India Account Payable Market Size, Share, Trends, and Forecast by Component, Deployment, Vertical, Enterprise Size, and Region, 2025-2033

India Account Payable Market Overview:

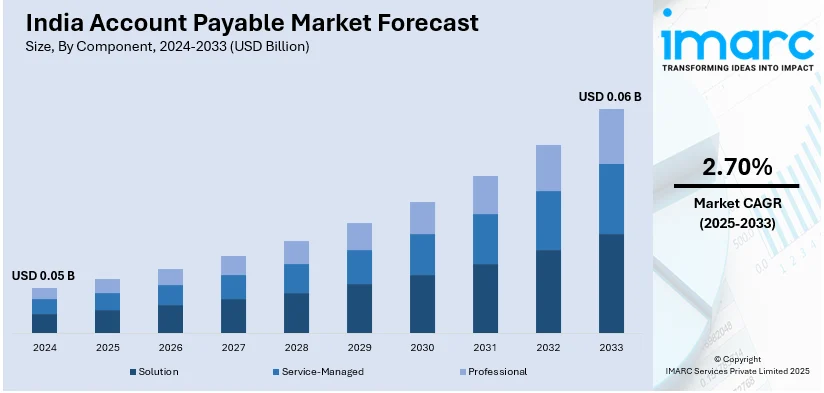

The India account payable market size reached USD 0.05 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.06 Billion by 2033, exhibiting a growth rate (CAGR) of 2.70% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of automation and AI in accounts payable processes and an enhanced focus on compliance and regulatory requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.05 Billion |

| Market Forecast in 2033 | USD 0.06 Billion |

| Market Growth Rate 2025-2033 | 2.70% |

India Account Payable Market Trends:

Increasing Adoption of Automation and AI in Accounts Payable Processes

Advances in automation and artificial intelligence (AI) technologies are rapidly turning their focus into the accounts payable processes in India for better operational efficiencies while minimizing human intervention. Companies are putting a lot of effort into bringing AIsmooth solutions into their invoice processing to reduce errors and further their compliance. The trend seems to be growing toward cloud account payable automation, even as the latest demand for cross-integration features with ERP-systems and real-time tracking have surfaced as the most promising add-ons within an automation process. For instance, in July 2024, Protean eGov Technologies announced the launch of ‘eSignPro,’ a digital signature and e-stamping solution to streamline operations, reduce costs, and digitalize agreements, addressing financial institutions’ ₹200 per document expense on printing, execution, and storage. Machine learning algorithms are playing a critical role in fraud detection and anomaly identification by analyzing transaction patterns and flagging suspicious activities. Optical character recognition (OCR) technology is improving invoice data extraction, reducing manual data entry, and expediting approval cycles. Additionally, robotic process automation (RPA) is enhancing workflow automation by handling repetitive tasks such as data validation, vendor verification, and payment scheduling. Large enterprises and mid-sized businesses are increasingly investing in AI-powered accounts payable solutions to optimize working capital and strengthen supplier relationships. The adoption of e-invoicing, driven by regulatory mandates from the Goods and Services Tax (GST) Council, is further accelerating the transition to digital accounts payable processes. As a result, automation and AI integration are reshaping the Indian accounts payable landscape, enabling businesses to achieve greater cost savings and operational agility.

