India 3D CAD Software Market Size, Share, Trends and Forecast by Deployment, Application, and Region, 2026-2034

India 3D CAD Software Market Summary:

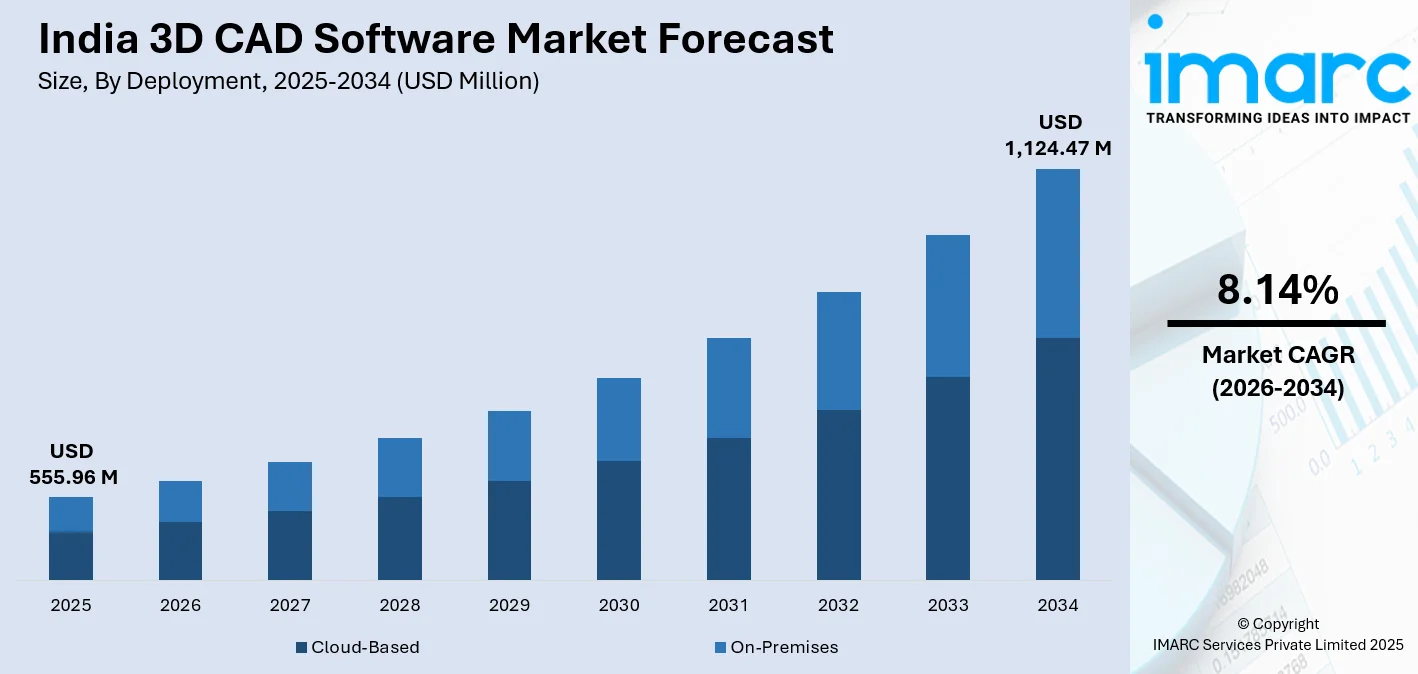

The India 3D CAD software market size was valued at USD 555.96 Million in 2025 and is projected to reach USD 1,124.47 Million by 2034, growing at a compound annual growth rate of 8.14% from 2026-2034.

India's 3D CAD software sector is experiencing robust growth driven by rapid digitalization across manufacturing sectors, government initiatives promoting engineering education, and increasing adoption of advanced design technologies. Apart from this, the market benefits from the country's growing engineering talent pool, rising infrastructure investments, and the shift toward cloud-based collaborative design platforms that enable real-time project modifications and remote workflows, thereby expanding the India 3D CAD software market share.

Key Takeaways and Insights:

- By Deployment: Cloud-based dominates the market with a share of 62% in 2025, driven by lower upfront costs, scalability advantages, and seamless collaboration capabilities across geographically dispersed engineering teams.

