India 5G Services Market Size, Share, Trends and Forecast by Communication Type, End Use, and Region, 2025-2033

India 5G Services Market Overview:

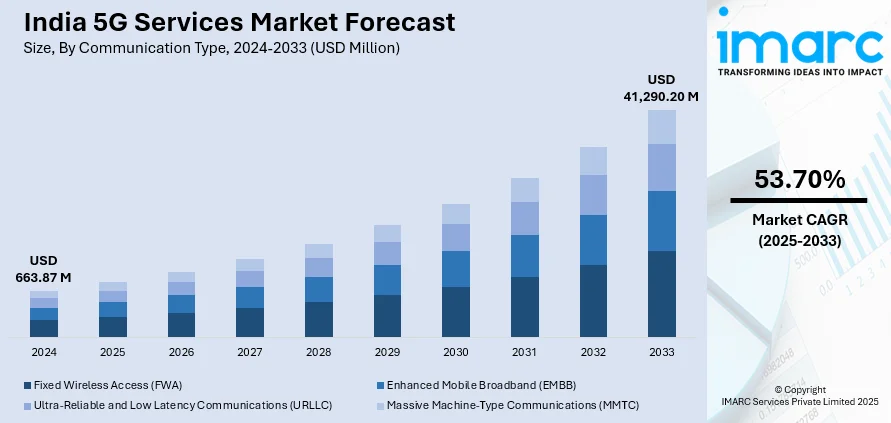

The India 5G services market size reached USD 663.87 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 41,290.20 Million by 2033, exhibiting a growth rate (CAGR) of 53.70% during 2025-2033. Rising mobile data consumption, expanding smartphone penetration, government-backed digital transformation initiatives, rapid smart city development, industrial automation needs, elevating demand for low-latency networks, competitive telecom pricing, and the nationwide 5G rollout by key telecom players are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 663.87 Million |

| Market Forecast in 2033 | 41,290.20 Million |

| Market Growth Rate 2025-2033 | 53.70% |

India 5G Services Market Trends:

Surge in Data Consumption and Mobile Internet Demand

One of the primary drivers fueling the expansion of the 5G services market in India is the rapid and constant surge in mobile data usage among urban as well as rural consumers. India has become one of the biggest consumers of mobile data worldwide, with customers downloading higher levels of video content, social media, games, and cloud-based services on a daily basis. The proliferation of video streaming services, such as YouTube, Netflix, Hotstar, and local OTTs, has also extensively increased the requirement for high-speed, low-latency networks that 4G infrastructures cannot handle as efficiently. This has prompted telecom operators and stakeholders to invest heavily in 5G, as it provides up to 10x higher speeds and much lower latency compared to current networks. In addition to this, India's growing base of smartphone users—projected to exceed 1 billion by 2026—further adds to the strain on legacy networks. As smartphones and mobile plans have become more affordable, consumers are extensively dependent on mobile data for business, leisure, learning, and social purposes.

To get more information on this market, Request Sample

Industrial and Government Push for Smart Infrastructure and Digital India

Another key driver of India's 5G services market is the strategic initiative from industries and the government to adopt smart infrastructures and facilitate the 'Digital India' vision. The government has been actively encouraging digital transformation in sectors such as healthcare, transportation, manufacturing, and public administration. This transformation is based on real-time processing of data, smart automation, and device-to-device communication without a hitch—functions that 5G networks are best positioned to deliver. For instance, the creation of smart cities with intelligent traffic management, energy-efficient structures, and sensor-enabled waste management systems is critically dependent on the ultra-reliable low latency and large IoT connectivity provided by 5G. Likewise, the Make in India campaign sees a technologically advanced manufacturing industry with smart factories and automation driven by 5G-facilitated Industrial IoT (IIoT). Even agriculture is poised to gain through 5G-driven drones, real-time soil analysis, and precision farming. Moreover, 5G is considered a national security strategic asset, which has engendered robust support from the central and state governments.

India 5G Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on communication type and end use.

Communication Type Insights:

- Fixed Wireless Access (FWA)

- Enhanced Mobile Broadband (EMBB)

- Ultra-Reliable and Low Latency Communications (URLLC)

- Massive Machine-Type Communications (MMTC)

The report has provided a detailed breakup and analysis of the market based on the communication type. This includes fixed wireless access (FWA), enhanced mobile broadband (EMBB), ultra-reliable and low latency communications (URLLC), and massive machine-type communications (MMTC).

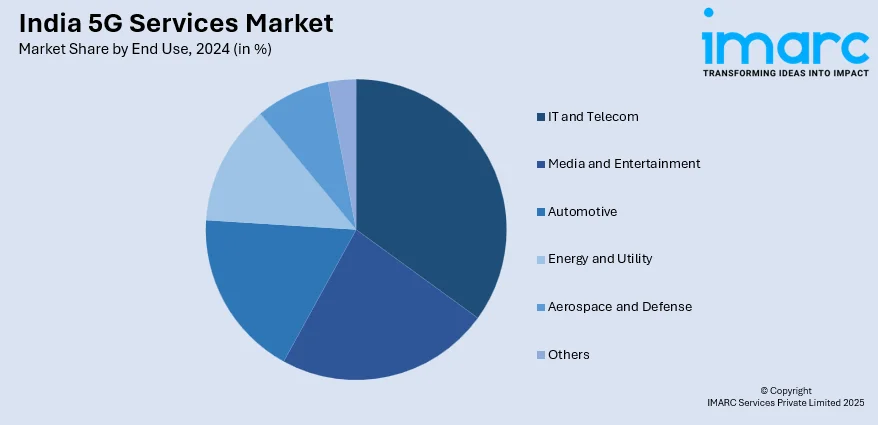

End Use Insights:

- IT and Telecom

- Media and Entertainment

- Automotive

- Energy and Utility

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes IT and telecom, media and entertainment, automotive, energy and utility, aerospace and defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India 5G Services Market News:

- April 2025: BSNL announced plans to launch 5G services by mid-2025, following the Department of Telecommunications' allocation of 5G spectrum worth INR 61,000 crore. This initiative is set to enhance competition in the telecommunications sector, potentially leading to improved services and pricing for consumers.

- March 2025: Vodafone Idea (Vi) launched its 5G network in Mumbai, partnering with Nokia for deployment. Vi aims to deploy 5G equipment to 75,000 existing 4G sites within three years and plans a phased expansion across India.

- October 2024: India achieved nationwide 5G rollout, with services available in 779 out of 783 districts across all states and union territories, supported by over 460,000 base transceiver stations.

India 5G Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Communication Types Covered | Fixed Wireless Access (FWA), Enhanced Mobile Broadband (EMBB), Ultra-Reliable and Low Latency Communications (URLLC), Massive Machine-Type Communications (MMTC) |

| End Uses Covered | IT and Telecom, Media and Entertainment, Automotive, Energy and Utility, Aerospace and Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India 5G services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India 5G services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India 5G services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The 5G services market in India was valued at USD 663.87 Million in 2024.

The India 5G services market is projected to exhibit a CAGR of 53.70% during 2025-2033, reaching a value of USD 41,290.20 Million by 2033.

The expansion of smart devices and cloud-based services is creating the need for 5G infrastructure. Government initiatives to promote digital inclusion and smart cities are also contributing to the market growth. Telecom operators are actively investing in 5G spectrum, infrastructure, and partnerships to deliver enhanced services to both urban and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)