Ice Cream Processing Equipment Market Size, Share, Trends and Forecast by Equipment Type, Product Type, Operations, and Region, 2025-2033

Ice Cream Processing Equipment Market Size and Share:

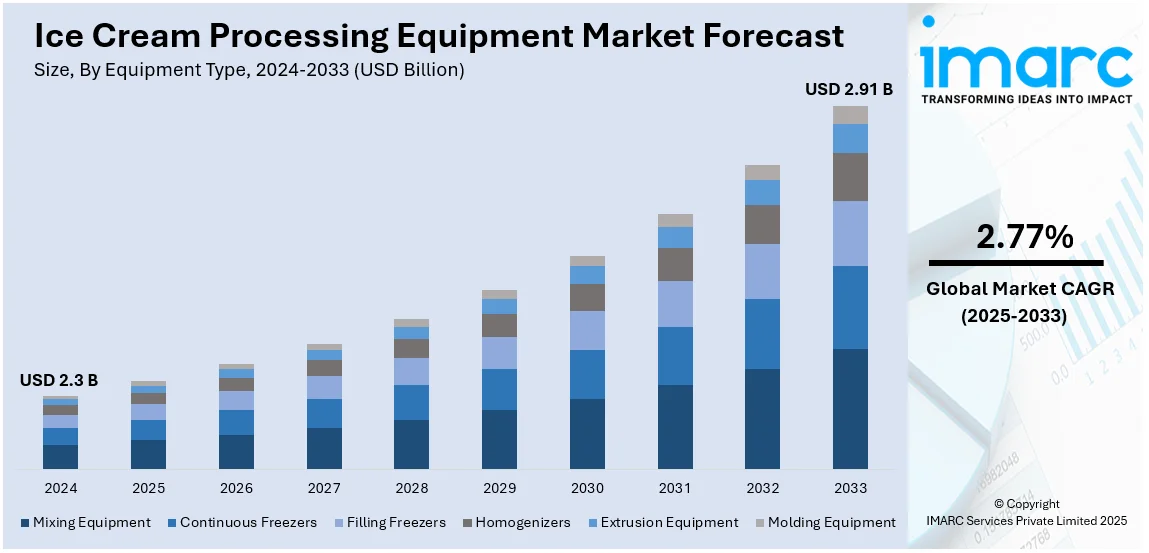

The global ice cream processing equipment market size was valued at USD 2.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.91 Billion by 2033, exhibiting a CAGR of 2.77% from 2025-2033. North America currently dominates the market, holding a market share of over 42.0% in 2024. The ice cream processing equipment market share is expanding, driven by the rising demand for premium ice cream products, ongoing technological advancements in machinery, continuous product innovations, the expansion of cold chain logistics, and the growing popularity of automated production processes in the food industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 2.91 Billion |

| Market Growth Rate (2025-2033) | 2.77% |

At present, the increasing demand for ice cream encourages manufacturers to upgrade production capabilities. Besides this, technological advancements in equipment, such as automation and energy efficiency, help companies to reduce costs and improve quality. Additionally, innovations in flavor and ingredient variety like dairy-free and low-sugar options, create the need for specialized machinery. Apart from this, rising disposable incomes and changing lifestyles encourage people to spend more on indulgent products like ice cream, which enhances the utilization of processing equipment. Moreover, environmental concerns lead to a shift towards eco-friendly equipment, thereby catalyzing the demand for modern processing solutions.

The United States has emerged as a major region in the ice cream processing equipment market because of many factors. The increasing demand for diverse ice cream products, including low-fat, sugar-free, and plant-based options, creates the need for advanced processing equipment. In March 2024, Eclipse Foods, a well-known company that produces vegan products, introduced plant-based ice cream bonbons in the United States. The range included three flavors- chocolate hazelnut truffle, peanut butter pretzel, and coffee almond crunch, set to arrive at selected grocery stores in the US. Additionally, technological advancements like automation and energy-efficient machinery, assist manufacturers in improving productivity and lowering operational costs. Besides this, the growing trend of customization, where individuals prefer unique flavors and textures, enables companies to adopt more flexible production systems. The market also benefits from high disposable incomes, with people willing to spend more on high-quality ice cream.

