Hypersomnia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

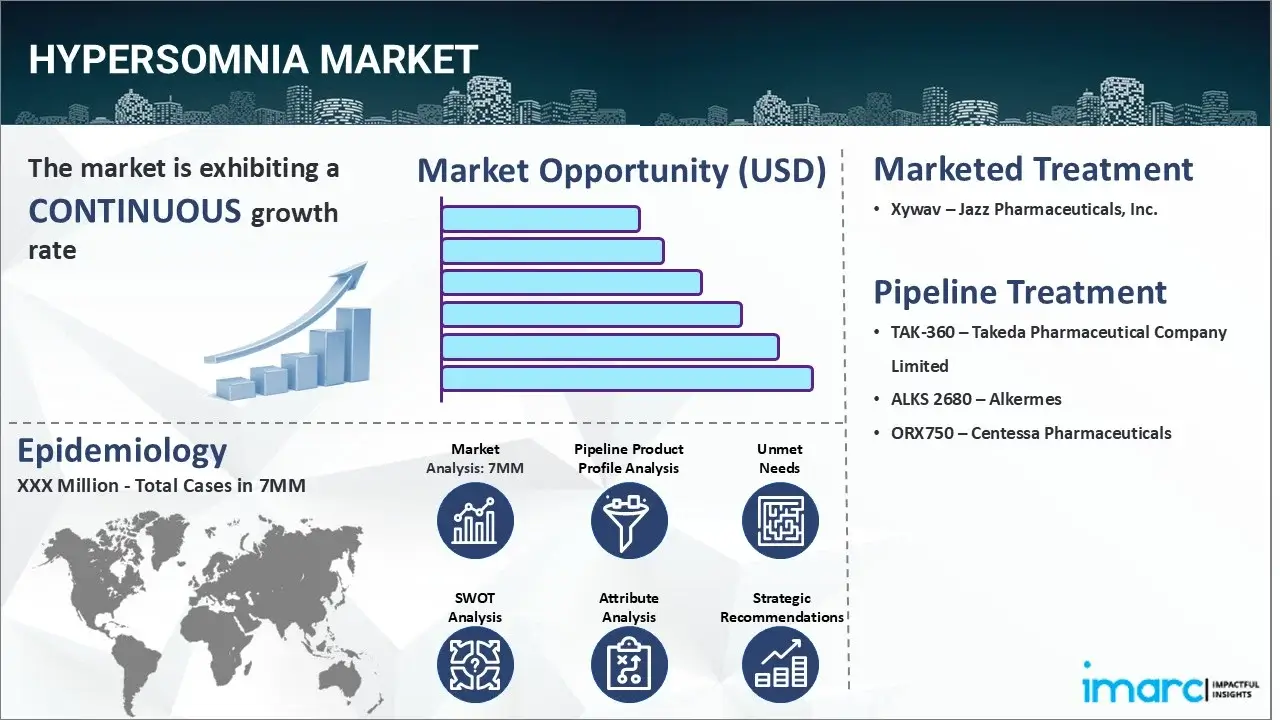

The top 7 (US, EU4, UK, and Japan) hypersomnia markets are expected to exhibit a CAGR of 6.47% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2035

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2035 | 6.47% |

The Hypersomnia market has been comprehensively analyzed in IMARC's new report titled "Hypersomnia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Hypersomnia refers to a neurological disorder characterized by excessive daytime sleepiness and prolonged periods of sleep at night. Individuals suffering from this ailment often find it challenging to stay awake during the day, despite getting adequate sleep at night. The disease can significantly impact daily functioning, leading to difficulties in maintaining concentration, memory problems, and impaired performance at work or school. Some common symptoms of this ailment include persistent drowsiness, long naps that provide little relief, trouble waking up, confusion, reduced alertness, irritability, slow thinking and movements, mood swings, emotional instability, heightened anxiety, restlessness, sleep drunkenness, etc. The diagnosis of hypersomnia typically consists of a combination of the patient's medical history, clinical features, and physical examination. The healthcare provider may also perform actigraphy, which involves wearing a small, non-invasive device on the wrist that records movement and activity levels over an extended period to evaluate sleep-wake patterns and detect disruptions in the circadian rhythm. In some cases, blood workups may be performed to check for underlying medical conditions, such as thyroid disorders or metabolic issues, that could be contributing to hypersomnia.

To get more information on this market, Request Sample

The increasing cases of abnormalities in the neurotransmitters, including norepinephrine and gamma-aminobutyric acid (GABA), which affect the excitability levels in the brain, are primarily driving the hypersomnia market. Besides this, the rising incidences of certain neurological conditions, like depression, multiple sclerosis, head trauma, etc., that can disrupt sleep patterns and lead to excessive sleepiness are creating a positive outlook for the market. Moreover, the widespread adoption of cognitive behavioral therapy to identify negative thoughts and substitute them with more adaptive and positive thinking is further bolstering the market growth. Apart from this, the inflating application of non-stimulant medications, such as sodium oxybate and armodafinil, since they can promote restorative sleep without altering the natural sleep-wake cycle, thereby providing a sustained and steady improvement in wakefulness throughout the day, is acting as another significant growth-inducing factor. Additionally, the emerging popularity of continuous positive airway pressure therapy, which helps to maintain an open and unobstructed airway during sleep, ensuring persistent airflow to the lungs, is expected to drive the hypersomnia market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the Hypersomnia market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for Hypersomnia and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the Hypersomnia market in any manner.

Key Highlights:

- Hypersomnia, or excessive daytime sleepiness, affects four to six percent of the general population.

- Hypersomnia is most common in adolescents, and it is uncommon in those beyond the age of 30.

- In pediatric clinics, middle school-aged children are twice as likely as preschool-aged children to have excessive daytime sleepiness.

- Men are more likely than women to suffer from hypersomnia, which may be caused by sleep apnea syndromes.

- In elderly people, patient-reported hypersomnia is connected with cognitive and functional deficits.

Drugs:

Xywav, also known as JZP258, is a lower sodium oxybate approved by the United States FDA for the treatment of idiopathic hypersomnia in adults. For the management of idiopathic hypersomnia in adults, Xywav can be taken twice or once every night.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the Hypersomnia market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the Hypersomnia market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current hypersomnia marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Xywav | Jazz Pharmaceuticals, Inc. |

| TAK-360 | Takeda Pharmaceutical Company Limited |

| ALKS 2680 | Alkermes |

| ORX750 | Centessa Pharmaceuticals |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the Hypersomnia market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the Hypersomnia across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the Hypersomnia across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of Hypersomnia across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Hypersomnia by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Hypersomnia by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Hypersomnia by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with Hypersomnia across the seven major markets?

- What is the size of the Hypersomnia patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend Hypersomnia of?

- What will be the growth rate of patients across the seven major markets?

Hypersomnia: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for Hypersomnia drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the Hypersomnia market?

- What are the key regulatory events related to the Hypersomnia market?

- What is the structure of clinical trial landscape by status related to the Hypersomnia market?

- What is the structure of clinical trial landscape by phase related to the Hypersomnia market?

- What is the structure of clinical trial landscape by route of administration related to the Hypersomnia market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)