India Acetylene Market Size, Share, Trends and Forecast by Production, Application, End User, and Region, 2025-2033

India Acetylene Market Overview:

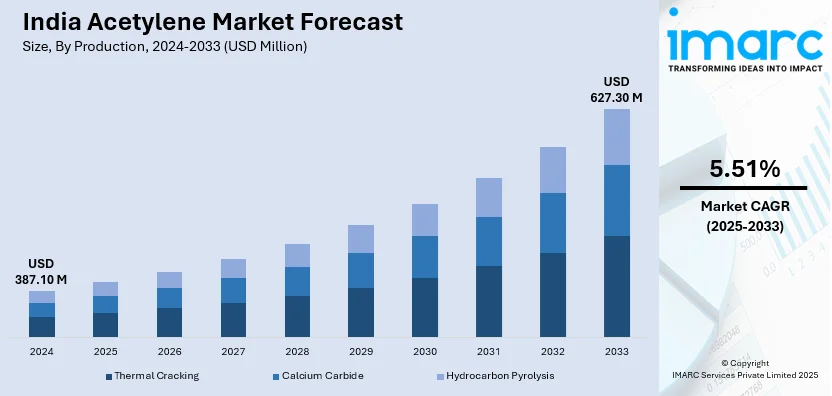

The India acetylene market size reached USD 387.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 627.30 Million by 2033, exhibiting a growth rate (CAGR) of 5.51% during 2025-2033. The rising demand in metal fabrication, expanding chemical manufacturing, increasing adoption in the automotive and aerospace industries, advancements in gas production technologies, and government initiatives promoting industrialization are boosting market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 387.10 Million |

| Market Forecast in 2033 | USD 627.30 Million |

| Market Growth Rate 2025-2033 | 5.51% |

India Acetylene Market Trends:

Expansion of the Metal Fabrication Industry

The metal fabrication sector in India is experiencing substantial growth, significantly boosting the demand for acetylene, primarily used in welding and cutting applications. Acetylene's high flame temperature, approximately 3,200°C, makes it ideal for precision welding tasks in industries such as construction, automotive, and shipbuilding. Government initiatives like the "Make in India" campaign and the National Infrastructure Pipeline (NIP), which aims to invest over ₹111 lakh crore (approximately USD 1.5 trillion) by 2025, are driving infrastructure development. This surge in construction activities necessitates extensive metal fabrication, thereby increasing acetylene consumption. Moreover, India's automotive industry is expanding rapidly, with the country producing over 4.5 million vehicles in 2023, marking a 7% increase from the previous year. The manufacturing processes for these vehicles require significant metal fabrication, relying heavily on acetylene for welding and cutting operations, which is propelling the market forward.

To get more information on this market, Request Sample

Advancements in Acetylene Production Technologies

Technological advancements in acetylene production improve efficiency, safety, and environmental compliance, making it more accessible and desirable to a wide range of sectors. The development of highly efficient acetylene manufacturing processes has decreased operational costs while improving safety, making acetylene more accessible to small and medium-sized businesses. Furthermore, as environmental restrictions become more stringent, the acetylene market places a greater premium on sustainable manufacturing processes. Companies are investing in green solutions that use renewable resources or seek to minimize carbon emissions from acetylene manufacturing. For instance, Denka partnered with Transform Materials LLC in June 2023 to establish a low-carbon acetylene supply chain. The company will install acetylene and hydrogen production equipment at its Omuta Plant in Japan, aiming to reduce CO2 emissions and achieve carbon neutrality by 2050. The agreement aims to attain a "three-star business" with specialty, megatrends, and sustainability under its eight-year management plan, Mission 2030. These developments in production technology not only make acetylene more cost-effective but also correspond with global environmental trends, resulting in growing usage across numerous industrial applications in India.

India Acetylene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on production, application, and end user.

Production Insights:

- Thermal Cracking

- Calcium Carbide

- Hydrocarbon Pyrolysis

The report has provided a detailed breakup and analysis of the market based on the production. This includes thermal cracking, calcium carbide, and hydrocarbon pyrolysis.

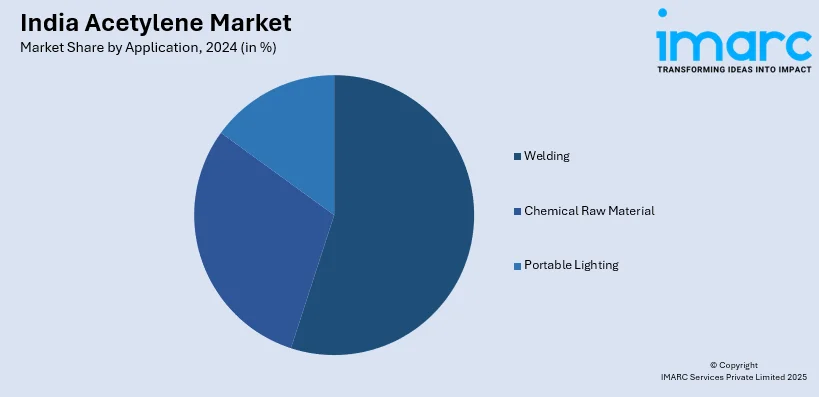

Application Insights:

- Welding

- Chemical Raw Material

- Portable Lighting

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes welding, chemical raw material, and portable lighting.

End User Insights:

- Aerospace

- Automotive

- Chemical

- Agriculture

- Metal Fabrication

The report has provided a detailed breakup and analysis of the market based on the end user. This includes aerospace, automotive, chemical, agriculture, and metal fabrication.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Acetylene Market News:

- February 2025: PCBL Chemical Ltd. entered into a technology transfer deal with Chinese business Ningxia Jinhua Chemical Co. to manufacture acetylene black in India. The business intends to establish its first acetylene black factory in India to fulfill rising demand in the Indian battery sector and sell to worldwide battery, semiconductor, and conductive industries.

- June 2024: Transform Materials and Johnson Matthey collaborated to develop mercury-free alternatives for PVC manufacture. The agreement brings together Transform Materials' revolutionary plasma-based acetylene manufacturing technology, Johnson Matthey's acetylene-based VCM technology, and JM's patented catalyst. The corporation allows PVC producers to gradually boost output without jeopardizing their environmental objectives.

India Acetylene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Productions Covered | Thermal Cracking, Calcium Carbide, Hydrocarbon Pyrolysis |

| Applications Covered | Welding, Chemical Raw Material, Portable Lighting |

| End Users Covered | Aerospace, Automotive, Chemical, Agriculture, Metal Fabrication |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India acetylene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India acetylene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India acetylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The acetylene market in India was valued at USD 387.10 Million in 2024.

The India acetylene market is projected to exhibit a CAGR of 5.51% during 2025-2033, reaching a value of USD 627.30 Million by 2033.

The India acetylene market is driven by rising industrial fabrication needs, growing use in metal cutting and welding, increasing applications in chemical synthesis, and expanding demand from construction and automotive sectors. Advancements in production methods and a focus on versatile, efficient fuel solutions further strengthen its role across multiple industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)