India Abrasives Market Size, Share, Trends and Forecast by Product Type, Material Type, End-Use, and Region, 2025-2033

India Abrasives Market Overview:

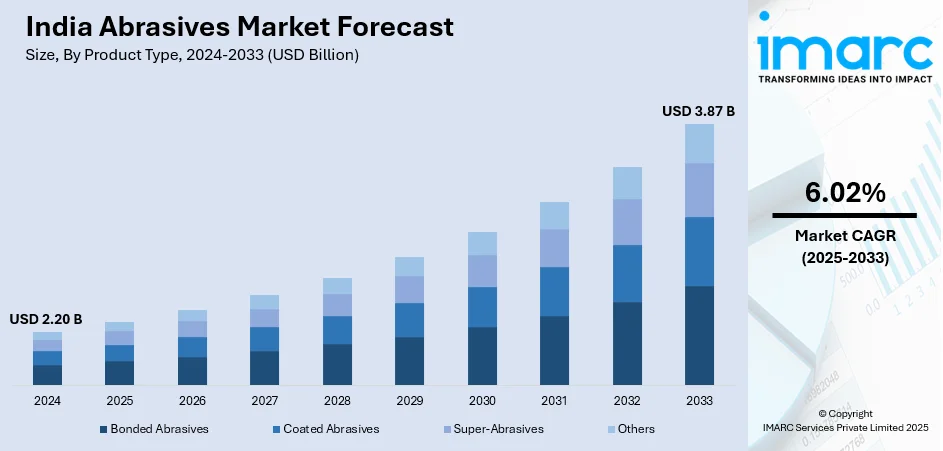

The India abrasives market size reached USD 2.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.87 Billion by 2033, exhibiting a growth rate (CAGR) of 6.02% during 2025-2033. The India abrasives market share is expanding, driven by the rising support for small and medium enterprises (SMEs) in manufacturing, resulting in increased investments in advanced manufacturing methods, along with the growing demand for commercial vehicles, encouraging manufacturers to employ high-performance abrasives for working with composites.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.20 Billion |

| Market Forecast in 2033 | USD 3.87 Billion |

| Market Growth Rate (2025-2033) | 6.02% |

India Abrasives Market Trends:

Growing implementation of government initiatives

The rising implementation of government initiatives that support regional industrial growth is offering a favorable India abrasives market outlook. In November 2024, the single window clearance authority under the Odisha government, led by Chief Secretary Manoj Ahuja, sanctioned 15 industrial projects with a total investment of INR 3,353.15 Crore in India. Initiatives spanning various sectors, such as pharmaceuticals, chemicals, renewable energy, food processing, manufacturing, textiles and apparel, downstream steel and aluminum, tourism, and cement, were set to be established in six districts, including Puri, Bargarh, Cuttack, Jharsuguda, Koraput, and Khurda, creating over 4,637 employment opportunities. Initiatives like Make in India are encouraging domestic production, catalyzing the demand for abrasives in industries, such as metal fabrication and construction. Extensive infrastructure projects, including smart cities, residential building developments, and highways, require abrasives for cutting, grinding, and polishing materials like concrete, metal, and stone. The Government’s push for electric vehicles (EVs) through subsidies and incentives is also creating the need, as abrasives are essential for manufacturing lightweight components made from aluminum and composites. Stricter quality standards and workplace safety regulations are prompting industries to adopt high-performance abrasives for precision work. Additionally, the growing support for SMEs in manufacturing is leading to higher investments in modern production techniques, further expanding the market. Moreover, import restrictions on foreign items promote local abrasives manufacturing, strengthening domestic supply chains.

