India Actuators Market Size, Share, Trends and Forecast by Product, Type, End Use Industry, and Region, 2025-2033

India Actuators Market Overview:

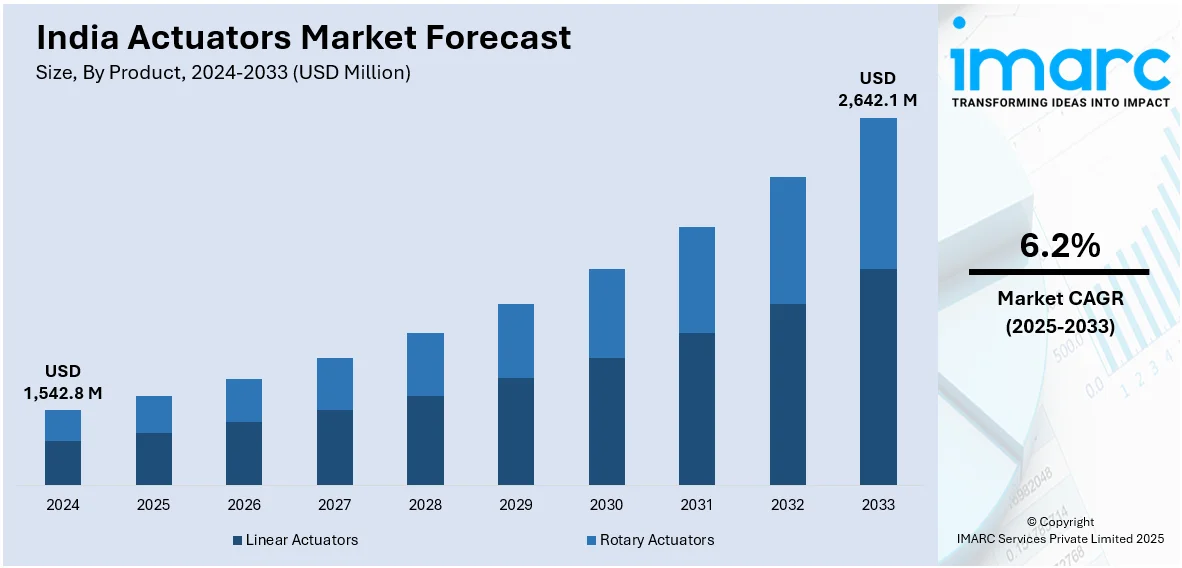

The India actuators market size reached USD 1,542.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,642.1 Million by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033. The market is expanding due to rising space missions, industrial automation, and defense modernization. Demand for precision, reliability, and locally developed systems is encouraging domestic manufacturing and innovation across aerospace, robotics, and smart manufacturing sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,542.8 Million |

| Market Forecast in 2033 | USD 2,642.1 Million |

| Market Growth Rate 2025-2033 | 6.2% |

India Actuators Market Trends:

Growing Demand from Space Missions

India's actuator industry is observing steady growth, driven by rising demand from aerospace and satellite programs. Precision control in satellite positioning, orientation, and maneuvering is fueling actuator adoption. As space missions require accurate movement and stability, actuators are becoming a central part of onboard systems. Domestic innovation and rising satellite deployment by public and private players are further increasing the need for specialized actuators. Developments like the SpaDeX mission, completed in January 2025, showcased the Indigenous use of reaction wheels, magnetic torques, and thrusters to achieve successful in-orbit docking. This not only validated India's actuator capabilities but also created momentum for further investment in actuator research and production. The trend is expected to accelerate with ISRO's growing collaboration with private firms. This opens up market opportunities for actuator manufacturers with experience in compact, high-precision systems designed for harsh space environments. Local sourcing preferences and demand for self-reliant component supply chains are also pushing manufacturers to innovate. The steady increase in satellite launches, coupled with a focus on strategic autonomy in space, continues to strengthen actuator demand in the aerospace segment.

To get more information on this market, Request Sample

Industrial Automation and Defense Expansion

India's industrial automation and defense modernization initiatives are creating consistent demand for actuators. Actuators are widely used across robotic systems, motion control setups, and critical defense applications like missile guidance and combat vehicles. Government support for domestic manufacturing and increased private participation in defense projects are key market enablers. The rise in industrial robot installations and smart factory transitions is contributing to the actuator market's scale. A notable development in March 2025 was HEX20's successful launch of India's first private payload satellite, which carried German release actuators to support rideshare missions. Such projects reflect growing cross-border partnerships while increasing the use of precision actuators in satellite deployment. These trends indicate a steady shift toward the integration of advanced actuator systems in defense and industrial platforms. As industries continue to digitize operations and the government promotes import substitution in defense manufacturing, actuator suppliers are focusing on cost-effective, high-efficiency systems with long service life. The demand for linear, rotary, and electro-mechanical actuators in India is expected to grow, driven by reliability needs, real-time responsiveness, and compatibility with digital control systems in both defense and industrial sectors.