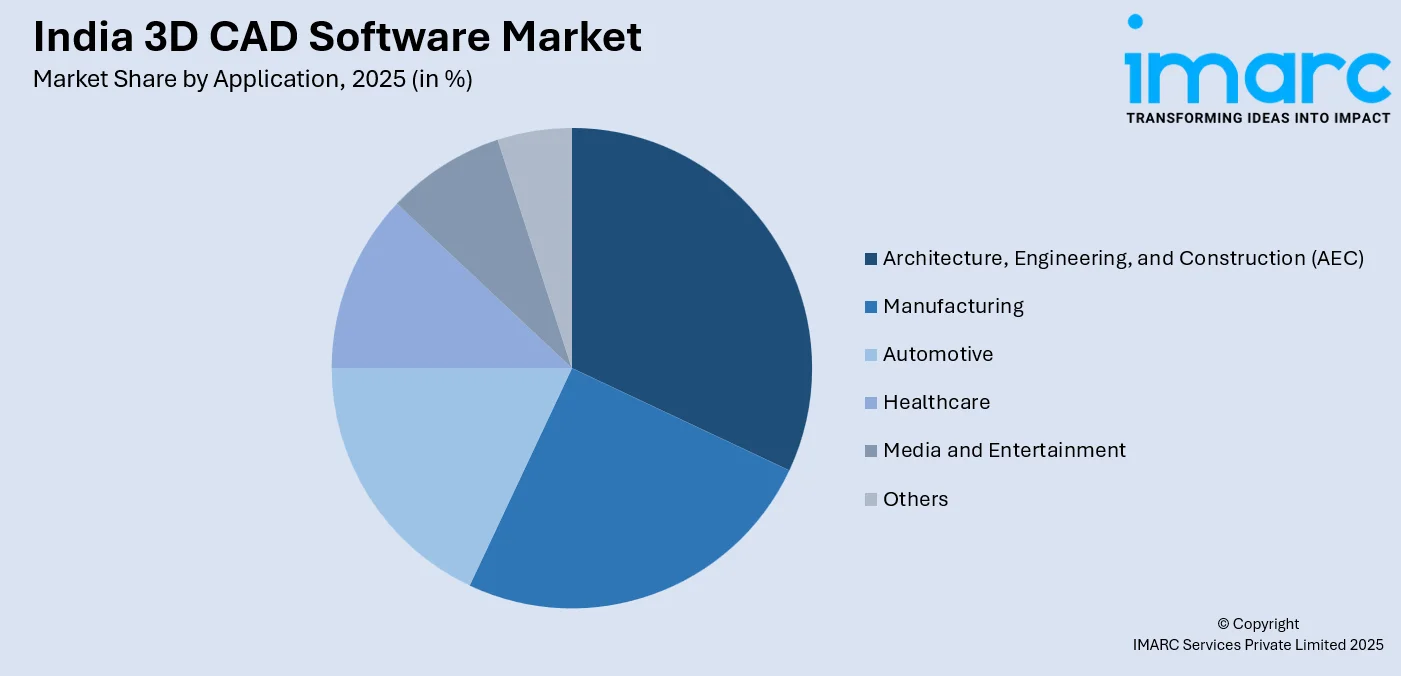

- By Application: Architecture, engineering, and construction (AEC) leads the market with a share of 26% in 2025, fueled by massive infrastructure development projects and smart city initiatives requiring sophisticated 3D modeling capabilities.

- By Region: North India represents the largest segment with a market share of 29% in 2025, benefiting from the concentration of manufacturing hubs, automotive clusters, and engineering institutes in Delhi NCR and surrounding industrial corridors.

- Key Players: The India 3D CAD software market exhibits high competitive intensity, with global software giants competing alongside emerging domestic providers across various price segments and application verticals.

To get more information on this market Request Sample

The India 3D CAD software market is undergoing a transformative phase as enterprises across manufacturing, construction, and design sectors embrace digital engineering workflows. The convergence of affordable high-speed internet, increasing cloud infrastructure penetration, and growing awareness of design automation benefits has accelerated software adoption among small and medium enterprises. The market is particularly strengthened by India's position as a global engineering services hub, with multinational corporations establishing design centers that require sophisticated 3D modeling capabilities. Educational institutions are increasingly incorporating CAD training into engineering curricula, creating a skilled workforce proficient in advanced design tools. The government's Make in India initiative and production-linked incentive schemes have further catalyzed manufacturing investments, driving demand for precise design and prototyping solutions that reduce time-to-market and minimize production errors. In 2024, ASCON is announced about its collaboration with Reliamotive Labs in India. Reliamotive Labs focuses on developing next-gen technology, providing consulting, and distributing software, offering solutions for heavy industries and academic and research institutions globally. Reliamotive Labs, in collaboration with ASCON, will showcase the KOMPAS-3D computer-aided design system in India, providing a variety of ASCON CAD solutions to meet the demands of this fast-expanding market.