Ice Cream Processing Equipment Market Trends:

Growing demand for artisanal and premium ice cream

Specialized processing equipment is becoming high in demand, as people show a greater preference for premium and artisanal ice cream. Brands often emphasize quality ingredients, unique flavors, and small-batch production, requiring equipment that supports flexibility and customization. The trend of premium products encourages manufacturers to wager on advanced processing technologies that enable precise control over texture, flavor, and consistency. Industry research discloses that despite rising prices, 68% of consumers are interested to pay extra for fresh food. This promotes the development of advanced equipment, such as batch freezers, homogenizers, and flavoring systems. The rising popularity of gourmet and organic products further drives the need for high-end processing options that can handle complicated formulations and provide superior quality, thereby bolstering the ice cream processing equipment market growth.

Technological advancements and automation

The market is witnessing rapid technological advancements, particularly in automation and digitalization. Modern processing equipment is being equipped with smart technologies, such as Internet of Things (IoT) integration, artificial intelligence (AI)-driven analytics, and advanced control systems. The global IoT market size reached USD 1,022.6 Billion in 2024. Moreover, automation enhances production efficiency, minimizes labor costs, and ensures consistent product quality. For instance, automated systems can optimize mixing, freezing, and packaging processes, leading to higher throughput and reduced operational errors. Innovations in equipment design like continuous freezers and automated filling machines are improving manufacturing scalability and flexibility. These technological advancements are crucial for brands seeking to stay competitive in a market characterized by rapid product innovation and shifting user preferences.

Increasing focus on sustainability and energy efficiency

Sustainability and energy efficiency are offering a favorable ice cream processing equipment market outlook. They are becoming central considerations in the design and operations of ice cream processing equipment. An increasing focus is placed on lessening the environmental effects of manufacturing methods, stimulated by regulatory demands and user interest in sustainable products. A survey showed that although 65% of users expressed interest in purchasing purpose-driven brands that advocate sustainability, only around 26% actually made these purchases. Producers embrace energy-saving technologies and integrate eco-friendly methods into their equipment designs. For instance, energy-efficient refrigeration units, minimal waste manufacturing techniques, and incorporating recyclable materials for equipment assembly are increasingly common. Moreover, machinery that facilitates the handling of plant-derived and alternative dairy components corresponds with the wider shift towards sustainable food production. This focus helps companies to comply with environmental regulations and appeals to eco-conscious individuals.

Ice Cream Processing Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ice cream processing equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on equipment type, product type, and operation.

Analysis by Equipment Type:

- Mixing Equipment

- Continuous Freezers

- Filling Freezers

- Homogenizers

- Extrusion Equipment

- Molding Equipment

Continuous freezers offer several benefits over traditional batch freezers. They enable nonstop production, which means they can handle significant volumes of ice cream without needing to pause and restart the operation. This assists manufacturers in enhancing efficiency and shortening production time. Because they run continuously, they also save on labor costs, needing fewer employees to monitor the operation. They also feature the ability to make ice cream smoother and creamier. Continuous freezers provide better control of the freezing process, ensuring that the ice cream has uniform texture and quality. They are additionally more energy-efficient, helping companies to reduce operating expenses. Due to the strong demand for ice cream in different flavors and varieties, such as low-fat or dairy-free options, continuous freezers allow rapid changes in production, making them perfect for fulfilling varied choices. All these elements position continuous freezers as a preferred option for ice cream producers.

Analysis by Product Type:

- Soft Ice Cream Processing Equipment

- Hard Ice Cream Processing Equipment

Hard ice cream processing equipment leads the market with 45.8% of the market share. It is essential for producing the most popular type of ice cream – the classic hard scoop variety. This equipment is designed to handle the final stages of ice cream production, including freezing and hardening, which gives the ice cream its firm texture. Since hard ice cream is widely consumed in various forms, such as in cones, tubs, and novelty items, there is consistent demand for equipment that can produce it at scale. Hard ice cream equipment also offers versatility, allowing manufacturers to create a wide range of flavors and mix-ins like chocolate chips, nuts, and fruit swirls. The ability to quickly freeze ice cream without compromising texture helps to maintain high quality. With increasing preference for premium, artisanal, and indulgent ice cream, manufacturers are investing in these machines to meet the rising demand. These equipment are also cost-effective, making them a popular choice for both large and small producers.

