Ilmenite Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Ilmenite Price Trend, Index and Forecast

Track the latest insights on ilmenite price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Ilmenite Prices Outlook Q2 2025

- USA: US$ 336/MT

- Malaysia: US$ 332/MT

- India: US$ 295/MT

- Indonesia: US$ 260/MT

- Japan: US$ 350/MT

Ilmenite Price Chart

Get real-time access to monthly/quaterly/yearly prices, Request Sample

During the second quarter of 2025, the ilmenite prices in the USA reached 336 USD/MT in June. As per the ilmenite price chart, prices were influenced by fluctuating demand, particularly from the titanium dioxide (TiO2) sector, and changing supply dynamics. Other factors like raw material availability, energy costs, and environmental regulations also influenced ilmenite prices.

During the second quarter of 2025, ilmenite prices in Malaysia reached 332 USD/MT in June. Ilmenite prices in Malaysia experienced fluctuations due to a combination of factors, including changes in demand from downstream industries, inventory levels, and broader economic conditions.

During the second quarter of 2025, the ilmenite prices in India reached 295 USD/MT in June. Prices in India were influenced by a combination of factors, including fluctuating demand, raw material costs, and potential supply disruptions. Changing downstream demand, particularly in sectors like automotive and construction, also contributed to price variations.

During the second quarter of 2025, the ilmenite prices in Indonesia reached 260 USD/MT in June. Geopolitical tensions and uncertainties, especially concerning exports, created an environment of market stagnation, further impacting pricing.

During the second quarter of 2025, the ilmenite prices in Japan reached 350 USD/MT in June. The market faced challenges from volatile raw material prices, potential supply disruptions, and the increasing commercialization of ilmenite alternatives like rutile and leucoxene.

