India 3D Printing Materials Market Size, Share, Trends and Forecast by Type, Form, End User, and Region, 2025-2033

India 3D Printing Materials Market Overview:

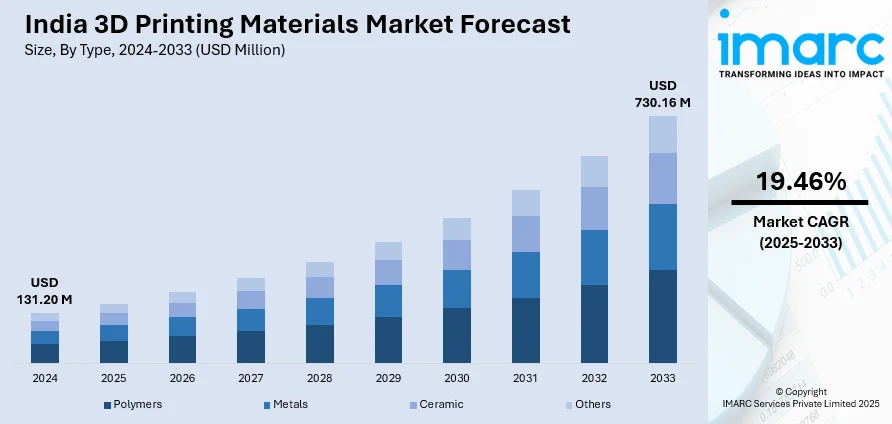

The India 3D printing materials market size reached USD 131.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 730.16 Million by 2033, exhibiting a growth rate (CAGR) of 19.46% during 2025-2033. The market is driven by increasing adoption across healthcare, automotive, and aerospace sectors, augmenting demand for customized and cost-effective solutions, and government initiatives promoting advanced manufacturing. Rising environmental concerns are also fueling the use of sustainable materials, while technological advancements and R&D investments are accelerating India 3D printing materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 131.20 Million |

| Market Forecast in 2033 | USD 730.16 Million |

| Market Growth Rate (2025-2033) | 19.46% |

India 3D Printing Materials Market Trends:

Rising Demand for Sustainable and Biodegradable 3D Printing Materials

The transition towards sustainable and green materials is heavily driving the India 3D printing materials market development. As more environmental concerns grow and regulations tighten, industries are turning to biodegradable materials like PLA (polylactic acid) and recycled polymers for 3D printing purposes. The materials are budget-friendly and fit into the world's drive for sustainability. Healthcare, packaging and consumer goods industries are spearheading efforts to minimize their carbon footprint. Additionally, government-initiated initiatives on green manufacturing and circular economy strategies are significantly elevating the call for sustainable materials in 3D printing. As more and more companies adopt sustainable practices, it is likely that the trend will extend, and more businesses will discover innovative means of adopting sustainable manufacturing.

To get more information on this market, Request Sample

Expansion of 3D Printing in Healthcare and Medical Applications

The healthcare sector in India is emerging as a key driver in the India 3D printing materials market outlook. The demand for customized medical devices, prosthetics, and implants is fueling the adoption of advanced materials including biocompatible resins, titanium, and nylon. 3D printing enables the production of patient-specific solutions, improving treatment outcomes and reducing costs. According to a research report published by the IMARC Group, the size of the market for implantable medical devices in India is expected to reach USD 109.2 Billion in 2024. The market is expected to reach USD 182.1 Billion in value by 2033, growing at a CAGR of 5.7% during the next 8 years (2025 to 2033). Moreover, the COVID-19 outbreak further accelerated this trend with the use of 3D printing for producing personal protective equipment (PPE), ventilator parts, and many more medical-related supplies. With a changing healthcare landscape, the requirement for ultra-grade materials that meet strict medical specifications is increasing. This trend is driven by increasing investment in research and development, in addition to collaboration between material manufacturers and healthcare providers, making 3D printing a game-changing technology in the medical field in India.

