India Acetone Market Size, Share, Trends and Forecast by Manufacturing Process, Application, End-Use, and Region, 2025-2033

India Acetone Market Overview:

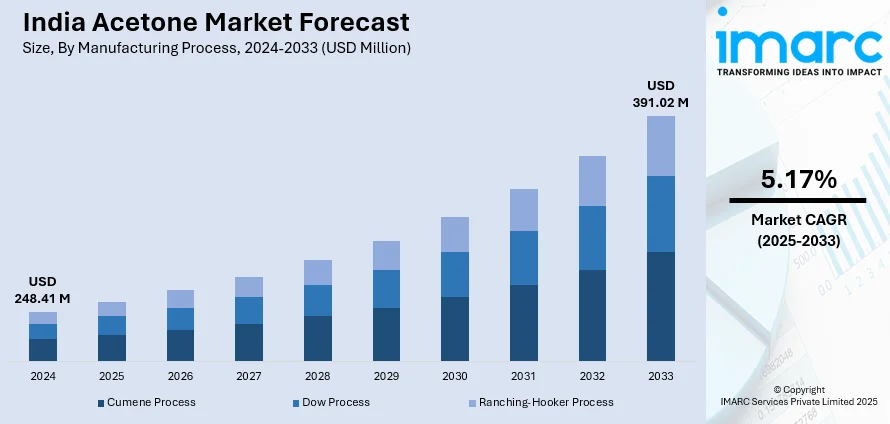

The India acetone market size reached USD 248.41 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 391.02 Million by 2033, exhibiting a growth rate (CAGR) of 5.17% during 2025-2033. The India acetone market is driven by propelling demand for solvents in the pharmaceutical industry, expanding applications in cosmetics and personal care, substantial domestic production investments like Haldia Petrochemicals’ new plant, rising consumption in paints and coatings, and a shift toward reducing import dependence to stabilize supply chains and lower costs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 248.41 Million |

| Market Forecast in 2033 | USD 391.02 Million |

| Market Growth Rate 2025-2033 | 5.17% |

India Acetone Market Trends:

Growing Demand from the Pharmaceutical Industry

Acetone is an important solvent in the pharmaceutical industry for the manufacture of many active pharmaceutical ingredients (APIs) and formulations. Its activity as a dissolver for organic materials makes it an essential component in drug manufacturing operations. In India, the pharmaceutical industry has been developing strongly, and the demand for acetone has significantly contributed to this development. As per the India Brand Equity Foundation (IBEF), the overall market size of the Indian Pharma Industry is likely to become USD 130 billion by 2030 and USD 450 billion market by 2047. The COVID-19 pandemic further heightened this demand, with increased production of disinfectants and sanitizers, most of which use acetone as an important ingredient. The improved health and hygiene awareness has had a lasting effect, continuing the high demand for acetone in pharmaceutical uses. Furthermore, acetone as a solvent finds application in other sectors such as paints, coatings, and adhesives, further boosting its market demand. The ability of acetone to dissolve many different substances gives it popularity across these industries, leading to increasing use in India.

To get more information on this market, Request Sample

Increased Use in the Cosmetics and Personal Care Industry

The Indian cosmetics and personal care market has seen considerable development, fueled by growing consumer spending and awareness for beauty and hygiene products. Acetone is a key ingredient in products like nail polish removers, where its solvent characteristics are critical for efficient performance. The escalating demand for nail care and associated beauty products has directly impacted the demand for acetone. Additionally, the movement toward environmentally friendly and sustainable beauty products has prompted manufacturers to look for effective solvents that are also eco-friendly. Acetone, as a straightforward organic compound, is well in line with this trend, and this has led to higher adoption in cosmetics even further. Acetone is also used in skincare preparations and some hair care products as a solvent or denaturant. The expanding range of personal care products in the Indian market, combined with changing consumer tastes, continues to propel the adoption of acetone in this sector. As per the IMARC Group, beauty and personal care market in India is expected to reach USD 48.5 Billion by 2033.