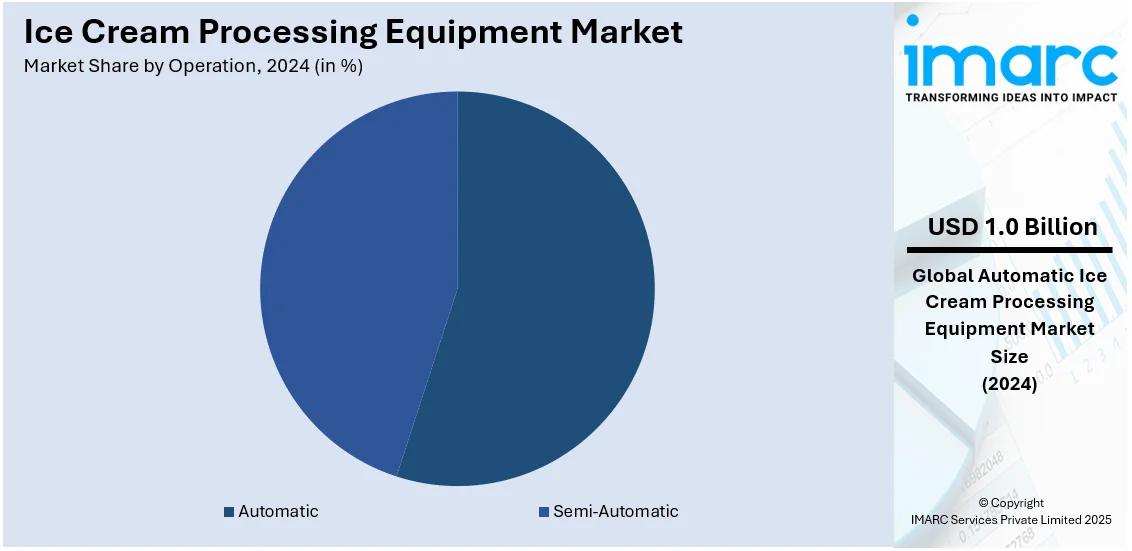

Analysis by Operation:

- Automatic

- Semi-Automatic

Automatic leads the market with 35.0% of the market share. It provides numerous benefits that assist producers in remaining efficient and competitive. Automation diminishes the requirement for manual work, thereby reducing expenses and accelerating the production process. By utilizing automatic machines, producers can create substantial quantities of ice cream without concerns over human mistakes or variances, guaranteeing excellent item quality consistently. These machines are also more adaptable, enabling producers to swiftly transition between various flavors or modify settings for different production requirements. Automatic equipment can handle complex tasks, like mixing, freezing, and packaging, all in one system, which simplifies operations. As demand for ice cream continues to rise, especially in developing regions, automatic machines aid businesses in scaling up quickly while maintaining quality. Additionally, with advancements in technology, these machines are more energy-efficient and environment friendly, making them an even more attractive choice for producers looking to improve both production and sustainability.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 42.0%, enjoys the leading position in the market. The region is noted for its well-established ice cream industry and high user demand for premium and artisanal products. The presence of leading manufacturers and advanced production facilities, particularly in the US, encourages the adoption of cutting-edge processing equipment, such as continuous freezers and automated systems. The area's emphasis on technological innovations and energy-efficient machinery caters to the rising ice cream processing equipment market demand. Besides this, North America's strong preference for diverse ice cream flavors and textures has motivated manufacturers to invest in specialized equipment capable of handling complex formulations. Furthermore, the high number of large-scale ice cream brands and an increasing focus on sustainability and automation in production processes contribute to the market growth. Companies in the United States wager on opening new facilities and branches to increase the sales of ice cream, created through modern equipment. In November 2024, Handel’s Homemade Ice Cream, an ice cream company franchise founded by Alice Handel, celebrated the grand opening of its latest location in Oxnard, US with exciting giveaways. The firm introduced its high-quality and homemade flavors and generated enthusiasm with three days of festivities for the community.