To get more information on this market, Request Sample

Rising production of vehicles

The increasing production of vehicles is impelling the India abrasives market growth. Abrasives are essential in vehicle manufacturing for cutting, grinding, and polishing metal parts to ensure smooth surfaces and precise fittings. The two-wheeler segment, which dominates the Indian automobile market, also relies on abrasives for shaping body panels, smoothing engine components, and preparing surfaces for painting. According to the Society of Indian Automobile Manufacturers (Siam), the annual rise in vehicle production in 2024 was mainly due to the two-wheeler segment, which saw an increase of 14.5% compared to 2023, achieving sales of 19.5 Million units. With the high demand for passenger cars, commercial vehicles, and EVs, manufacturers require high-performance abrasives for working with materials like steel, aluminum, and composites. Additionally, the growing vehicle maintenance and repair sector drives the demand for abrasives in workshops and service centers. The shift towards lightweight and fuel-efficient vehicle designs further creates the need for specialized abrasives that offer high precision.

India Abrasives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, material type, and end-use.

Product Type Insights:

- Bonded Abrasives

- Coated Abrasives

- Super-Abrasives

- Others

The report has provided a detailed breakup and analysis of the market based on the product types. This includes bonded abrasives, coated abrasives, super-abrasives, and others.

Material Type Insights:

- Natural Abrasives

- Synthetic Abrasives

A detailed breakup and analysis of the market based on the material types have also been provided in the report. This includes natural abrasives and synthetic abrasives.

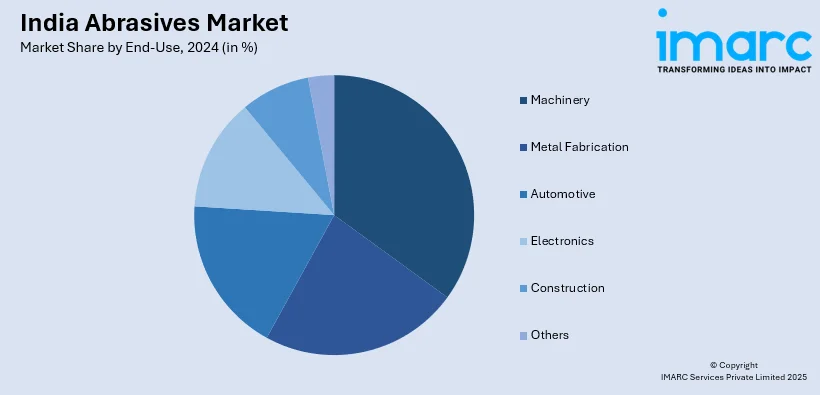

End-Use Insights:

- Machinery

- Metal Fabrication

- Automotive

- Electronics

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end-uses. This includes machinery, metal fabrication, automotive, electronics, construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Abrasives Market News:

- In August 2024, Guhan Industries and Manufacturing Solutions (GIMS), teamed up with NIRMAAN, the flagship initiative of IIT-M, developed India’s initial abrasive waterjet machine that allows for cutting of combustible materials without heat generation, significantly impacting the semiconductor, aviation, defense, and diamond sectors. The abrasive waterjet consisted of a blend of water and abrasives. It was stronger and capable of cutting tough materials.

- In June 2024, Carborundum Universal Ltd., a well-known firm within the Murugappa group (CUMI), intended to establish two new plants in India to produce thin wheels and high purity silicon carbide, an abrasive, with an estimated investment of INR 350 Crore in FY25. CUMI aimed to establish a high-purity silicon carbide plant in Kerala with a capacity of six tons per month. This required approximately 18 months. In FY24, the company also purchased the assets, brand, and technology of German abrasive product maker Dronco.

India Abrasives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bonded Abrasives, Coated Abrasives, Super-Abrasives, Others |

| Material Types Covered | Natural Abrasives, Synthetic Abrasives |

| End-Uses Covered | Machinery, Metal Fabrication, Automotive, Electronics, Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India abrasives market performed so far and how will it perform in the coming years?

- What is the breakup of the India abrasives market on the basis of product type?

- What is the breakup of the India abrasives market on the basis of material type?

- What is the breakup of the India abrasives market on the basis of end-use?

- What are the various stages in the value chain of the India abrasives market?

- What are the key driving factors and challenges in the India abrasives market?

- What is the structure of the India abrasives market and who are the key players?

- What is the degree of competition in the India abrasives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India abrasives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India abrasives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India abrasives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)