India 3D CAD Software Market Trends:

Integration of Artificial Intelligence (AI) and Generative Design Capabilities

AI-powered generative design features are revolutionizing how engineers approach product development by automatically generating multiple design alternatives based on specified parameters. Machine learning (ML) algorithms now enable predictive modeling that anticipates potential design flaws, optimizes material usage, and suggests performance improvements before physical prototyping. In 2025, the Government of India highlighted the idea of 'AI for All,' in line with the Hon’ble Prime Minister's goal to make technology accessible to everyone. This effort seeks to guarantee that AI advantages all areas of society, fostering innovation and expansion. The Union Cabinet, under the leadership of the Hon’ble Prime Minister, has sanctioned the IndiaAI Mission on 7th March 2024, a strategic plan to create a strong and inclusive AI ecosystem that corresponds with the nation’s development objectives.

Adoption of Virtual Reality and Augmented Reality Design Review

The incorporation of immersive technologies into CAD workflows is transforming design validation and client presentation processes across architectural and manufacturing applications. India's AR/VR market is expected to witness a robust CAGR, with high demand in manufacturing, healthcare and retail sectors. Engineering teams can now conduct virtual walkthroughs of building designs or inspect industrial equipment in three-dimensional space before construction begins, identifying spatial conflicts and ergonomic issues that traditional two-dimensional reviews might miss. The rise of virtual reality and augmented reality in CAD facilitates immersive design reviews and stakeholder engagement, further enhancing product innovation. India augmented reality market is projected to attain USD 49.6 Billion by 2033, as per IMARC Group.

Subscription-Based Licensing Models Replacing Perpetual Licenses

The software industry is witnessing a fundamental shift toward flexible subscription models that lower entry barriers for smaller enterprises while providing vendors with predictable revenue streams. This transition enables engineering firms to access premium features through monthly or annual subscriptions rather than significant capital expenditures, with automatic updates ensuring access to the latest technological advancements. The actual price for AutoCAD subscription in India is INR 1,03,000 plus 18% GST, representing a structured investment that manufacturing SMEs across Indian industrial hubs have increasingly adopted, allowing them to scale software access according to project demands while maintaining budget flexibility during economic fluctuations.

Market Outlook 2026-2034:

The India 3D CAD software market is poised for sustained growth as digital transformation initiatives penetrate deeper into traditional manufacturing sectors and emerging industries adopt sophisticated design tools. The expanding aerospace and defense manufacturing ecosystem, combined with the electronics hardware production surge under government incentive programs, will create substantial demand for specialized CAD applications. The market generated a revenue of USD 555.96 Million in 2025 and is projected to reach a revenue of USD 1,124.47 Million by 2034, growing at a compound annual growth rate of 8.14% from 2026-2034. Healthcare equipment manufacturers and medical device companies are increasingly requiring biocompatible design capabilities, while the renewable energy sector's expansion necessitates advanced turbine and solar panel design tools.

India 3D CAD Software Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Deployment | Cloud-Based | 62% |

| Application | Architecture, Engineering, and Construction (AEC) | 26% |

| Region | North India | 29% |

Deployment Insights:

- Cloud-Based

- On-Premises

Cloud-based dominates with a market share of 62% of the total India 3D CAD software market in 2025.

Cloud-based 3D CAD solutions have emerged as the preferred deployment model due to their ability to eliminate substantial upfront infrastructure investments while providing automatic software updates and seamless version control. The subscription-based pricing structure allows engineering firms to convert capital expenditures into operational expenses, improving cash flow management and enabling predictable budgeting. Cloud platforms facilitate real-time collaboration among geographically dispersed design teams, allowing engineers in Bangalore to work simultaneously with manufacturing specialists in Ahmedabad on the same project file, with changes reflected instantaneously across all access points.

The cloud deployment model addresses critical challenges faced by India's rapidly growing engineering services sector, particularly for companies managing multiple client projects with varying software requirements. Cloud providers offer scalable computing resources that can handle complex rendering and simulation tasks without requiring local high-performance workstations, democratizing access to advanced design capabilities. Data security concerns, once a significant barrier, have diminished as providers implement robust encryption protocols and comply with international data protection standards, making cloud-based CAD increasingly attractive to enterprises handling sensitive intellectual property and proprietary designs.

