India Accounting Software Market Size, Share, Trends and Forecast by Component, Enterprise Size, Type, End-Use Industry, and Region, 2025-2033

India Accounting Software Market Size and Share:

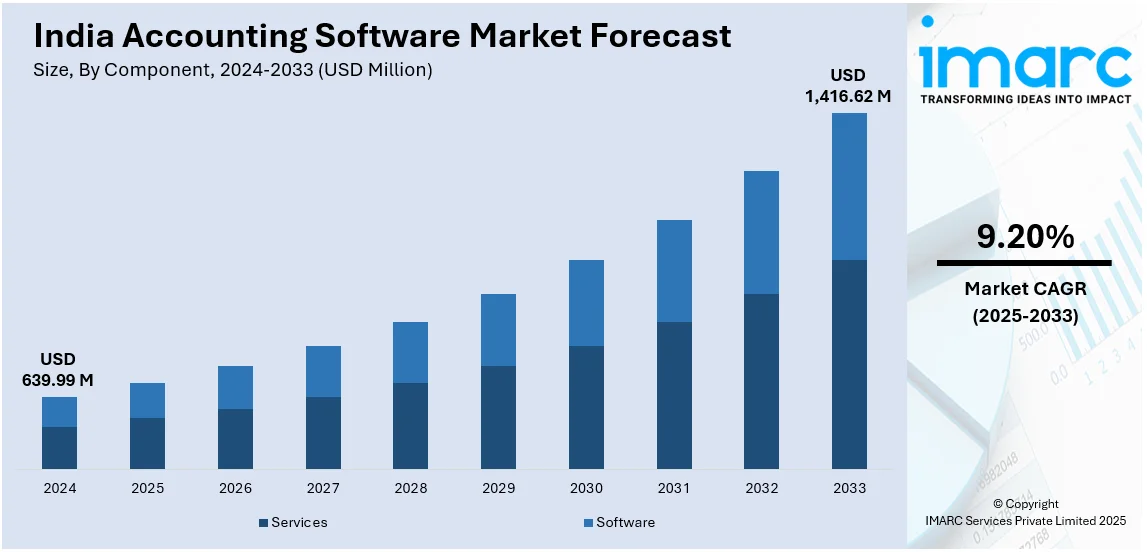

The India accounting software market size reached USD 639.99 Million in 2024. The market is expected to reach USD 1,416.62 Million by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The market growth is attributed to the rising adoption of accounting software due to automation, AI integration, and cloud-based solutions, expansion of micro, small and medium enterprises (MSMEs) catalyzing the demand for scalable financial tools, increasing digital transformation enhancing financial automation and efficiency, government initiatives promoting digital payments and e-invoicing accelerating software adoption across different industry verticals.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of component, the market has been divided into services and software.

- On the basis of enterprise size, the market has been divided into large enterprises and small and medium enterprises.

- On the basis of type, the market has been divided into spreadsheets, ERP, custom accounting software, and tax management.