Key Regional Takeaways:

United States Ice Cream Processing Equipment Market Analysis

The market is experiencing significant growth, accounting for a share of 83.60%, driven by the heightened need for premium and innovative frozen desserts. As user preferences shift towards healthier and more sustainable options, there is a high demand for low-fat, dairy-free, and plant-based ice creams. Despite inflation, in 2022, user interest in plant-based food items continued to be robust, as indicated by the Plant-Based Foods State of the Marketplace report, which showed that 70% of Americans ate plant-based products. This trend has led to a surge in the requirement for plant-based ice cream options, particularly in categories like dairy-free and vegan varieties. The demand for artisanal and small-batch ice cream is also growing, prompting manufacturers to invest in flexible equipment that can handle diverse and customized production. Apart from this, technological advancements, such as automated and energy-efficient machinery, are improving production efficiency and reducing costs, which is essential in meeting both high user demand and environmental sustainability goals. Moreover, the rise of indulgence-focused products, combined with the growing concerns for environmental and health-related factors, is pushing the market towards eco-friendly and hygienic production systems. The integration of these elements, coupled with regulatory systems that guarantee food safety, encourages innovations and market expansion, creating a competitive landscape for producers.

Europe Ice Cream Processing Equipment Market Analysis

The market in Europe is witnessing significant growth, driven by evolving consumer preferences for premium, organic, and health-conscious frozen desserts. With a rising inclination towards low-fat, lactose-free, sugar-free, and plant-based ice creams, manufacturers wager on advanced processing technologies to meet these demands. According to reports, in 2023, 92% of individuals in Europe used the Internet, with 70% purchasing or ordering products and services online within the last year. This increased reliance on e-commerce platforms is influencing the industry, as people seek convenient, innovative, and customizable frozen desserts through online platforms. As a result, manufacturers focus on improving their online presence and expanding direct-to-consumer channels, which drives demand for efficient production systems capable of offering diverse product varieties. Furthermore, the rising trend of indulgence, coupled with the need for convenience, is increasing retail sales of ice cream in supermarkets and specialty stores. Technological advancements, such as automated systems, energy-efficient machinery, and packaging innovations have enhanced production processes, thereby reducing costs and boosting operational efficiency. Additionally, sustainability and eco-friendly practices are becoming key priorities for both users and manufacturers, attracting investments in greener equipment and environmentally responsible production methods.

Asia-Pacific Ice Cream Processing Equipment Market Analysis

The market in the APAC region is experiencing significant growth, driven by rising disposable incomes, urbanization, and shifting user preferences towards innovative frozen desserts. The World Bank states that East Asia and the Pacific is the fastest urbanizing area globally, experiencing an average yearly urbanization rate of 3%. As cities grow, the need for high-quality and varied ice cream choices increases. This trend of urbanization, especially in nations such as China, India, and Japan, has resulted in a growing demand for both traditional and plant-based ice cream options. People are becoming more health-conscious, leading to a high need for dairy-free, low-calorie, and sugar-free products. Moreover, the rise of artisanal and small-batch ice creams drives the demand for advanced processing equipment that can produce customized and high-quality products. Manufacturers are also investing in state-of-the-art machinery that enhances production efficiency and meets the rising need for sustainable and eco-friendly options.

Latin America Ice Cream Processing Equipment Market Analysis

The market in Latin America is experiencing growth, driven by high disposable incomes and rising urbanization. According to reports, urbanization in Latin American countries has reached around 80%, surpassing most other regions. As urban centers expand, individuals are demanding more premium and diverse ice cream options, including healthier alternatives like low-fat and plant-based varieties. Additionally, advancements in technology are enabling manufacturers to improve production efficiency and meet evolving user preferences. The rise in retail presence and competition is further driving the demand for innovative and high-quality ice cream processing equipment in the region.

Middle East and Africa Ice Cream Processing Equipment Market Analysis

The market in the Middle East and Africa is growing owing to higher disposable incomes and the trend of urbanization. The World Bank states that the Middle East and North Africa (MENA) region is currently 64% urbanized, leading to an increased demand for luxurious frozen desserts. The region's increasing preference for healthier, low-calorie, and plant-based ice cream options is also contributing to the market growth. With a hot climate and increased consumer interest in frozen treats, manufacturers are investing in energy-efficient and technologically advanced equipment to meet the growing need for diverse ice cream products in this dynamic market.