Application Insights:

To get detailed segment analysis of this market Request Sample

- Architecture, Engineering, and Construction (AEC)

- Manufacturing

- Automotive

- Healthcare

- Media and Entertainment

- Others

Architecture, engineering, and construction (AEC) leads with a share of 26% of the total India 3D CAD software market in 2025.

The AEC sector's dominance reflects India's unprecedented infrastructure development phase, with government initiatives allocating substantial funding toward urban transportation networks, affordable housing projects, and commercial real estate development. 3D CAD software enables architects and structural engineers to create detailed building information models that integrate architectural aesthetics with structural integrity and MEP (mechanical, electrical, plumbing) systems coordination. The technology facilitates clash detection during the design phase, preventing costly on-site modifications and construction delays that have historically plagued large-scale infrastructure projects across Indian cities.

Smart city developments across one hundred urban centers require sophisticated spatial planning and utility integration that traditional two-dimensional drafting cannot adequately address. CAD platforms enable municipal planners to visualize how proposed developments interact with existing infrastructure, assess environmental impact, and optimize resource allocation before breaking ground. Real estate developers in Hyderabad are increasingly mandating BIM-compliant 3D models from architects, recognizing that comprehensive digital twins reduce construction timelines and improve coordination among multiple contractors, ultimately enhancing project profitability and buyer satisfaction in India's competitive property market.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 29% share of the total India 3D CAD software market in 2025.

North India's market leadership stems from the Delhi NCR region's concentration of automotive manufacturing facilities, aerospace component producers, and heavy engineering enterprises that require sophisticated design capabilities. The region hosts numerous research and development centers established by multinational corporations, creating sustained demand for cutting-edge CAD platforms that support complex product development cycles. Educational institutions across Delhi, Noida, and Gurgaon produce a significant proportion of India's engineering graduates, many of whom receive CAD training during their academic programs, creating a skilled workforce that drives software adoption among regional employers.

The region's industrial corridors, particularly the Delhi-Mumbai Industrial Corridor and the proposed Amritsar-Kolkata Industrial Corridor, are attracting substantial manufacturing investments that necessitate advanced design infrastructure. Government initiatives promoting defense equipment indigenization have spurred growth among precision engineering firms in the region, many of which require military-grade CAD systems for component design and testing. Infrastructure development projects, including the expansion of metro networks across Delhi, Jaipur, and Lucknow, generate continuous demand for architectural and civil engineering CAD applications, reinforcing North India's position as the primary market for 3D design software across diverse industry verticals.

Market Dynamics:

Growth Drivers:

Why is the India 3D CAD Software Market Growing?

Government Initiatives Promoting Manufacturing and Infrastructure Development

The Indian government's production-linked incentive schemes across electronics, automotive, and pharmaceutical manufacturing sectors are driving substantial capital investments in production facilities that require sophisticated design capabilities. By March 2025, PLI programs had attracted ₹1.76 lakh crore in investment, delivered ₹16.5 lakh crore in production, and generated over 12 lakh jobs across 14 sectors. These initiatives mandate specific localization targets and quality standards that necessitate precise engineering design and simulation tools. The National Infrastructure Pipeline, allocating significant funding toward transportation, energy, and urban development projects, creates sustained demand for architectural and civil engineering CAD applications. State governments are establishing dedicated industrial parks with plug-and-play infrastructure, attracting both domestic manufacturers and foreign direct investment that relies on advanced design software for rapid production setup and product customization.

Increasing Adoption of Digital Twin Technology Across Manufacturing

Manufacturing enterprises are increasingly implementing digital twin frameworks that create virtual replicas of physical assets, enabling real-time monitoring, predictive maintenance, and performance optimization. India's digital twin market size reached USD 1,147.5 Million in 2025 and is expected to reach USD 18,016.9 Million by 2034, exhibiting a growth rate of 35.79% during 2026-2034. This approach requires comprehensive 3D CAD models as the foundational layer upon which sensor data and operational analytics are overlaid. The pharmaceutical industry is applying similar methodologies to equipment design and facility layout, ensuring regulatory compliance while maximizing production efficiency through virtual experimentation that eliminates costly physical prototyping.