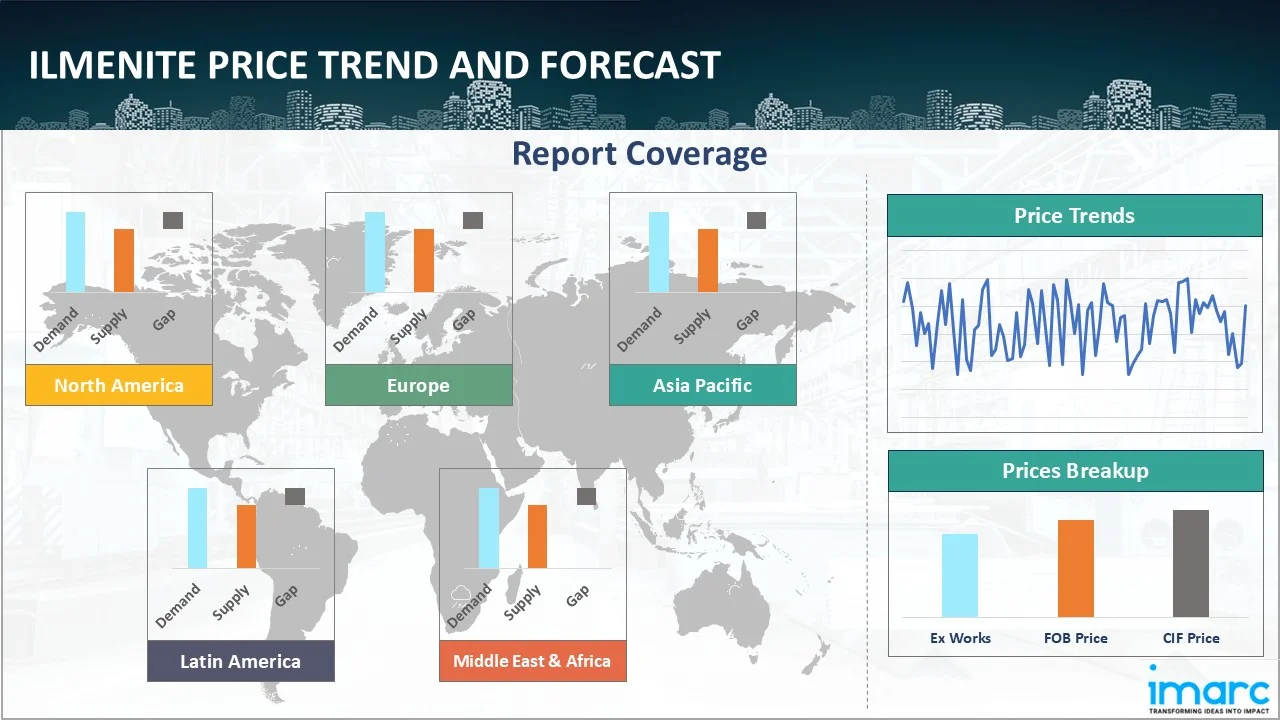

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the ilmenite prices.

Global Ilmenite Price Trend

The report offers a holistic view of the global ilmenite pricing trends in the form of ilmenite price charts, reflecting the worldwide interplay of supply-demand balances, international trade policies, and overarching economic factors that shape the market on a macro level. This comprehensive analysis not only highlights current price levels but also provides insights into historical price of ilmenite, enabling stakeholders to understand past fluctuations and their underlying causes. The report also delves into price forecast models, projecting future price movements based on a variety of indicators such as expected changes in supply chain dynamics, anticipated policy shifts, and emerging market trends. By examining these factors, the report equips industry participants with the necessary tools to make informed strategic decisions, manage risks, and capitalize on market opportunities. Furthermore, it includes a detailed ilmenite demand analysis, breaking down regional variations and identifying key drivers specific to each geographic market, thus offering a nuanced understanding of the global pricing landscape.

Europe Ilmenite Price Trend

Q2 2025:

As per the ilmenite price index, in Q2 2025, ilmenite prices experienced a noticeable decline, largely influenced by persistent weakness in downstream industries such as automotive, construction, and coatings. These sectors, which are significant consumers of titanium dioxide (TiO₂), a major derivative of ilmenite, continued to face demand-side challenges due to broader economic uncertainty, cost inflation, and restrained consumer spending.

This analysis can be extended to include detailed ilmenite price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Ilmenite Price Trend

Q2 2025:

At the beginning of the quarter, prices declined as the market grappled with a persistent demand slowdown, particularly from its principal end-use sector, titanium dioxide (TiO₂). The TiO₂ industry, which heavily relies on ilmenite as a raw material, continued to face subdued consumption across major applications such as plastics, paper, and especially paints and coatings. While there was some stability in demand from the coatings segment, supported by ongoing infrastructure maintenance and seasonal construction, this proved insufficient to counterbalance the broader weakness across industrial and consumer-driven sectors.

Specific ilmenite prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Ilmenite Price Trend

Q2 2025:

The report explores the ilmenite trends and ilmenite price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on ilmenite prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Ilmenite Price Trend

Q2 2025:

In early April 2025, ilmenite prices in the Asia Pacific region were influenced by gradual changes in the electric vehicle (EV) and broader manufacturing sectors. As governments in Asia, particularly China and South Korea, continued to promote EV adoption through policy incentives and infrastructure development, the need for high-performance coatings, plastics, and lightweight materials, many of which rely on TiO₂ escalated, influencing pricing and demand for ilmenite.

This ilmenite price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Ilmenite Price Trend

Q2 2025:

Latin America's ilmenite market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in ilmenite prices. Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the ilmenite price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing ilmenite pricing trends in this region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Ilmenite Price Trend, Market Analysis, and News

IMARC's latest publication, “Ilmenite Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the ilmenite market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of ilmenite at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed ilmenite price trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting ilmenite pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Ilmenite Industry Analysis

The global ilmenite market size reached USD 11.70 Billion in 2024. By 2033, IMARC Group expects the market to reach USD 17.71 Billion, at a projected CAGR of 4.7% during 2025-2033.

