In-vitro Colorectal Cancer Screening Tests Market Size, Share, Trends and Forecast by Product, Imaging Type, End User, and Region, 2025-2033

In-vitro Colorectal Cancer Screening Tests Market Size and Share:

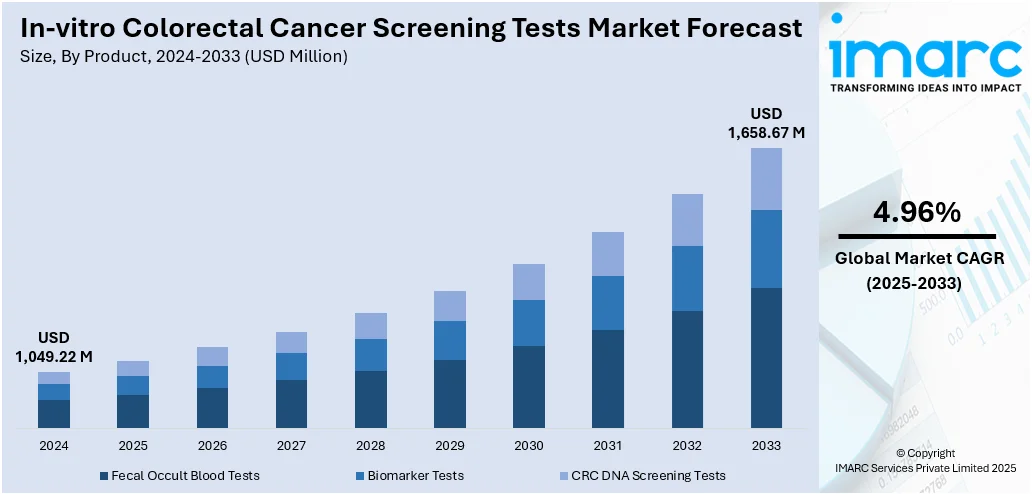

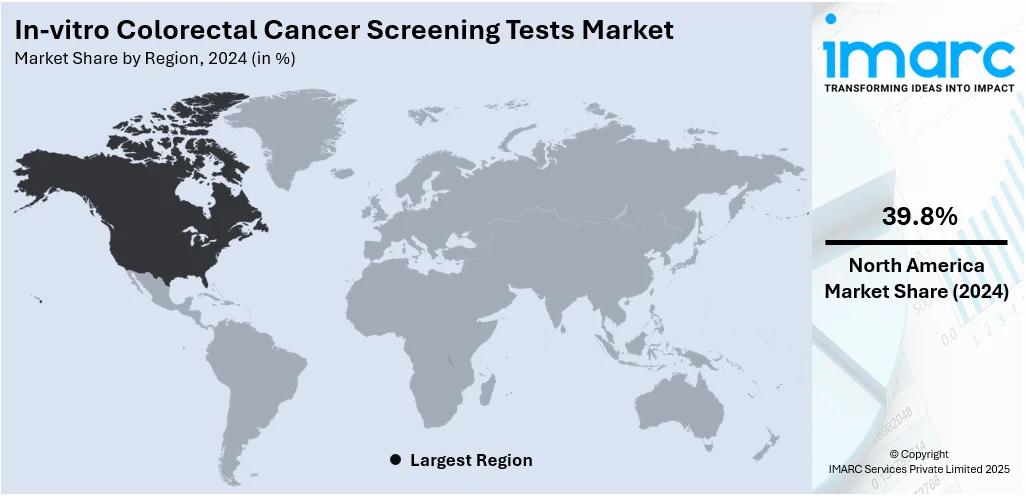

The global in-vitro colorectal cancer screening tests market size was valued at USD 1,049.22 Million in 2024. The market is projected to reach USD 1,658.67 Million by 2033, exhibiting a CAGR of 4.96% from 2025-2033. North America currently dominates the market, holding a market share of 39.8% in 2024. The market is driven by the rising incidence of colorectal cancer globally, growing awareness about early detection, and increasing adoption of non-invasive diagnostic methods. Technological advancements in test accuracy and ease of use further fuel market growth. Additionally, supportive government initiatives, aging populations, and a shift toward preventive healthcare contribute to increased demand. The convenience, affordability, and efficiency of in-vitro tests compared to traditional screening methods also play a significant role in driving in-vitro colorectal cancer screening tests share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,049.22 Million |