Competitive Landscape:

Major participants in the market unveil cutting-edge technologies and focus on enhancing production efficiency. These firms significantly allocate resources to research and development (R&D) efforts to produce sophisticated and energy-saving equipment that lowers expenses and enhances ice cream quality. By implementing automation, they assist manufacturers in increasing production and ensuring uniform quality. Big companies also promote sustainability, designing eco-friendly equipment that meets environmental standards. Additionally, through strategic partnerships and customer support, they assist businesses in navigating challenges in production and customization. Their efforts in providing flexible and reliable equipment keep the market competitive and cater to evolving user preferences. They also focus on offering equipment that caters to the high demand for specialized products, like dairy-free or low-sugar ice creams. For instance, in February 2023, Froneri broadened its ice cream range by introducing Cadbury Caramilk in the UK, offered in sticks and tubs. After its candy triumph, the product boasted a caramelized white chocolate exterior and a smooth center.

The report provides a comprehensive analysis of the competitive landscape in the ice cream processing equipment market with detailed profiles of all major companies, including:

- Carpigiani Group (Ali Group Srl)

- GEA Group Aktiengesellschaft

- Goma Engineering Pvt. Ltd.

- Gram Equipment A/S

- Ice Group

- ROKK Processing Ltd

- Technogel S.p.a

- Teknoice Srl (ITAGO S.r.l.)

- Tetra Pak International S.A.

- Vojta s.r.o

Latest News and Developments:

- November 2024: Cuisinart launched the Solo Scoops Ice Cream Maker, aimed at making homemade frozen dessert creation easier. This small device featured one-button functionality, enabling users to prepare ice cream, gelato, sorbet, or frozen yogurt in less than 25 minutes. Its compact and freezer-compatible churning bowl improved convenience for home use.

- July 2024: Aavin set up a fresh ice cream manufacturing facility, involving an estimated investment of INR 43.41 Crore (USD 5 Million). The establishment aims to manufacture various ice creams, such as kulfi and candy, as well as dairy items like buttermilk and lassi. Backed by the Dairy Processing and Infrastructure Development Fund, the facility will feature a 10-tonne capacity for fermented dairy items.

Ice Cream Processing Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Mixing Equipment, Continuous Freezers, Filling Freezers, Homogenizers, Extrusion Equipment, Molding Equipment |

| Product Types Covered | Soft Ice Cream Processing Equipment, Hard Ice Cream Processing Equipment |

| Operations Covered | Automatic, Semi-Automatic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Carpigiani Group (Ali Group Srl), GEA Group Aktiengesellschaft, Goma Engineering Pvt. Ltd., Gram Equipment A/S, Ice Group, ROKK Processing Ltd, Technogel S.p.a, Teknoice Srl (ITAGO S.r.l.), Tetra Pak International S.A., Vojta s.r.o, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ice cream processing equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ice cream processing equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ice cream processing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ice cream processing equipment market was valued at USD 2.3 Billion in 2024.

The ice cream processing equipment market is projected to exhibit a CAGR of 2.77% during 2025-2033, reaching a value of USD 2.91 Billion by 2033.

Innovations in automation, energy-efficient machinery, and improved freezing techniques are helping companies to enhance production while maintaining product quality. Besides this, the rise of premium and artisanal ice creams, which require specialized equipment, is driving the demand for more customized processing machinery. Moreover, people are seeking healthier and more diverse ice cream options, encouraging manufacturers to upgrade equipment to handle different ingredients and production needs.

North America currently dominates the riot control system market, accounting for a share of 42.0%, in 2024, driven by high demand for diverse ice cream products, established industry presence, technological advancements, innovations in flavors and ingredients, and rising preference for premium and artisanal products.

Some of the major players in the ice cream processing equipment market include Carpigiani Group (Ali Group Srl), GEA Group Aktiengesellschaft, Goma Engineering Pvt. Ltd., Gram Equipment A/S, Ice Group, ROKK Processing Ltd, Technogel S.p.a, Teknoice Srl (ITAGO S.r.l.), Tetra Pak International S.A., Vojta s.r.o, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)