025: The ACTINIA® cementless hip stem with collar was launched on June 2nd as an extension of the ACTINIA® system. It was made from TiAl6V4 and coated with hydroxyapatite to enhance implant stability and reduce the risk of periprosthetic fracture and aseptic loosening.

- April 2025: Lincotek and Promimic signed a strategic license agreement that expanded Lincotek’s service portfolio with Promimic’s HAnano Surface technology, which uses nanometer-thin hydroxyapatite to enhance implant osseointegration. The agreement strengthened their collaboration and broadened Promimic’s global orthopedic market access.

- March 2025: Boka expanded into select Target locations and Target.com as the first in-store oral care brand featuring Nano-Hydroxyapatite (n-HA). It introduced its best-selling fluoride-free toothpastes—Ela Mint and Refresh Mint Whitening—in 3.4 oz packaging, highlighting hydroxyapatite’s growing role in science-backed oral care.

Hydroxyapatite Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nano-Sized, Micro-Sized, Greater than Micrometer |

| Applications Covered | Orthopedic, Dental Care, Plastic Surgery, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | APS Materials, Inc., Berkeley Advanced Biomaterials, Bio-Rad Laboratories, Inc., CAM Bioceramics, CGBIO Co., Ltd., Fluidinova S.A., Granulab (M) Sdn Bhd, HOYA Technosurgical Corporation, Medtronic, Merz North America, Inc., SANGI Europe GmbH, SigmaGraft Biomaterials, Tomita Pharmaceutical Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hydroxyapatite market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global hydroxyapatite market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydroxyapatite industry and its attractiveness.

Key Questions Answered in This Report

The hydroxyapatite market was valued at USD 2.72 Billion in 2024.

The hydroxyapatite market is projected to exhibit a CAGR of 4.94% during 2025-2033, reaching a value of USD 4.22 Billion by 2033.

Key factors driving the hydroxyapatite market include increasing demand for orthopedic and dental implants, advancements in bone regeneration therapies, growing prevalence of bone disorders, and the rise of minimally invasive procedures. Additionally, its biocompatibility, osteoconductive, and expanding medical applications further contribute to market growth.

In 2024, Asia Pacific dominated the hydroxyapatite market, accounting for the market share of 52.0%, driven by advanced healthcare infrastructure, increasing prevalence of bone-related diseases, and high demand for medical implants. The region's strong research and development capabilities, along with growing adoption of hydroxyapatite in orthopedic and dental applications, further fueled market growth.

Some of the major players in the global hydroxyapatite market include APS Materials, Inc., Berkeley Advanced Biomaterials, Bio-Rad Laboratories, Inc., CAM Bioceramics, CGBIO Co., Ltd., Fluidinova S.A., Granulab (M) Sdn Bhd, HOYA Technosurgical Corporation, Medtronic, Merz North America, Inc., SANGI Europe GmbH, SigmaGraft Biomaterials, Tomita Pharmaceutical Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)