India Acetaldehyde Market Size, Share, Trends and Forecast by Derivatives, Sales Channel, End User, and Region, 2026-2034

India Acetaldehyde Market Size and Share:

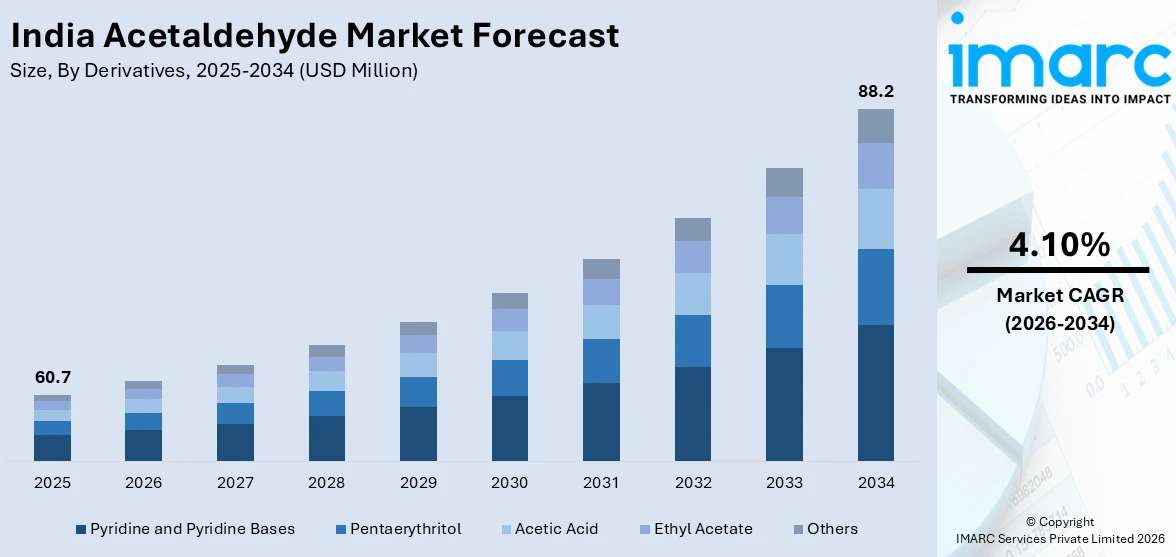

The India acetaldehyde market size reached USD 60.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 88.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.10% during 2026-2034. The rising demand in agrochemicals, pharmaceuticals, and food additives, growing usage in paints, coatings, and synthetic rubber, increasing industrial applications in manufacturing, expanding chemical sector, government support for domestic production, and technological advancements in production processes are expanding the India acetaldehyde market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 60.7 Million |

| Market Forecast in 2034 | USD 88.2 Million |

| Market Growth Rate 2026-2034 | 4.10% |

India Acetaldehyde Market Trends:

Rising Demand from the Food and Beverage Industry

The increasing usage in the food and beverage sector drives India acetaldehyde market growth. Acetaldehyde is widely utilized as a preservative and flavoring agent, enhancing the shelf life and taste of various food products. Additionally, it serves as an intermediate in the production of acetic acid and other derivatives used in food processing. The growing demand for packaged and processed foods, driven by changing consumer lifestyles and urbanization, is propelling the need for acetaldehyde-based additives. Moreover, the implementation of government initiatives promoting food safety and quality standards further supports the market expansion. For instance, The Ministry of Food Processing Industries announced on March 28, 2025, a 30.19% budget increase for 2024–2025 over the previous year to support India's food processing industry. As of February 28, 2025, the Ministry has approved 1,608 projects, including 394 Cold Chain initiatives and 41 Mega Food Parks, and has awarded funds totaling INR 6,198.76 Crore (about USD 755.95 Million) since the PM Kisan SAMPADA Yojana's launch. Furthermore, 171 food processing companies have been approved for assistance under the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI), with INR 1,155.296 Crore (about USD 140.87 Million) disbursed. This growth, in turn, drives the demand for various chemicals, such as acetaldehyde, and raw materials essential for food preservation, packaging, and production. With the rise in convenience food consumption and increased investments in food manufacturing, the demand for acetaldehyde is expected to grow steadily. Emerging food processing technologies and innovations in flavor enhancement will further boost the market, positioning acetaldehyde as a crucial ingredient in India's expanding food and beverage industry.

