India Adhesive Tape Market Size, Share, Trends and Forecast by Material, Resin, Technology, Application, and Region, 2026-2034

India Adhesive Tape Market Overview:

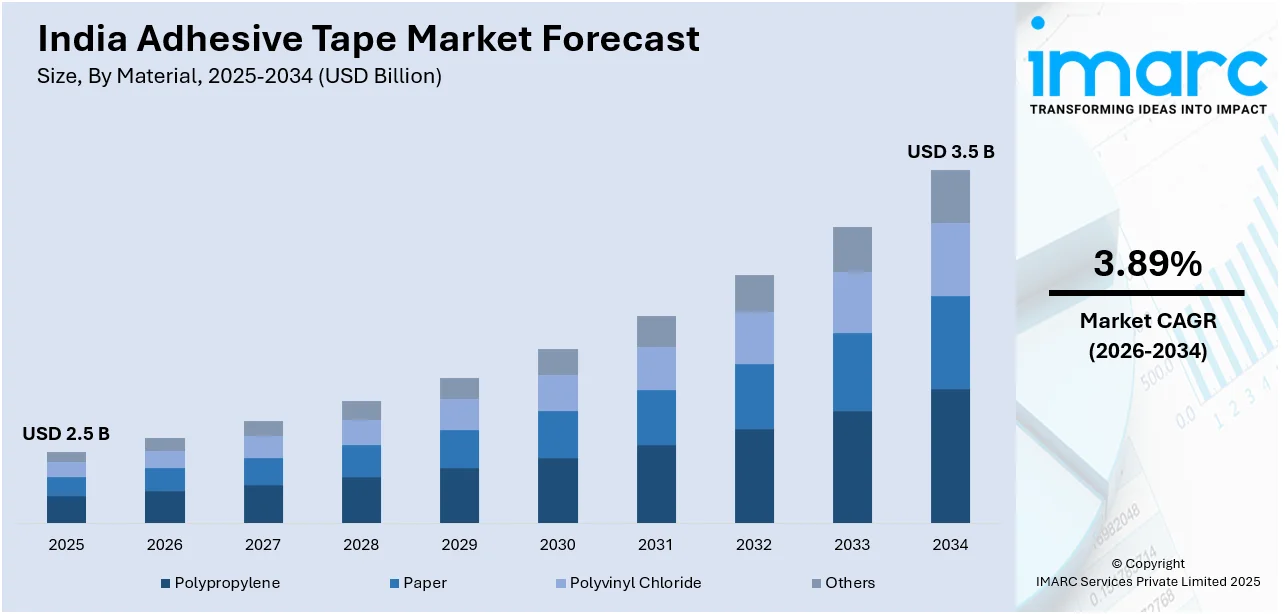

The India adhesive tape market size reached USD 2.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2034, exhibiting a growth rate (CAGR) of 3.89% during 2026-2034. The India adhesive tape market share is expanding, driven by advancements in medical adhesive technology, leading to the development of tapes with stronger adhesion, better flexibility, and reduced skin irritation, along with the expansion of online marketplaces, enabling users to explore different adhesive tapes, compare costs, and review feedback.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.5 Billion |

| Market Forecast in 2034 | USD 3.5 Billion |

| Market Growth Rate 2026-2034 | 3.89% |

India Adhesive Tape Market Trends:

Rising medical and healthcare applications

The increasing pharmaceutical and healthcare applications are impelling the India adhesive tape market growth. According to the Ministry of Chemicals and Fertilizers, India’s exports of drugs and pharmaceuticals rose by 8.36% from USD 2.13 Billion in July 2023 to USD 2.31 Billion in July 2024. Medical facilities, healthcare centers, and drug manufacturers depend on these tapes for several medical uses Surgical tapes are crucial for wound management, fastening bandages, and stabilizing medical equipment, establishing them as a standard in healthcare settings. The large volume of surgeries and medical treatments creates the need for high-quality and skin-compatible adhesive tapes. Furthermore, due to the rise in chronic illnesses and an older population, the use of medical tapes in home healthcare for wound dressing and securing catheters is expanding. The demand for specialized adhesive tapes, such as hypoallergenic, breathable, and waterproof types, is growing, as healthcare professionals focus on patient comfort and safety. Additionally, advancements in medical adhesive technology have resulted in tapes that offer enhanced adhesion, improved flexibility, and minimized skin irritation, thereby increasing their effectiveness.

To get more information on this market, Request Sample

Expansion of e-commerce portals

The expansion of e-commerce sites is offering a favorable India adhesive tape market outlook. Online marketplaces enable people to explore different adhesive tapes, compare costs, and review feedback prior to buying, leading to increased sales. Small and medium enterprises (SMEs) gain advantages from e-commerce channels by accessing a broader audience without requiring physical retail locations. Options for bulk buying and direct-to-consumer (D2C) sales models assist manufacturers and distributors in cutting costs while enhancing profit margins. Furthermore, sectors like packaging, logistics, and construction depend on adhesive tapes, while e-commerce platforms offer a swift and efficient method to acquire these materials. As online shopping expands, buyers are purchasing adhesive tapes for home and do it yourself (DIY) tasks, leading to greater demand in the retail sector. Quick delivery, cash-on-delivery choices, and discounts promote repeat buying and customer loyalty. Moreover, digital marketing and focused ads assist adhesive tape brands in connecting with the appropriate audience, enhancing visibility and sales. With more number of businesses and individuals turning to online shopping for its convenience and selection, the market in India is experiencing growth, benefiting from the broader access and effectiveness of e-commerce portals. According to the India’s Brand Equity Foundation (IBEF), the Indian e-commerce industry is set to attain USD 325 Billion by 2030, witnessing substantial expansion.