|

Market Forecast in 2033

|

USD 1,658.67 Million |

| Market Growth Rate 2025-2033 | 4.96% |

One major driver in the in-vitro colorectal cancer screening tests market is the growing demand for non-invasive, home-based diagnostic solutions. Traditional methods like colonoscopies are often perceived as uncomfortable, costly, and inconvenient, leading many individuals to avoid screening. In-vitro tests, such as fecal immunochemical tests (FIT) and stool DNA tests, offer a simpler, painless alternative that can be performed at home without clinical assistance. This convenience significantly improves patient compliance and expands screening coverage, especially among aging and at-risk populations. As healthcare systems prioritize preventive care, the shift toward non-invasive testing continues to boost in-vitro colorectal cancer screening tests growth.

To get more information on this market, Request Sample

The U.S. in-vitro colorectal cancer screening tests market is experiencing steady growth due to strong healthcare infrastructure, rising awareness of early cancer detection, and a shift toward non-invasive, home-based diagnostic options. In 2023, 72.6% of U.S. adults aged 50–75 were up-to-date with colorectal cancer screening, with home-based tests playing a major role in this achievement. Patients increasingly prefer at-home solutions like fecal immunochemical and stool DNA tests over invasive procedures like colonoscopies. Technological advancements, including blood-based screening and biomarker innovations, are further improving test accuracy and expanding available options. Supportive policies, insurance coverage, and a focus on preventive healthcare continue to drive market demand across the U.S. healthcare landscape.

In-vitro Colorectal Cancer Screening Tests Market Trends:

Rising Incidence of Colorectal Cancer Globally

One of the main market trends for in-vitro colorectal cancer screening tests is the rising incidence of colorectal cancer worldwide. Around 1.93 million new instances of colorectal cancer and 930,000 related deaths were reported globally in 2020; by 2040, these numbers are predicted to increase by more than 60%. One of the most frequent malignancies to be diagnosed and a major contributor to cancer-related death is colorectal cancer. Contributing factors include sedentary lifestyles, unhealthy diets, rising obesity rates, and aging populations. Early detection significantly improves outcomes, increasing the demand for accessible, non-invasive screening options. In-vitro tests, such as fecal immunochemical and stool Deoxyribonucleic acid (DNA) tests, offer a cost-effective and scalable solution ideal for early-stage detection. Governments and health organizations are increasingly implementing national screening programs to reduce mortality rates. As global awareness grows around the importance of early diagnosis, adoption of in-vitro screening tests continues to strengthen across healthcare systems.

Technological Advancements and Innovation in Screening Methods

Continuing technological advancements have greatly improved the sensitivity, specificity, and convenience of in-vitro screening tests for colorectal cancer. Next-generation fecal immunochemical tests (FIT), DNA stool tests, and biomarker-based diagnostics provide more accurate and stable results compared to older methods. Incorporation of automation, artificial intelligence, and digital pathology into diagnostic processes has decreased turnaround time, decreased human error, and enhanced diagnostic throughput. These enhancements make screening more attractive to patients and healthcare providers alike, leading to higher uptake. Furthermore, the creation of simple home-based test kits enables easy and intimate screening, even particularly attractive to those who are hesitant to submit to invasive exams like colonoscopies. As competition in the diagnostic arena gets fiercer, firms are pouring money into R&D to create innovative, affordable, and scalable in-vitro tests, thus propelling long-term market expansion and shaping early cancer detection strategies.