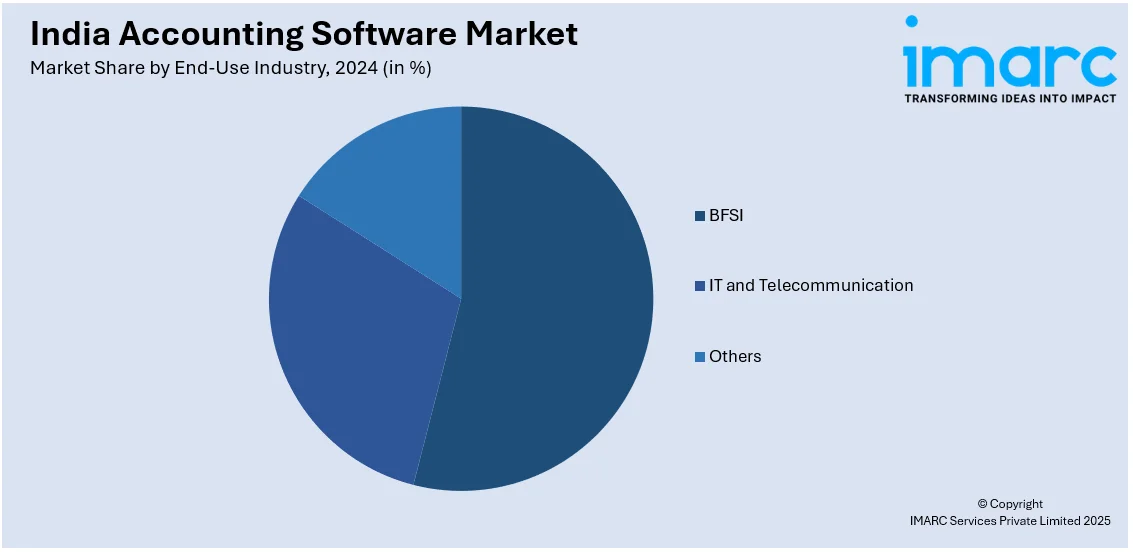

- On the basis of end-use industry, the market has been divided into BFSI, IT and telecommunication, and others.

Market Size and Forecast:

- 2024 Market Size: USD 639.99 Million

- 2033 Projected Market Size: USD 1,416.62 Million

- CAGR (2025-2033): 9.20%

India Accounting Software Market Trends:

Rising Digital Transformation

Increasing digital transformation is positively influencing the India accounting software market outlook by enhancing financial automation and efficiency. Businesses are adopting cloud-based accounting solutions to streamline operations and reduce manual financial management errors. Automation features like artificial intelligence (AI)-driven analytics and real-time reporting help companies make informed financial decisions quickly. Digital accounting tools integrate with enterprise resource planning (ERP) systems, improving overall business workflow and operational transparency. The demand for remote access solutions is increasing, enabling businesses to manage finances from any location seamlessly. Small and medium enterprises (SMEs) benefit from cost-effective digital solutions that simplify tax compliance and financial tracking. Government initiatives promoting digital payments and e-invoicing are further accelerating the software adoption across different industry verticals. Businesses are shifting from traditional bookkeeping to cloud-based platforms for real-time access to data. AI and machine learning (ML) enhance fraud detection, financial forecasting, and automated reconciliation, improving financial accuracy. The Institute of Chartered Accountants of India (ICAI) launched CA GPT in December 2024, an AI-powered platform for financial analysis of 5,000 listed companies. With 70,000 active users and 70+ specialized GPT models, it strengthens AI adoption in financial audits and reporting. The integration of accounting software with AI-driven tools is revolutionizing financial insights, making digital transformation essential.

To get more information on this market, Request Sample

Expansion of Micro, Small and Medium Enterprises (MSMEs)

Growing businesses require efficient financial management solutions to handle transactions, invoicing, and taxation seamlessly. Accounting software helps MSMEs automate bookkeeping, reducing manual errors and improving overall financial accuracy. Government initiatives like Make in India and Startup India are encouraging digital adoption among small enterprises, which further strengthens the India accounting software market growth. Compliance with GST regulations and tax filing requirements is compelling MSMEs toward automated accounting solutions. Cloud-based accounting platforms provide MSMEs with cost-effective, scalable solutions for managing financial operations efficiently. Real-time financial tracking enables businesses to make informed decisions and optimize cash flow management effectively. In 2024, India's MSME sector witnessed significant growth, with 5.70 crore MSMEs being formalized and the Credit Guarantee Scheme approving ₹2.44 lakh crore in guarantees. The PM Vishwakarma Scheme registered 24.77 lakh applications, reflecting a surge in small business participation. Khadi and Village Industries sales reached ₹1.55 lakh crore, marking a fourfold increase in a decade. This rapid expansion is accelerating the adoption of AI-driven accounting tools for financial forecasting, payroll processing, and expense tracking. Mobile-friendly applications further enhance accessibility, allowing MSMEs to manage finances remotely, reinforcing their role in India's economic growth.