India Acetone Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on manufacturing process, application, and end-use.

Manufacturing Process Insights:

- Cumene Process

- Dow Process

- Ranching-Hooker Process

The report has provided a detailed breakup and analysis of the market based on the manufacturing process. This includes cumene process, dow process, and ranching-hooker process.

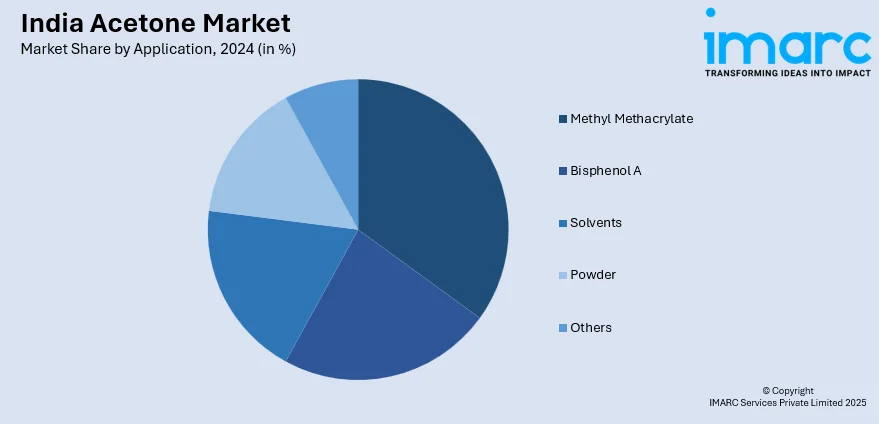

Application Insights:

- Methyl Methacrylate

- Bisphenol A

- Solvents

- Powder

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes methyl methacrylate, bisphenol A, solvents, powder, and others.

End-Use Insights:

- Plastic

- Chemical

- Pharmaceutical

- Cosmetics and Personal Care

- Paint and Coatings

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes plastic, chemical, pharmaceutical, cosmetics and personal care, paint and coatings, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Acetone Market News:

- March 2025: Haldia Petrochemicals Limited announced its investment of INR 5,000 crore to establish India's largest phenol-acetone plant in West Bengal, with an annual production capacity of 185,000 tonnes of acetone. This investment reduces India's reliance on imports, stabilizes supply chains, and enhances availability for key industries like pharmaceuticals, solvents, and cosmetics. Increased domestic production lowers costs and supports market progress by ensuring a steady supply for expanding industrial applications.

- November 2024: Haldia Petrochemicals Limited (HPL) partnered with Lummus Technology to expand the capacity of its upcoming phenol and acetone plant in Haldia, West Bengal, raising phenol production from 300 KTPA to 345 KTPA. This expansion aligned with HPL's USD 59.22 billion investment plan, which included enhancing cumene and acetone production capacities to meet elevating domestic demand. The heightened acetone production is expected to reduce India's reliance on imports, stabilize supply chains, and support industries such as pharmaceuticals and cosmetics.

India Acetone Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Manufacturing Processes Covered | Cumene Process, Dow Process, Ranching-Hooker Process |

| Applications Covered | Methyl Methacrylate, Bisphenol A, Solvents, Powder, Others |

| End-Uses Covered | Plastic, Chemical, Pharmaceutical, Cosmetics and Personal Care, Paint and Coatings, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India acetone market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India acetone market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India acetone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The acetone market in India was valued at USD 248.41 Million in 2024.

The India acetone market is projected to exhibit a CAGR of 5.17% during 2025-2033, reaching a value of USD 391.02 Million by 2033.

Major drivers for the India acetone market are increasing demand from major end-use industries like personal care, paints and coatings, pharmaceuticals, and chemicals, in which acetone plays a crucial role as a solvent and intermediate. Furthermore, increasing plastic and adhesive manufacturing, and quick industrialization as well as petrochemical sector growth, also contribute to consistent India acetone market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)