Growing Penetration of Additive Manufacturing and Rapid Prototyping

The declining costs of 3D printing technology and increasing material options have made additive manufacturing accessible to small and medium enterprises across India, creating demand for CAD software optimized for layer-based fabrication. The government is now aiming to advance additive manufacturing or 3D printing domestically, targeting a 5% share of the worldwide market and seeking to contribute nearly $1 billion to GDP by 2025. Engineering firms require specialized design tools that can generate topology-optimized structures, incorporate lattice geometries, and account for material-specific printing parameters. In 2024, STPL3D introduced India's first-ever SLS 3D Printer with a build volume of 500 x 500 x 500 mm, transforming additive manufacturing with higher accuracy and scalability.

Market Restraints:

What Challenges the India 3D CAD Software Market is Facing?

High Software Licensing Costs Limiting SME Adoption

Despite the availability of subscription models, comprehensive CAD software suites with advanced simulation and rendering capabilities remain financially prohibitive for many small and medium enterprises operating on tight margins. The total cost of ownership extends beyond licensing fees to include necessary hardware upgrades, employee training programs, and ongoing technical support, creating barriers for companies considering digital transformation. Many SMEs continue relying on outdated or pirated software versions, limiting their ability to participate in supply chains that mandate specific file formats or collaboration platform compatibility.

Shortage of Skilled Professionals Proficient in Advanced CAD Systems

The rapid evolution of CAD software features, particularly AI-enhanced design tools and parametric modeling capabilities, has created a skills gap between what engineering curricula provide and what industry requires. Many recent graduates possess only basic CAD proficiency, necessitating extensive on-the-job training that smaller firms cannot afford. The shortage of experienced CAD specialists who can optimize workflows, troubleshoot complex modeling issues, and train junior staff constrains software adoption, as enterprises hesitate to invest in tools their workforce cannot fully utilize.

Cybersecurity Concerns and Intellectual Property Protection Issues

The shift toward cloud-based CAD platforms raises significant concerns about design file security and intellectual property theft, particularly for companies working on proprietary products or defense-related projects. Data sovereignty requirements and concerns about foreign server locations create hesitation among enterprises handling sensitive design information. The lack of comprehensive cybersecurity frameworks and limited awareness about proper data encryption practices expose companies to potential industrial espionage, making some organizations reluctant to adopt cloud-based solutions despite their operational advantages.

Competitive Landscape:

The India 3D CAD software market features intense competition among established global software providers and emerging domestic developers offering localized solutions at competitive price points. International vendors leverage their extensive feature sets, robust technical support networks, and integration capabilities with other enterprise software systems to maintain market leadership across large enterprises and multinational corporations. These providers continuously invest in artificial intelligence enhancements, cloud infrastructure improvements, and industry-specific customization to address diverse application requirements. Domestic software companies are gaining traction by offering affordable alternatives with simplified interfaces targeted toward small and medium enterprises, often providing vernacular language support and local customer service that resonates with regional manufacturers. The competitive landscape is further shaped by strategic partnerships between software vendors and hardware manufacturers, educational institutions, and industry associations that promote specific platforms through training programs and certification initiatives. Companies are increasingly adopting freemium models to build user bases among students and startups, anticipating conversion to paid subscriptions as these users advance in their careers or scale their businesses.

India 3D CAD Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployments Covered | Cloud-Based, On-Premises |

| Applications Covered | Architecture, Engineering, and Construction (AEC), Manufacturing, Automotive, Healthcare, Media and Entertainment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India 3D CAD software market size was valued at USD 555.96 Million in 2025.

The India 3D CAD software market is expected to grow at a compound annual growth rate of 8.14% from 2026-2034 to reach USD 1,124.47 Million by 2034.

Cloud-based dominated the market with a 62% share in 2025, driven by lower upfront investments, automatic software updates, seamless collaboration capabilities, and scalable computing resources that eliminate the need for high-performance local workstations while enabling real-time multi-location project coordination.

Key factors driving the India 3D CAD software market include government manufacturing incentives and infrastructure development programs that attracted investments, increasing adoption of digital twin technology and growing penetration of additive manufacturing with the 3D printing market experiencing significant growth.

Major challenges include high licensing and implementation costs that limit SME adoption, shortage of skilled professionals proficient in advanced CAD features and parametric modeling, and cybersecurity concerns regarding intellectual property protection in cloud-based deployment models.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)