Technology-Driven Innovation and Market Transformation

The India accounting software market is undergoing revolutionary transformation through the convergence of advanced AI and automation technologies that are redefining financial management practices across industries. AI-driven analytics, fraud detection systems, and automated reconciliation tools are significantly improving accounting accuracy while reducing manual intervention and human errors in financial processes. The widespread shift from traditional bookkeeping methods to sophisticated cloud-based platforms has enabled real-time data access, seamless ERP integration, and remote finance management capabilities that cater to modern business requirements. Government initiatives under Digital India framework, coupled with mandatory GST compliance requirements and e-invoicing mandates, are catalyzing software adoption across diverse business sectors and driving technological standardization. The formalization of MSMEs and successful implementation of schemes like Startup India and PM Vishwakarma are generating substantial demand for affordable, scalable accounting tools that can accommodate rapid business growth. Mobile-first solutions are gaining significant traction, with increasing adoption of mobile applications for invoicing, payroll management, and expense tracking among SMEs who prioritize accessibility and convenience. Localized innovation is exemplified by groundbreaking platforms such as ICAI's "CA GPT" which provides AI-powered financial analysis capabilities, and TallyPrime 5.0 featuring advanced GST compliance tools, highlighting India's evolution toward indigenous technology solutions that address specific market needs and regulatory requirements.

Growth, Opportunities, and Challenges in the India Accounting Software Market:

- Growth Drivers of the India Accounting Software market: The primary growth drivers include rapid digital transformation accelerating cloud-based solution adoption, expanding MSME sector with numerous formalized businesses requiring efficient financial management tools, and government initiatives promoting Digital India and GST compliance mandates. AI integration in accounting processes for fraud detection, automated reconciliation, and financial forecasting is significantly enhancing market appeal and driving enterprise adoption across industries.

- Opportunities in the India Accounting Software market: The market presents substantial opportunities through the development of mobile-first accounting applications catering to growing smartphone penetration, integration of localized AI solutions like CA GPT for industry-specific financial analysis, and expansion into tier-II and tier-III cities where digital adoption is accelerating. Export potential to global markets leveraging cost-effective development capabilities and specialized features for emerging economies offers significant revenue diversification opportunities.

- Challenges in the India Accounting Software market: The industry faces challenges including intense competition from international software providers offering advanced features, the need for continuous compliance updates to match evolving regulatory requirements, and cybersecurity concerns related to cloud-based financial data storage. Limited digital literacy among traditional businesses and resistance to change from conventional bookkeeping practices pose additional market penetration barriers requiring targeted education and support initiatives.

India Accounting Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033 Our report has categorized the market based on component, enterprise size, type, and end-use industry.

Component Insights:

- Services

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes services and software.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium enterprises.

Type Insights:

- Spreadsheets

- ERP

- Custom Accounting Software

- Tax Management

The report has provided a detailed breakup and analysis of the market based on the type. This includes spreadsheets, ERP, custom accounting software, and tax management.

End-Use Industry Insights:

- BFSI

- IT and Telecommunication

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes BFSI, IT and telecommunication, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Accounting Software Market News:

- November 2024: The Institute of Chartered Accountants of India (ICAI) officially launched CA GPT-Industry Forum during a global webinar attended by over 10,000 professionals, integrating annual reports of 5,000 listed companies into 70+ specialized AI-powered tools for enhanced financial analysis capabilities.

- September 2024: Tally Solutions released TallyPrime 5.0 featuring enhanced GST compliance tools including direct portal integration, GSTR-1 and GSTR-3B reconciliation, multilingual support for Arabic and Bangla, and advanced notification systems for improved business efficiency and regulatory compliance.

India Accounting Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Services, Software |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Types Covered | Spreadsheets, ERP, Custom Accounting Software, Tax Management |

| End-Use Industries Covered | BFSI, IT and Telecommunication, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India accounting software market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India accounting software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India accounting software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The accounting software market in India was valued at USD 639.99 Million in 2024.

Implementation of the goods and services tax (GST) is driving the demand for compliant invoicing and tax-processing tools. Cloud-based models provide economical options with real-time access and enhanced security, making adoption easier for businesses. Besides this, increased smartphone and internet penetration are also facilitating mobile accounting. Moreover, automation and artificial intelligence (AI) integration, such as bank reconciliation, expense tracking, and financial reporting, assist in minimizing manual work and errors.

The India accounting software market is projected to exhibit a CAGR of 9.20% during 2025-2033, reaching a value of USD 1,416.62 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)