To get more information on this market, Request Sample

Growing Focus on Compliance and Regulatory Requirements

The Indian accounts payable market is witnessing heightened regulatory scrutiny, prompting businesses to enhance compliance frameworks and adopt structured governance policies. The implementation of the GST e-invoicing system has transformed invoice processing, making digital compliance a necessity for organizations. For instance, in October 2024, the GST Network (GSTN) announced the launch of the Invoice Management System (IMS) to enhance Input Tax Credit (ITC) accuracy, reduce mismatches, and improve compliance by enabling invoice confirmation and reconciliation. Under the current framework, businesses exceeding prescribed turnover thresholds must generate electronic invoices through government-authorized platforms, ensuring transparency and reducing tax evasion. Additionally, companies are strengthening their compliance infrastructure to align with the Reserve Bank of India’s (RBI) payment regulations, including stricter Know Your Customer (KYC) norms and real-time gross settlement (RTGS) guidelines. Adherence to financial reporting standards such as the Indian Accounting Standards (Ind AS) is also driving investments in accounts payable solutions that support audit trails, tax deductions at source (TDS) compliance, and automated reconciliation. As regulatory mandates evolve, businesses are prioritizing digital payment solutions and integrating compliance-centric analytics tools to mitigate financial risks. The push for data security under India’s Digital Personal Data Protection Act (DPDPA) is further reinforcing the need for secure payment workflows and encrypted transactions. With increasing regulatory complexities, enterprises are leveraging accounts payable automation to enhance accuracy, ensure real-time regulatory reporting, and minimize financial liabilities.

India Account Payable Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, deployment, vertical, and enterprise size.

Component Insights:

- Solution

- Service-Managed

- Professional

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution, service-managed, and professional.

Deployment Insights:

- On-Premise

- Cloud

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premise and cloud.

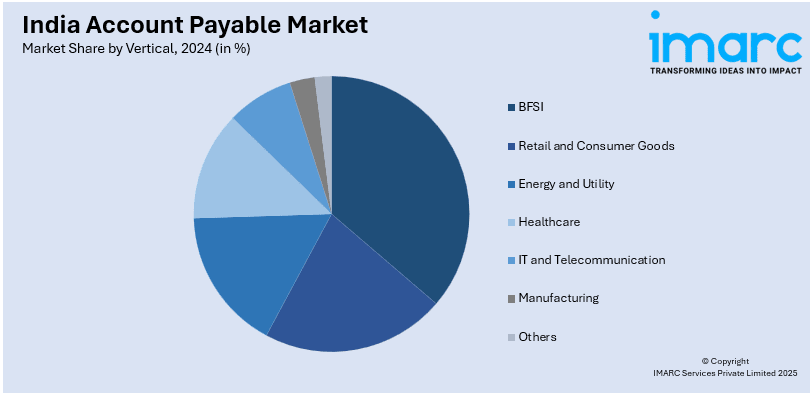

Vertical Insights:

- BFSI

- Retail and Consumer Goods

- Energy and Utility

- Healthcare

- IT and Telecommunication

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, retail and consumer goods, energy and utility, healthcare, IT and telecommunication, manufacturing, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium enterprises.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Account Payable Market News:

- In December 2024, IBN Technologies announced its plans to transform financial management with advanced AP automation solutions, leveraging AI and ML for real-time analytics and workflow optimization. CEO Ajay Mehta emphasizes automation’s role in shifting businesses to proactive financial management, ensuring accuracy, seamless enterprise integration, efficient vendor payments, reduced errors, and enhanced remote operations.

India Account Payable Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Service-Managed, Professional |

| Deployments Covered | On-Premise, Cloud |

| Verticals Covered | BFSI, Retail and Consumer Goods, Energy and Utility, Healthcare, IT and Telecommunication, Manufacturing, Others |

| Enterprise Sizes | Large Enterprises, Small and Medium Enterprises |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India account payable market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India account payable market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India account payable industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The account payable market in India was valued at USD 0.05 Billion in 2024.

The India account payable market is projected to exhibit a (CAGR) of 2.70% during 2025-2033, reaching a value of USD 0.06 Billion by 2033.

The market is spurred by growing digital transformation within enterprises, need for streamlined financial processes, and government programs facilitating e-invoicing and goods and services tax (GST) compliance. Automation solutions are being undertaken to gain efficiency, avoid errors, and facilitate better supplier relationships, especially among small and medium enterprises (SMEs) and large businesses that desire real-time visibility and payment cycle control.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)