India Actuators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, type, and end use industry.

Product Insights:

- Linear Actuators

- Rod Type

- Screw Type

- Belt Type

- Rotary Actuators

- Motors

- Bladder and Vane

- Piston Type

The report has provided a detailed breakup and analysis of the market based on the product. This includes linear actuators (rod type, screw type, belt type) and rotary actuators (motors, bladder and vane, piston type).

Type Insights:

- Electric

- Pneumatic

- Hydraulic

- Mechanical

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes electric, pneumatic, hydraulic, mechanical, and others.

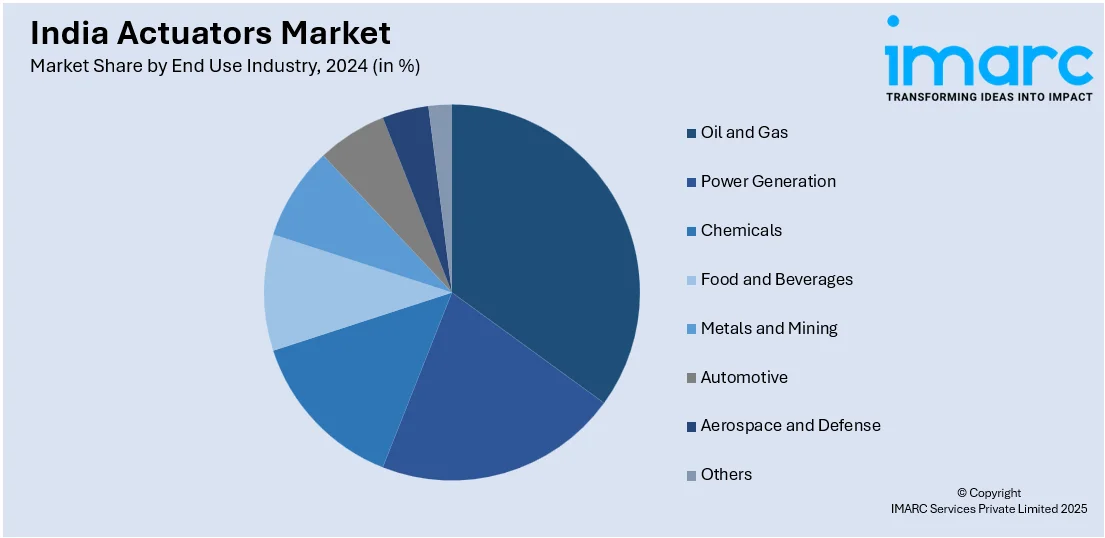

End Use Industry Insights:

- Oil and Gas

- Power Generation

- Chemicals

- Food and Beverages

- Metals and Mining

- Automotive

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, power generation, chemicals, food and beverages, metals and mining, automotive, aerospace and defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Actuators Market News:

- March 2025: HEX20 launched India’s first private payload hosting satellite ‘Nila,’ carrying release actuators from Germany-based Dcubed. This marked a strategic advancement in actuator applications, boosting demand for space-grade actuators and strengthening India’s actuator industry through enhanced global collaboration and aerospace innovation.

- January 2025: ISRO’s SpaDeX mission successfully demonstrated space docking using actuators like reaction wheels, magnetic torquers, and thrusters. This validated indigenous actuator technology, inducing growth in India’s actuator segment and enhancing local capabilities for future space applications, including satellite servicing and space station projects.

India Actuators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Types Covered | Electric, Pneumatic, Hydraulic, Mechanical, Others |

| End Use Industries Covered | Oil, Gas, Power Generation, Chemicals, Food, Beverages, Metals, Mining, Automotive, Aerospace, Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India actuators market performed so far and how will it perform in the coming years?

- What is the breakup of the India actuators market on the basis of product?

- What is the breakup of the India actuators market on the basis of type?

- What is the breakup of the India actuators market on the basis of end use industry?

- What are the various stages in the value chain of the India actuators market?

- What are the key driving factors and challenges in the India actuators market?

- What is the structure of the India actuators market and who are the key players?

- What is the degree of competition in the India actuators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India actuators market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India actuators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India actuators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)