India Adhesive Tape Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on material, resin, technology, and application.

Material Insights:

- Polypropylene

- Paper

- Polyvinyl Chloride

- Others

The report has provided a detailed breakup and analysis of the market based on the materials. This includes polypropylene, paper, polyvinyl chloride, and others.

Resin Insights:

- Acrylic

- Rubber

- Silicone

- Others

A detailed breakup and analysis of the market based on the resins have also been provided in the report. This includes acrylic, rubber, silicone, and others.

Technology Insights:

- Water-Based Adhesive Tapes

- Solvent-Based Adhesive Tapes

- Hot-Melt-Based Adhesive Tapes

The report has provided a detailed breakup and analysis of the market based on the technologies. This includes water-based adhesive tapes, solvent-based adhesive tapes, and hot-melt-based adhesive tapes.

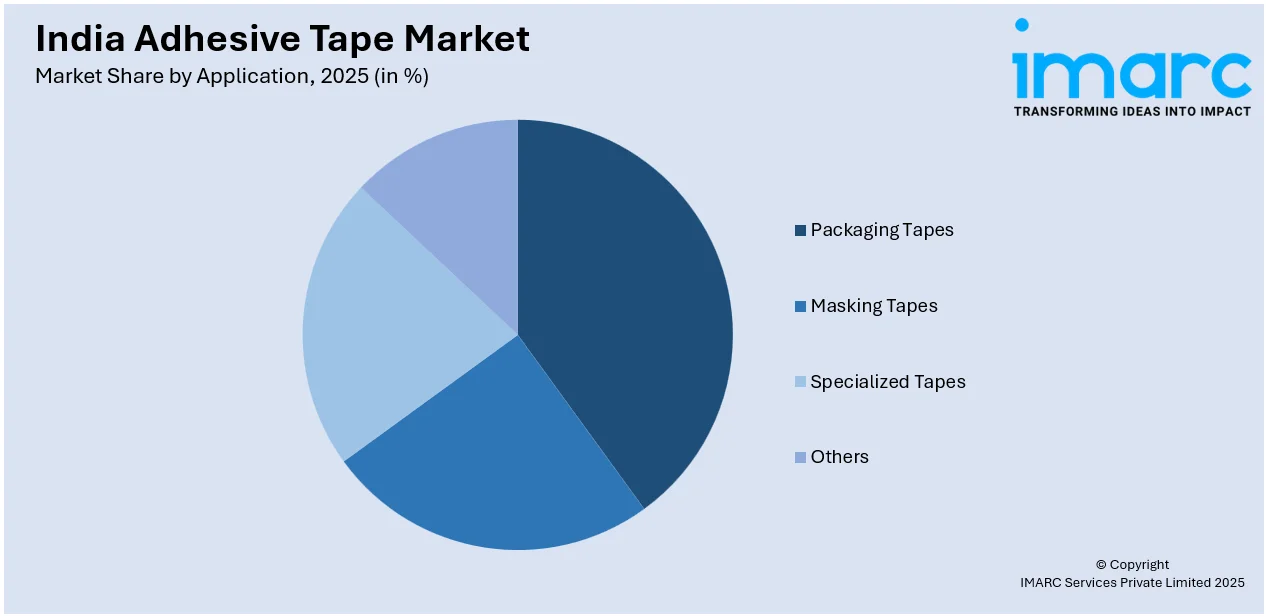

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Packaging Tapes

- Masking Tapes

- Specialized Tapes

- Others

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes packaging tapes, masking tapes, specialized tapes, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Adhesive Tape Market News:

- In December 2024, tesa, the prominent producer of creative adhesive tapes and self-adhesive product solutions, announced the launch of its new offices in Mumbai and Bengaluru in India. This strategic growth showcased tesa's dedication to strengthening its footprint in India's manufacturing industry and is in line with its development plan for the Asia-Pacific area. These sites aimed to strengthen the firm’s operational talents and improve its capacity to innovate items and connect more successfully with clients.

- In November 2024, Labelexpo India, a specialized event at India Expo Centre & Mart, was set to take place from 14-17 November 2024 in Greater Noida, India. Jesons Industries, the well-known manufacturer of water-based pressure sensitive adhesive tapes, aimed to highlight its innovative hot melt pressure-sensitive adhesive (HMPSA) types for tape and label uses. The product debuted in January 2024. The firm’s goal was to fill the market void in India, allowing users to find the appropriate solutions for their needs.

India Adhesive Tape Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Polypropylene, Paper, Polyvinyl Chloride, Others |

| Resins Covered | Acrylic, Rubber, Silicone, Others |

| Technologies Covered | Water-Based Adhesive Tapes, Solvent-Based Adhesive Tapes, Hot-Melt-Based Adhesive Tapes |

| Applications Covered | Packaging Tapes, Masking Tapes, Specialized Tapes, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India adhesive tape market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India adhesive tape market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India adhesive tape industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The adhesive tape market in India was valued at USD 2.5 Billion in 2025.

The India adhesive tape market is projected to exhibit a CAGR of 3.89% during 2026-2034, reaching a value of USD 3.5 Billion by 2034.

Key factors driving the India adhesive tape market include increasing demand from the automotive and packaging sectors, growth in e-commerce, and advancements in adhesive technology. Additionally, rising user preferences for eco-friendly products and enhanced application versatility are contributing to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)