- The titanium dioxide sector remains the dominant driver of the ilmenite market, as ilmenite is a primary feedstock for TiO₂ production. TiO₂ is widely used as a white pigment in paints, coatings, plastics, paper, and cosmetics. With urbanization and infrastructure development on the rise, especially in emerging economies, the demand for architectural coatings and construction materials is increasing steadily. Additionally, growth in the packaging and automotive industries is expanding the need for high-performance plastic products, further driving TiO₂ consumption. As regulatory standards push industries toward higher durability and energy efficiency, the demand for advanced coatings incorporating TiO₂ continues to climb.

- The continued expansion of industrial activities and infrastructure development in regions such as Asia-Pacific, Africa, and the Middle East significantly influences ilmenite market growth. Massive government investments in housing, roads, transportation, and energy infrastructure stimulate demand for construction materials, particularly paints and coatings, which utilize titanium dioxide produced from ilmenite. In countries like India, China, and Indonesia, rising urban populations and industrialization efforts have led to sustained growth in construction, automotive, and consumer goods manufacturing sectors that indirectly fuel demand for ilmenite-based pigments and intermediates. These economies are also expanding their domestic mining and refining capabilities to reduce import dependency, which supports a robust local supply chain.

- Supply-side dynamics play a crucial role in shaping the ilmenite market. A significant portion of global ilmenite production comes from politically sensitive or geographically volatile regions such as Madagascar, Mozambique, and parts of India and Ukraine. Any disruptions due to geopolitical tensions, labor unrest, environmental restrictions, or export bans can tighten global supply, creating upward pressure on prices. In recent years, stricter environmental regulations and permitting challenges have slowed the pace of new mine development and expansions, leading to constrained supply growth. Furthermore, logistical bottlenecks such as port congestion and limited shipping capacity can delay exports, impacting timely availability in key consuming markets. In times of supply tightness, downstream TiO₂ producers may face procurement challenges, prompting stockpiling behavior and speculative buying that further inflate demand.

Ilmenite News

The report covers the latest developments, updates, and trends impacting the global ilmenite industry, providing stakeholders with timely and relevant information. This segment covers a wide array of news items, including the inauguration of new production facilities, advancements in ilmenite production technologies, strategic market expansions by key industry players, and significant mergers and acquisitions that impact the ilmenite price trend.

Latest developments in the Ilmenite industry:

- June 2025: Atlantic Strategic Minerals began commercial production at fully integrated mining and processing facilities in Virginia. Under long-term offtake agreements, the project, which is mostly owned by the private equity firm Appian Capital Advisory, started supplying high-purity zircon and ilmenite to domestic industrial consumers.

Product Description

Ilmenite is a naturally occurring titanium-iron oxide mineral with the chemical formula FeTiO₃. It is the most abundant titanium-bearing ore and serves as a critical raw material for the production of titanium dioxide (TiO₂), a white pigment widely used in paints, coatings, plastics, paper, and cosmetics. Ilmenite typically appears as a black or dark gray mineral with a metallic to submetallic luster and is found in both hard rock deposits and beach sand placers, often alongside minerals like rutile, leucoxene, and zircon.

The primary industrial use of ilmenite is as a feedstock in sulfate or chloride processes for producing TiO₂ pigment. It is also used in the production of titanium metal and welding rod coatings. Major ilmenite-producing countries include Australia, South Africa, India, Vietnam, and Mozambique.

Ilmenite’s market dynamics are closely linked to trends in the construction, automotive, and consumer goods sectors, which influence TiO₂ demand. As global infrastructure and industrial activities expand, especially in developing regions, the demand for ilmenite rises accordingly. However, the market is also sensitive to environmental regulations, geopolitical disruptions, and changes in mining policies, which can affect supply stability.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Ilmenite |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonia Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of ilmenite pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting ilmenite price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The ilmenite price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)