Hyperinsulinemia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

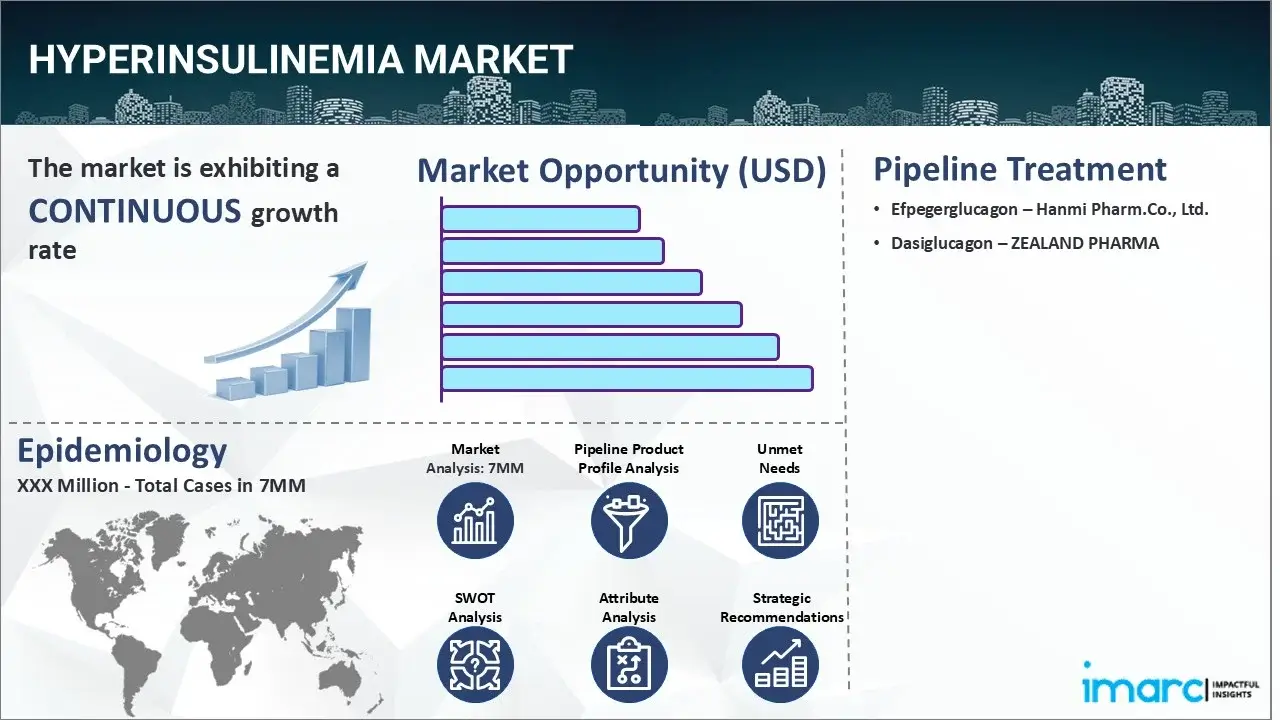

The hyperinsulinemia market reached a value of USD 73.2 Million across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 123.2 Million by 2035, exhibiting a growth rate (CAGR) of 4.87% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year | 2024 |

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 73.2 Million |

|

Market Forecast in 2035

|

USD 123.2 Million |

|

Market Growth Rate 2025-2035

|

4.87% |

The hyperinsulinemia market has been comprehensively analyzed in IMARC's new report titled "Hyperinsulinemia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Hyperinsulinemia refers to a condition characterized by abnormally high levels of insulin in the bloodstream. It typically does not manifest with specific symptoms on its own but is often associated with underlying disorders like insulin resistance, obesity, metabolic syndrome, etc. Individuals suffering from hyperinsulinemia may experience various indications, such as persistent hunger, frequent cravings for carbohydrates, difficulty losing weight, increased abdominal fat deposition, high blood pressure, elevated triglyceride levels, low HDL cholesterol levels, impaired glucose tolerance, etc. The diagnosis of the ailment typically involves a combination of clinical assessment, medical history review, and laboratory tests. Fasting insulin levels are commonly measured to determine baseline insulin concentrations, with elevated levels indicating hyperinsulinemia. An oral glucose tolerance test (OGTT) may also be performed, involving the measurement of glucose and insulin levels at various intervals after consuming a glucose solution. Additionally, several diagnostic imaging techniques, such as magnetic resonance imaging (MRI) and computed tomography (CT) scans, are utilized to assess fat distribution as well as identify associated conditions. Furthermore, genetic testing may be considered in cases of suspected monogenic forms of hyperinsulinemia.

To get more information on this market, Request Sample

The escalating cases of insulin resistance, characterized by increased insulin production to compensate for reduced cellular response, are primarily driving the hyperinsulinemia market. Additionally, the rising prevalence of various associated risk factors, including sedentary lifestyles, excessive carbohydrate intake, chronic stress, preexisting medical conditions like polycystic ovary syndrome, genetic predisposition, hormonal imbalances, etc., is also creating a positive outlook for the market. Moreover, the widespread adoption of numerous insulin-lowering agents, such as glucagon-like peptide-1 (GLP-1) agonists and dipeptidyl peptidase-4 (DPP-4) inhibitors, which work by stimulating insulin secretion in response to elevated blood sugar levels, thus reducing the demand for insulin, is further bolstering the market growth. Apart from this, the inflating application of probiotics and prebiotics, since they aid in modulating the gut microbiota while alleviating insulin resistance and inflammation, is acting as another significant growth-inducing factor. Additionally, the ongoing advancements in diagnostic technologies, including the introduction of continuous glucose monitoring (CGM) systems that offer real-time monitoring of glucose levels, insulin response, and metabolic patterns, are expected to drive the hyperinsulinemia market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the Hyperinsulinemia market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for Hyperinsulinemia and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the Hyperinsulinemia market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the hyperinsulinemia market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the hyperinsulinemia market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current hyperinsulinemia marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Efpegerglucagon | Hanmi Pharm.Co., Ltd. |

| Dasiglucagon | ZEALAND PHARMA |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the Hyperinsulinemia market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the Hyperinsulinemia across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the Hyperinsulinemia across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of Hyperinsulinemia across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Hyperinsulinemia by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Hyperinsulinemia by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Hyperinsulinemia by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with Hyperinsulinemia across the seven major markets?

- What is the size of the Hyperinsulinemia’ patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend Hyperinsulinemia of?

- What will be the growth rate of patients across the seven major markets?

Hyperinsulinemia: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for Hyperinsulinemia drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the Hyperinsulinemia market?

- What are the key regulatory events related to the Hyperinsulinemia market?

- What is the structure of clinical trial landscape by status related to the Hyperinsulinemia market?

- What is the structure of clinical trial landscape by phase related to the Hyperinsulinemia market?

- What is the structure of clinical trial landscape by route of administration related to the Hyperinsulinemia market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)