Growing Preference for Non-Invasive and Home-Based Screening

One of the main forces propelling the in-vitro colon cancer screening tests market outlook is the growing patient demand for non-invasive, at-home diagnostic tools. Conventional methods such as colonoscopy are highly effective but are usually viewed as unpleasant, costly, and inconvenient. On the other hand, in-vitro tests like FIT and multi-target stool DNA tests can be done discreetly at home without bowel preparation, sedation, or hospitalization. This convenience maximizes patient compliance, particularly for elderly and vulnerable patients. In the COVID-19 pandemic era, home-based testing became popular because access to clinical sites was restricted, underlining long-term need for remote diagnostic services. As healthcare systems become more oriented toward prevention and personalized medicine, home-based in-vitro tests fit into these trends. Greater availability through pharmacies, web platforms, and telehealth options further drives adoption, positioning non-invasive screening as a primary driver of in-vitro colorectal cancer screening tests demand.

In-vitro Colorectal Cancer Screening Tests Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global in-vitro colorectal cancer screening tests market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, imaging type, and end user.

Analysis by Product:

- Fecal Occult Blood Tests

- Guaiac FOB Stool Test

- Immuno-FOB Agglutination Test

- Lateral Flow Immuno-FOB Test

- Immuno-FOB ELISA Test

- Biomarker Tests

- Tumor M2-PK Stool Test

- Transferrin Assays

- CRC DNA Screening Tests

- Methylated Gene Testing

- Panel DNA Tests

Based on the in-vitro colorectal cancer screening tests forecast, the fecal occult blood tests (FOBTs) account for the majority of shares in the in-vitro colorectal cancer screening tests market due to their affordability, ease of use, and widespread availability. These tests are non-invasive, require no specialized equipment, and can be performed at home, making them highly accessible and widely accepted, especially in large-scale public health screening programs. Their low cost compared to other diagnostic methods makes them particularly suitable for use in resource-limited settings and for population-wide screening initiatives. Additionally, FOBTs have long been integrated into clinical guidelines, which supports consistent demand. While newer technologies are emerging, the simplicity, cost-effectiveness, and established clinical utility of fecal occult blood tests continue to drive their dominant market share globally.

Analysis by Imaging Type:

- Colonoscopy

- Proctoscopy

- CT Scan

- Ultrasound

- MRI

- PET Scan

Colonoscopy dominates the market demand in colorectal cancer screening due to its status as the gold standard for both detection and prevention. Unlike in-vitro tests, colonoscopy allows direct visualization of the entire colon and enables the removal of precancerous polyps during the same procedure, reducing cancer risk. Its high sensitivity and diagnostic accuracy make it the preferred choice among healthcare professionals for high-risk individuals or those with positive in-vitro test results. Additionally, colonoscopy is often recommended in national screening guidelines and widely covered by insurance, further encouraging its use. Despite being invasive and requiring preparation, its ability to provide immediate, actionable results and long-term screening intervals makes it a trusted and effective option in colorectal cancer prevention and early diagnosis.

Analysis by End User:

- Hospitals

- Clinics

- Diagnostic Laboratories

- Others

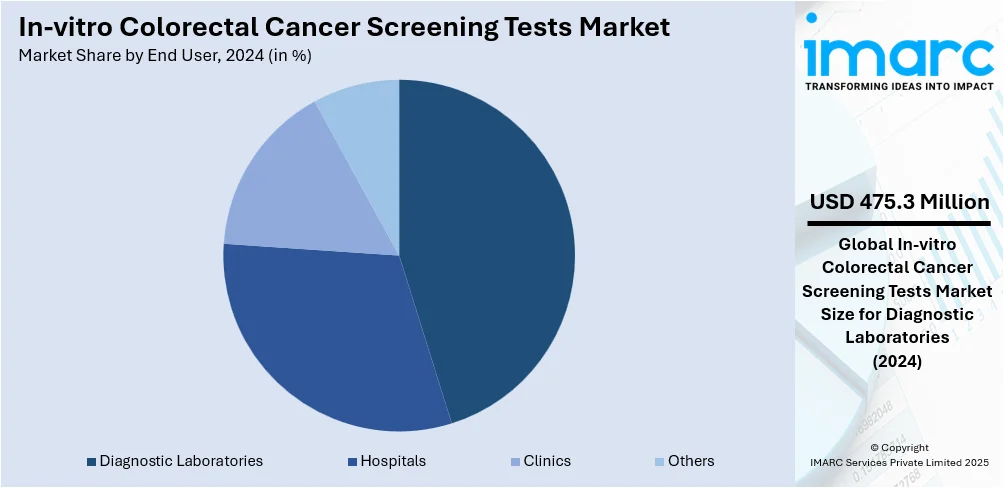

According to the in-vitro colorectal cancer screening tests analysis, the diagnostic laboratories represent the majority of shares in the in-vitro colorectal cancer screening tests market owing to their established infrastructure, advanced testing capabilities, and ability to process large volumes of samples with high accuracy. These laboratories offer a wide range of specialized tests, including fecal immunochemical tests (FIT), stool DNA tests, and biomarker-based assays, enabling comprehensive and early detection of colorectal cancer. Their integration with healthcare providers and insurance networks ensures broader patient access and coverage, enhancing test adoption. Additionally, diagnostic labs continuously invest in automation, quality control, and innovation to improve turnaround times and diagnostic reliability. Their nationwide reach, regulatory compliance, and participation in public screening programs position them as key players driving efficiency, accessibility, and trust in colorectal cancer screening services.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America is the leading region in the in-vitro colorectal cancer screening tests market due to a combination of advanced healthcare infrastructure, high public awareness, and strong government support for cancer screening programs. The region benefits from early adoption of innovative technologies, including non-invasive tests like fecal immunochemical, stool DNA, and emerging blood-based assays. Favorable reimbursement policies and widespread health insurance coverage further promote regular screening among high-risk populations. Public health campaigns and national screening guidelines encourage early detection, improving patient outcomes and driving market demand. Additionally, the presence of key industry players and continuous investment in research and development contribute to a competitive and innovation-driven environment. These factors collectively position North America as the dominant force in this growing market.

Key Regional Takeaways:

United States In-Vitro Colorectal Cancer Screening Market Analysis

The United States in-vitro colorectal cancer screening market is primarily driven by the rising incidence and prevalence of colorectal cancer, which is driving increased demand for early detection tools. According to the American Cancer Society, colorectal cancer is the third most common cause of cancer-related deaths in men and the fourth most common in women in the United States. In 2025, colorectal cancer is projected to cause approximately 52,900 deaths. Lifestyle trends such as obesity, sedentary behavior, smoking, alcohol consumption, and diets high in red and processed meats are contributing to rising colorectal cancer risks, prompting more widespread screening. According to the U.S. Centers for Disease Control and Prevention (CDC), obesity prevalence among adults in the United States reached 40.3% from August 2021 to August 2023. Other than this, advancements in automation, AI‑enhanced laboratory platforms, and next‑generation sequencing have increased throughput and lowered per‑test costs, making sophisticated assays more accessible. A heightened emphasis on early detection through value‑based care models is also strengthening insurer and Medicare reimbursement for non‑invasive diagnostics, thereby broadening patient access. Government-funded cancer prevention programs and enhanced regulatory support for novel test approvals are reducing barriers and catalyzing market growth as labs and providers increasingly integrate these in‑vitro solutions into routine screening protocols.