To get more information on this market Request Sample

Expanding Applications in the Chemical and Pharmaceutical Sectors

The chemical and pharmaceutical industries are major drivers of the India acetaldehyde market, as the compound is a key intermediate in the production of various chemicals, solvents, and drugs. Acetaldehyde is widely used in manufacturing acetic acid, pyridine derivatives, and pentaerythritol, which have applications in resins, adhesives, and coatings. In the pharmaceutical industry, acetaldehyde plays a vital role in the synthesis of vitamins, sedatives, and other medicinal compounds. The expanding pharmaceutical sector, driven by rising healthcare demands and increased investment in research and development (R&D) activities, is leading to higher consumption of acetaldehyde-based compounds. Acetaldehyde's role in synthesizing active pharmaceutical ingredients (APIs) makes it indispensable for pharmaceutical manufacturing. According to an industry report, over 50% of the demand for different vaccines worldwide, 40% of the demand for generic drugs in the US, and 25% of all medications in the UK are supplied by the Indian pharmaceutical industry. There are 10,500 production facilities and 3,000 medicinal businesses in the domestic pharmaceutical industry. Therefore, the need for acetaldehyde remains significant to support the production of essential drugs and intermediates. Additionally, its role in producing disinfectants and antiseptics is further positively impacting the India acetaldehyde market outlook. With India emerging as a global hub for chemical and pharmaceutical manufacturing, the demand for acetaldehyde is expected to rise, supported by advancements in production processes and an increasing focus on high-quality raw materials.

India Acetaldehyde Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on derivatives, sales channel, and end user.

Derivatives Insights:

- Pyridine and Pyridine Bases

- Pentaerythritol

- Acetic Acid

- Ethyl Acetate

- Others

The report has provided a detailed breakup and analysis of the market based on the derivatives. This includes pyridine and pyridine bases, pentaerythritol, acetic acid, ethyl acetate, and others.

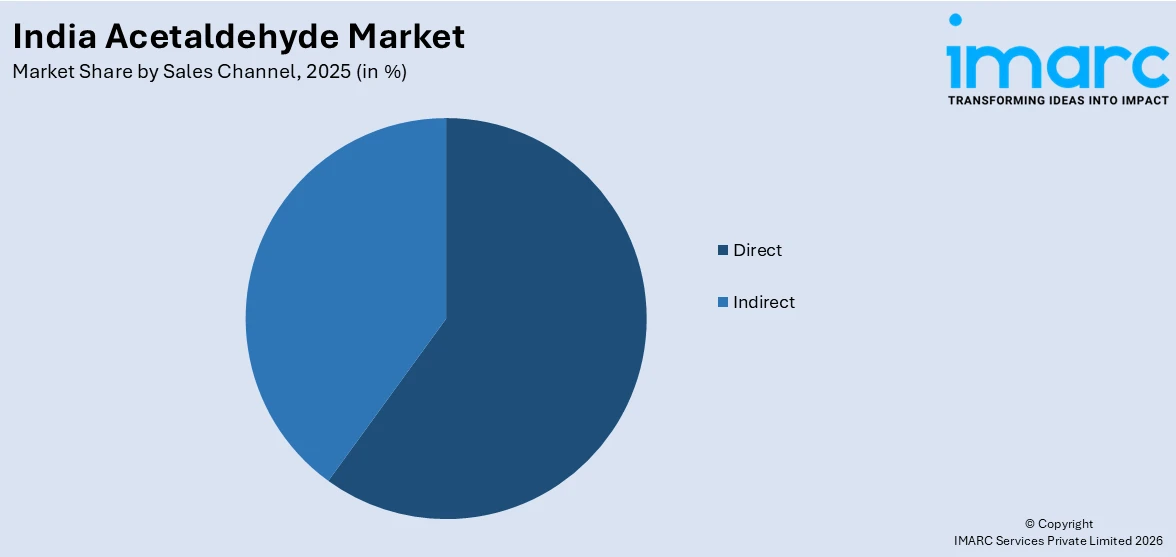

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct

- Indirect

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes direct and indirect.

End User Insights:

- Agrochemicals

- Pharmaceuticals

- Paints and Coatings

- Food and Flavour Additives

- Plastics and Synthetic Rubber

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes agrochemicals, pharmaceuticals, paints and coatings, food and flavour additives, plastics and synthetic rubber, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Acetaldehyde Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Derivatives Covered | Pyridine and Pyridine Bases, Pentaerythritol, Acetic Acid, Ethyl Acetate, Others |

| Sales Channels Covered | Direct, Indirect |

| End Users Covered | Agrochemicals, Pharmaceuticals, Paints and Coatings, Food and Flavour Additives, Plastics and Synthetic Rubber, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India acetaldehyde market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India acetaldehyde market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India acetaldehyde industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The acetaldehyde market in India was valued at USD 60.7 Million in 2025.

India acetaldehyde market is projected to exhibit a (CAGR) of 4.10% during 2026-2034, reaching a value of USD 88.2 Million by 2034.

India acetaldehyde market is influenced by its application in food preservatives, pharmaceuticals, agrochemicals, and synthetic resins. Amplifying industrial uses, development of the plastics and paint industries, and rising demand for pentaerythritol and acetic acid manufacturing stimulate consumption. Boosted chemical manufacturing and supportive government policies further drive local production and market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)