India 3D Printing Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, form, and end user.

Type Insights:

- Polymers

- Acrylonitrile Butadiene Styrene (ABS)

- Polylactic Acid (PLA)

- Photopolymers

- Nylon

- Others

- Metals

- Steel

- Titanium

- Aluminum

- Others

- Ceramic

- Silica Sand

- Glass

- Gypsum

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes polymers acrylonitrile butadiene styrene (ABS), polylactic acid (PLA), photopolymers, nylon, and others), metals (steel, titanium, aluminum, and others), ceramic (silica sand, glass, gypsum, and others), and others.

Form Insights:

- Powder

- Filament

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes powder, filament, and liquid.

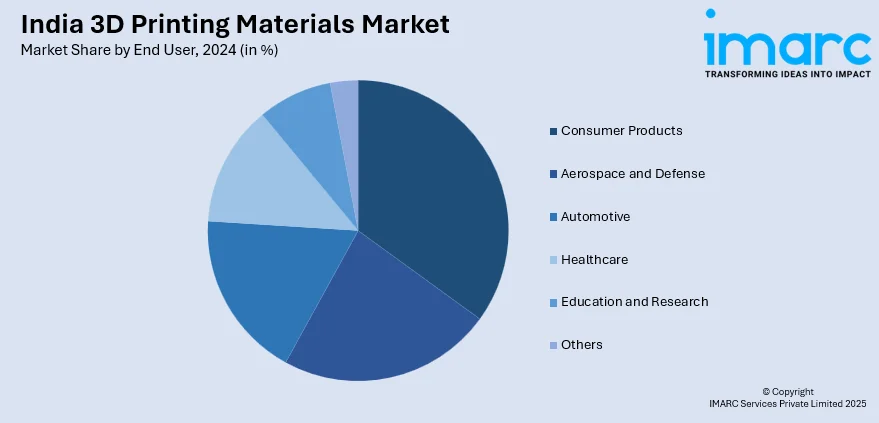

End User Insights:

- Consumer Products

- Aerospace and Defense

- Automotive

- Healthcare

- Education and Research

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes consumer products, aerospace and defense, automotive, healthcare, education and research, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India 3D Printing Materials Market News:

- November 04, 2024: Sparsh Hospitals opened a 3D printing lab at the facility for the manufacturing of bespoke prosthetics and surgical models to increase precision in orthopedic procedures in India. This facility aims to reduce recovery times and healthcare costs, resulting in increased demand for advanced 3D printing materials in the Indian medical industry. With the market for 3D printing materials projected to grow, innovations such as patient-specific implants and bioengineered organs are set to change the healthcare sector.

- June 01, 2024: Chennai-headquartered startup Agnikul Cosmos unveiled Agnibaan SOrTeD, the world's first fully 3D-printed engine for use in a rocket, and the rocket is also a first of sorts for India. Developed by ISRO and IN-SPACe, this rocket uses a domestically built semi-cryogenic engine and was launched from Dhanush, India's first private launchpad. This development indicates how the demand for advanced 3D printing materials in India's aerospace industry is on the rise.

India 3D Printing Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Forms Covered | Powder, Filament, Liquid |

| End Users Covered | Consumer Products, Aerospace and Defense, Automotive, Healthcare, Education and Research, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India 3D printing materials market performed so far and how will it perform in the coming years?

- What is the breakup of the India 3D printing materials market on the basis of type?

- What is the breakup of the India 3D printing materials market on the basis of form?

- What is the breakup of the India 3D printing materials market on the basis of end user?

- What is the breakup of the India 3D printing materials market on the basis of region?

- What are the various stages in the value chain of the India 3D printing materials market?

- What are the key driving factors and challenges in the India 3D printing materials market?

- What is the structure of the India 3D printing materials market and who are the key players?

- What is the degree of competition in the India 3D printing materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India 3D printing materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India 3D printing materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India 3D printing materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)