Asia Pacific In-Vitro Colorectal Cancer Screening Market Analysis

The Asia Pacific in-vitro colorectal cancer screening market is expanding due to advancements in molecular diagnostics and biomarker research, enabling the development of more precise and sensitive screening assays. For instance, the molecular diagnostics market in India reached USD 1.3 Million in 2024 and is forecasted to grow at a CAGR of 7.7% from 2025-2033, as per industry reports. Rising demand for early cancer detection in increasing geriatric populations across countries such as Japan, South Korea, and Australia is also expediting the shift toward laboratory-based preventive diagnostics. In 2023, individuals aged 65 years and over accounted for 30% of the total population of Japan. Increasing prevalence of colorectal cancer among younger age groups is also prompting healthcare authorities to lower the recommended screening age, expanding the target demographic for in-vitro testing. The growing presence of international diagnostic companies is fostering technology transfer and innovation within local markets.

Europe In-Vitro Colorectal Cancer Screening Market Analysis

The growth of the Europe in-vitro colorectal cancer screening market is largely fueled by the emergence of novel biomarker assays, which is driving demand for more sensitive, non‑invasive lab tests that offer improved diagnostic accuracy and patient comfort. Moreover, increased public funding for cancer registries and large‑scale epidemiological studies is enabling data‑driven, risk‑based screening strategies tailored to subpopulations, boosting uptake of in‑vitro diagnostics. Increasing telehealth integration across the region is also transforming sample tracking and lab coordination, reducing turnaround times and enhancing patient compliance. Additionally, national screening programs are increasingly integrating in-vitro testing into routine preventive care, supported by eHealth solutions that streamline patient tracking and follow-up. According to the European Commission, the average overall composite score for the EU increased from 72% to 79% in 2023 on the eHealth indicator, highlighting a robust eHealth maturity rate for the region. Other than this, heightened focus on sustainability in healthcare has led to greater interest in minimally invasive, low-waste diagnostic solutions, with in-vitro tests offering a lower environmental footprint compared to traditional procedures.

Latin America In-Vitro Colorectal Cancer Screening Market Analysis

The Latin America in-vitro colorectal cancer screening market is experiencing robust growth due to the increasing prevalence of colorectal cancer, which is driving the demand for effective screening methods. For instance, 60,118 cases of colorectal cancer were recorded in Brazil in 2022, as per a report by the World Cancer Research Fund. Of these, men accounted for 30,164 cases, while women accounted for 29,954 cases. In response, several countries in the region are implementing national screening programs that utilize non-invasive in-vitro tests to improve early detection and reduce mortality rates associated with colorectal cancer. Besides this, advancements in diagnostic technologies have led to the development of more accurate and cost-effective in-vitro screening tests, making them accessible to a broader population and supporting market growth.

Middle East and Africa In-Vitro Colorectal Cancer Screening Market Analysis

The Middle East and Africa in-vitro colorectal cancer screening market is significantly driven by increasing investments in healthcare infrastructure modernization and the expansion of diagnostic laboratories. Rising government focus on implementing nationwide cancer screening policies is improving early detection efforts. Besides this, private sector growth and partnerships with global diagnostic companies are enhancing the availability and affordability of advanced in-vitro screening technologies. As reported, Saudi Arabia is actively pursuing privatization in its healthcare sector, aiming to increase private sector contribution from 40% to 65% by 2030. Initiatives to train healthcare professionals on the latest diagnostic methods are also helping increase screening rates across the region.

Competitive Landscape:

Competition is driven by innovation, technology, and an emphasis on non-invasive diagnostic tests. Several players compete through the creation of more precise, easy-to-use, and affordable tests, such as stool-based DNA, fecal immunochemical, and blood-based tests. The market witnesses steady investment in research and development to improve test sensitivity and broaden accessibility, particularly through home-based solutions. Strategic partnerships, regulatory clearances, and increased insurance coverage are some of the drivers of competition. Firms are also placing a focus on digital health integration and patient outreach to drive screening compliance. As the need for early detection increases, the market is lively, with high stakes being played to gain share through best-in-class clinical performance and extensive market reach.

The report provides a comprehensive analysis of the competitive landscape in the in-vitro colorectal cancer screening tests market with detailed profiles of all major companies, including:

- Beckman Coulter Inc. (Danaher Corporation)

- Eiken Chemical Co. Ltd.

