India Acetic Anhydride Market Size, Share, Trends and Forecast by Application, End User, and Region, 2025-2033

India Acetic Anhydride Market Overview:

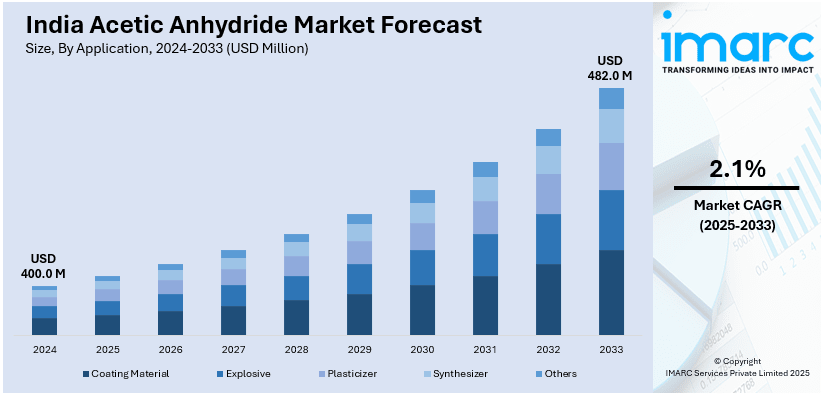

The India acetic anhydride market size reached USD 400.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 482.0 Million by 2033, exhibiting a growth rate (CAGR) of 2.1% during 2025-2033. The rising demand from pharmaceuticals, agrochemicals, and cellulose acetate production, increasing domestic manufacturing capabilities, government initiatives supporting chemical industries, and growing exports are some of the key factors positively impacting the India acetic anhydride market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 400.0 Million |

| Market Forecast in 2033 | USD 482.0 Million |

| Market Growth Rate 2025-2033 | 2.1% |

India Acetic Anhydride Market Trends:

Expansion of Agrochemical and Pesticide Production

Acetic anhydride is a critical raw material for pesticide and herbicide synthesis. The rapid growth in India's agriculture sector is driving its demand, which is positively influencing the India acetic anhydride market outlook. The country is among the top global producers of agrochemicals, with domestic and export-oriented production growing due to increasing food security concerns, rising farm productivity initiatives, and government subsidies on fertilizers and pesticides. According to IBEF, India exports half of the total production of agrochemicals, making them the country's main source of income. Between April and September of 2024, agrochemical exports totalled USD 2.09 Million. Acetic anhydride is widely used in the manufacture of acephate and other organophosphate pesticides, which are extensively applied to crops such as rice, wheat, and cotton. The increasing global demand for agrochemicals is resulting in a growth of acetic anhydride consumption. Furthermore, manufacturing is shifting to India due to stronger environmental restrictions in countries such as the US and Europe for the production of pesticides, which is also increasing demand for acetic anhydride in the synthesis of agrochemicals.

To get more information on this market, Request Sample

Increasing Pharmaceutical Demand for Acetylated Compounds

India's pharmaceutical sector is a key driver for the acetic anhydride market. According to IBEF, it is anticipated that the pharmaceutical industry in India will reach a total market growth of USD 130 Millionby 2030 and USD 450 Million by 2047. The growth of the pharmaceutical sector leads to the increased production of aspirin, paracetamol intermediates, and other acetylated compounds. The country is a major global supplier of generic drugs, and the rising incidence of lifestyle diseases such as cardiovascular disorders and arthritis is increasing the demand for aspirin and other acetylated medications. Acetic anhydride plays a crucial role in acetylation reactions, making it indispensable for drug synthesis. Also, government initiatives and schemes encourage domestic active pharmaceutical ingredient (API) production, reducing dependency on imports. According to industry reports, in 2023–2024, India's pharmaceutical exports increased 9.67% to USD 27.9 Million. The growth in pharmaceutical exports is further increasing the demand for key intermediates, including acetic anhydride. Regulatory support for local drug production and investments in pharmaceutical infrastructure further bolster India acetic anhydride market growth.

India Acetic Anhydride Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application and end user.

Application Insights:

- Coating Material

- Explosive

- Plasticizer

- Synthesizer

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes coating material, explosive, plasticizer, synthesizer, and others.

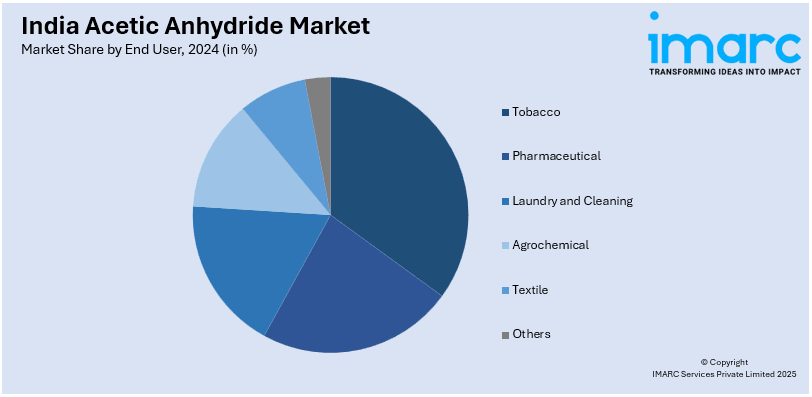

End User Insights:

- Tobacco

- Pharmaceutical

- Laundry and Cleaning

- Agrochemical

- Textile

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes tobacco, pharmaceutical, laundry and cleaning, agrochemical, textile, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Acetic Anhydride Market News

- On April 18, 2023, Jubilant Ingrevia Limited commissioned a new acetic anhydride plant at its Bharuch, Gujarat facility, increasing its annual capacity by 60,000 metric Tonnes to a total of 210,000 metric Tonnes. This expansion aims to enhance the company's global market presence and reinforce its leadership in the domestic market. The additional capacity is expected to support various industries, including agrochemicals, pharmaceuticals, food, wood acetylation, vitamins, dyes and electronics.

- On November 20, 2024, a Memorandum of Understanding (MoU) was signed by INEOS Acetyls and Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC) to investigate the possibility of building a 600,000-ton-per-year acetic acid factory at GNFC's location in Bharuch, Gujarat, India. With India currently importing over 85% of its yearly acetic acid needs, this joint venture seeks to lessen India's dependency on imports. By 2028, the plant should be operational.

India Acetic Anhydride Market Report Coverage

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Coating Material, Explosive, Plasticizer, Synthesizer, Others |

| End Users Covered | Tobacco, Pharmaceutical, Laundry and Cleaning, Agrochemical, Textile, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India acetic anhydride market performed so far and how will it perform in the coming years?

- What is the breakup of the India acetic anhydride market on the basis of application?

- What is the breakup of the India acetic anhydride market on the basis of end user?

- What is the breakup of the India acetic anhydride market on the basis of region?

- What are the various stages in the value chain of the India acetic anhydride market?

- What are the key driving factors and challenges in the India acetic anhydride market?

- What is the structure of the India acetic anhydride market and who are the key players?

- What is the degree of competition in the India acetic anhydride market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India acetic anhydride market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India acetic anhydride market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India acetic anhydride industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)