- Epigenomics AG

- Exact Sciences Corporation

- Hemosure Inc.

- Immunostics Inc. (Boditech Med Inc.)

- Medline Industries LP

- Merck KGaA

- Qiagen N.V.

- Quest Diagnostics Incorporated

- R-Biopharm AG

- Siemens AG

- Sysmex Corporation

Latest News and Developments:

- May 2025: Sysmex Europe SE, a provider of advanced diagnostic solutions, including in-vitro diagnostic assays, introduced its revolutionary automated colorectal cancer (CRC) screening solution. By adding a new completely automated stool analysis solution to its FIT DX Series portfolio, Sysmex Europe intends to meet the urgent demand for scalability and efficiency in the fight against colorectal cancer, which is one of the most deadly cancers globally.

- March 2025: Exact Sciences announced a major update to Cologuard, its at-home colorectal cancer screening test. Cologuard Plus, the latest version, integrates more genetic biomarkers to increase accuracy. This improvement is expected to lower false positives and maintain the test's sensitivity to identify advanced precancerous polyps and early-stage cancers.

- January 2025: Tempus AI, Inc. introduced the NGS-based in-vitro diagnostic tool, xT CDx, for colorectal cancer screening. The xT CDx is currently accessible to all ordering clinicians across the country. It is an FDA-approved test that provides thorough insights using one of the most extensive gene panels on the market.

- July 2024: The United States Food & Drug Administration (FDA) has approved Guardant Shield, a blood test for colorectal cancer screening. Shield is an in-vitro diagnostic test used to identify changes in cell-free DNA in the blood that are caused by colorectal cancer. The test is designed to assess individuals at an average risk of colorectal cancer (CRC) who are aged 45 years and older.

In-vitro Colorectal Cancer Screening Tests Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Imaging Types Covered | Colonoscopy, Proctoscopy, CT scan, Ultrasound, MRI, PET Scan |

| End Users Covered | Hospitals, Clinics, Diagnostic Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Beckman Coulter Inc. (Danaher Corporation), Eiken Chemical Co. Ltd., Epigenomics AG, Exact Sciences Corporation, Hemosure Inc., Immunostics Inc. (Boditech Med Inc.), Medline Industries LP, Merck KGaA, Qiagen N.V., Quest Diagnostics Incorporated, R-Biopharm AG, Siemens AG and Sysmex Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the in-vitro colorectal cancer screening tests market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global in-vitro colorectal cancer screening tests market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the in-vitro colorectal cancer screening tests industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The in-vitro colorectal cancer screening tests market was valued at USD 1,049.22 Million in 2024.

The in-vitro colorectal cancer screening tests market is projected to exhibit a CAGR of 4.96% during 2025-2033, reaching a value of USD 1,658.67 Million by 2033.

Key factors driving the in-vitro colorectal cancer screening tests market include rising colorectal cancer prevalence, growing awareness of early detection, and increasing preference for non-invasive, home-based tests. Technological advancements, improved test accuracy, supportive government initiatives, and a shift toward preventive healthcare further boost demand and market expansion globally.

North America currently dominates the in-vitro colorectal cancer screening tests market, accounting for a share of 39.8% due to high awareness, strong healthcare infrastructure, advanced diagnostic technologies, and favorable reimbursement policies drive market growth. This dominance is further supported by government screening programs and widespread adoption of non-invasive, home-based testing solutions across the region.

Some of the major players in the in-vitro colorectal cancer screening tests market include Beckman Coulter Inc. (Danaher Corporation), Eiken Chemical Co. Ltd., Epigenomics AG, Exact Sciences Corporation, Hemosure Inc., Immunostics Inc. (Boditech Med Inc.), Medline Industries LP, Merck KGaA, Qiagen N.V., Quest Diagnostics Incorporated, R-Biopharm AG, Siemens AG, Sysmex Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)